Summary:

- I read an excellent analysis of Amazon’s retail margins published by In Practise.

- Their analysis delved into Amazon’s retail business, an area of concern for investors.

- Amazon’s true e-commerce profitability has been obscured.

David Ryder

The following segment was excerpted from this fund letter.

Amazon (NASDAQ:AMZN)

I read an excellent analysis of Amazon’s retail margins published by In Practise – a primary research service that puts out high quality, well researched interview transcripts with former employees of public companies.

Their analysis delved into Amazon’s retail business, an area of concern for investors. Many worry that the segment will never be profitable and that without AWS, Amazon, after 20+ years, still cannot make money in retail. Recent increases in capital expenditure and the resulting decline in quarterly free cash flow have amplified these concerns. Furthermore, Amazon’s public financial reporting obscures some details and makes it difficult to estimate the actual margins of the retail business.

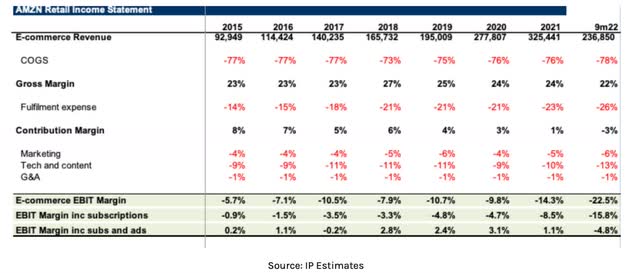

In Practise interviewed a former executive at the company responsible for collating financial reports for Brian Orlovsky, Amazon’s CFO, and asked him to estimate some cost allocations between the different divisions to arrive at a “retail business only” profit and loss estimates. (Shown below with permission).

A few things become clear from the table. First, e-commerce revenue has grown substantially from $93bn in 2015 to $237bn for nine months of 2022, and gross margins have been remarkably consistent in the high 70’s.

Second, Fulfilment expenses have increased tremendously, from 14% of revenues in 2015, to 26% in 2022. That is approximately a 6-fold increase in dollar terms. As a result, the contribution margin, or the profit on each item sold, has gone from 8% profit to 3% loss.

So, it seems that Amazon loses money for every order, even before including marketing, technology, and general and administrative costs. On the face of it, a sorry state of affairs.

Amazon’s true e-commerce profitability has been obscured by aggressive growth investments, and normalizing for these, the underlying operations are profitable. In particular, Amazon has invested well ahead of demand to grow fulfillment operations, especially with initiatives such as 2-day and then 1-day shipping.

In addition, the post-Covid e-commerce slowdown, well documented in the financial media, caught Amazon off-guard and exacerbated the situation. (Even Amazon can’t predict the future perfectly!). Moreover, Tech and Content expenditures have grown from 9% of sales to 13% of sales. One interesting fact from the expert interviews was that 15-20% of tech costs are for “venture type” investments that are loss-making. Somewhat similar to how Alphabet throws billions into its “moonshot” investments.

Suppose Amazon were to slow down fulfillment expenditure to be more aligned with 2018 levels (before the rapid scaling of cost and introduction of faster shipping) and cut out the “moonshot-like” loss-making technology investments. In that case, it could add approximately $20bn to cash flow, resulting in low-to-mid single-digit EBIT margins, in line with highly respected retail stalwarts Costco and Walmart.

Few companies could turn on that kind of cash flow almost at will.

The thesis on Amazon is that they are investing, on the one hand, in becoming the “rails” of e-commerce, with logistics and fulfillment operations that have surpassed those of FedEx in size.

On the other hand, Amazon Prime subscriptions attract consumers who want to receive free 2-day shipping and additional services such as movies and other content. The combination of the two ads to Amazon’s famous marketplace “flywheel,” where sellers are attracted to the access to consumers as well as all the logistics/fulfillment, and consumers are attracted to the range of merchandise, as well as fast shipping.

Amazon continues to invest in its powerful moat.

DisclaimerAlphyn Capital Management, LLC is a state registered investment adviser. The description herein of the approach of Alphyn Capital Management, LLC and the targeted characteristics of its strategies and investments is based on current expectations and should not be considered definitive or a guarantee that the approaches, strategies, and investment portfolio will, in fact, possess these characteristics. Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances of market events, nature and timing of the investments and relevant constraints of the investment. Alphyn Capital Management, LLC has presented information in a fair and balanced manner. Alphyn Capital Management, LLC is not giving tax, legal or accounting advice, consult a professional tax or legal representative if needed. Reference or comparison to an index does not imply that the portfolio will be constructed in the same way as the index or achieve returns, volatility, or other results similar to the index. Unlike indices, the model portfolio will be actively managed and may include substantially fewer and different securities than those comprising each index. Results for the model portfolio as compared to the performance of the Standard & Poor’s 500 Index (the “S&P 500”) for informational purposes only. The S&P 500 is an unmanaged market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent US equity performance. The investment program does not mirror this index and the volatility may be materially different from the volatility of the S&P 500. Performance results of the master portfolio are presented for information purposes only and reflect the impact that material economic and market factors had on the manager’s decision-making process. No representation is being made that any investor or portfolio will or is likely to achieve profits or losses similar to those shown. Results are net of all standard fees calculated at the highest rate charged, expenses and estimated incentive allocation. Model portfolio returns are inclusive of the reinvestment of dividends and other earnings, including income from new issues. The return is based on annual returns since inception and does not give effect to high water marks, if any. Returns may vary for investors who are restricted from participating in new issues. Hypothetical performance results are unaudited and do not reflect actual results of any accounts managed by Alphyn Capital Management, LLC. Hypothetical performance results are for illustrative purposes only and are not necessarily indicative of performance that would have been actually achieved if an investment utilized the strategy during the relevant periods, nor are these simulations necessarily indicative of future performance of the strategy. Inherent limitations of hypothetical performance may include: 1) hypothetical results are generally prepared with the benefit of hindsight; 2) hypothetical results do not represent the impact that material economic and market factors might have on an investment adviser’s decision-making process if the adviser were actually managing client money; 3) there are numerous factors related to the markets in general, many of which cannot be fully accounted for in the preparation of hypothetical performance results and all of which may adversely affect actual investment results. There is no assurance that any of the securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed do not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein. The graphs, charts and other visual aids are provided for informational purposes only. None of these graphs, charts or visual aids can and of themselves be used to make investment decisions. No representation is made that these will assist any person in making investment decisions and no graph, chart or other visual aid can capture all factors and variables required in making such decisions. This report is for informational purposes only and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy or investment product. Our research for this report is based on current public information that we consider reliable, but we do not represent that the research or the report is accurate or complete, and it should not be relied on as such. Our views and opinions expressed in this report are current as of the date of this report and are subject to change. Any reproduction or other distribution of this material in whole or in part without the prior written consent of Alphyn Capital Management, LLC is prohibited. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Additional disclosure: Copyright © Alphyn Capital Management, LLC