Summary:

- Investing in Meta is such an interesting opportunity that value investors and speculators are attracted alike.

- In this article, I present 3 ‘speculative’ opportunities that, if materialized, could push Meta stock higher.

- First, and most obviously, Zuckerberg’s metaverse ambitions might succeed.

- Second, TikTok usage might be banned in western countries due to data/ privacy concerns.

- Third, Meta successfully leverages its technology and software engineering ‘talent’ to market new opportunities in AI.

VITALII BORKOVSKYI/iStock via Getty Images

Thesis

I see Meta Platforms (NASDAQ:META) as a value opportunity. And I have argued multiple times that the market undervalues the social media giant’s earnings potential. However, investing in Meta is such an interesting opportunity that value investors and speculators are attracted alike. With that frame of reference, I don’t mean to associate Meta investors with a hunch for gambling. In fact, the best way to think about the speculation associated with an investment in Meta is in terms of free implied call options — whereby the implied speculative potential only adds to the value.

In this article I present 3 ‘speculative’ opportunities that, if materialized, could push Meta stock higher: First, and most obviously, Zuckerberg’s metaverse ambitions might succeed; Second, TikTok usage might be banned in western countries due to data/ privacy concerns; Third, Meta successfully leverages its technology and software engineering ‘talent’ to market new opportunities in AI.

I have previously covered Meta’s recently announced subscription strategy (see here), also assigning a Strong Buy recommendation. As compared to the subscription discussion, this article is more of a conceptual analysis of yet-to-materialize speculative considerations.

Zuckerberg’s Metaverse Ambitions Could Succeed

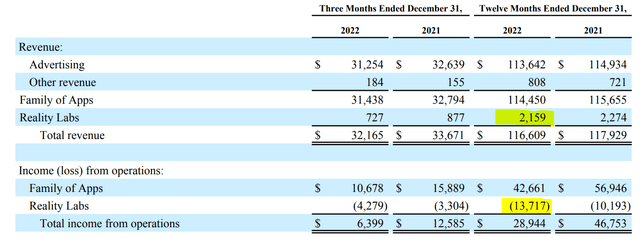

In FY 2022, Meta lost close to $13.7 billion on developing Zuckerberg’s metaverse ambitions. This is a breathtaking amount of money, which, if attributed to shareholders in form of profits, could add an estimated $150 – $200 billion to Meta’s market capitalization (depending on the multiple assumed). Accordingly, it is no surprise that many analysts and investors argue against the metaverse ‘opportunity’.

However, investors should consider that valued at a $450 billion market cap, Meta investors are not really paying for Zuckerberg’s metaverse ambitions anymore — they have been ‘valued-out’. But still, investors may enjoy the financial benefit if the $10 – $15 billion R&D investment per year successfully materializes new market and product opportunities.

Personally, I continue to believe that Zuckerberg’s metaverse ambitions make sense in the context of ‘immersive communication’, which will inevitably develop sooner or later. Or in Mark Zuckerberg own words:

When I got started in 2004, the main medium for people to share online was text. Then we got phones… with cameras and it became primarily photos, now it is video. But it is not the end of the line. There is something after text, photo and video. Communication keeps on getting more immersive.

Like the internet revolution starting early 1990, the metaverse revolution could have potential to change how people interact, learn, seek entertainment and spend money. Moreover, I would also argue that Zuckerberg is not working on something completely ridiculous, but on something that avant-garde thinkers have long conceptualized — referencing “Snow Crash”, “The Matrix” and “Ready Player One”.

TikTok Might Be Banned

I have previously argued that TikTok is less of a threat to Meta as perceived by many analysts — simply because TikTok usage is skewed towards entertainment and Facebook/ Instagram/ WhatsApp is slightly skewed towards social connection. However, many current and potential Meta investors continue to be worried about how the competition with TikTok will unfold. And accordingly, the TikTok debate remains relevant.

Investors should consider that in the U.S. more than 30 states have banned TikTok usage on government-related devices. And European as well as Canadian authorities have enforced a similar ban. Now, as tensions between China and Western nations continue to deteriorate, a TikTok becomes increasingly more likely — although still unlikely, in my opinion. But even though the likelihood of a complete TikTok ban within the next 24 months could be below 10%, there is notable speculative value in the event.

For reference, investors should consider that many tech companies, including Meta are banned from operating in China. Accordingly, why should the same policy not be pushed vice versa?

Meta’s AI Initiatives

AI, it’s the foundation of our discovery engine and our ads business. And we also think that it’s going to enable many new products and additional transformations in our apps. Generative AI is an extremely exciting new area with so many different applications. And one of my goals for Meta is to build on our research to become a leader in generative AI in addition to our leading work in recommendation AI.

— Mark Zuckerberg, Q4 2022 Earnings Conference Call (emphasis added)

Another argument why Meta Platforms might offer speculative value is anchored on the social media giant’s ambition to lever its technology and software engineering ‘talent’ to develop new opportunities in [generative] AI. While the market has well acknowledged Microsoft’s (MSFT), Baidu’s (BIDU) Nvidia’s (NVDA) potential, as well as punished Google’s (GOOG) failed attempt to launch Bard, Meta Platforms’ potential remains underappreciated, in my opinion.

Investors should consider that only recently Zuckerberg announced the formation of a dedicated AI team that is developing AI-related products for Instagram, WhatsApp.

We’re creating a new top-level product group at Meta focused on generative AI to turbocharge our work in this area

adding that

We have a lot of foundational work to do before getting to the really futuristic experiences, but I’m excited about all of the new things we’ll build along the way.

More specifically, Zuckerberg commented that Meta is exploring opportunities for how AI could support a [research]-chatbot for Messenger and WhatsApp, as well as AI-supported product features such as filters and ad formats for Instagram and Facebook.

Notably Meta has already announced a proprietary ‘chatbot’, called LLaMA. According to Meta, LLaMA differs significantly from OpenAI’s ChatGPT, as Meta’s technology utilized publicly accessible datasets, including Common Crawl, Wikipedia, and C4, to train their AI. This, so common sense suggests, increases the transparency of Meta’s training process and potentially allows for the model to be offered as an open-source resource.

Building a more conceptual argument, I would also like to highlight how AI could support Zuckerberg’s metaverse ambitions: The combination of Generative AI and the metaverse could significantly improve user experience on multiple frontiers — for example by using AI language models to structure realistic human interactions, or by modelling virtual environments.

Conclusion

In FY 2022, Meta accumulated about $34 billion of operating income and repurchased $32 billion worth of equity. Accordingly, Meta’s market cap of about $450 billion looks cheaply valued as compared to fundamentals. But the ‘undervaluation’ argument doesn’t end with fundamentals. In fact, I believe the market underappreciates Meta’s speculative potential, which might imply free call options for investors. Specifically, I see 3 ‘speculative’ opportunities that, if materialized, could push Meta stock higher: First, and most obviously, Zuckerberg’s metaverse ambitions might succeed; Second, TikTok usage might be banned in western countries due to data/ privacy concerns; Third, Meta successfully leverages its technology and software engineering ‘talent’ to market new opportunities in AI.

Meta Platforms remains a ‘Strong Buy’.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is not financial advise, but expresses the opinions of the author only.