Summary:

- Walmart has seen aggressive insider selling that appears to be accelerating this year.

- Q4 earnings and forecast 2023/2024 FY net sales and EPS figures are weak WMT trades at a demanding valuation that is incongruent with the current stock price.

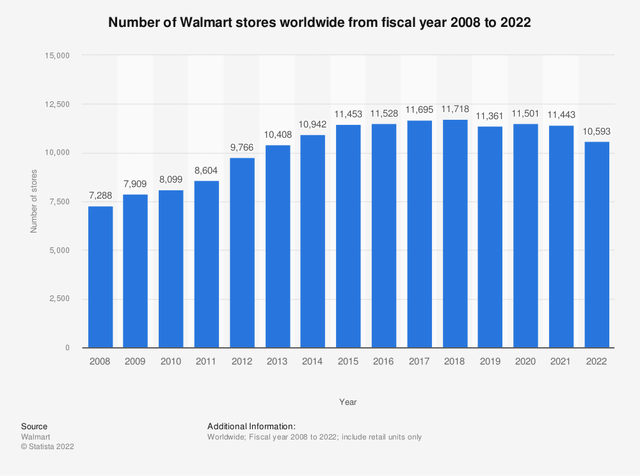

- WMT also has seen declining store numbers both in the US and internationally.

Justin Sullivan

By David Huston and Nick Gomez (technical)

There are reasons to be very cautious on Walmart and it would appear – for now – that the market is discounting the potential headwinds facing the company.

In essence, this piece will argue that Walmart is overvalued at today’s levels, has significant headwinds to consumer spending and price pressures, and that management are unloading shares in advance of a medium – and perhaps larger than medium-term correction in the price of the stock.

Insider Selling

The situation is reminiscent of what happened with mega cap tech at the end of 2021 and into the start of 2022. Insiders with knowledge of the business started to unload shares at the top of the cycle. They warned the market on the challenges of margins and competition – and if you had been paying attention, you could have avoided the loss of capital that followed.

Let’s start with the obvious first. It is well understood that insider selling does not contain the same prescience and future gazing knowledge that insider buying does. That is true to a point: an insider buying $100 million dollars’ worth of stock in a $5 billion market cap company, in the open market, generally has one reason to buy and that’s to make a profit and show the market that they have skin in the game. Insiders can sell for all sorts of reasons: they may want to fund expenditures, or big capital items, and potentially diversify their investments.

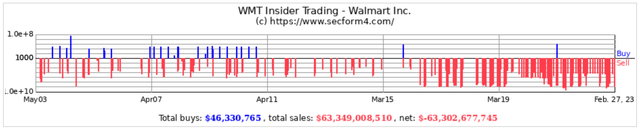

Over the course of the past two years insiders have sold $6.58 billion worth of stock and made virtually no insider purchases in the open market. However, if you look closer there is a more persistent trend and the recent 2023 sales have become more aggressive:

Zooming out further we can see that insider buying stopped after 2016 and has accelerated into aggressive insider selling since 2019. The Walton family and the senior executives cannot be said to have avoided purchasing stock, either; in 2003 and after the GFC there were numerous significant insider buys that happened periodically.

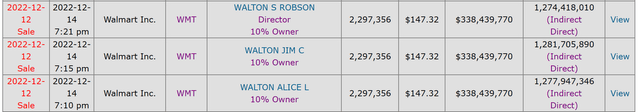

The insider selling has accelerated even further recently – in the past 3 months – with Robson S Walton, Alice L Walton, Jim C Walton, and President Douglas McMillon all unloading shares on the same trading days in volume over the course of December 2022, January and February 2023:

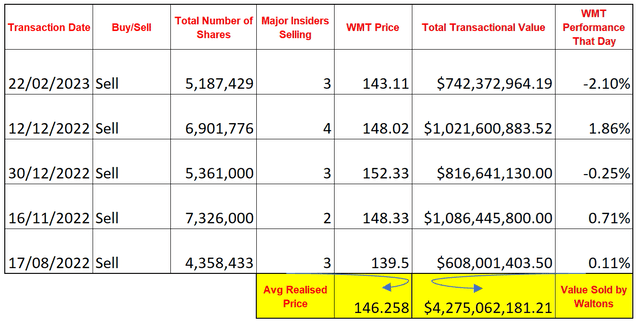

This isn’t cherry picking the data either. Look at the following major sale dates, the summary of how much was sold by the Waltons, and what the volume of shares sold and the share price was on those key dates:

There are two key takeaways from this analysis. The first is that, in my opinion, the Waltons are coordinating their sales on key days in the open market with an average realised price since August of 2022 of $146.26. Apart from one day, we have evidence of 3 family members selling large tranches of shares for the past 3 years, but this has become more aggressive in the past 5 months.

The second takeaway is that Walmart is a huge company and so we have to view these figures in context. The 2-year volume of shares sold is 27,437,110 according to Yahoo Finance. The total share count for WMT is 2.711 billion shares and that means that insiders have unloaded 1% of the total shareholding of the entire business within 2 years, and about 2% of the Walton’s family holdings

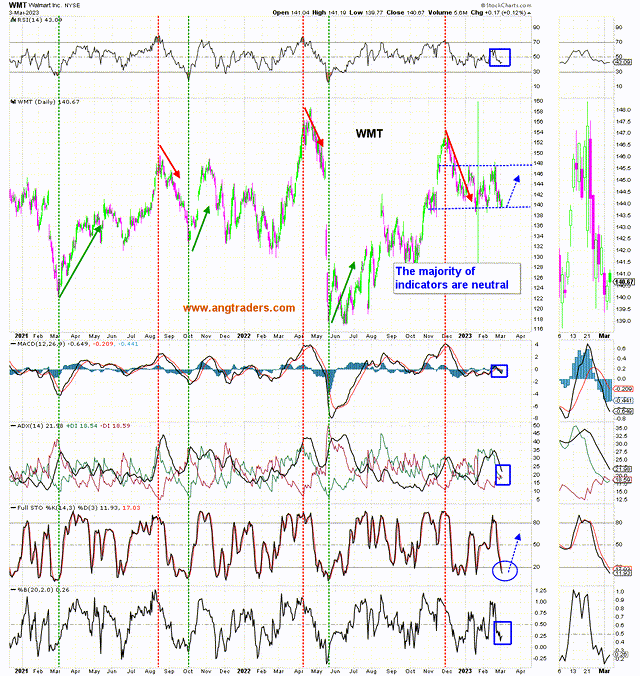

Technical Analysis

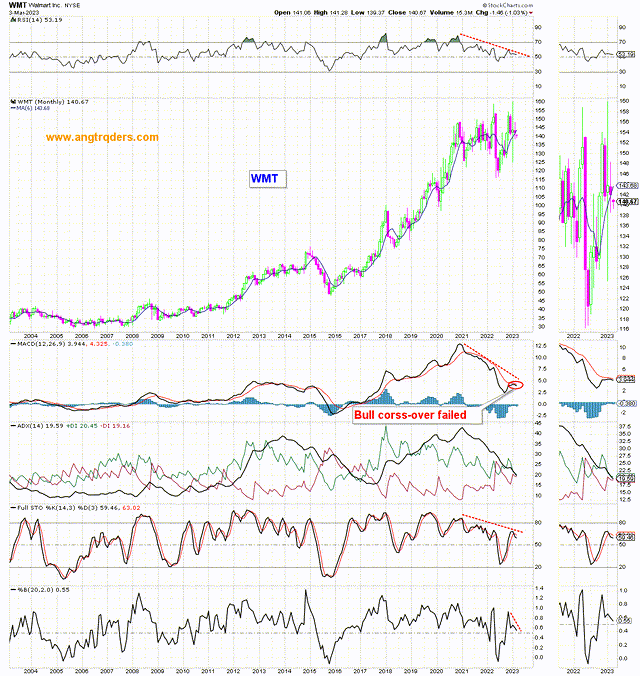

Let’s take a look at the technical picture of WMT and whether the company’s stock has any obvious momentum:

WMT has just dipped below its 6-month moving average, which currently sits at $143.66, which is bearish from a medium to long term horizon. Below that level and given where we are with valuations we’d expect continued weakness.

At the daily-scale, WMT technicals are mostly neutral in setup, but the stochastic has entered oversold levels which could lead to some price gains. If there are some higher prices in the near-future, it would be an opportunity to sell or take on the option positions that David is suggesting (chart below).

Valuation & Fundamentals

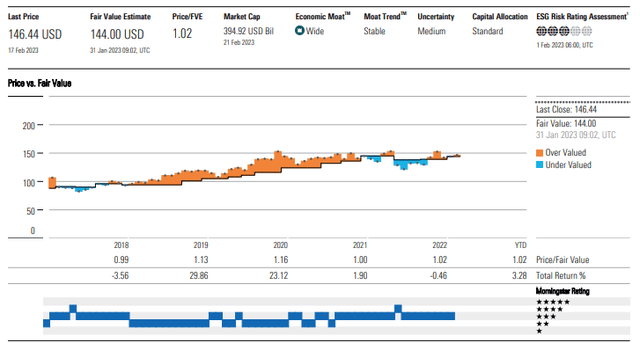

When it comes to valuation we can see that, historically, Walmart has traded higher than its intrinsic value based on its cash flows as a business:

Walmart is right around fair value at today’s prices, trading at $146.44 against a fair value of $144. However, a lot of that was thrown into question with management’s recent guidance towards a weaker fiscal 2024 that pointed to a deterioration in margins and weaker forecasted demand.

Trading at a rather demanding 33x earnings (TTM) and sporting a rather modest 1.6% payout it’s difficult to show any clear value proposition here with obvious headwinds on the horizon.

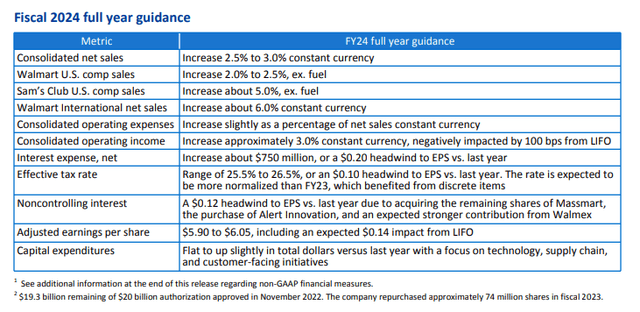

Management have guided for 2.5-3% sales growth and adjusted EPS of $5.90-$6.05, which falls short of analyst expectations for next year. This implies near term low-single-digit sales growth and a luke-warm adjusted operating margin in the single-digits. Competition is fierce and has clearly had an impact on the bottom and top line as we move into 2023/24 FY and the full impact of interest rate hikes takes its toll on the consumer.

No doubt Doug McMillon (CEO) and John David Rainey (CFO) are sharp operators and steer the company well. They tried to strike a balanced tone on the Q4 earnings call, and their view was best summarised by John:

“In this period of macroeconomic uncertainty, we believe that we are well equipped to continue gaining market share in an environment where consumers need to stretch their dollars further. We will continue to advocate for customers and work with our supplier partners to maintain strong price gaps and deliver lower relative pricing versus competitors. We’re also navigating real inflation on our own cost structure and continue to seek ways to reduce costs and improve leverage potential. With these considerations in mind, we’re maintaining a balanced approach to our guidance, incorporating a cautious view on the consumer together with our confidence in our ability to execute”…..John David Rainey, CFO, Walmart

It sounds fairly pessimistic when you balance the views of the executives – that the macroeconomic period is uncertain, and they need to offer value for money in order to grab and maintain market share while also looking at their cost basis. Meanwhile the forecasts for 2023/24 involve 2.5-3% constant currency sales growth and a hit to earnings.

Growth fundamentally slowing down

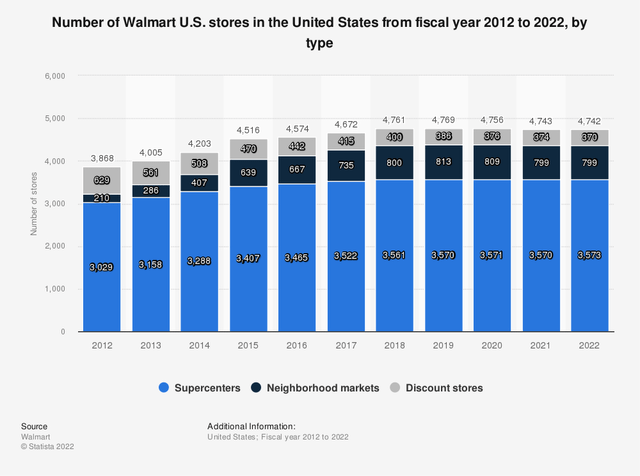

Peter Lynch, the famous investor who ran the Magellan Fund between 1977 and 1990 and managed a neck-snapping 29.2% annual return – used to quip that big companies have small moves and small companies have big moves. This is a big company that has already past it’s prime in terms of number of stores and expansion of its footprint, and it is slowing down to anaemic levels of growth.

What surprises me about Walmart is that the total number of stores, which is a good proxy for growth in the business because it’s their primary mechanism for adding to their reach and their bottom line, stalled in 2019. They peaked at 4769 stores in the US and have seen a decline since, that based on Q4 numbers looks set to continue:

“Ahh, yes, but that’s just in the United States,” you might say to me. Well let’s have a look at total International stores – it’s a similar picture:

In fact globally Walmart is in an even worse position, with a significant drop in stores for 2022 that would strongly support the thesis that the business may enter into a period of challenging consolidation as it tries to maintain market share, drive margins, and do so in an environment where the consumer is simply not going to be supported by low rates and aggressively easy financial and lending conditions that support spending.

This is why Walmart has a PEG ratio (TTM) of 4.11, which is pretty poor. You are paying a high P/E to buy future earnings – which is what you own to buy the stock – and when you factor in growth (PEG is the P/E ratio divided by earnings growth) you’re paying a high premium for a business with very weak underlying growth.

Imagine it from the customers point of view: if I can barely afford to pay my mortgage and put food on the table then perhaps the only retailers truly thriving in this environment are the Dollar Store, Pound Land (in the UK), and Aldi / Lidl stores that have ruthlessly tight control of prices and costs.

Consumer Spending & Sentiment

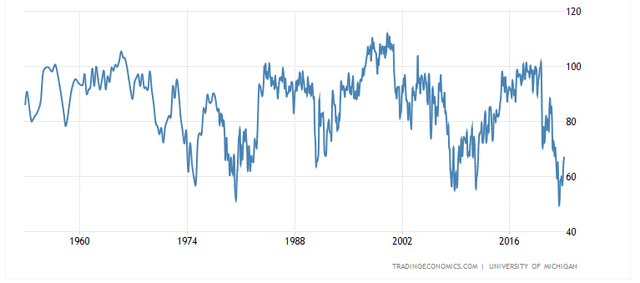

With that in mind let’s turn to the final leg of the table – the all-mighty consumer. The University of Michigan consumer sentiment survey was revised higher to 67 in February and shows an improving trend:

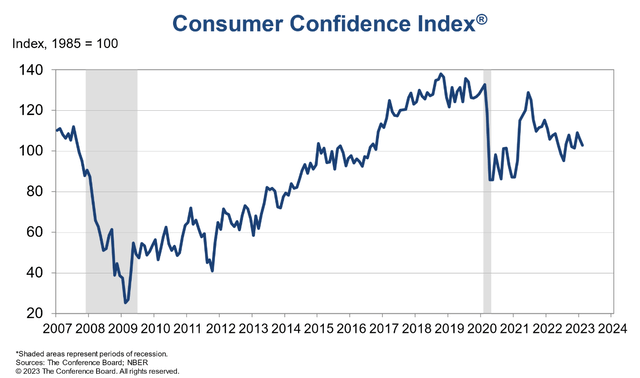

Perhaps a more wide ranging index is the Consumer Confidence Index issues by the Conference Board. This paints a pretty grim picture for the consumer and the outlook for individuals right in Walmart’s key demographic:

“Consumer confidence declined again in February. The decrease reflected large drops in confidence for households aged 35 to 54 and for households earning $35,000 or more,” said Ataman Ozyildirim, Senior Director, Economics at The Conference Board.

Based on the data, consumers assessment of underlying business conditions worsened in February and remains on a relatively bearish downward trend (short term) and this represents a cross section of consumers views on business conditions and the labor market.

Summary and Affirmative Action

Walmart has a number of headwinds that make it very difficult to recommend the stock as a buy. The business has seen and continues to see aggressive insider selling that is coordinated, in my opinion, and looks to suggest that Walmart is over-valued at the $140-$150 price range. When the stock price has reached these levels it has been followed by quite large insider sales.

Based on Q4 earnings and net sales targets for next year Walmart’s management expect soft growth in the top and bottom line figures. The business from a fundamental standpoint trades just over fair value but on some indicators like the PE, PEG and from an EPS and Net Sales growth point of view, the business appears to be over-valued. Store growth has clearly gone in reverse and this is a larger, more mature company with a fairly low dividend payout that is simply not able to grow at the rates that it did back in the heyday.

Overall, we assign a neutral to outright bearish view on Walmart. From a positioning point of view this opens up a number of enticing possibilities.

For equity investors with long positions now would be a good time to consider exiting those positions and selling on advances in the stock price

For derivatives positions that can pay attractive rates of return if the thesis that we outline here plays out, you could begin selling at-the-money covered calls on your equity position (if you have stock and want to sell it) and at current rates yield 2.5% a month until your equity gets called away.

If you don’t hold the stock one could look at Bear Calls Spreads or enter into outright short positions in WMT with a particular eye on $146 as a starting point.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Take advantage of our 14-day free trial and stay on the right side of the market and Away From the Herd.

“ I am SO VERY thankful for the discovery of this site, and the wisdom and knowledge I have gained ...”

” I have not seen this type of analysis anywhere else. “

“It is probably the only report of its type on the planet when you think about it.”

Take advantage of our 14-day free trial and stay on the right side of the market and Away From the Herd.