Summary:

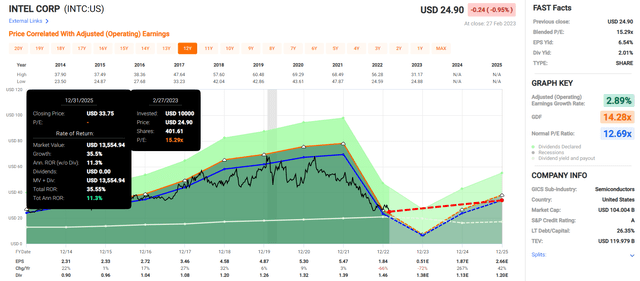

- Intel Corporation just slashed its dividend by 66%. It was the first dividend cut since the company began paying one 31 years ago.

- Studies show that dividend cutters historically underperform and have higher volatility to boot. When the dividend is cut, it’s time to sell.

- Intel just confirmed its fundamentals are the worst in at least 31 years.

- Intel’s new lower dividend will cost it $6.3 billion over the next three years and require $12 billion in new debt. Its interest costs will soar by 140%. If we get into a recession, Intel could suspend the dividend entirely.

- Intel offers 7.7% long-term return potential, while these 2 rivals are thriving hyper-growth chip stocks with excellent management, wide moats, and efficient R&D. They offer 19% to 26% long-term return potential, 2.5X to 3.5X more than Intel.

JuSun

This article was published on Dividend Kings on Tuesday, February 28th, 2023.

—————————————————————————————

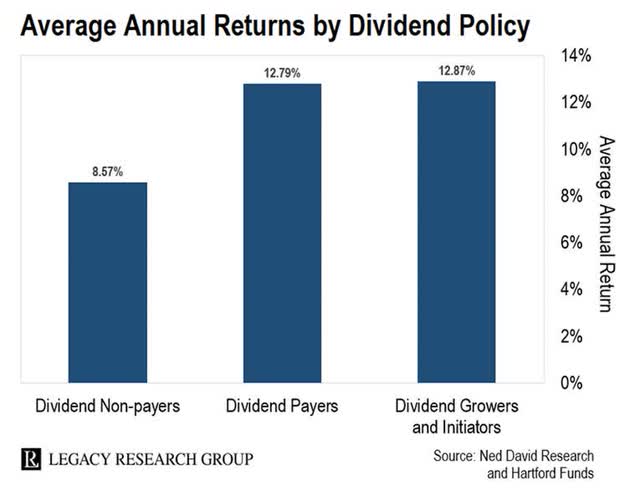

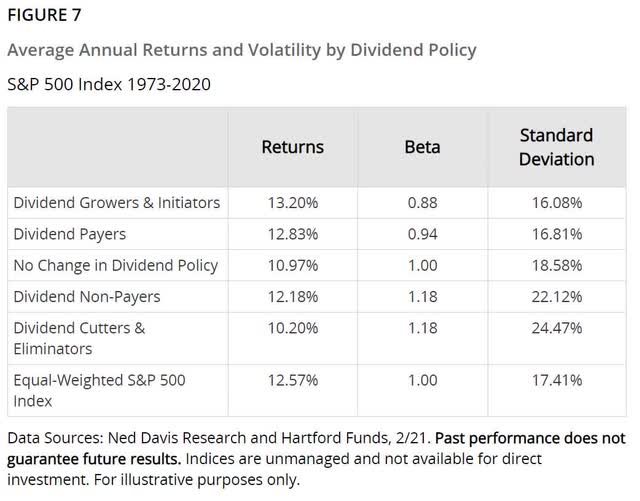

Owning blue-chip dividend stocks for the long term is the best investment strategy in history.

For the last 50 years, dividend growth blue chips delivered around 13% annual returns and about 10% inflation-adjusted returns.

How impressive is that? According to a study from AQR, Buffett’s unlevered returns since 1965 were 12.8%. Or, to put it another way, Buffett’s $120 billion fortune was built from buying the world’s best dividend blue-chips at reasonable valuations, using 1.6X leverage (from his insurance companies).

But that doesn’t mean you can just buy any old dividend stock and hope to earn Buffett-like unleveraged returns. Why? Because almost half of all U.S. stocks turn into disasters.

| Sector |

% Of Companies That Suffer Permanent 70+% Declines Since 1980 |

| Energy | 65% |

| Tech | 59% |

| Communications | 49% |

| Consumer Discretionary | 48% |

| Healthcare | 48% |

| All Sectors | 44% |

| Industrials | 39% |

| Materials | 38% |

| Financials | 29% |

| Utilities | 14% |

(Source: JPMorgan Asset Management.)

Since 1980, 44% of all U.S. stocks have suffered permanent 70+% losses. The wheels fell off those buses, and they went into the ditch and stayed there.

Almost 60% of tech stocks, a sector where change is rapid and constant, turn out to be mistakes.

That’s why Dividend Kings uses a 3,000-point safety and quality model that includes over 1,000 metrics. Our goal is to help you avoid value traps like these.

Or, at the very least, to ensure you don’t spend decades holding onto underperforming companies hoping and praying to make back your money.

Why Selling Dividend Cut Stocks Is Usually A Sound Idea

Ben Graham considered dividend streaks an important sign of quality.

- 20+ years without a dividend cut is a sign of a quality company

- 20+ year dividend growth streak is a sign of excellence.

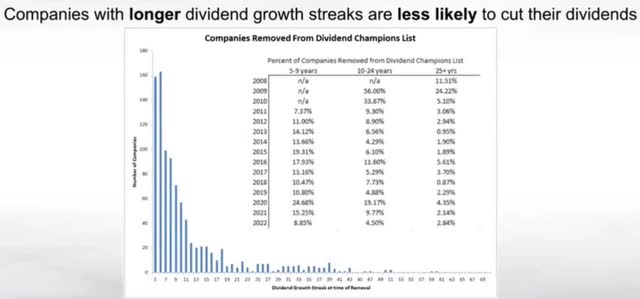

But there are no certainties on Wall Street, just probabilities. For example, during the Great Recession, Dividend Aristocrats were 80% less likely to cut their dividends than stocks with 5 to 9-year streaks

In the Great Recession, Aristocrats were half as likely to cut as companies with 10 to 24-year growth streaks.

And historically, two Dividend Kings (50+ year streaks) per decade cut their payouts.

DK Research Terminal

U.S. companies hate cutting dividends and usually won’t do so unless absolutely necessary.

This is why a steadily rising dividend is usually a sign of a healthy company, and a dividend cut means something is usually very wrong.

And it’s why, as a rule of thumb, I will sell any company I own that cuts its dividend (unless it’s a variable payer).

Let me give you three examples of why this is usually a smart idea.

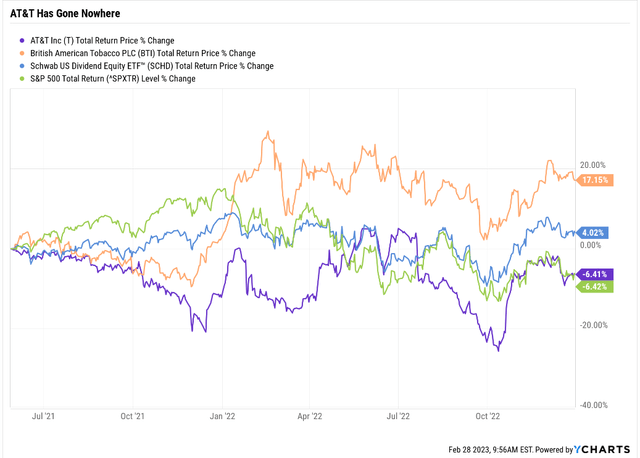

On May 28th, AT&T Inc. (T) announced it would split Time Warner off, merge it with Discovery, and cut the dividend by approximately 50% the following year.

I sold AT&T, recommended DK members do the same, and locked in a 28% annualized return in nine months.

After buying it at the lowest valuation in 20 years, we made out like bandits even when the thesis broke.

And guess what AT&T has done since then?

AT&T managed to match the market’s returns by falling 6%, including dividends.

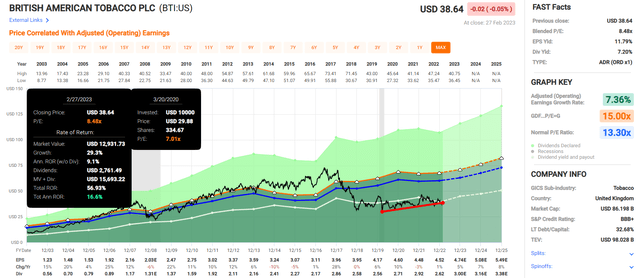

Schwab U.S. Dividend Equity ETF (SCHD) beat AT&T by 10%, and British American Tobacco p.l.c. (BTI) has outperformed by 23%.

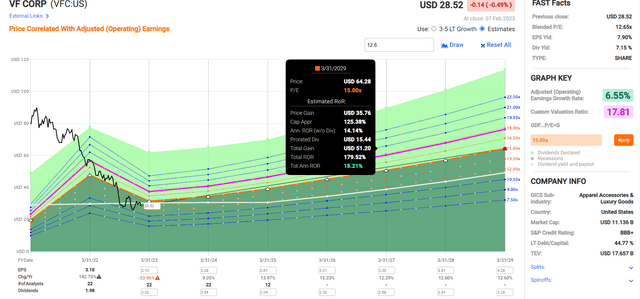

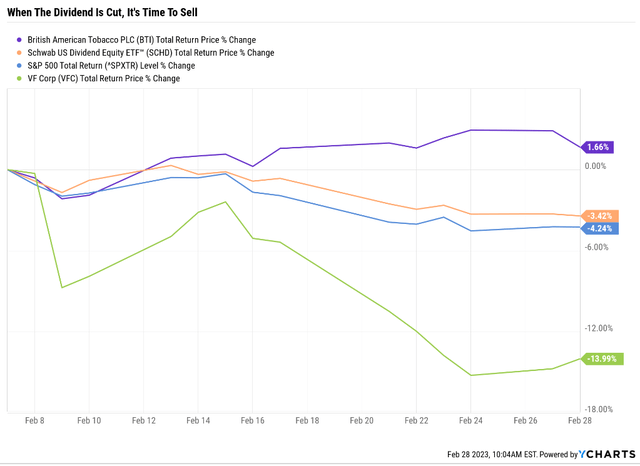

On February 8th, I recommended selling V.F. Corporation (VFC) because the thesis was broken. Management had raised the dividend for the 51st consecutive year just three months before. And three months later, they cut it by 40%.

Yes, VFC is a much higher-quality company than AT&T. Its valuation is very attractive, and it has the POTENTIAL for 20% returns in the coming years.

Now that VFC isn’t a Dividend King, its historical 18 price/earnings ratio might come down slightly. What if it is permanently reduced to the Ben Graham rule of thumb of 15 for most companies? Then, based on the current management guidance and forward earnings forecasts, VFC’s total return potential for the next few years is here.

- 2023: 29% or 25% annually

- 2024: 53% or 22% annually

- 2025: 82% or 21% annually

- 2026: 110% or 20% annually

- 2027: 143% or 19% annually

- 2028: 180% or 18% annually.

But that’s IF VFC grows as expected from here. I personally have no interest in a company whose fundamentals have deteriorated so much in 3 months, that management felt it had no choice but to throw away a 51-year dividend growth streak.

As I like to say, short-term stock price is vanity, cash flow is sanity, and dividends are reality.

Management can talk a great game all day long about how the turnaround will turn out great, but dividends are where they put their money where their mouth is.

The morning VFC announced the 40% dividend “reset,” the stock price initially went up. And then, guess what happened?

VFC is down another 14% since its dividend cut.

And BTI? The global aristocrat that DK used our VFC proceeds to buy more of? It’s up 2%, outperforming the market and SCHD by about 6% in the last few weeks.

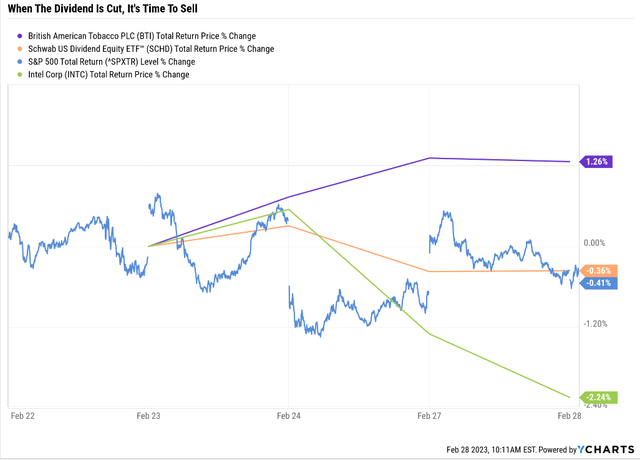

So far, in 2023, about a dozen U.S. companies have cut their dividends. Intel is one of them, with a 66% slashing of its payout.

We’ve been lowering Intel’s safety and quality score for months as its fundamentals deteriorated, and now it’s time to sell.

Just like AT&T and VFC, INTC started out rising modestly on news of the cut.

- Wall Street was supposedly “relieved” that they ripped off the Band-Aid and would be saving $4 billion per year in dividend costs.

But since that initial pop, Intel has steadily slid downwards. And my go-to dividend salvation stock? BTI? It’s up, just like it was since the VFC and AT&T cut.

Of course, you can use SCHD as a dividend salvation stock if you don’t want to pick stocks. Or you can buy numerous other alternative chip makers, which we’ll discuss today.

The point is that when management lets you know something is terribly wrong with the business by cutting its dividend, it’s usually a bad idea to hope and pray that the turnaround succeeds.

And a dividend cut is a pretty big warning flag.

How big of a warning? Intel had an eight-year dividend growth streak but had never cut its dividend since it began paying one in 1992.

- 31 years without a dividend cut.

But now management effectively admits that Intel’s fundamentals are the worst they’ve ever been in 31 years.

I love buying blue chips growing while their stock prices slide or go nowhere.

- why BTI is 14% of my family’s hedge fund.

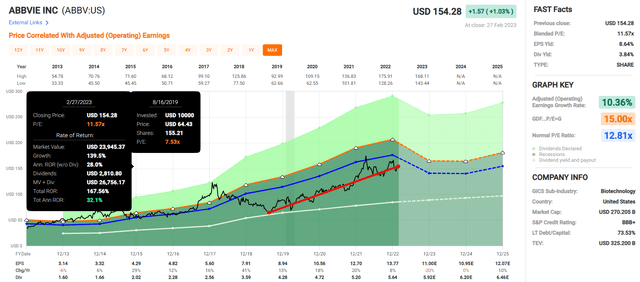

Remember AbbVie Inc. (ABBV)? Remember how it fell to a P/E of 7 and a yield of 6% even though this dividend king was growing at double-digits?

AbbVie Was Never Broken And Has Delivered 32% Annualized Returns Off Its Lows

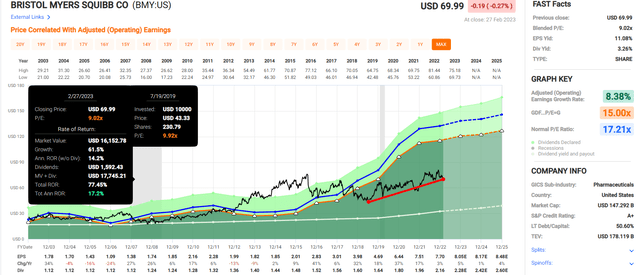

Or how about Bristol-Myers Squibb Company (BMY), who reached a forward P/E of 6X based on management’s guidance of what buying Celgene would do for EPS (a more than 20% boost)?

Bristol-Myers Was Never Broken And Has Delivered 17% Annualized Returns Off Its Lows

Remember that Warren Buffett’s unlevered returns are just 12.8%. If you buy quality blue chips at a great price, you can literally achieve Buffett-like returns.

British American Was Never Broken And Has Delivered 17% Annualized Returns Off Its Lows

BTI fell to a P/E of 7 during the Pandemic and a very safe yield of 8.6%.

It’s up 17% annually since then, even though it’s still in a bear market.

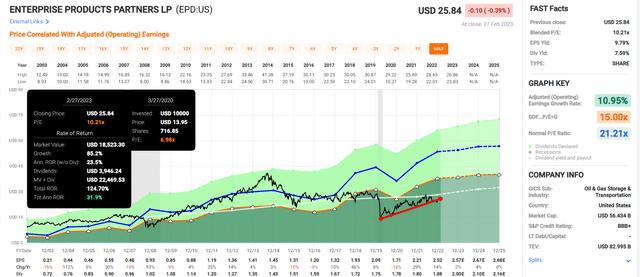

Enterprise Products Was Never Broken And Has Delivered 32% Annualized Returns Off Its Lows

Enterprise Products Partners L.P. (EPD) hit a peak yield of 15% during the Pandemic crash (17% intra-day). It was 65% historically undervalued.

But I was 80% confident that EPD wasn’t broken, so I spent months pounding the table on Dividend Kings, iREIT, and Seeking Alpha.

- 80% is the Marks/Templeton certainty limit on individual companies

- the most confident you can ever be, given that facts can and will change in the future

- “I’ll die on this hill” confidence.

Do you know how many speculative turnaround stocks my family’s hedge fund owns? None.

There is no reason to, not when there are always wonderful world-beaters who are thriving and available at reasonable to wonderful prices.

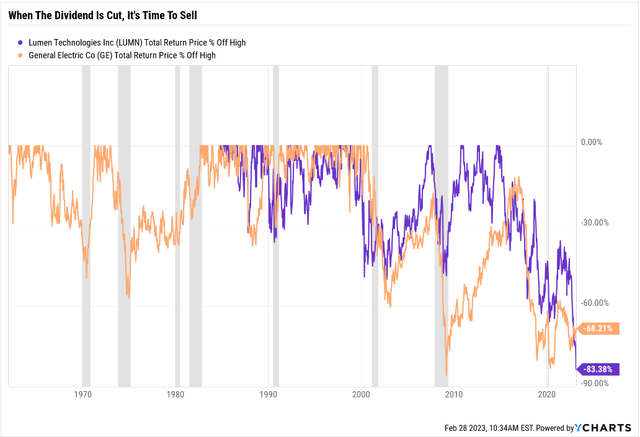

So does that mean that Intel is doomed? Is it the next General Electric (GE), the next CenturyLink (LUMN)?

59% of all U.S. tech stocks end up as permanent, catastrophic failures. Let’s take a quick look at what Intel’s fundamentals look like now.

Intel Is Broken: Time To Sell

Worst Fundamentals In 31 Years…In Exchange For a 36% Return Potential

Intel’s fundamentals have deteriorated so much that it’s not even undervalued.

- 91% EPS decline in 2 years:

The firm has been plagued by weak PC demand, competitive pressures from a resurgent AMD, and ongoing execution issues culminating in market share loss and margin compression. Although we still support Intel’s IDM 2.0 strategy to fix its manufacturing, we view this dividend cut as necessary given its turnaround plan’s material capital expenditure requirements.” – Morningstar.

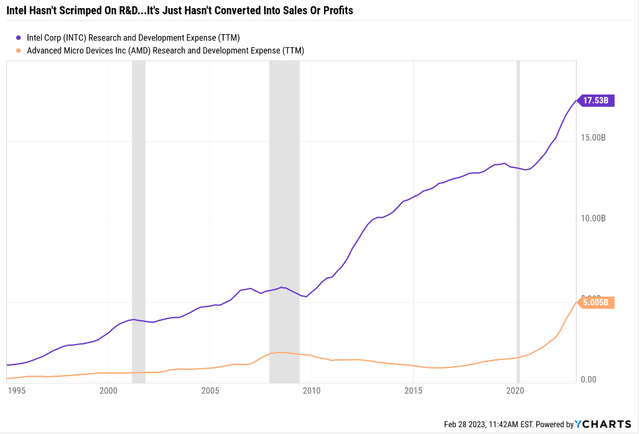

Intel’s wide moat in chips has been eroding for years, despite impressive amounts of R&D spending.

Intel has been pouring a fortune into R&D, more than 3X more than AMD, which has been executing well and stealing market share for years.

Intel has spent $32 billion in R&D since its 60% bear market began in 2021. Investors have not been rewarded.

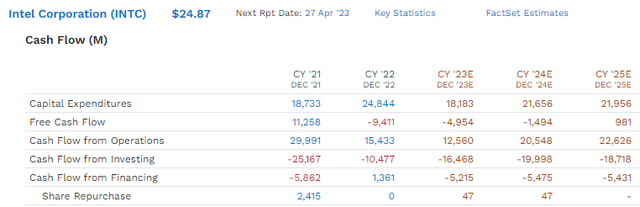

Dividends new $2.1 billion per year dividend is still unsustainable and expected to remain so through at least 2025.

It must take on more debt to fund its ambitious turnaround growth efforts.

And that means Intel’s dividend might not be falling. Why?

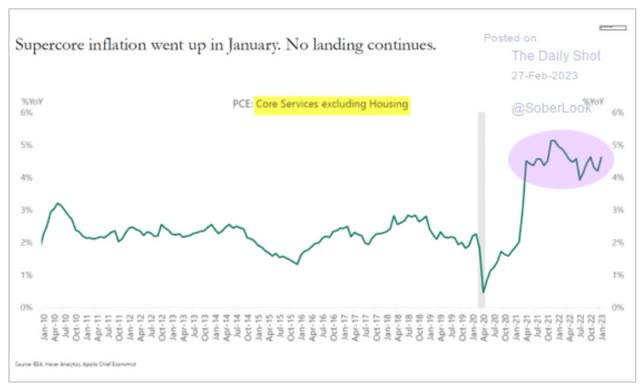

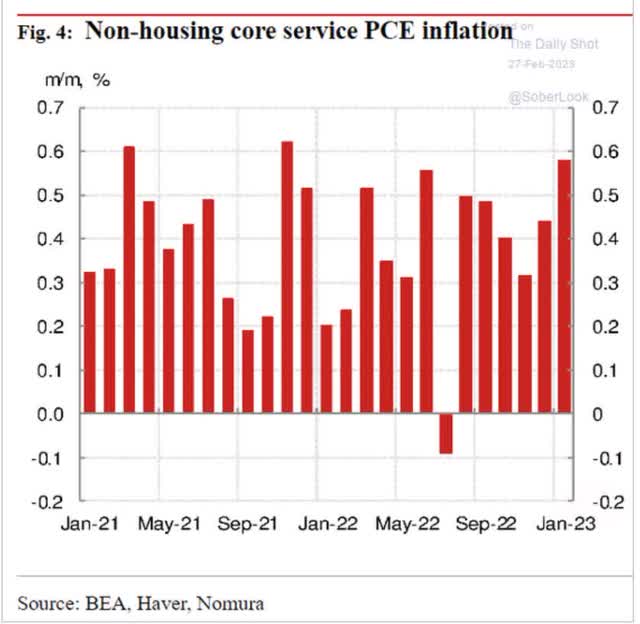

Because the Fed’s new Super Core inflation metric is stuck at 4% to 5%.

And has been going up for three consecutive months.

Today Super Core inflation is running at 7.4% annualized (0.6% month-over-month) and 4.6% YOY.

Core PCE, the Fed’s official inflation metric, is 4.7% and running at 0.6% MOM.

- 7.4% annualized.

The Cleveland Fed’s real-time inflation model estimates next month’s core PCE will also come in at 4.7% YOY and 0.6% MOM.

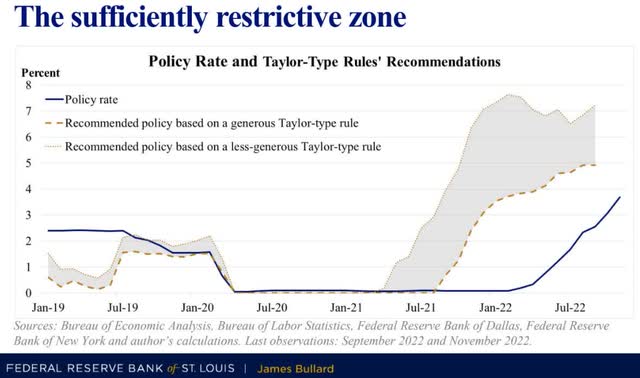

Or, to put it another way, inflation is stuck, and the Fed might have a lot higher to hike.

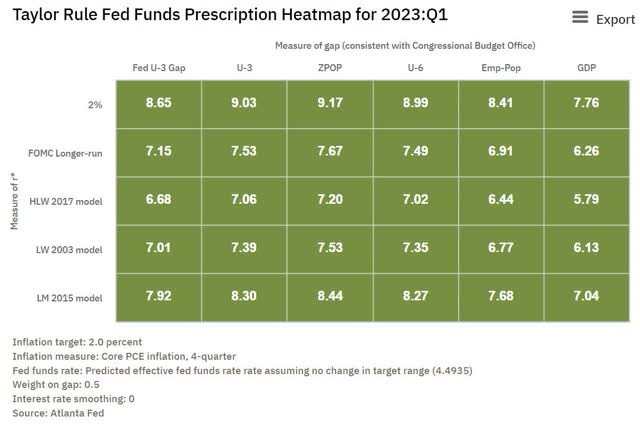

The Taylor Rule says the Fed should be at 6.7% to 9.2% based on the economy. We’re 4.75%, and the bond market thinks the Fed will stop at 5.25%.

Unless the economy stays overheated, in which case the Fed has said it is willing to go as high as 6% to 7%.

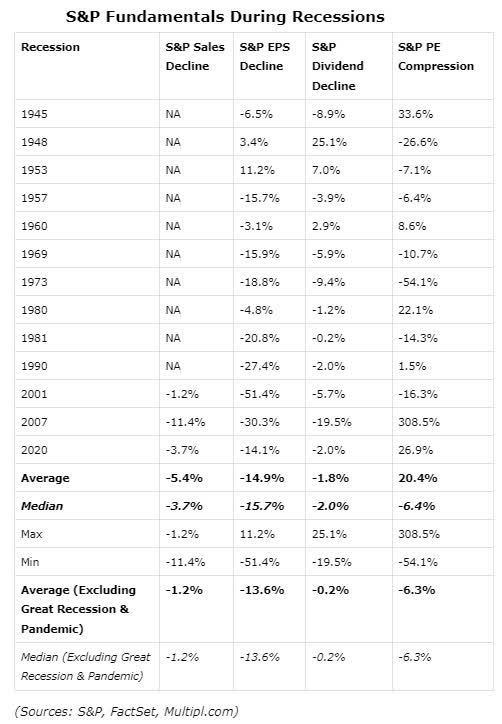

What if the Fed does hike to 6% to 7%? While this is not the most likely outcome, here’s what it could mean for Intel.

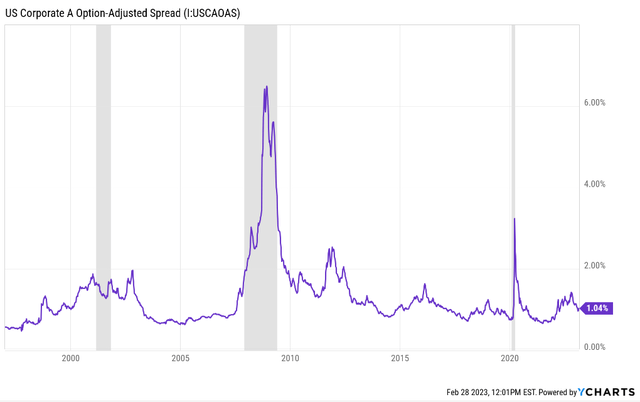

- Assuming a 1% to 2% 2/10 yield curve inversion 10-year yields could go to 5% to 6%.

The spread between A-rated bonds and 10-year yields is 1% but during recessions can rise as much as 2%.

- Intel’s future borrowing costs could rise to 6% to 7%

- up from 1.46% effective borrowing costs today.

Intel has $40 billion in debt, and $6 billion will mature by 2025.

Intel’s interest expenses are expected to jump from $418 million in 2022 to $551 million in 2023 alone.

Intel’s dividend over the next three years will consume $6.3 billion, compared to -$5.5 billion in cumulative consensus free cash flow.

- An $11.8 billion shortfall that will have to be made up with debt.

Currently, Intel has to pay 5% interest rates on new debt. So that’s another $590 million per year in interest costs.

- factoring in Intel’s “cut everything to the bone” cost-cutting plans.

What if the Fed has to hike to 6%, 7%, or even higher? Then Intel’s $12 billion in minimum new debt could cost an extra $840 million in interest.

- Total interest expenses using current interest rates: $1.01 billion (140% increase).

Intel’s interest expenses will double in the next three years, even if management’s plan goes perfectly.

- Total interest expenses using at 7% borrowing costs: $1.26 billion (200% increase).

If rates go higher, Intel’s dividend safety could deteriorate further and it might have to suspend it entirely.

I would have preferred they eliminate it and rip off the Band-Aid. After all, management just told us Intel’s fundamentals are the worse in 31 years.

$6.3 billion in dividends over the next three years should be going to save the company and not pay a 2% yield that no income investor is happy with.

Intel is trying to cut costs but risks losing its top talent to thriving rivals such as AMD.

The firm sees $3 billion in cost savings in 2023. It targets annualized savings of $8 billion to $10 billion by the end of 2025, including headcount reductions, cuts to marketing budgets, exiting noncore businesses, and a temporary reduction to compensation and rewards programs for employees and executives. In our view, the danger with some of these actions is that Intel will underinvest in key areas while risking the loss of top engineering and chip design talent.” – Morningstar (emphasis added).

Intel is spending a fortune while at the same time making employees very angry. Angry employees in the tightest job market in 54 years? When are there two job openings for every person looking for work?

That’s a recipe for talent flight to thriving chip makers who can afford to pay employees what they are worth.

Why Own Intel When You Can Own These Thriving Chip Makers Instead?

Here are two chip makers firing on all cylinders who are far better long-term income growth prospects than Intel.

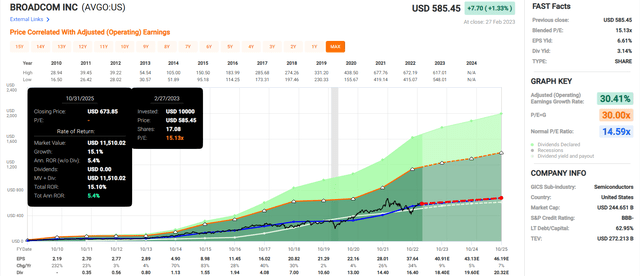

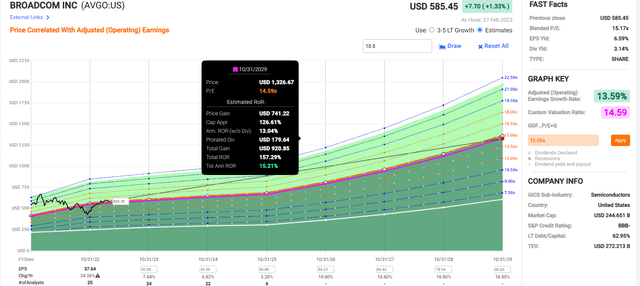

Broadcom Inc. (AVGO): The Berkshire Of Chip Makers

Further Reading

Summary Facts

- DK quality rating: 83% medium risk 12/13 Ultra SWAN (sleep-well-at-night)

- Fair value: $613.53

- Current price: $591.94

- Historical discount: 3%

- DK rating: potential reasonable buy

- Yield: 3.1%

- Long-term growth consensus: 18.8%

- Long-term total return potential: 21.9%.

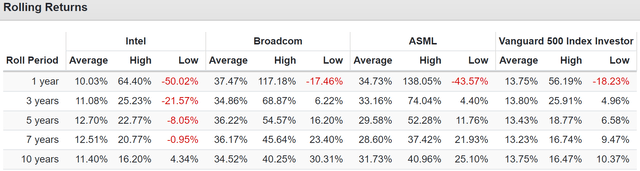

AVGO might not seem that impressive compared to Intel’s 11% return potential for the next few years.

But its long-term growth prospects are far better once the recession is over.

Broadcom 2029 Consensus Return Potential

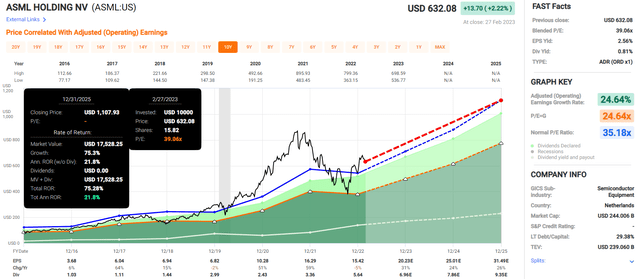

ASML Holding N.V. (ASML): The Ultimate Dividend Chip Stock

Further Reading

Summary Facts

- DK quality rating: 99% very low risk 13/13 Ultra SWAN (sleep-well-at-night)

- Fair value: $707.18

- Current price: $623.09

- Historical discount: 11%

- DK rating: potential good buy

- Yield: 0.9%

- Long-term growth consensus: 25.4%

- Long-term total return potential: 26.3%.

ASML has the potential to double Intel’s returns over the next three years, thanks to its hyper-growth.

Bottom Line: When The Dividend Is Cut, It’s Time To Sell

Remember, 44% of all stocks turn into permanent disasters.

Since 1973 dividend cutters have underperformed every other kind of stock, with higher volatility.

- Wall Street is a game of long-term probabilities

- don’t play a game where the odds are stacked against you.

When the facts change, I change my mind. What do you do, sir?” – John Maynard Keynes

What do analysts expect from Intel in the future? They expect its turnaround to succeed…sort of.

Intel Offers Worse Return Potential Than Almost Any Other Stock

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return |

| ASML | 0.9% | 25.4% | 26.3% | 18.4% |

| Broadcom | 3.1% | 18.8% | 21.9% | 15.3% |

| ZEUS Income Growth (My family hedge fund) | 4.2% | 10.4% | 14.6% | 10.2% |

| Schwab US Dividend Equity ETF | 3.6% | 9.4% | 13.0% | 9.1% |

| Vanguard Dividend Appreciation ETF | 2.2% | 10.0% | 12.2% | 8.5% |

| Nasdaq | 0.8% | 10.9% | 11.7% | 8.2% |

| Dividend Aristocrats | 1.9% | 8.5% | 10.4% | 7.3% |

| S&P 500 | 1.7% | 8.5% | 10.2% | 7.1% |

| REITs | 3.9% | 6.1% | 10.0% | 7.0% |

| Intel | 2.0% | 5.7% | 7.7% | 5.4% |

| 60/40 Retirement Portfolio | 2.1% | 5.1% | 7.2% | 5.0% |

(Source: DK Research Terminal, FactSet, Morningstar.)

Buy Intel today, and our best available evidence says you’ll earn less than 8%. Less than almost any other investment strategy. Heck, you might make more with junk bonds.

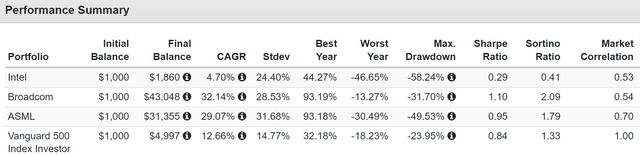

In contrast, AVGO and ASML are reasonably to attractively valued world-beater dividend blue-chip chip stocks.

Thanks to their great management, efficient R&D, and stable, wide moats, they have run circles around Intel and almost everything else.

Total Returns Since 2009

Over 14 years, there is a 90% statistical probability that quality companies will outperform and lousy ones won’t.

The market has spoken, and Intel has been found lacking.

Its management can’t keep up with the competition.

Its mammoth R&D spending has been about as useful to its shareholders as IBM’s Watson and 5,000 annual patent filings.

Its dividend remains unsustainable through at least 2025.

And its $12 billion in planned borrowing at the highest interest rates in 15 years means that a future recession could cause the dividend to be suspended entirely.

It’s not undervalued, trading at 13.9X consensus 2024 earnings.

- Intel’s earnings estimates are falling by the week.

Meanwhile, Broadcom and ASML are firing on all cylinders, run by brilliant and adaptable management. They are dividend growth stocks with safe or very safe dividends that are growing like weeds.

When the dividend gets cut, it means something is terribly wrong. And when a dividend gets raised, it’s validation that a company is doing well or even thriving.

With limited investable savings, I can’t recommend Intel to anyone except index investors who have no choice but to own it.

- VIG and SCHD won’t own intel for at least the next 11 years

- and so neither will I.

Disclosure: I/we have a beneficial long position in the shares of ASML either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: DK owns ASML and AVGO in our portfolios.

—————————————————————————————-

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

-

Access to our 13 model portfolios (all of which are beating the market in this correction)

-

my correction watchlist

- my family hedge fund

-

50% discount to iREIT (our REIT-focused sister service)

-

real-time chatroom support

-

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.