Summary:

- Visa is poised for strong double-digit earnings growth as the global trend of cashless transactions continues.

- The stock is valued attractively based on multiple years of growth.

- Visa’s stock is likely to outperform over the long-term based on valuation, growth, and earnings upgrades.

The long-term outlook for Visa (NYSE:V) looks bright with the likelihood for multiple years of double-digit revenue and earnings growth. The main reason for that is due to the continued global trend of transactions going cashless. Global digital payments are expected to grow at about 14% annually to reach $228 billion by 2028.

The COVID-19 pandemic accelerated this trend as more brick and mortar businesses added digital payments to avoid handling cash. Consumers also purchased more online using digital payments during the pandemic. Now, that these new habits have been formed, they are likely to continue going forward.

Long-Term Move to Cashless Transactions

The shift from cash transactions to more digital payment transactions has been going on for many years, long before COVID. The movement began back in the 1950s when the Diners Club was introduced as the first credit card issuer. The credit card industry grew from there with networks and additional issuers entering the market.

Of course, the e-commerce market really accelerated the shift to more cashless transactions in recent decades. The global e-commerce market is expected to grow at an impressive 26.6% annual pace to reach $14.3 trillion by 2028. This is likely to drive payment volume demand for Visa, allowing the company to grow revenue and earnings at an above-average pace.

Smartphone technology added to this trend, which has enabled street vendors to accept credit cards. The use of technology by Block (SQ), Zettle by PayPal (PYPL), Stax, and Stripe make this possible. Now, many transactions that were formerly done in cash are being done with credit/debit accounts. Of course, Visa benefits from this as its accounts are used with this technology.

The convenience of not having to haul a wad of cash around for payment transactions is continuing to trend. Having your cards loaded on a smartphone adds additional convenience for cashless transactions. The COVID pandemic added to this trend as many people feared cash to be a spreader of the virus and other germs. As a result, many businesses switched to card only transactions during the pandemic and/or many consumers choose to use cards to avoid handling potentially contaminated cash and for the convenience factor.

Another reason for the shift to cashless transactions has to do with the safety of not handling large amounts of cash, which can put businesses at risk for theft.

This trend of increased cashless payments is important for Visa since the company has over 3.9 billion accounts and over 80 million merchant locations throughout the world. Visa gets a percentage of the transactions from these numerous accounts. There is still a large opportunity for growth as Visa strives to convert $18 trillion worth of cash and check transactions into cards and digital transactions on the company’s network.

Visa’s Future Revenue and Earnings Growth Expectations

Visa has been consistently growing earnings by a double-digit annual pace for the past 5 years. The company averaged about 12% annual earnings growth over the past five years. The future looks even brighter with expectations of over 15% annual earnings growth for the next three to five years. This is higher than S&P 500’s (SPY) expected annual growth of about 12% over the same period.

Visa is expected to grow earnings at about 12% to 13% for FY23 and about 15% for FY24. EPS estimates for FY23 were upgraded from $8.28 3 months ago to the current estimate of $8.44. Earnings upgrades tend to be one of the most powerful forces affecting stock prices. Therefore, Visa is likely to perform well heading into the next earnings report on April 27, 2023.

The revenue outlook also looks good. Visa is projected to grow revenue at an annual pace of over 11% over the next five years. Revenue growth is projected to be over 10% for FY23, which ends in September. Visa’s strong revenue and earnings growth is likely to drive the stock higher for above-average gains over multiple years.

Valuation

Since Visa is a strong growth company, I like using the PEG ratio to evaluate the stock. The PEG ratio takes the company’s 3 to 5 year projected earnings growth into consideration. Visa currently trades with a PEG of 1.64, giving the stock a fair valuation.

The growth stocks that I cover tend to perform well when the PEG is below 2 when the business is performing well. Visa is certainly performing well with its strong double-digit revenue and earnings growth. The stock can reasonably grow approximately in-line with earnings growth from this fair valuation.

Technical Perspective

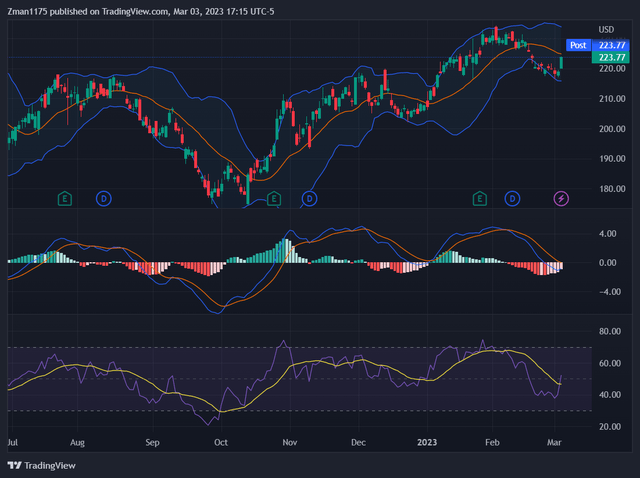

Visa’s daily chart above shows a positive upward trend. The stock recently dipped and looks like it may begin a new uptrend leg higher. This would be confirmed by the MACD indicator in the middle of the chart. The trend would be considered back to positive when the blue line crosses above the red signal line. The purple RSI line at the bottom of the chart is showing positive strength, indicating that the stock may continue upward.

Visa’s Long-Term Investment Outlook

Overall, Visa is likely to perform well over the long-term, meaning over multiple years for the foreseeable future. The big shift from cash to cashless transactions continues throughout the world. Visa is a large part of this shift as its accounts are used in smartphone transactions and in many other cashless transactions.

The company’s fair valuation should allow the stock to grow approximately in-line with earnings growth over the long-term. Since Visa is expected to grow earnings at an above-average annual pace for the foreseeable future, the stock is likely to outperform the S&P 500.

The main risk for Visa is a recession which could occur within the next year. This could lower overall spending during the economic downturn, depressing Visa’s revenue growth. However, the company would likely bounce back quickly as it usually does as the economy recovers and returns to growth.

Visa is a stock that I feel comfortable owning over the long-term due to the strong consistent long-term above-average growth.

Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The article is for informational purposes only (not a solicitation or recommendation to buy or sell stocks). David is not a registered investment adviser. Investors should do their own research or consult a financial adviser to determine what investments are appropriate for their individual situation. This article expresses my opinions and I cannot guarantee that the information/results will be accurate. Investing in stocks involves risk and could result in losses.

Consider joining Kirk Spano’s Margin of Safety Investing which offers a more in-depth analysis of individual companies.

Try Margin of Safety Investing free for two weeks and get your first year for 20% off.

Learn the 4-step investment process that top hedge funds use.

Invest with us in a changing world that demands a margin of safety.