Summary:

- Even after the 14% increase following recent earnings, Nvidia’s risk-reward profile remains unattractive.

- Shareholders relying on future revenue growth to justify the current share price are faced with a major problem.

- The recent earnings report also highlights some problems related to inventory levels and the amount of stock-based compensation.

David Tran/iStock Editorial via Getty Images

Nvidia (NASDAQ:NVDA) reported its full fiscal year results and all the attention seems to gravitate around one buzz word, or in our case an abbreviation that gets everyone’s heart pounding – AI. The sudden pivot on the recent earnings call was to an extent expected, but also sounded like promotional activity that aims to redirect shareholders’ attention.

The cumulation of technology breakthroughs has brought AI to an inflection point. Generative AI‘s versatility and capability has triggered a sense of urgency at enterprises around the world to develop and deploy AI strategies. Yet, the AI supercomputer infrastructure, model algorithms, data processing and training techniques remain an insurmountable obstacle for most. Today, I want to share with you the next level of our business model to help put AI within reach of every enterprise customer.

Jensen Huang – Co-Founder, CEO & President

Source: Nvidia Q4 2023 Earnings Transcript

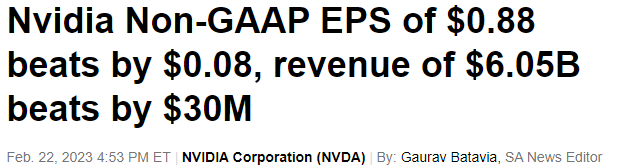

In addition to the so called “AI inflection point,” investors also got really excited about Nvidia’s quarterly results, which on the surface appeared as positive news with earnings per share declining year-on-year but yet beating expectations.

Seeking Alpha

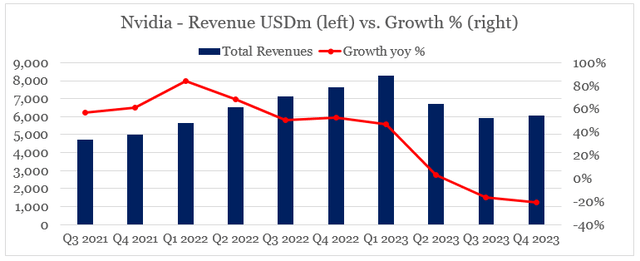

Data center revenue was mixed, noting an increase from the same period of last year, but also near 6% decline from the prior quarter. Market commentators were talking about gaming recovery, even though gaming revenue remains well below its highs prior to Q2 of this fiscal year.

All in all, investors breathed a sigh of relief and seem to believe that the semiconductors giant is once again on track to outperform the market. In my view, however, this can not be further from the truth.

Some Much Needed Context

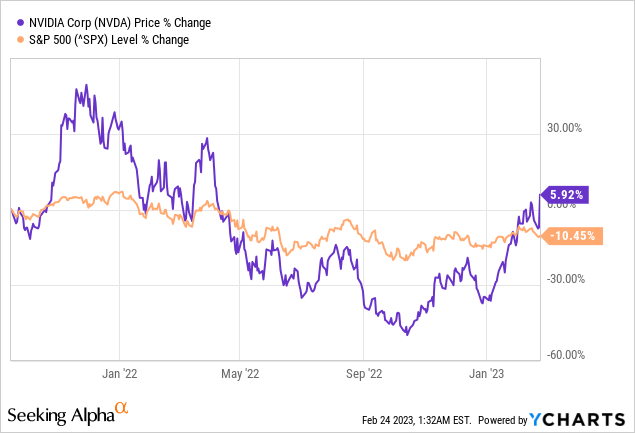

Even though Nvidia’s share price increased by more than 14% during the day following the release, investors are still barely in positive territory since September 2021, when I warned that business fundamentals are not in the driver’s seat.

More importantly, however, return does not compensate for the risk involved when investing in Nvidia. By simply looking at the graph below, we don’t even need to calculate the difference in standard deviation of Nvidia’s daily returns versus those of the market to conclude that the risk/reward profile of Nvidia is highly unattractive.

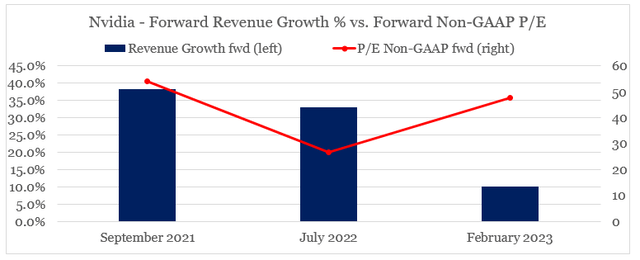

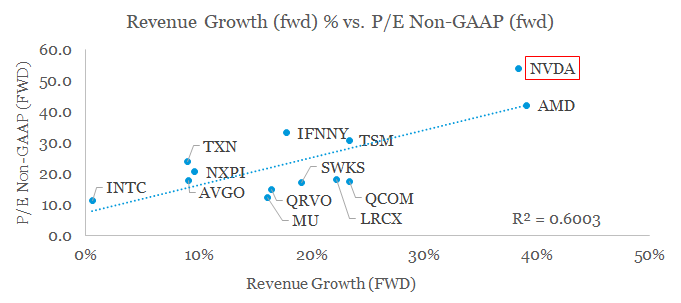

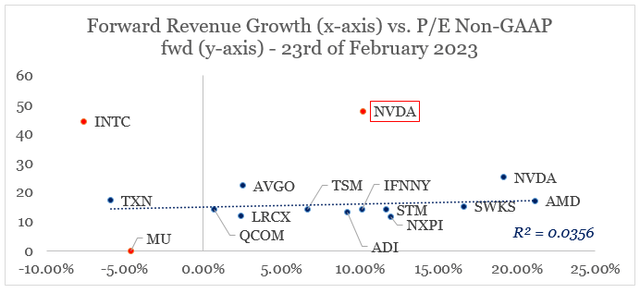

When taking into account expected revenue growth and the company’s forward Non-GAAP Price-to-Earnings ratio (making a huge compromise when using Non-GAAP numbers), we could see that now is actually the worst time to consider taking a long position in the company. The forward revenue growth fell down to earth, while forward P/E ratio even when using Non-GAAP numbers is back to its previous highs.

prepared by the author, using data from Seeking Alpha

*Note: September of 2021 and July of 2022 are the dates of my two other analyses on Nvidia (see here and here).

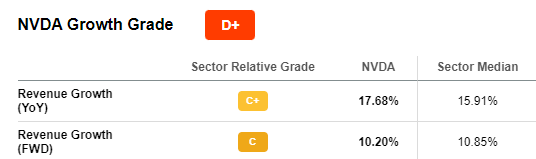

Expected revenue growth has now cratered to only 10.2%, which is actually lower than the sector median.

Seeking Alpha

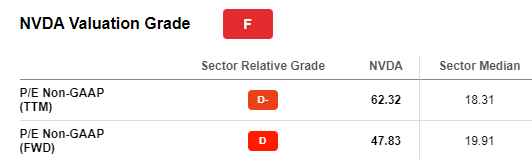

At the same time, non-GAAP forward earnings multiple stands at almost 50.

Seeking Alpha

The Problem Of Relying On Revenue Growth

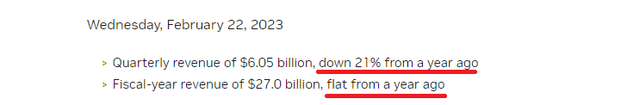

No matter how exciting the narrative of an “AI inflection point” is, it’s hard to ignore the quarterly revenue decrease of 21% from a year ago and annual sales number being flat over the whole 12-month period.

Nvidia Earnings Release prepared by the author, using data from Seeking Alpha

From where we stand today, investors would require by far their most optimistic assumptions to justify sales multiple of nearly 20 and GAAP earnings multiple approaching 100 when taking into account the above figures.

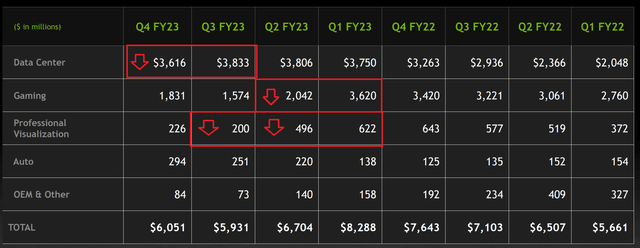

Sustained momentum in data center and recovery of the gaming segment have been the prevailing narrative surrounding the latest quarterly results. However, data center revenue noted a decline from the prior quarter and gaming revenue is far from recovering to its Q1 2023 highs. Although a robust recovery of the latter segment is needed for Nvidia’s current valuation to be justified, consumer spending is now overshadowed by a potential recession. When it comes to professional visualization revenues, the situation over the past few quarters was even worse.

Nvidia Quarterly Revenue Trend

Overall, the positive reaction of Nvidia’s share price points to the market now pricing in the narrative that the recent declines will be only temporary and revenue will not only quickly recover, but also continue growing at an even higher rates.

Although this appears to be an unlikely scenario, Nvidia shareholders also should be aware that the market no longer rewards high topline growth with premium multiples to the same extent it used to back in 2020-21 period.

For example, back in September of 2021, when market liquidity was near record highs, expected revenue growth was among the main drivers of P/E ratios on a cross-sectional basis.

prepared by the author, using data from Seeking Alpha

As of today, this relationship no longer holds, and even if we take the outliers out – Intel (INTC), Nvidia and Micron Technology (MU), the R-Squared between the two variables is still close to zero.

prepared by the author, using data from Seeking Alpha

*Note: MU forward P/E ratio is shown as 0 for illustrative purposes only

There are now other factors that are far more important for valuations within the semiconductors space. On top of that, the dynamics within the sector are changing and with that some of the less popular names are in a much better position to outperform in the coming years.

Areas Of Concern Beyond Revenue Growth

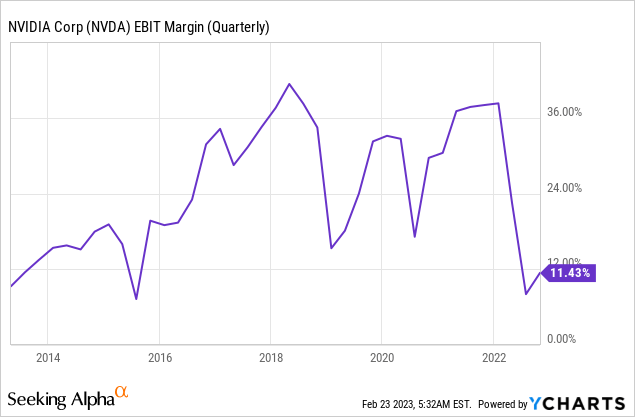

Beyond the obvious slowdown of Nvidia’s revenue growth, operating margins were compressed to levels last seen in 2015.

Based on the outlook for the next quarter, GAAP operating margin is expected to improve to roughly 25%, which is nowhere near the recent highs of the 2020-21 period.

Revenue is expected to be $6.5 billion, plus or minus 2%. GAAP and non-GAAP gross margins are expected to be 64.1% and 66.5%, respectively, plus or minus 50 basis points. GAAP operating expenses are expected to be approximately $2.53 billion.

Source: Nvidia Q4 2023 Earnings Transcript

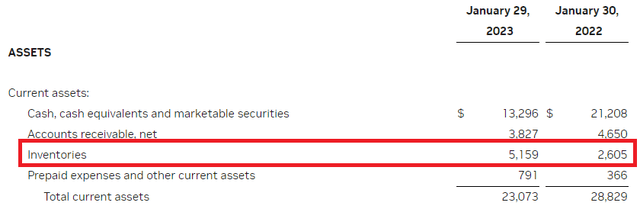

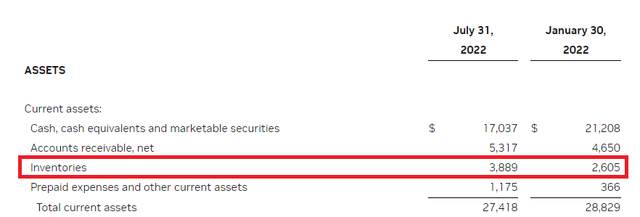

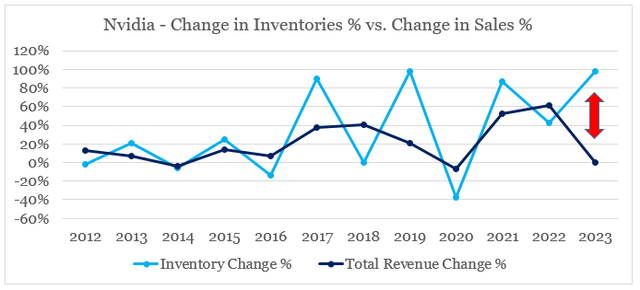

The stakes also are very high for Nvidia as being a fabless company results in far less control when it comes to inventory. Therefore, the massive increase in inventories during the fiscal year 2023 is of a concern and puts even more pressure on future growth.

As a matter of fact, inventories noted a massive jump back in the second quarter of the current fiscal year, which also coincided with the 44% drop in gaming revenue.

On an annual basis, divergence between sales and inventory growth is indeed concerning and would most likely put further pressure on gross margins going forward, even if inventory write-downs are avoided.

prepared by the author, using data from Seeking Alpha

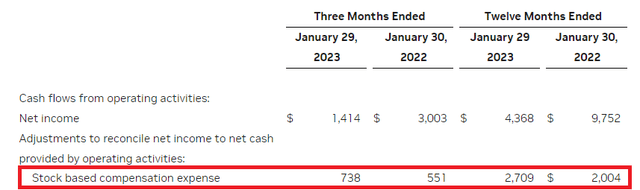

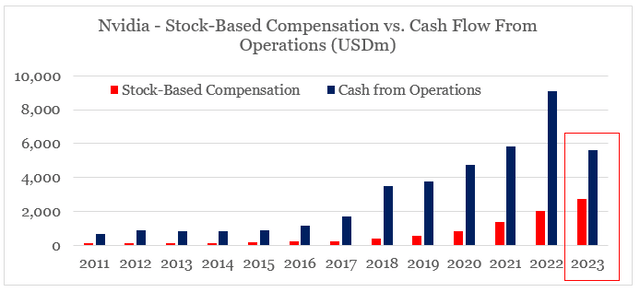

Lastly, the issue of Nvidia now relying too much on stock-based compensation is often ignored or left unnoticed.

Stock-based compensation increased by roughly $700m during the past 12-month period and now sits at $2.7bn.

This figure makes 48% of Nvidia’s cash flow from operations which is unsustainable and creates a number of risks for medium to long-term shareholders.

prepared by the author, using data from Seeking Alpha

I outlined the importance of this metric for share price returns in a recent sector analysis, where levels of stock-based compensation were linked to recent share price performance across the whole peer group we saw above.

Closing Remarks

In a nutshell, the market is back to its prior state of hype when it comes to future expectations regarding Nvidia’s business performance. Not only that, but the company is once again priced at the outlandish multiples we had near the recent top, when excessive liquidity was raging through the market.

The narrative of an AI inflection point could have some merits for future demand, however, at this point in time it’s largely a marketing gimmick. At the same time issues related to Nvidia’s topline growth, margins, inventory levels and stock-based compensation remain while the share price is back to its prior outlandish valuation.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies’ SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication and are subject to change without notice.

Looking for better positioned high quality businesses in the semiconductors space?

Looking for better positioned high quality businesses in the semiconductors space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning. The opportunities laid out in the service also capitalize on inefficiencies in the market associated with short-termism, momentum chasing and narrative driven expectations. For more information follow the link provided.