Summary:

- Apple continues working on turning the Apple Watch into a medical device.

- The tech giant has made progress on a glucose monitoring system with the signs the concept works, but the company needs to scale the product into a wearable form factor.

- The stock is already priced for a Holy Grail new product, while investors should buy the stock when a new medical device is a bonus for a cheap stock.

- Apple shouldn’t already trade at 25x FY23 EPS targets.

CHAYAKORN MAMUANG/iStock via Getty Images

The holy grail of the Apple (NASDAQ:AAPL) Watch is turning the product into a medical device. The tech company has a promising new use for the watch, but the market has already hyped the entry of the company into the blood glucose monitoring market. My investment thesis remains ultra Bearish on the stock until investors can purchase the stock with upside potential from such new products, instead of the current scenario where Apples falls unless the company releases new hit products.

Medical Device

Considering Apple already has fall detection monitoring and ECG readouts on the Apple Watch, the company working on a glucose monitoring device isn’t shocking. The big question is whether the tech giant is actually close to a monitoring tool capable of being included within the scale of the current Watch footprint to disrupt the diabetes market.

The Apple Watch already has these health functions incorporated into Apps:

- Temperature sensing for women’s health.

- Advanced cycle tracking.

- Crash detection to help in an emergency.

- ECG tests for heart monitoring.

- Blood oxygen measuring.

Apparently, Apple has been working on a blood glucose monitoring device going back to the Steve Jobs era. According to Bloomberg, Apple was so secretive as to place the development under a different name to not alert outsiders to the work. Employees actually had badges under the Avolonte Health LLC corporate name and worked in an office a dozen miles away from Apple HQ.

While the market started hyping a medical breakthrough in the device, the actual report suggests Apple is years away from having a small enough device to monitor blood glucose without pricking fingers or implanting a device that needs replacement. Once the device is down to scale, the tech giant will need to verify the product still works with patients and obtain FDA approval, which could be a lengthy process for a company new to the medical device field.

Apple is working on a measurement process called optical absorption spectroscopy. In essence, the technology is able to measure the blood glucose level via a sensor and an algorithm, but the issue appears more the size of the device needed for the measurement.

According to Bloomberg, the technology is now at proof of concept stage suggesting the system works, but Apple still has to shrink it down to include in the Watch format or another wearable device. The early system apparently sat atop a table and the suggestion from the report is for the device to be the size of an iPhone strapped to a bicep or leg.

Either way, Apple appears far, far away from including the technology into an existing device like the Watch. The holy grail is a scenario where the glucose monitoring system is part of an existing Apple product, not a whole new device.

The tech giant is already working on an AR/VR device to be released later this year. Another high-cost device doesn’t appear ideal for diabetes patients. The CDC estimates the U.S. currently has 34.2 million people with diabetes for over 10% of the population, while only 26.8 million people have been diagnosed.

DexCom (DXCM) and Abbott Labs (ABT) already have glucose monitoring systems on the market now. DexCom is the independent player in the industry with only a $3 billion business for Apple to disrupt.

The company recently launched the DexCom G7 CGM System, after obtaining FDA approval back in December, as a wearable sending real-time glucose readings to a compatible smart device or reader. Per DexCom, the G7 costs $89/month for commercial insurance.

Either way, DexCom only generates $3 billion worth of annual revenues while competing with the Libre system from Abbott Labs. Whether the diabetes market is large or not, the independent glucose monitoring company doesn’t generate holy grail type revenues.

Apple will need to obtain FDA approval and constantly upgrade the product in order to stay ahead of these companies focused on the diabetes CGM category.

Watch Opportunity

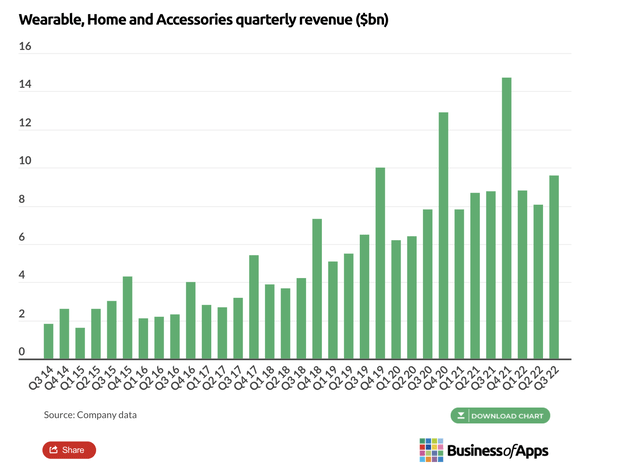

Apple no longer reports Apple Watch units sold and the sales are included in the general Wearables category. The category sales have soared over the years, but the category includes the large AirPods sales along with Apple TV and HomePod sales.

The Wearable category had FY22 sales of $41.1 billion with BuisnessofApps estimating the Watch generated $12 to $14 billion in sales. The Watch product launched in 2015 with 8.3 million units sold and jumped to 46.1 million in 2021.

The question is how much opportunity exists for Apple to garner Watch sales from the large diabetes market. If the company only garners an additional watch sale, Apple would generate roughly $400 from diabetes customers every several years and possibly these customers would already have plans to purchase a watch.

The company would probably charge a glucose monitoring fee, but the best case scenario is a product that generates the revenue similar to DexCom. Possibly Apple could generate both an additional Apple Watch sale and a monthly monitoring fee, but one probably can’t argue how the tech giant is going to generate more revenue on a blood glucose monitoring system that exceeds the amounts produced by DexCom.

If Apple got the device onto the market in FY25, the glucose monitoring revenues would have to completely replace DexCom and yet the revenues would still not reach 1% of sales. Any incremental sales are definitely appealing to any company regardless of size, but the consensus estimates are for Apple to produce $442 billion in annual sales.

The stock trades at 25x FY23 EPS estimates of nearly $6. Apple is forecast to watch earnings dip this fiscal year with no signs of growth exceeding 10% in the next 3 to 4 years.

The stock is already priced for success in new overhyped products like a glucose monitoring system. Apple would need this new device or the AR/VR product to be so successful as to change the earnings forecast to where EPS growth exceeds 10% in order to warrant the current stock valuation, much less higher prices.

Takeaway

The key investor takeaway is that the Apple Watch as a true medical device is a holy grail opportunity. The glucose monitoring device has the potential for such an opportunity, but the tech giant sill appears far away from a workable device and the near-term revenue potential is relatively small despite the scope of diabetes.

Investors shouldn’t buy Apple for an overhyped product. In addition, the stock is already priced for such a medical device to be successful trading at 25x FY23 estimates while the ideal time to buy Apple is when a new product is a bonus to shareholders.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.