Summary:

- Despite gaining 9% since our last update in November, Comcast stock still has a P/E of just 9.9x and a Dividend Yield of 3.1%.

- The core cable business has continued its moderate EBITDA growth, driven by higher Average Revenue Per User and cost efficiencies.

- Theme Parks and Studios are doing well, but Media profits are falling due to rising Peacock losses and pressures on linear networks.

- The small Sky business has good operational growth in the U.K. but has not yet turned the corner fully in EBITDA.

- With shares at $37.23, our forecasts indicate a total return of 53% (16.4% annualized) by 2025 year-end. Buy.

Sundry Photography

Introduction

We review our investment case on Comcast Corporation (NASDAQ:CMCSA), three months after our last update in November 2022, based on Q4 2022 results and CFO Jason Armstrong’s comments at a investor conference this week.

Comcast shares have gained 9.3% (including dividends) since our last update, but have still lost 24.5% since the end of 2020 and 9.5% since we initiated our Buy rating in January 2020. The share price is basically flat from 5 years ago:

|

Comcast Share Price (Last 5 Years)  Source: Google Finance (03-Mar-23). |

Our revised investment case is on track. The core cable business has continued its moderate EBITDA growth, driven by higher Average Revenue Per User and cost efficiencies. In NBC Universal, Theme Parks and Studios are performing strongly, but Media profits are falling due to rising Peacock losses and pressures on linear networks. Sky has good operational growth in its connectivity businesses, but has not yet fully turned the corner on EBITDA. Comcast shares are at an undemanding P/E of 9.9x and a FCF Yield of 7.1%. The Dividend Yield is 3.1% and buybacks helped reduced the share count by 7% in 2022. Our forecasts indicate a total return of 53% (16.4% annualized) by 2025 year-end. Buy.

Comcast Buy Case Recap

Our Comcast investment case, revised in November with significantly reduced forecasts, is primarily based on the core Cable Communications (“Cable Comms”) business generating moderate EBITDA growth. For the other businesses, we believe NBC Universal’s (“NBCU”) Theme Parks and Studios are strong businesses that can generate good EBITDA growth, Sky is a mediocre business that will see EBITDA recover at a gradual pace, while NBCU’s Media business (which includes Peacock) has the most uncertain future but will see EBITDA stabilizes in 2023.

Q4 2022 results and recent management comments largely support our investment case.

Comcast Headline Results

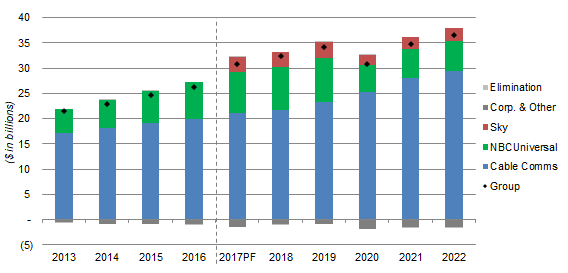

Comcast’s long-term record in growing EBITDA, unbroken in the past decade except in 2020 by COVID-19, continued in 2022. Group EBITDA reached $36.5bn, $2.2bn (or 6%) higher than in 2019. Cable Comms was responsible for more than 100% of this, contributing $6.1bn, while NBCU EBITDA fell $2.8bn and Sky EBITDA fell $0.6bn:

|

Comcast EBITDA by Segment (2013-22)  Source: Comcast company filings. |

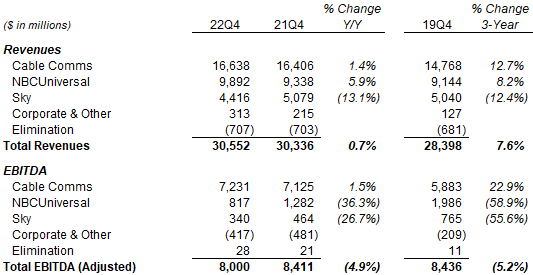

The picture is similar in the latest quarter, though somewhat distorted by higher severance expenses. (The group incurred $638m of severance expenses in Q4, $541m higher year-on-year.) Cable Comms Adjusted EBITDA grew 1.5% as reported, or 5.8% excluding higher severance expenses, while NBCU Adjusted EBITDA fell 36.3% (22.1% excluding Headquarters & Other severance) and Sky EBITDA fell 26.7% (2.0% excluding higher severance):

|

Comcast Revenues and EBITDA by Segment (Q4 2022 vs. Prior Years)  Source: Comcast results releases. |

Trends in each of Comcast’s businesses are in line with our investment case, as discussed below.

Cable: Moderate Underlying EBITDA Growth

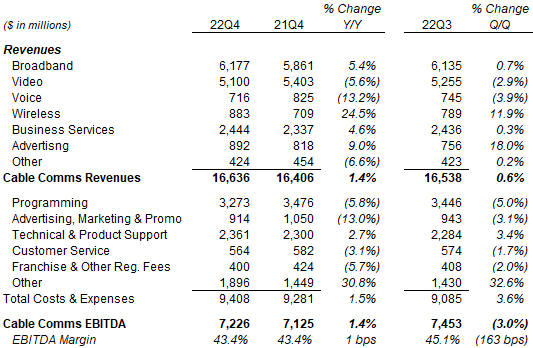

In Q4 2022, Cable Comms EBITDA grew 1.4% as reported, but by 5.8% excluding higher severance expenses:

|

Comcast Cable Comms Revenues and EBITDA (Q4 2022 vs. Prior Periods)  Source: Comcast results schedule (Q4 2022). |

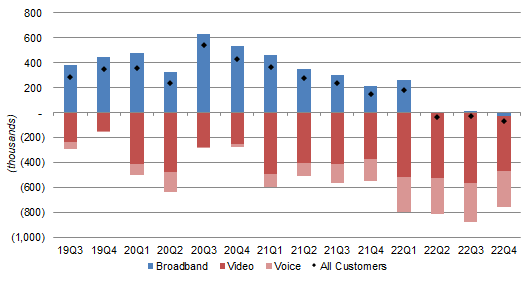

Broadband revenues grew 5.4% year-on-year, on subscriber growth of 0.8% and Average Revenue Per User (“ARPU”) growth of 3.8% (adjusted for certain COVID-related credits in the prior year). Broadband revenues also grew 0.7% from Q3. Management is prioritizing ARPU over volume, and Broadband net adds have continued to decline in recent quarters, from zero in Q2 2022, to +14k in Q3 and -26k in Q4 (impacted by Hurricane Ian, otherwise +4k):

|

Comcast Cable Customer Net Adds by Category (Since Q3 2019)  Source: Comcast company filings. |

This same approach will continue in 2023, as CFO Mike Cavanagh said on the Q4 earnings call:

“We expect ARPU growth will continue to be the primary driver of our residential broadband revenue growth in 2023”

On the same call, Cable Comms CEO Dave Watson described 2023 as a “challenging environment” to add broadband subscribers. More recently, at a Deutsche Bank conference on February 27, CFO Jason Armstrong indicates that broadband net adds will likely be negative in Q1 2023, as some sell-side analysts already forecasted.

Longer-term, similar to what we have discussed in our recent review of Charter Communications (CHTR), Comcast broadband net adds can improve with market gross adds normalizing, rival Fixed Wireless products becoming less attractive due to higher speed demands or limited spectrum capacity, and/or Comcast’s higher passings construction translating into higher gross adds. Management believe Comcast can potentially add 1m passings in 2023 (to a 2022 year-end base of 61.4m), compared to around 0.8m in each of 2021 and 2022.

Video revenues fell 5.6%, with an 11.2% decline in Video subscribers being offset by a 5.8% increase in APRU (primarily due to price increases at the start of 2022), and was offset by Programming Costs falling by 5.8%.

Voice revenues fell 13.2% due to customer losses.

Wireless revenues grew 24.5% year-on-year and 11.9% from Q3, as Comcast continues to rapidly gain customers. The number of Wireless lines grew 33.5% year-on-year to 5.3m, including net add of 365k during Q4.

Advertising revenues grew 9.1%, driven by political ads related to the U.S. mid-term elections; excluding this and the relocation of revenues to the new Xumo joint venture with Charter, advertising revenue fell 1.6%.

Total Costs & Expenses only grew 1.5% year-on-year as reported, despite elevated inflation, and fell by 1.9% excluding $305m of higher severance expenses.

Management has explicitly expressed confidence in achieving EBITDA growth even with little or negative broadband net adds on multiple occasions, mostly recently with Jason Armstrong saying on February 27:

“We have plenty of growth runners between broadband rate, business services and wireless that, overall, in the connectivity bucket, we’re comfortable with our ability to grow revenue and comfortable with our ability to expand margins”

We continue to expect moderate EBITDA growth in Cable Comms.

NBCU: Strong Parks & Studios, Weak Media

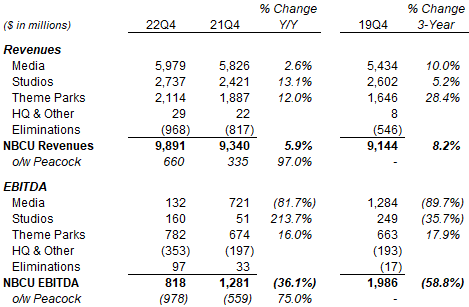

In NBC Universal, Theme Parks and Studios have performed strongly, but Media profits are falling due to rising Peacock losses and pressures on linear networks.

In Q4 2022, Theme Parks EBITDA grew by 16.0% year-on-year and Studios EBITDA rebounded 214%, but Media EBITDA has collapsed by more than 80% to just $132m:

|

NBCU Revenues & EBITDA by Segment (Q4 2022 vs. Prior Years)  Source: Comcast company filings. |

Theme Parks EBITDA was helped by continuing strong demand in both the U.S. and Japan, though the park in Beijing was affected by COVID disruptions during Q4 2022. Consumer spending in NBCU’s U.S. parks has remained strong, at least for now, as CFO Jason Armstrong commented on February 27:

“And as you look towards 2023, off to a really good start at this point, where domestic showing no signs of a consumer slowdown in our parks right now I think we’re all waiting for the phone call if that’s happening, but it hasn’t happened yet”

The Theme Parks business has continued to expand. Comcast is currently building the new Epic Universe extension to its Orlando park, and has announced new sites at Dallas and Las Vegas.

Studios EBITDA was boosted by strength in both licensing and theatrical revenue, the latter helped by successful recent releases. Studios was #2 in worldwide box office for the full year.

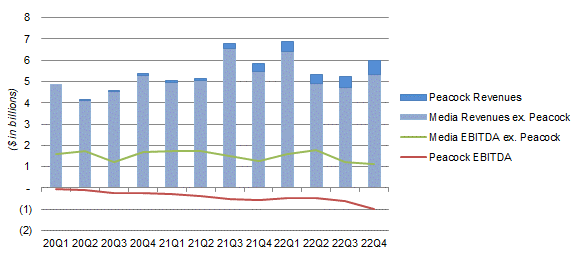

Media’s EBITDA collapse was mainly due to higher losses at Peacock, Comcast’s streaming service, from the costs of adding new content. However, excluding Peacock, Media EBITDA still fell 13% year-on-year in Q4 (despite revenues from Telemundo broadcasting the World Cup), as headwinds from subscribers reducing or abandoning linear networks continued.

Peacock ended 2022 with 20m paying subscribers, more than doubled during the year, including 5m gained in Q4. However, losses have continued to climb, reaching $2.5bn in total in 2022 and have been guided to reach $3bn in 2023. Management expects Peacock losses to peak in 2023 and fall after.

|

Media Revenues & EBITDA – Peacock vs. Non-Peacock (Since 2020)  Source: Comcast company filings. NB. Q3 2021 and Q1 2022 revenues were boosted by Olympics games (in Tokyo and Beijing respectively). |

Peacock is taking some steps to improve its profitability. Armstrong acknowledged at the conference that the service has recently stopped taking new sign-ups for its free tier, and described an intent to move free subscribers over to the paid AVOD (Advertising-Based Video on Demand) tier over time.

We are uncertain about Peacock. While we have observed management changes and new cost cuts across pureplay media players such as Disney (DIS), long-term sector profitability may require all rival streaming services to become more rational on costs, including those owned by Apple (AAPL) and Amazon (AMZN).

In addition to the higher Peacock losses, management also expected to see a weak EBITDA in the rest of Media, as it would “continue to be impacted by the top line pressures at our linear networks”.

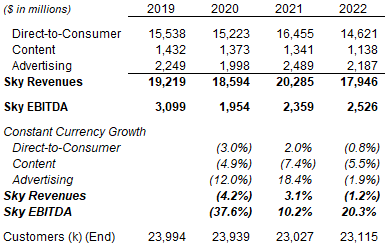

Sky: Not Yet Turning the Corner

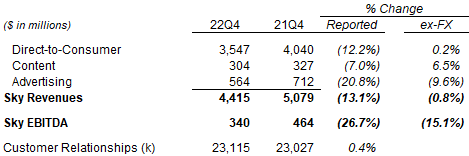

Sky’s revenues were down 0.8% year-on-year while EBITDA was down 15.1% (2.0% excluding higher severance expenses) in Q4 2022:

|

Sky Revenues, EBITDA & Customers (Q4 2022 vs. Prior Year)  Source: Comcast results release (Q4 2022). |

Direct-To-Consumer revenues were flattish (up 0.2%) in local currencies, with customer gains in the U.K. being offset by losses in Italy and Germany. Sky now has 6.5m+ broadband customers and 3m mobile lines in the U.K. Content revenues also grew. However, these was offset by a decline in Advertising revenues (due to weak macro).

Sports costs were lower in Q4 as some football matches were shifted out of the quarter by the World Cup, but are expected to be higher in H1 2023 due to an extended season and the aforementioned shifted games.

Sky has shown some EBITDA recovery on an annual basis, albeit offset by the strengthened dollar:

|

Sky Revenues, EBITDA & Customers (2022 vs. Prior Years)  Source: Comcast company filings. |

We continue to expect a gradual recovery in Sky’s EBITDA, albeit with near-term headwinds in H1 2023.

Comcast Valuation

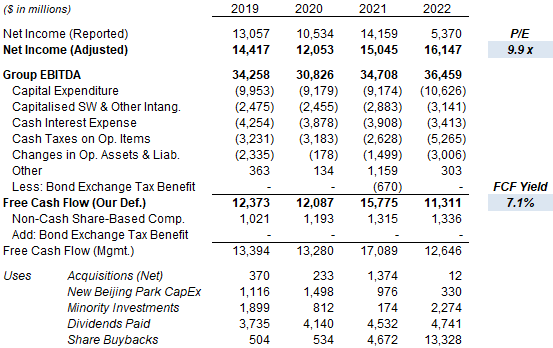

At $34.50, relative to 2022 financials, Comcast has a 9.9x P/E and a 7.1% Free Cash Flow (“FCF”) Yield:

|

Comcast Earnings, Cashflows & Valuation (2019–22)  Source: Comcast company filings. |

2022 FCF was $4.4bn lower, despite a higher EBITDA, mostly due to higher cash taxes ($2.6bn), higher CapEx ($1.5bn) and higher working capital ($2.6bn), the last item due to a continuing recovery in content production from the disruption by COVID-19. Management expects working capital to moderate, but we expect CapEx to stay elevated due to continuing spend on Cable Comms upgrades and Theme Parks.

Comcast pays a dividend of $1.16 (which was raised 7.4% with Q4 results), representing a Dividend Yield of 3.1%.

Comcast repurchased $13.0bn worth of its shares in 2022, including $3.5bn in Q4. Buybacks helped reduced the share count by 7% in 2022.

Net Debt / EBITDA was 2.4x, in line with management target.

Comcast Stock Forecasts

We keep the assumptions in our forecasts unchanged, except for the 2022 share count.

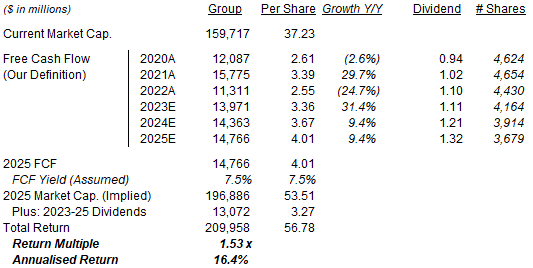

Our new 2025 FCF/Share forecast is $4.01, 1% lower than before ($4.06):

|

Illustrative Comcast Return Forecasts  Source: Librarian Capital estimates. |

With shares at $37.23, we expect an exit price of $54 and a total return of 53% (16.4% annualized) by 2025 year-end.

Is Comcast Stock A Buy? Conclusion

We reiterate our Buy rating on Comcast stock.

Disclosure: I/we have a beneficial long position in the shares of CHTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.