Summary:

- AT&T is a telecom operator with high exposure to the U.S. and muted growth prospects.

- Its investment case is highly geared to its high-dividend yield of about 6%.

- Following its dividend cut last year, its current dividend is sustainable due to a good coverage based on earnings and cash flow.

Brandon Bell

AT&T (NYSE:T) is a good income play right now given that its current high-dividend yield is sustainable following the dividend cut last year, providing a safe and recurring income stream for investors over the next few years.

Company Overview

AT&T is one of the largest providers of integrated telecommunications in the U.S., offering local and long-distance phone, wireless and data communications, internet accessing, beyond other services. Its current market value is about $133 billion, being the third-largest telecom company in the U.S. by this measure, behind T-Mobile US (TMUS) and Verizon (VZ).

Its business is highly exposed to the U.S., even though in the past there was some interest in growing abroad, mainly through acquisitions. There was some speculation that AT&T could bid for some parts of Telefonica (TEF) or Vodafone (VOD) operations, but nothing was ultimately pursued. Its current foreign operation is only its Mexican unit, and is not likely that AT&T will grow much further in international markets in the near term.

Regarding its business diversification, AT&T’s mobility segment are the company’s largest, accounting to some 69% of its revenue, while the second-largest is the wireline (business and consumer) segment being responsible for 28% of total revenue, while the Mexican unit accounts for only about 4% of revenue.

This means that AT&T is highly exposed to its domestic market, which is mature and has relatively muted growth prospects, a profile that is not expected to change much in the foreseeable future. Furthermore, AT&T decided in 2021 to refocus on its core telecom business and sold 30% of DirectTV, and deconsolidated it from its financial results, plus it divested the Warner Media business in 2022.

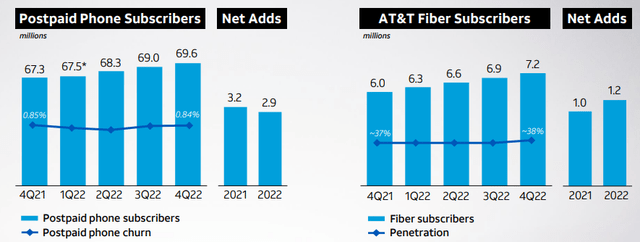

As I’ve analyzed previously in a Deutsche Telekom (OTCQX:DTEGY) article, the U.S. telecom market is highly competitive and players need to invest considerably in spectrum, 5G infrastructure, and fibre to remain competitive. As AT&T is more exposed to wireline than its competitors, it faces some structural headwinds in its business and consumer wireline segments, which it needs to offset in the mobility segment. The company acknowledges this situation and has been pushing for growth in the wireless segment, being together with T-Mobile US one of the carriers with higher net consumer adds over the past few quarters.

US wireless net adds (Counterpoint)

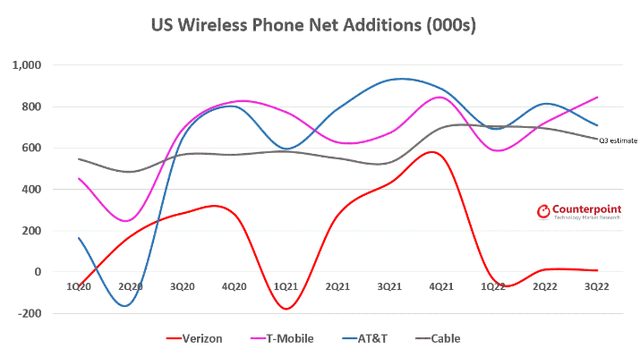

Given that AT&T is the largest wireless operator, with a market share of close to 45%, it’s also the one that has more to lose if competitors offer more competitive packages. Indeed, T-Mobile has been able to differentiate itself from competitors due to a better 5G infrastructure and by offering other attractive perks, such as free Netflix, Apple TV+, or free airline Wi-Fi, being a major threat to both AT&T and Verizon.

US wireless market share (Statista)

While AT&T has been able to protect its market share in the recent past, it needs to maintain strong investments in 5G to remain competitive, on top of its $36 billion spectrum investment over the past couple of years. Additionally, the company strategy has also been to offer significant discounts to customers on new phones, as a strong push to show subscriber growth, a trend that is not likely to change much in the short term.

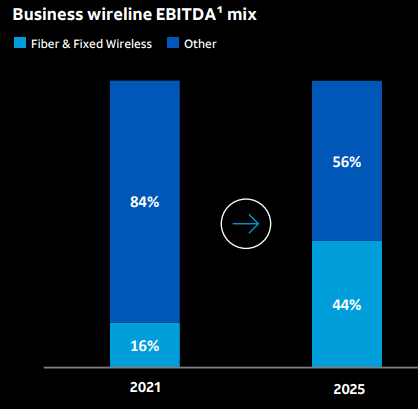

On the wireline segment, AT&T’s strategy is to expand its fiber infrastructure to improve its position both to consumer and business applications, of which the Internet of Things (IoT) is a great opportunity over the next few years. As shown in the next graph, AT&T’s wireline segment is expected to be much more exposed to fiber in the coming years compared to what is today, which will be a key factor to offset structural issues in its legacy wireline business.

Wireline (AT&T)

Given AT&T’s large size and high mobile penetration rate in the U.S., its business strategy is not much likely to change much in the near future. Taking into account this business background and competitive landscape, AT&T’s growth prospect should be relatively muted over the next few years, as usual within the telecom industry.

Financial Overview

Regarding its financial performance, AT&T’s track record is not impressive as the company’s revenue and earnings growth has been relatively weak over the past few years, which has also translated into a poor share price performance over the past few years. Indeed, as shown in the next graph, T stock price has been flat to a downtrend over the past ten years, reflecting the company’s poor growth achieve during this period.

More recently, AT&T’s growth has been a little bit stronger, even though overall it remains on low single digit growth, considering pro-forma figures for its disposals in the past couple of years. In 2022, total reported revenue was $120.7 billion, a decline of 9.9% YoY. However, adjusted for the deconsolidation of DirectTV, its revenue was up by 2.1% YoY, with positive trends coming from wireless and fiber segments, while business wireline maintained a weaker operating momentum.

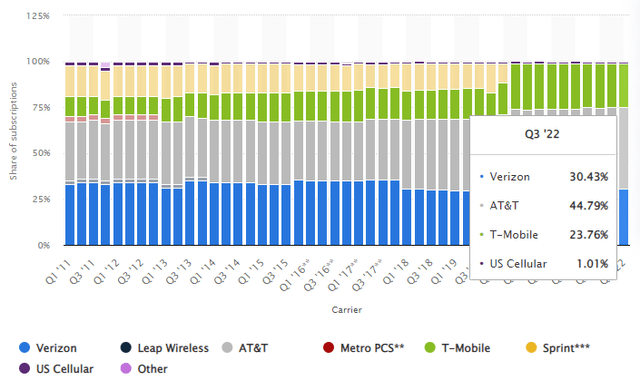

A strong support for overall revenue growth has been its wireless service revenue, which has been supported by strong net adds and low churn, plus a relatively stable ARPU during the past couple of years. In Q4 2022, wireless service revenue increased by 5.5% YoY and postpaid phone ARPU was up by 2.5% YoY, showing that its strategy to push for growth in this segment is bearing fruit. In fiber, AT&T is also reporting positive trends, particularly in the consumer segment, with Q4 2022 fiber ARPU up by 8.8% YoY.

Increasing revenue and strong cost control, led to an adjusted EBITDA of $41.5 billion in the last year, representing an increase of 3.5% YoY, and its EBITDA margin was 34.3% (an improvement of 40 basis points during the year). Its adjusted net income amounted to $18.5 billion and its adjusted EPS was $2.57.

While the company has some cost saving measures ongoing, the challenging economic background and fierce competition in the telecom market are strong headwinds for significant earnings growth ahead. AT&T’s guidance for 2023 is to achieve low single digit revenue growth and adjusted EBITDA growth of about 3% YoY, which seems achievable considering its gains in wireless and fiber that are likely to continue in the near future.

Nevertheless, reflecting the company’s low growth prospects, its revenues should be about $125 billion by 2025 according to Street estimates, and its net income is expected to be close to $18 billion, which aren’t impressive figures compared to its financial figures reported in 2022.

Dividends

While in the past AT&T had an impressive dividend history given that it increased its dividend consecutively for a long time, this has changed dramatically in 2022. Following the disposal of its media assets and spin-off of Warner Media, AT&T decided to slash its dividend in a significant way to save cash and apply more resources to its investments in 5G and fiber.

Its quarterly dividend was cut from $0.52 per share, to its current $0.2775 per share, or $1.11 annually. At its current share price, AT&T offers a dividend yield of about 6%, being quite attractive for income investors. However, investors should be aware that high-dividend yields may be either good income opportunities or dividend traps, as quite often a high dividend yield is a sign of poor company fundamentals or questionable dividend sustainability.

In AT&T’s case, its fundamentals appear to be good, as the company is reporting positive operating trends, even though growth is clearly muted, but nothing that could justify a depressed share price and lead to a high-dividend yield. Therefore, it’s critical to analyze the dividend sustainability, to see if its 6% yield is an opportunity or not.

Based on adjusted earnings, its dividend payout ratio was 43%, which is clearly a very modest payout level and sustainable for a mature and relatively stable company like AT&T. As I’ve analyzed in previous articles on Vodafone and Orange (ORAN), these two European peers offer higher dividend yields, but their dividend payout ratios are much higher (close to 100% and 62%, respectively), which is a warning sign about dividend sustainability. In this respect, following its dividend cut last year, AT&T has now a good earnings coverage, and its dividend is not at risk based on this metric.

From a cash flow perspective, AT&T has a very good cash generation capacity and its annual cash outflow related to dividends decreased from $15 billion, to about $8 billion. During the past year, its cash flow from operations of $35.8 billion, which is close to 30% of its annual revenue, being more than enough to finance the company’s capital expenditures (capex) of $19.6 billion, and total capital investment of $24.3 billion. Its free cash flow amounted to more than $14 billion in the year, which is more than enough to finance its current $8 billion cash outflow related to dividends.

This means its dividend is also well covered by cash flows, being a key factor for AT&T’s dividend sustainability over the long term. For 2023, its guidance is to generate free cash flow of $16 billion or better, which means only about 50% of its annual FCF will be allocated to dividend payments, which is a conservative payout.

Regarding its balance sheet, AT&T used proceeds from the Warner Media divestiture to reduce debt, but at the end of 2022 its net debt still amounted to $132 billion. This is a high level in absolute terms, and also relatively high when compared to its adjusted EBITDA of $41.5 billion achieved in 2022. This means that is net debt-to-EBITDA ratio was 3.22x at the end of 2022, which means AT&T’s financial leverage is higher than would be desirable, even though I don’t think this is a threat to its dividend.

As AT&T should continue to invest in infrastructure, capex is likely to remain at elevated in the short term, which means FCF is expected to be between $16-18 billion levels over the next few years. Assuming a flat dividend, AT&T will be able to reduce net debt by about $10 billion per year, and achieve a financial leverage ratio of about 2.5x, which is more acceptable within the telecom sector, by 2025. This means that AT&T has financial flexibility to both reduce debt and maintain dividend payments in the near future, being another positive factor for its dividend sustainability.

Conclusion

AT&T’s investment case relies highly on its high-dividend yield, given that growth prospects are quite low and its business profile is not expected to change much in the near future. This explains why AT&T is currently trading at 7.7x forward earnings, which may appear cheap, but it’s higher than its historical valuation over the past five years (average of 7x earnings). This means that for income investors AT&T is a good play right now due to a sustainable dividend over the long term, even though but capital appreciation may be limited in the short term unless operating trends improve more than expected.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.