Summary:

- We believe that AT&T’s mid-band coverage scale-up can incentivize customers to upgrade to premium plans, which will drive ARPU. It is also possible that AT&T will raise prices this year.

- While the competition from Cable will likely intensify thanks to their network upgrades, fiber still has ample room for growth. AT&T is pulling all levers to maintain its fiber scale-up.

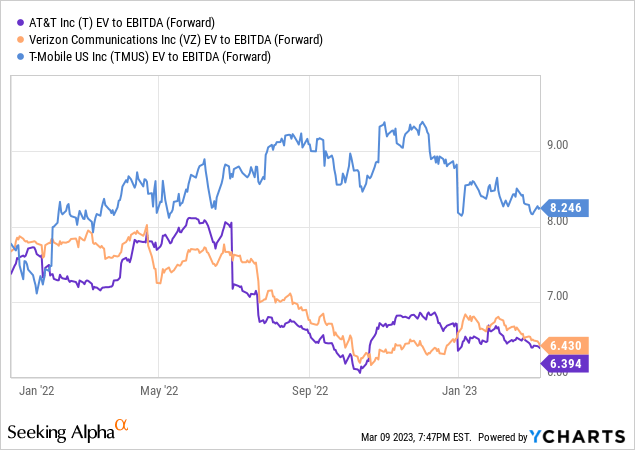

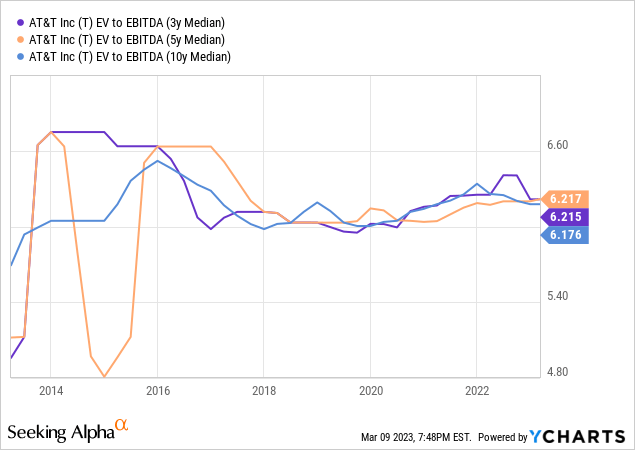

- However, AT&T trades at 6.4x forward EV/EBITDA, slightly higher than the multiple’s long-term median. Shares are attractive if they trade at least $17 per share (20% margin of safety).

- Our thesis may fail to materialize if customers look for cheaper options during a possible recession. Cable companies are aggressive in their bundle offerings.

Ronald Martinez

Investment Thesis

We like AT&T’s (NYSE:T) solid position in the industry with strong net adds and the lowest postpaid phone churn among the big three. Expanding mid-band coverage should incentivize subscribers to upgrade their plans. Further, while cable companies are upgrading their existing network to compete, fiber still has ample room for growth: more than half of primary homes still not yet passed by fiber. Still, at $18, shares do not provide a comfortable margin of safety.

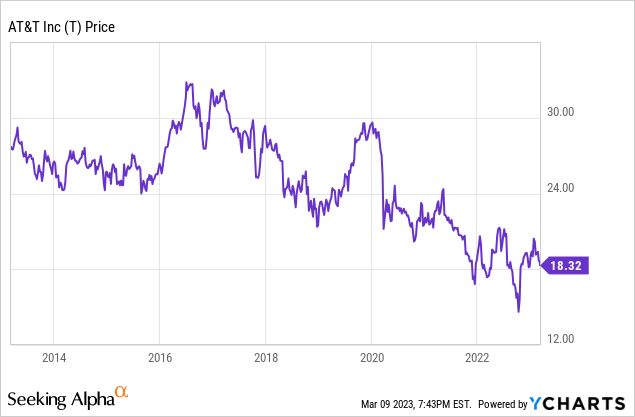

Lower Debt, But Shares Stuck At $18

AT&T is one of the largest telecommunications companies in the US. In the last ten years, AT&T’s stock peaked at $33 per share and plunged as low as $15 per share. A saturated industry, tough competition left and right, and massive debt from past acquisitions and spectrum purchases cause severe headaches. Realizing that it is burdened by too much debt, AT&T sold some of its businesses, such as DirecTV and WarnerMedia–now Warner Bros. Discovery (NASDAQ:WBD) following the merger–which ironically were bought only a few years ago. Even after the company reduced its net debt to $132 billion from $156 billion a year earlier, the stock remains stuck at $18 per share.

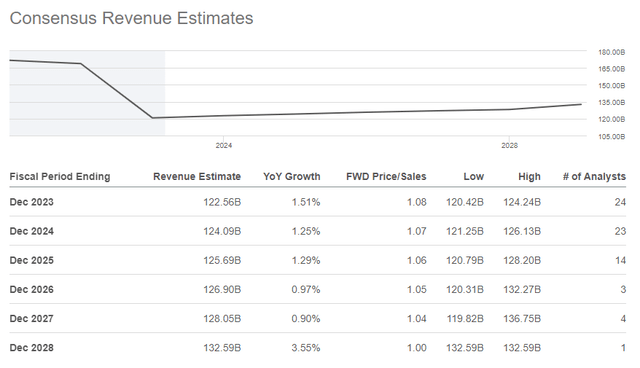

A question remains about how AT&T will grow its business as we move forward. Indeed, consensus expects AT&T’s revenue growth rate to hover between 1.2% and 1.5% in the next three years. Also, the management stated that the company “will be operating in a challenging macroeconomic environment.” Thus, is there any story left for AT&T?

Consensus revenue estimates (Seeking Alpha)

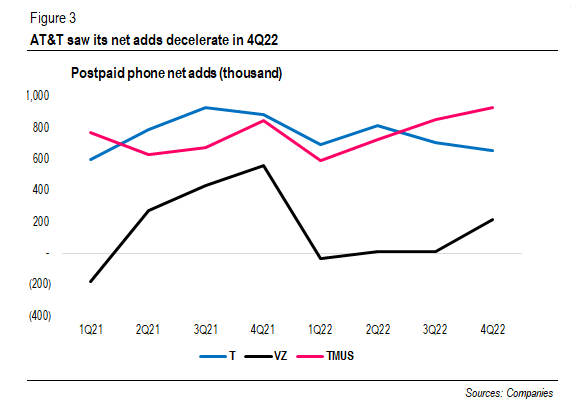

Migration to Premium Plans Will Drive ARPU

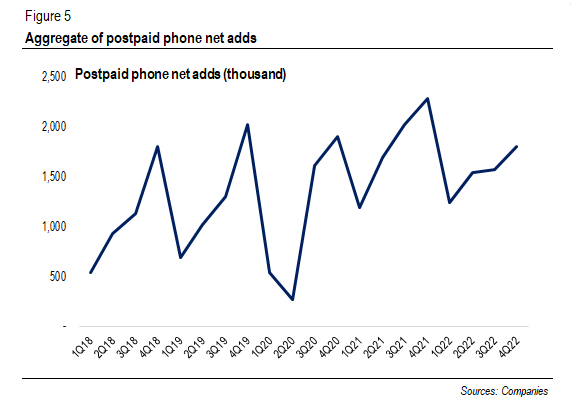

AT&T reported 656,000 postpaid phone net adds in 4Q22, a decline from 708,000 in 3Q22. By contrast, T-Mobile (NASDAQ:TMUS) is still going strong; Verizon’s (NYSE:VZ) net adds picked up in 4Q22 after the company introduced the Welcome Unlimited plan that charges only $25 per month for four lines. Moreover, cable companies, such as Comcast (NASDAQ:CMCSA) and Charter (NASDAQ:CHTR) under Xfinity and Spectrum brands, respectively, remain aggressive.

AT&T’s fiber net adds (thousand) (Company) Cable’s mobile line net adds (thousand) (Companies)

One may ask where net adds come from since most Americans have phones, and population growth is slowing down. Analysts said that because 3G was shut down last year, the industry was “double counting them,” as cited in Fierce Wireless. Others suggest that the age group of people owning smartphones is getting wider. Alternatively, it is also possible that more people are getting extra phones.

Aggregate postpaid phone net adds (thousand) (T, VZ, TMUS)

However, net adds should be slowing down at some point, in our view. Instead, one way to drive growth is to encourage subscribers to upgrade their plans, especially as companies have been spending billions of dollars to invest in the latest 5G technology. People will be happier if they get what they are paying for, which means higher speeds or lower latency. We believe that AT&T’s mid-band spectrum coverage expansion could incentivize people to upgrade to premium plans.

In short, the mid-band spectrum is considered a sweet spot for 5G, yielding better signal propagation than the millimeter-wave band spectrum and providing greater capacity than the low-band spectrum. Opensignal noted that, since the deployment of C-band, AT&T’s 5G download speed was up 34.6% in six months, and Verizon showed a similar trajectory with 15.8%, as Verizon’s deployment is more “mature” than AT&T.

Take, for example, Verizon. Hans Vestberg, CEO of Verizon, said that 45% of the company’s unlimited subscribers were on the premium plan, up from 41% in 3Q22. By the end of 2021, the number was “just over one-third,” suggesting a 3% increase, on average, per quarter. Just as Hans Vestberg said during the 4Q22 earnings call:

And on the switcher pool, yes, there we’re going to be seeing that we’re prudent and disciplined, but we will go for the units we think are the right. It’s a subscription model long term that is even more important to increase the P sometimes than increasing the Q because this is long term that you stay with the customers to get the long-term value from them. But it’s a balance of it all the time and that we will continue to have.

Similarly, AT&T expects “the migration to higher-price line” to continue to last several years while at the same time aiming to “move a legacy rate plan customer up to something a bit more current to participate in the 5G space.” In addition, AT&T’s management suggested that price increases could be on the cards so that the company could have “some ARPU accretion.” Yet, the plan to up-tier remains to be seen, as John Stankey refused to provide details during the latest earnings call.

Nevertheless, AT&T trailed T-Mobile and Verizon in mid-band spectrum deployment. Research by Opensignal, while outdated, suggests that up until 2Q22, only 1.4% of counties where 5G services were available had seen AT&T’s enhanced 5G service, namely 5G+ that utilizes mid-band and high-band spectrum. In comparison, T-Mobile led with 41.9%, followed by Verizon with 11.7%. T-Mobile expects to cover 300 million people with its Ultra Capacity 5G by the end of this year. Verizon is on track to 200 million people with C-band by 1Q23, while AT&T were behind with 150 million.

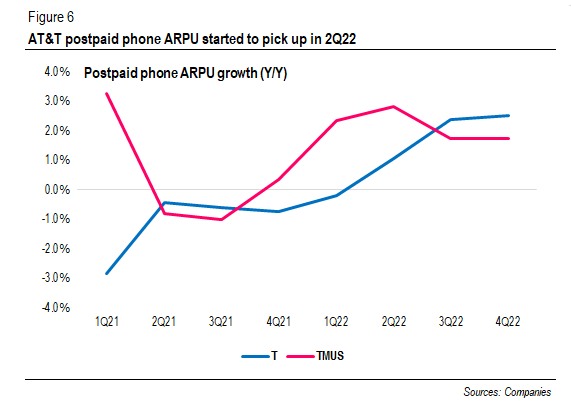

But this is where an opportunity comes in: AT&T is still early in the journey. Figure 6 shows that AT&T’s postpaid phone ARPU growth picked up in 2Q22, during which AT&T raised prices and began accelerating its C-band and 3.45-3.55 GHz spectrum coverage. Further, during that quarter’s earnings call, the management attributed the ARPU increase to “more customers trading up to higher-priced unlimited plans.” VZ does not disclose its postpaid phone ARPU numbers.

Postpaid phone ARPU growth (Y/Y) (Companies)

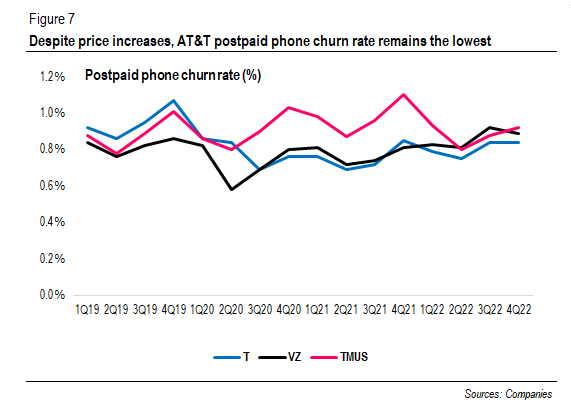

In conclusion, AT&T’s mobility growth will stem from ARPU growth resulting from customers up-tiering to higher-price premium plans and from price increases, in our view. Nevertheless, will this result in people switching to other providers? Figure 7 shows that AT&T only saw a slight uptick in the churn rate after a price increase in May last year. But the rate remains the lowest among the big three. Similarly, AT&T had raised its plans four years ago. On the contrary, the churn rate improved. In other words, AT&T managed to retain its customers despite a series of price hikes.

Postpaid phone churn rate (%) (Companies)

Pulling All Levers To Continue Fiber Scale-up

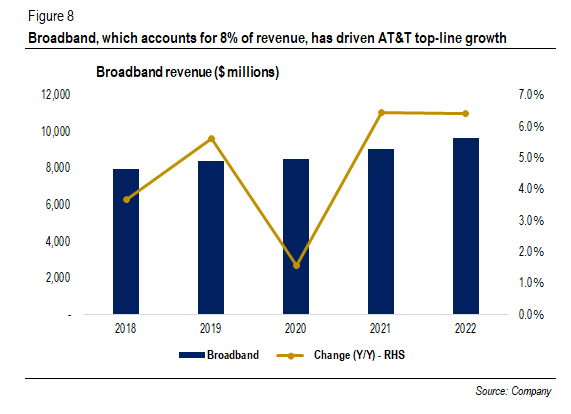

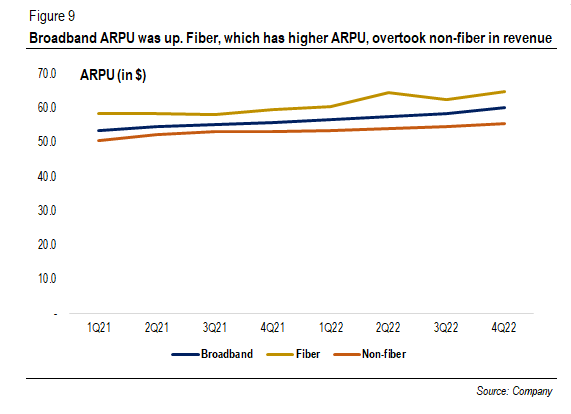

Second, broadband, which accounts for 8% of AT&T’s revenue, grew about 5% annually in the last five years. Fiber finally overtook non-fiber, which excludes DSL, in revenue, as the company is “rationalizing” its existing copper infrastructure. Such a transition will further increase ARPU since fiber generates more revenue per user than does non-fiber. Further, AT&T aims to increase its fiber passing to 30 million plus, including businesses, from the current 24 million, which implies 2 million to 2.5 million locations passed annually.

Broadband revenue ($ millions) (Company) Broadband ARPU ($) (Company)

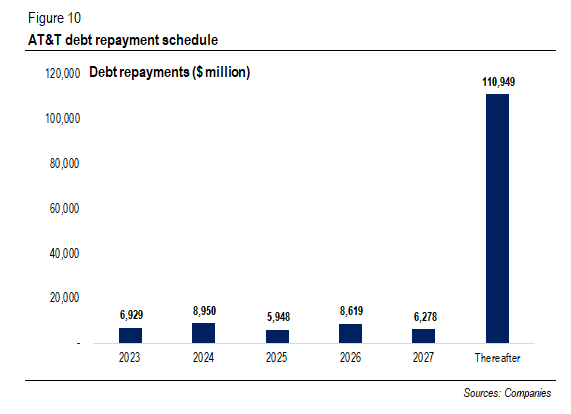

However, such a target poses questions to analysts as the company slows down its build. It makes sense because AT&T continues to deleverage its balance sheet. Moreover, the management said fiber is “probably costing us more than we thought when we started.” If we assume that AT&T will generate an annual FCF of $16 billion next year, the remaining cash is probably just enough to pay its maturing debt of $7 billion and dividends of $8 billion.

Analysts price target (Seeking Alpha)

In turn, the company partners with BlackRock to form a joint venture, Gigapower, a wholesale provider, to deploy fiber to 1.5 million locations. While such a number appears to be minuscule, the management said it will not “necessarily still be 1.5 million,” if the project succeeds. While AT&T will not consolidate Gigapower’s financial results, we think the company is testing the water if the wholesale business model will thrive, thus refusing to rule out the possibility that the company might “do some of this in-house.”

Arthur D. Little, a consultancy, released research on an open-access fiber network, a model prevalent in Europe. Benefits include new investments from funds and banks and higher valuations. But what interests us the most is the possibility that by allowing ISPs to become wholesale customers, they could stop their competing fiber roll-out. In addition, though it sounds counterintuitive, the consultancy cites an example of a telco providing an open-access fiber network that saw its market share expand as competitors’ focus shifted from simply providing high-speed broadband to improving customer experience.

And there is the $42.5 billion BEAD program. The company expects that “those volume start to come online” in 2024. We will discuss more about the program after NTIA allocates the BEAD funding by June 30 this year.

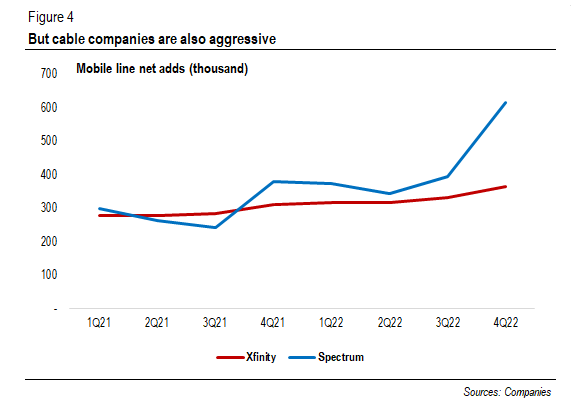

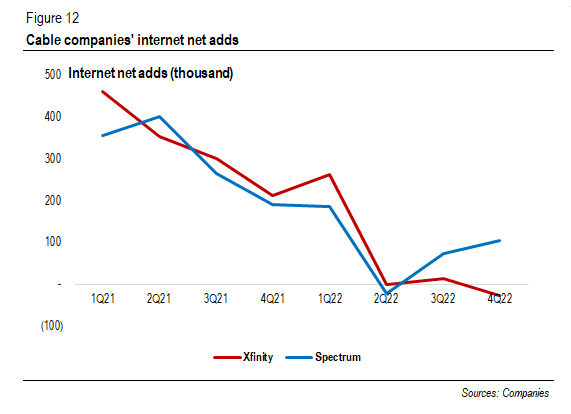

Nevertheless, the competition is getting tougher. Cable companies have announced that they are upgrading their existing Hybrid Fiber-Coaxial (“HFC”) network through the so-called DOCSIS 4.0, which enables providers to offer multi-gig symmetrical products to customers, spending billions of dollars. While customers increasingly demand low latency connections with more bandwidth allocated to upstream, as things stand, such offerings are more like a “marketing claim,” instead of a “real product demand,” according to Charter’s CEO.

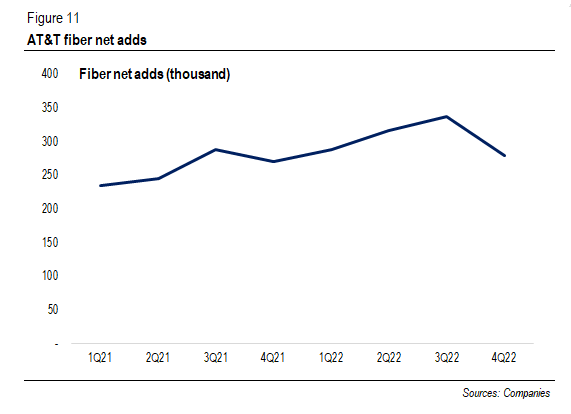

AT&T’s fiber net adds (thousand) (Company) Cable’s internet net adds (thousand) (Companies)

As a result, cable companies can compete with fiber providers thanks to its network upgrades, in our view. Nevertheless, we believe that there is still ample room for growth. A survey released by the Fiber Broadband Association and conducted by RVA LLC suggests that fiber has passed 63 million unique homes. But such numbers are still less than half of primary homes and over 10% of second homes, with around 45% take rate.

What about fixed wireless? AT&T does not consider fixed-wireless “an optimal way to service a customer in the near term.” AT&T does have a fixed wireless product, which could help the company serve customers in areas with no fiber footprint. Yet, it is unlikely that fixed wireless will become a significant source of growth for AT&T.

Valuation

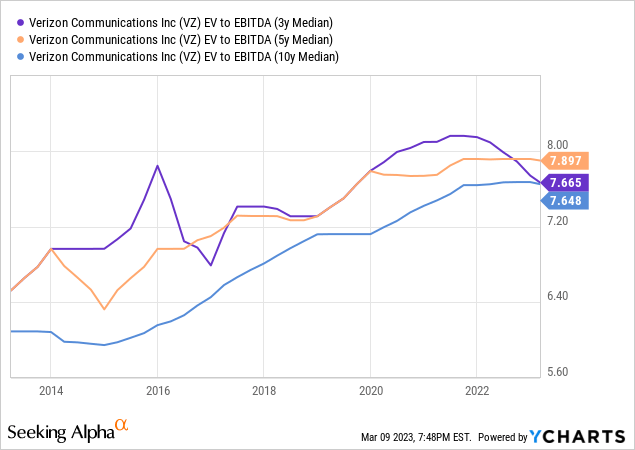

AT&T trades at 6.4x of its forward EBITDA. However, relative to its historical median, the multiple suggests that the stock is fairly valued. By contrast, Verizon trades at 16%-19% discount vs. the multiple historical medians.

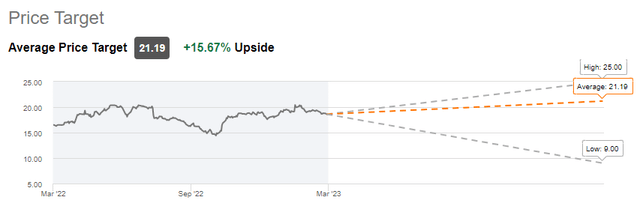

Analysts believe that AT&T’s fair value, on average, is around $21 per share, which implies a 16% upside. However, we think the stock does not provide a comfortable margin of safety. Shares are attractive if they trade at least $17 per share, implying a 20% margin of safety and a 6.5% dividend yield.

Analysts price target (Seeking Alpha)

Investment Risk

Cable’s aggressive pricing further takes net adds share. Cable is getting more aggressive, as Comcast and Charter recently announced that they offer mobile-broadband bundles for only $50 per month. Our thesis is that customers will up-tier their plans. But it will fail to materialize if a recession happens, forcing customers to look for cheaper options.

Conclusion

The bottom line is we believe that expanding C-band coverage will incentivize more AT&T customers to upgrade their plans, which should drive ARPU up. Further, the company is pulling all levers to continue its fiber footprint scale-up while at the same time reducing its debt holdings. Capex will peak this year thanks to spectrum deployments, and the company expects it to moderate next year, freeing up cash flows to pay debt and distribute dividends.

AT&T is a cash generating business with strong net adds and the lowest postpaid phone churn in the industry. We like AT&T’s efforts to cut down its debt caused by its past acquisitions and spectrum acquisitions and remain committed to distributing dividends to shareholders. However, AT&T’s shares trade around their multiple’s historical average, not providing a significant margin of safety.

Verizon offers a slightly better yield at 7%, and the stock trades at a discount relative to its historical multiple. A risk comes from cable companies that are more aggressive in pricing. A recession, if it happens, may prompt customers to look for cheaper options. Thus, we are assigning a HOLD rating for AT&T. If you have any thoughts, please do not hesitate to comment below.

Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Research reports are written based on analyst(s) analysis and expectations, and the analyst(s) must include sources for external data included in the analysis. The research analyst is not responsible for any inaccuracy caused by human errors. Still, Vektor Research will make sure, with reasonable efforts, to reduce such mistakes as minimal as possible. Please note that the forecasts do not guarantee any future performance. Vektor Research, along with the analyst(s), is not responsible for any loss, expenses, and the reader’s decision-making, as we do not force readers to act towards any securities. In other words, please do your own due diligence.