Summary:

- In addition to AI-related growth catalysts, Microsoft’s core business has all the chances to create additional shareholder value as well.

- If the macroeconomic environment continues to improve while the dollar weakens, then Microsoft would be able to continue to grow its business at an aggressive rate in the following quarters.

- The company’s successful performance in Q2 along with the positive outlook for 2023 and beyond already indicate that Microsoft’s shares have even more room for growth.

Jean-Luc Ichard

While Microsoft’s (NASDAQ:MSFT) decision to begin implementing ChatGPT within its own ecosystem of products and services has certainly positively impacted the business’s investment attractiveness and helped its shares to appreciate since the beginning of the year, the company nevertheless has several other growth catalysts that have all the chances to also create additional shareholder value in the foreseeable future. Microsoft’s recent successful earnings report for Q2 indicates that the business is able to continue to grow at an aggressive rate even in the current turbulent macroeconomic environment thanks to the strength of its core products that continue to have a dominant position on the market and help the company to outperform expectations. Considering this, there are reasons to believe that Microsoft’s shares have all the chances to retain their momentum and continue to appreciate further as the start of the disinflationary process could give the stock an additional boost.

Satya Nadella Continues To Deliver

Ever since taking the reins of Microsoft in 2014, Satya Nadella has focused on improving the company’s core products to create a formidable ecosystem that would be able to attract new customers and help scale the overall business at an aggressive rate. The recent earnings report for Q2, which was released at the end of January, shows that this business model has been successful, as even during the turbulent macroeconomic environment, Microsoft’s business nevertheless managed to grow as its revenues during the period were up 1.9% Y/Y to $52.7 billion. If we exclude the impact of the strong dollar during the period, then Microsoft’s revenues were up 7% in constant currency. What’s also important to note is that the company’s gross margins were up as well while its cloud business was able to grow at an aggressive double-digit rate of 18% and generated a greater amount of revenue in comparison to other segments.

Considering the strength of Microsoft’s ecosystem of products and services in the current environment, there are reasons to believe that if the macroeconomic situation improves and the disinflationary process which was mentioned by Fed Chairman Jerome Powell a month ago accelerates, then the company’s shares have all the reasons to appreciate as well. Let’s not forget that at the beginning of Q2 the dollar index was close to its all-time high and this was one of the main reasons why there was a decent gap between actual revenues and revenues in constant currency. The improvement of the macroeconomic situation has the potential to weaken the dollar and ensure that Microsoft is able to grow its revenues at a greater rate.

At the same time, several growth catalysts could also help Microsoft’s shares appreciate further and improve the investment attractiveness of the overall business. Back in November, I’ve already mentioned that the acquisition of Activision (ATVI) is going to be a game changer for Microsoft as it would be able to double the company’s gaming revenues and help it establish a greater presence in the growing video gaming market. While there were several setbacks with closing the deal due to regulatory scrutiny, the recent reports about the upcoming approval of the deal by the EU antitrust watchdog is a positive development that could finally help Microsoft close the deal and open new growth opportunities for the company.

On top of all of that, Microsoft’s decision to implement ChatGPT within its products also opens various new direct and indirect monetization opportunities that were not available before. The initial success of the Microsoft-backed AI chatbot has made it possible to take the company’s artificial intelligence capabilities to the next level which could be crucial in ensuring that the Redmond-based firm would become one of the leaders of the upcoming Web3 era of the internet.

Should You Buy Microsoft’s Shares Right Now?

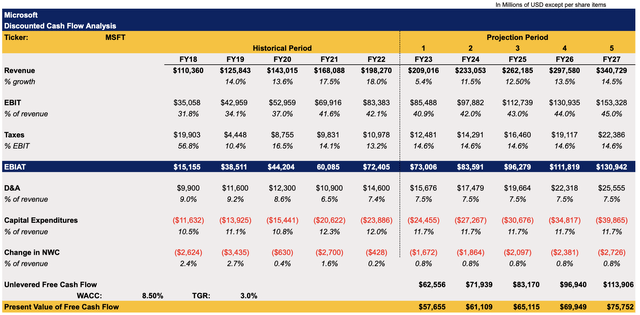

Considering all of those developments and growth catalysts, it makes sense to figure out Microsoft’s fair value to decide whether its stock represents any upside at the current levels. The revenue growth assumptions in my DCF model below are mostly in-line with the Street estimates for the next couple of years. Those assumptions indicate that Microsoft would be able to continue to grow its business, although at a smaller rate, but once the macroeconomic situation improves, the aggressive double-digit growth rate will return as well in FY24 and beyond.

The EBIT as a percentage of revenue grows in the following years as well due to the strengths of Microsoft’s ecosystem, continuous high demand for its high-margin cloud solutions, and the realization of various growth opportunities described earlier in this article. All the other rate assumptions in the model are mostly averages of the previous few years.

The terminal growth rate in the model is 3%, while the WACC rate is 8.5%. While some might consider this to be a small WACC due to the high-interest rate environment, let’s not forget that Microsoft is not your average firm that relies on leverage to conduct its operations and as such getting access to capital at a suitable rate is unlikely to become an issue.

Microsoft’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

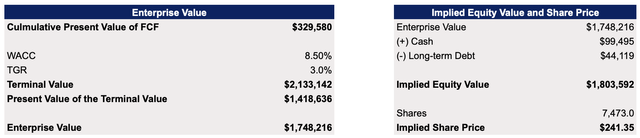

The model shows Microsoft’s enterprise value to be $1.75 trillion while its fair value is $241.35 per share, which is around 5% below the current market price.

Microsoft’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

Even though at first it seems that Microsoft is uninvestable at the current levels as it already trades above the fair value, there are several things that we need to consider. First of all, if the disinflationary process accelerates, then there’s a case to be made that the actual revenue growth rate would be greater than assumed which would already lead to the upward revision of Microsoft’s valuation. A similar thing is true for EBIT, as various growth catalysts described earlier in this article could ensure that Microsoft’s margins increase and lead to higher profitability. In such a scenario, the valuation would be higher as well.

On top of that, Microsoft remains a growth stock and the fact that it trades close to the fair value in the base case scenario could be considered a bargain for a lot of investors as during the market bull run it’s nearly impossible to acquire shares of growth stocks that trade at a small premium to their valuation.

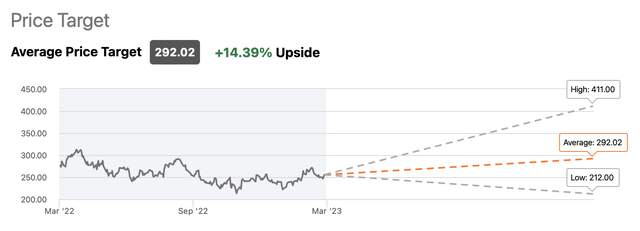

In addition to all of this, the Street is even more optimistic than my base case model as it believes that Microsoft’s consensus price target is $292.02 per share which represents an upside of nearly 15% from its current market price.

Microsoft’s Consensus Price Target (Seeking Alpha)

Risks To Consider

There are several things to consider before investing in Microsoft. First of all, for some, the current price might be slightly high due to the minimal margin of safety as the stock already trades above the company’s fair value from my model. If the disinflationary process accelerates, then the current price won’t be an issue as Microsoft is likely to greatly benefit from the improvement of the macroeconomic situation which could lead to the further appreciation of its shares. However, if Fed overtightens the economy while Europe enters a recession, then there’s a risk that the stock would depreciate in the short to near term on weaker economic data and a potentially weaker growth rate of the company’s business itself in such a scenario.

At the same time, there are reasons to believe that once the AI hype train loses steam and the market’s obsession with ChatGPT subsides, then there’s a decent chance that Microsoft’s shares are likely to depreciate in the short term as well due to the inability to retain momentum.

Last but not least, there’s still a risk that Microsoft’s acquisition of Activision won’t receive approval from the regulators which would prevent the company from monetizing popular franchises such as Call of Duty or Candy Crush that could help the company to continue to generate aggressive returns in case of a purchase. In addition, Microsoft would also be required to pay$3 billion in breakup fees to Activision in case the deal is not closed by July 18, which could negatively affect the company’s investment attractiveness for some investors.

The Bottom Line

Even though Microsoft’s shares trade close to their fair value, there’s still a case to be made that the company’s shares could appreciate further if the disinflationary process accelerates while the investments in AI coupled with the high demand for core products continue to positively affect the business’s performance. Even though the margin of safety is smaller at this stage and there’s no guarantee that the shares won’t depreciate in the short term if the AI hype train loses traction, it’s still safe to assume that Microsoft is a decent long-term investment for patient investors. Since Satya Nadella took the reins of the company nearly a decade ago, Microsoft managed to scale its ecosystem of products and services that generate aggressive returns to this day and there are reasons to believe that that will remain the case going forward.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He’s/It’s/They’re solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Brave New World Awaits You

The world is in disarray and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!