Summary:

- The impact of ChatGPT and generative AI on Microsoft is overhyped and misunderstood by markets. The music is currently playing elsewhere than in the Ad-Search business.

- Microsoft is present along the whole technological stack powering generative AI and it is able to monetize the technology with B2B end-users through GitHub’s CoPilot.

- CoPilot alone could rake in billions for Microsoft in the medium term, but it is still too small to move the needle, given Microsoft’s mammoth $200+ billion revenues.

- While Microsoft stock is certainly not trading cheaply at 28x earnings, we’d prefer it to consumer staples companies trading at similar multiples.

matejmo/iStock via Getty Images

Stock markets have been following the wrong narrative in the discussions around generative AI and Microsoft (NASDAQ:MSFT). Given Microsoft’s activities along the full technological stack of generative AI, reducing the discussion to “Bing vs. Google (GOOG) (GOOGL)” is seriously misguided. Although the Ad-search industry is undeniably vast, there are doubts regarding Bing’s monetization model and profitability.

Yet Microsoft has already established a strong presence in various areas of generative AI technology. Despite its impressive achievements – whether in end-user applications, AI model development, or cloud infrastructure – they receive little attention in discussions.

This article focuses on Microsoft’s potential in end-user applications powered by generative AI and is the first in a series of texts we will publish. We will argue that Microsoft’s revenue driver will be GitHub’s CoPilot, which could generate several billion dollars in annual revenue in the short-to-medium term, rather than Bing.

However, given Microsoft’s mammoth revenue of $200 billion, CoPilot is unlikely to have a significant impact on its bottom line and valuation, despite the widespread excitement surrounding the technology.

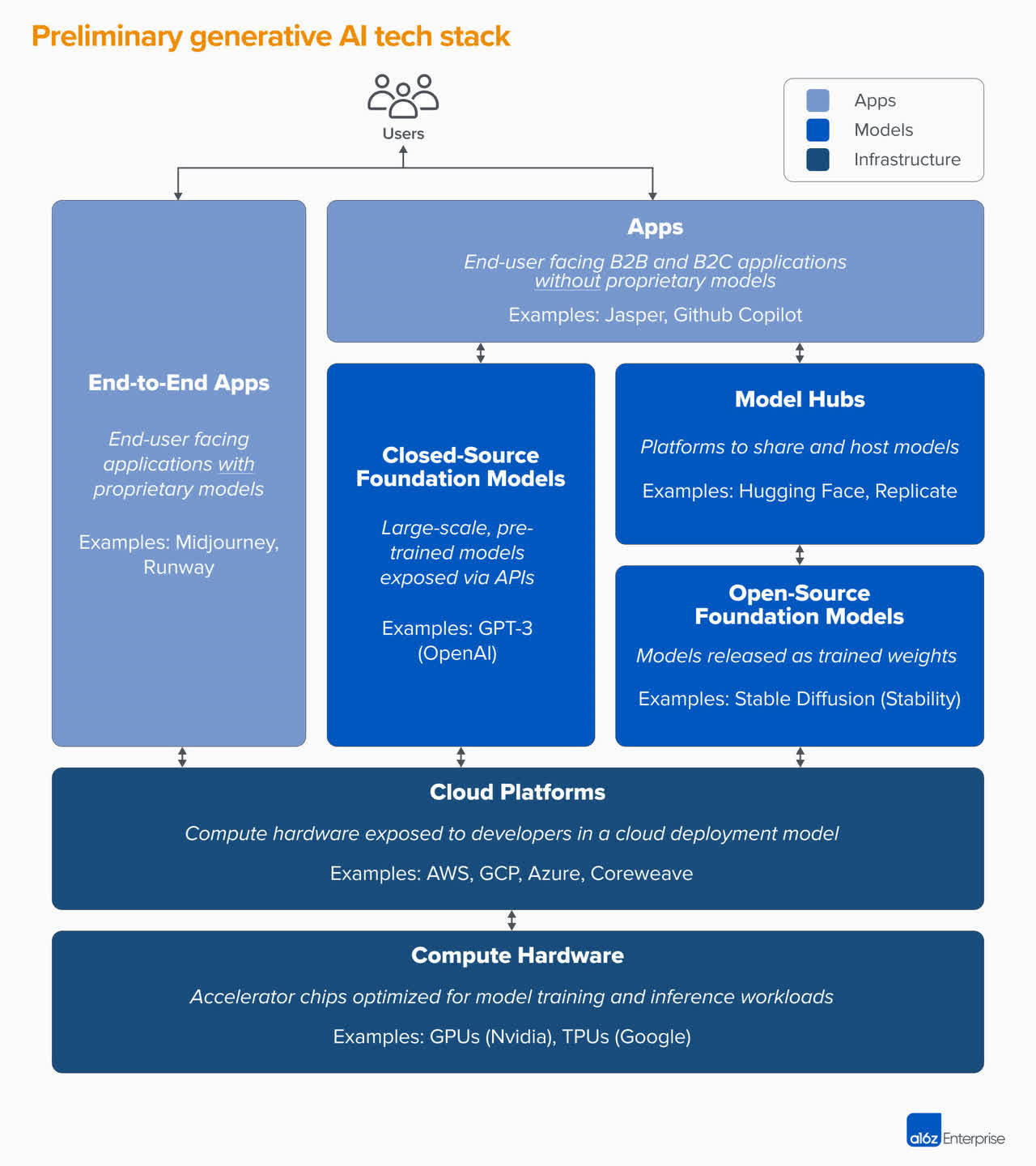

Landscape of the generative AI tech stack

Let’s first take a step back and have a look at the tech stack of generative AI, which is divided into three main layers.

- Applications that deploy AI models in a user-facing product. ChatGPT, GitHub’s CoPilot or an AI-powered Bing would fall into this category.

- Models that power AI applications and products. Models can be proprietary or available as open-source. Microsoft is indirectly present in this layer through its stake in OpenAI.

- Infrastructure that provides the ‘iron’ and tools to develop AI models and power the whole industry. Key players include platforms such as Azure, Amazon Web Services (AMZN) or Google Cloud, as well as hardware manufacturers such as Nvidia (NVDA) or TSMC (TSM).

Andreessen Horowitz

Domain-specific applications more likely to drive revenue than consumer-focused apps

Since the launch of ChatGPT, public attention has overwhelmingly focused on the top layer of the stack – applications – because this layer is most relevant to consumers. The big question everyone keeps asking is whether an AI-powered Bing will surpass Google.

Yet despite all the hype surrounding ChatGPT, it is still too early to declare the underlying technology a commercial victory. There is skepticism and a lack of evidence about the mass adoption of novel tech-driven applications focused on the mass consumer market. The hype surrounding ChatGPT reminds us of PokemonGO and augmented reality, which was an instant smash-hit upon its release, becoming the fastest mobile game to hit 10 million worldwide downloads. Augmented reality was touted as a groundbreaking technology, but how many AR apps are you using today? The same applies to voice assistants. Amazon’s Alexa has recently been described as a colossal failure, and Amazon is scaling back its investment in this division.

Our thesis is that end-user monetization of (generative) AI is likely to be limited, as mass-market consumers may not be willing to pay for generative AI. We believe that the most successful business models will be in domain-specific applications that provide exceptional value to end-users.

However, let’s take another look at an AI-powered Bing and its potential to drive growth for Microsoft.

GPT-3 powered Bing unsuitable for mass-market use

While a smart feature could certainly attract more attention to Bing, we do not anticipate that AI alone will turn Bing into a profit-generating machine, at least not in the near future. There are two significant challenges associated with monetizing the technology in the ad-search business. The first is that a ‘smart Bing’ that provides answers without displaying search results and references to other websites may leave little room for advertising. Additionally, advertising could cause users to question the quality and objectivity of the answers provided.

The second issue are unit economics and profitability. The most state-of-the-art AI models from the GPT-3 model class, on which ChatGPT is based, are computationally very intensive and carry high variable costs. Some sources estimate that ChatGPT query costs are 7x higher than Google’s and run in single-digit cents. For comparison, Google is estimated to generate approximately 1.6 cents from each search query. Sam Altman, OpenAI’s CEO, on the other hand estimated in a tweet that the costs for each chat on ChatGPT are in the single-digit cents. Another source claims that the costs are around 2 cents per chat with ChatGPT.

Thirdly, the costs of training the model are significant and estimated to be in the tens of millions of dollars. However, ChatGPT was only trained on data up to 2021, which means that the model is not up-to-date with the latest information. OpenAI/Microsoft would need to continuously incur costs to train the model to keep up with the most recent information, although these costs would likely be lower than the initial training costs.

Why is GPT-3 so expensive? It is simply because of its computational intensity. The models require a lot of electrical power and expensive hardware to run on. It is possible that OpenAI develops a more efficient model class over time. However, OpenAI is rumored to be working on GPT-4, which is a much larger model class than GPT-3. Computation costs grow exponentially with the size of the model, so it is reasonable to assume that running GPT-4 may be much more expensive than GPT-3.

Therefore, unless an AI-powered Bing becomes a much more efficient traffic channel for websites, inducing businesses to pay a multiple of what they pay to Google, it will likely have a negative gross margin. And the more popular the service would become, the more money Microsoft would lose. This also disregards Microsoft’s currently inferior pricing power due to a 10-20x smaller reach than Google. Despite Microsoft’s strong balance sheet, we do not think the company is keen on losing billions in operating profit by running a smart search engine just to compete with Google.

Last but not least, the question arises about who has more leverage in this relationship, and where the value would accrue: the app or the model provider? If it weren’t for the exclusive rights and Microsoft’s ownership stake in OpenAI, we believe that OpenAI would have more leverage due to the capital-intensive nature of developing models, rather than Bing.

Is AI powered code completion a blue print for the industry? GitHub as a Case Study

We are strong believers that NLP-based generative AI will be dominated by domain-specific applications. GitHub’s CoPilot may provide interesting insights and hints about how the industry will develop in general. We believe that domain-specific apps will provide a lot of tangible value to its users, who will have a willingness to pay for those products.

GitHub’s CoPilot is a great case in point. GitHub is a hosting service for software development, which Microsoft acquired in 2018. Along with GitHub, Microsoft purchased access to vast amounts of code. They now started to monetize this data by offering CoPilot, an AI-based “pair programming” product. CoPilot is essentially a tool that completes the code of software developers based on natural language prompts. GitHub launched CoPilot in June 2022 and in its first month it was able to add 400 thousand subscribers.

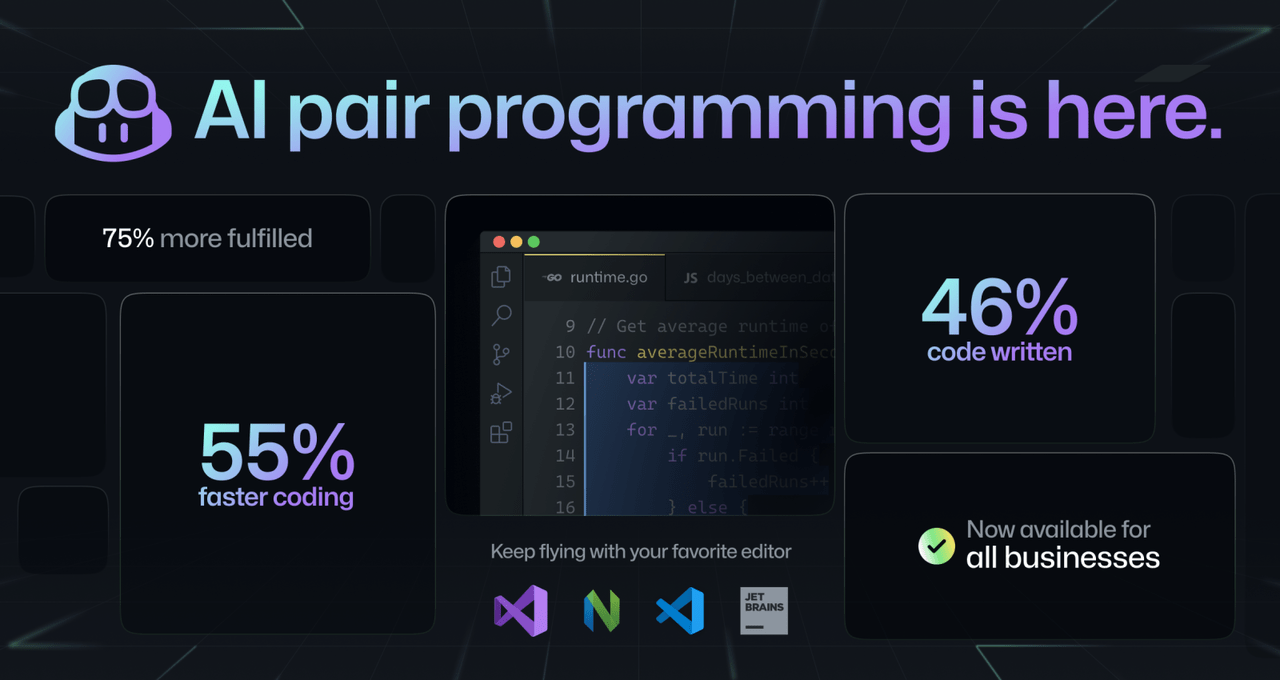

GitHub CoPilot coding example (GitHub)

CoPilot is available as a subscription-based model with two tiers: individual users are charged $10 monthly or $100 annually and enterprises are charged $19 monthly per seat. This is cheap considering the efficiency improvements: GitHub claims that, when enabled, it writes on average 46% of a developer’s code. Considering software engineers starting salary at $85 thousand, the product is more than worth it and is eventually saving users hundreds of hours of time and thousands of dollars to their customers.

GitHub

We estimate the target addressable market of AI-powered pair programming to be between $4-7 billion. There are around 25-30 million software developers worldwide and the technology may become indispensable to every software engineer out there over time.

CoPilot is not the only AI-powered code completion software out there. Amazon’s AWS is offering its Code Whisperer, and then there is a number of lesser-known competitors without outright big-tech backing such as Tabnine, GPT-Code-Clippy or Second Mate. It is an interesting observation that Google, despite its engineering prowess, has not tried to establish itself in the market, despite their ambitions in AI.

With the possible exception of Amazon’s Code Whisperer, none of the providers is developing their own AI models, but they are relying on ‘foundational models’ from 3rd party providers – including CoPilot! So in theory, anyone can build his own code completion software with the help of foundational models or open-source software, subject to having access to training data. The situation is analogous to an imaginary car producer who could choose to build in either Ford or Toyota engines for his new car model. True to “keeping it in the family”, GitHub is powered by OpenAI Codex and GPT-Code-Clippy and Tabnine are also based on fine-tuned versions of OpenAI’s models (GPT-2 and GPT-neo). Second Mate is powered by an open-source AI repository called Hugging Face.

CoPilot seems to be winning the race so far: a simple Google Trends analysis would suggest that CoPilot’s market share is around 80%. Amazon Code Whisperer was launched quickly after CoPilot’s launch in June 2022 and is available only under private preview so far. The only noteworthy competitor is Tabnine, which seems to be the #2 in the market and benefits from integrations with many IDE providers.

There is tangible value in being the biggest because there are signs that it supports the ‘virtuous cycle’, a positive feedback loop of users – data – model fine-tuning – better product – more users – more data – etc… According to GitHub, the acceptance rate of code-completions increased from an initial 27% after launch to 46% as the company is continuously fine-tuning its model based on user interactions. This is a head start that will be hard to catch up with, but also shows the importance of a large user based that enables the provider’s product to become better and better. This may turn out to become a key competitive advantage, enabling CoPilot to charge more and more over time as users will be willing to pay a premium for the best product on the market.

This brings us to the question of value accretion. Who will profit the most under this setup? Model provider? Application developer? … or the distributor? To make things a bit more complex, code completion software requires an integration with IDEs (Integrated Development Environment, or in layman’s terms, “software for writing software”), so questions arise around the ownership of the end-user and what role intermediaries and other stakeholders may play along the way.

Last but not least – let’s look at profitability. CoPilot is based on a model descending from GPT-3. It is fair to assume that compute costs will be similar. The costs of running GPT-3 are mainly variable, driven by the amount of input it receives and output in generates. OpenAI is currently offering Codex for free because it is in beta release, but it charges 0.02 cents for 750 words of input / output for its similar da Vinci model. The average software developer writes at most a couple of hundred lines of code per day with each line typically containing a handful of words. CoPilot is supposed to complete 45% of this code, translating to around 500 words in total (300-400 output words per day + another 100-200 words as input). While we don’t know OpenAI’s unit economics, the variable costs per developer per month likely will not be more than $1, translating to gross margins of 80-90% for CoPilot, given the $19 per seat it charges enterprise customers. Compared to an AI-powered Bing, those are beautiful unit economics!

What are the lessons learned?

There are a couple of interesting lessons and observations to draw from CoPilot.

Attractive TAMs: Domain-specific applications with tangible value to end-users are able to quickly draw hundreds of thousands of paying subscribers, and the target addressable markets can reach billions of dollars.

Monopolistic traits: The nature of the business strongly favors first movers and may lead to monopolistic business models due to the virtuous cycle. More users -> more data -> better product -> more users -> more data… and so on.

High gross margin: Domain-specific apps have the potential to be extremely profitable because of the efficiency boosts they provide and end-users willingness to pay. Our estimate of CoPilot’s business case and underlying margins of 80-90% looks highly attractive. However, only time will tell whether the value accrues with model providers who will start charging multiples of their current rates or to the app developers.

‘Data is the new oil’: Microsoft’s GitHub acquisition is confirming the idea that ‘data is the new oil’. We believe that without the acquisition of GitHub, it would have been impossible for Microsoft to build CoPilot.

Importance of model providers: App developers are relying on 3rd-party AI engines and are not developing their own AI. The most dominating provider of AI models for this particular use case is a research lab – OpenAI. Entry barriers are high because AI model development is capital-intensive, easily running into tens of millions of dollars.

Furthermore, Microsoft is actually swimming against the current with CoPilot. Other big tech players have not left a big dent in end-user apps so far and do not seem to be focusing on the market at all: AWS’ code-completion product has a weak position, and its release was forced more by CoPilot than internal Amazon’s decision-making. Google, despite being a leader in AI research, is not present at all, and the company may have an underlying problem in monetizing their research (think of its research lab DeepMind or its market-leading machine learning software TensorFlow). Microsoft seems to be more commercially driven. This reminds us of the Xerox PARC & Apple story, in which Apple ruthlessly copied innovative features such as the graphical user interface or the mouse from the original inventor – Xerox’s research lab. And Meta (META) ? It has been more in the headlines because of the Metaverse than AI.

The lesson for big tech investors is that while CoPilot represents an attractive use case, we are not aware of other commercial use cases of generative AI adopted on a large enough scale. This holds true even for Microsoft: we do not expect it to land another commercial hit, even though it could deploy the technology in its existing product suite. Despite that, it seems to be the furthest of all the big tech players in generative AI, and we would therefore rate it as ‘overweight’ compared to other tech players.

However, there are two more layers in the tech stack that investors need to pay attention to: models and infrastructure. We will cover those in our coming articles.

Disclosure: I/we have a beneficial long position in the shares of GOOGL, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article or analysis provides information, opinions, and commentary on financial markets and other topics. The information, opinions, and commentary presented here are for informational purposes only and should not be considered as personalized investment advice or a solicitation to buy or sell any securities. The views expressed by the author are his own and may not represent the views of any third party. The author may hold positions in securities mentioned in this article or analysis. Investing in securities involves risk, and you should be aware of the risks involved before investing in any securities. You should always conduct your own research and due diligence and obtain professional advice before making any investment decisions.

The author of this article or analysis has made every effort to ensure the accuracy of the information provided. However, the information may be inaccurate or incomplete, and the author does not guarantee the accuracy, timeliness, or completeness of any information provided. The author shall not be liable for any damages or losses arising from the use of any information provided.

The information provided in this article or analysis may contain forward-looking statements, which are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Forward-looking statements are based on the author’s current beliefs, assumptions, and expectations, and are not guarantees of future performance. The author does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

You should not rely on any information provided without conducting your own research and due diligence. The author is not a registered investment advisor, broker-dealer, or accountant, and you should seek the advice of a qualified professional if you have any questions about your investments or financial situation.