Summary:

- Market participants expecting strong earnings growth from the Cloud, AI and PC segments in the near future could be in for a rude awakening, given Microsoft’s cyclicality.

- We present a macro overlay why Microsoft’s stock could experience both margin compression and multiple compression.

- Investors seem to be factoring in fairly high earnings growth, given the high P/FCF and EV/EBITDA ratios, contrary to the macroeconomics that point to a recession.

- We currently have Microsoft as a hold, and outline the point where we see Microsoft as a buy again, also from a technical perspective.

georgeclerk/iStock Unreleased via Getty Images

Investment Thesis

Microsoft (NASDAQ:MSFT) has had a great year so far, with a return of about 5.21% YTD, thanks mainly to a strong ChatGPT response since its launch in December. This was particularly evident in their earnings call, where AI was mentioned a staggering 29 times.

We will address why investors should be very cautious when considering Microsoft, as we think it may be some time before the AI tailwinds become apparent, while in the meantime a mix of higher CapEx and strong macroeconomic headwinds could curb those rosy expectations more than investors currently expect. Especially at current share prices, which we believe are historically priced very high.

Fortunately, Microsoft has been around for quite some time, and we can see what the stock has done during the last three recessions, so we can also estimate what its performance would look like in this prospective recession.

Is This Time Really Different?

The four most dangerous words in investing go something like this: “this time it’s different”. Yet, in the current landscape, it does seem like market participants and the Federal Reserve again do believe this time it will be different, and we’ll see a “soft landing”.

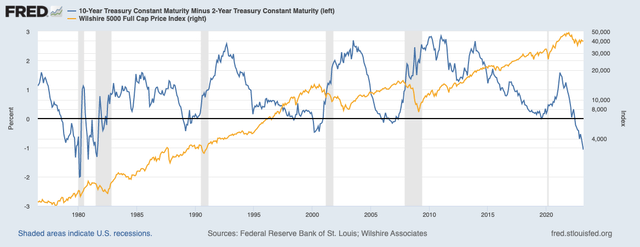

But when we actually look at arguably the most important market in the world, the US treasury market, the yield curve tells a different story. The 2-10 yield curve is currently inverted -1.07%, the most inverted since 1981. An inverted yield curve usually means trouble ahead, more specifically a recession. A deeply inverted curve however, as we have today, has always and every single time in recent history meant recession.

It even brings into question the idea of “there is no alternative” (TINA), which gained momentum after 2008 with 10-year real yields on treasuries being virtually 0.

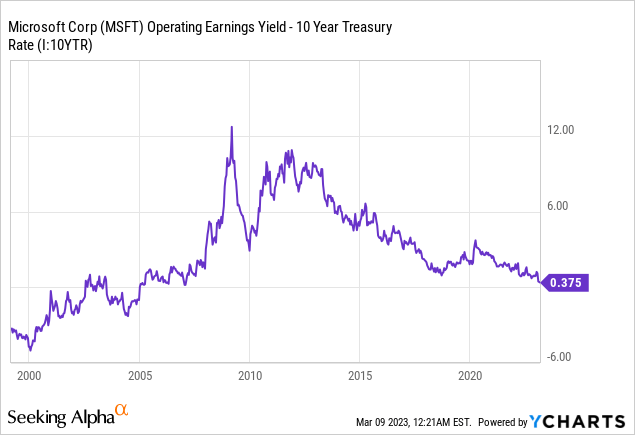

But now that interest rates are rising, an alternative is available, more specifically short-term Treasury bonds. Even looking at Microsoft from a macro perspective, the company’s earnings yield is the most expensive since the early 2000s. Below, we have taken Microsoft’s operating earnings yield and subtracted from it the 10-year Treasury bond yield. Currently, Microsoft has an operating earnings yield of 4.35%, compared to a 10-year Treasury yield of about 4%.

In other words, if you buy Microsoft today, you are risking capital purely for growth. If we take the spread with the earnings yield instead of the operating yield, the correlation is already negative, meaning the 10-year treasury is higher than Microsoft’s earnings yield.

And if we look at the front end of the yield curve, the contrast becomes even more drastic. It remains a mystery to us why Microsoft is trading at a P/E ratio of 28.19 or an earnings yield of 3.55%, when the 2-year treasury yield exceeds 5%, for example.

Microsoft’s earnings for the past quarter were already soft, especially when looking at segments like personal computing and intelligent cloud in terms of operating income, which we will discuss later. If we put it in macroeconomic terms, investors at these multiples predict that Microsoft will see significant earnings growth over the next two years, as you currently get a 1.5% higher yield from 2-year treasuries compared to Microsoft’s earnings yield.

But that contradicts the reality that in a recession, earnings are usually depressed along with multiples. Let me put it this way: you have a 3.55% earnings yield, which could drop like a stone over the next two years in a recession, versus a 5% risk-free rate over the same period.

Note that we also do not claim that Microsoft is a bad company. On the contrary, we think it is a very strong and diversified company that has stood the test of time.

We would rather buy an excellent company at a fair price than a fair company at an excellent price. But currently Microsoft is not fairly priced in our opinion, especially for the next two years as mentioned, which removes our margin of safety. A higher multiple might be warranted if Microsoft sees higher growth, although we should all recognize that past performance is not indicative of future results. And historically looking, Microsoft may be trading sideways for quite some time.

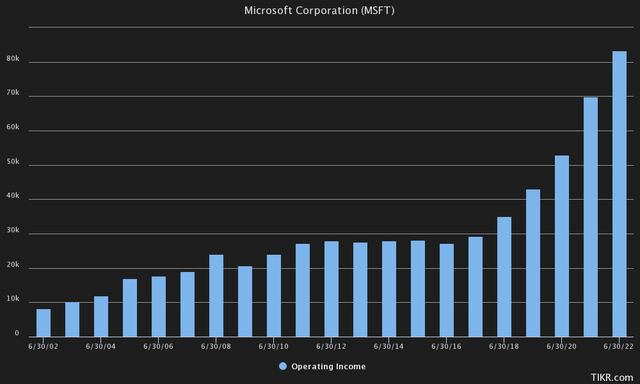

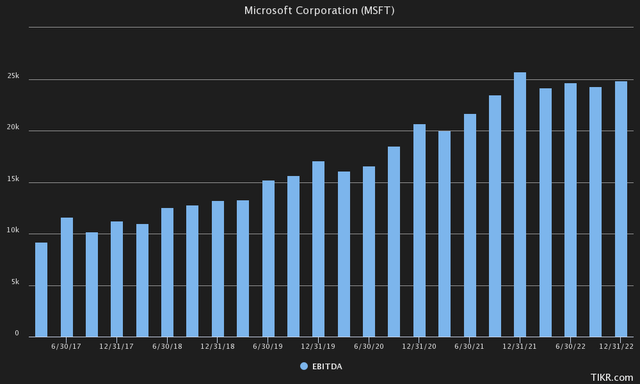

If we look at operating income, we see that Microsoft is actually quite cyclical, and can be broken down into several growth phases. After the 2000 recession, operating income bottomed out in 2002. In the following six years, it tripled from $8.27BN in 2002 to about $24BN at its peak in 2008.

But then came another recession, and operating income remained virtually flat for the next decade as Microsoft laid the foundation for its cloud segment and expanded Azure. That growth got realized again over the last six years, with operating income tripling exactly again between 2016 and 2022.

Now, in 2023, Microsoft’s cloud segment seems to be at its peak and once again paving the new path of technology in AI. But if we follow the trend and cyclicality, it would mean that operating results could go sideways for quite some time until AI actually becomes largely monetizable and scalable.

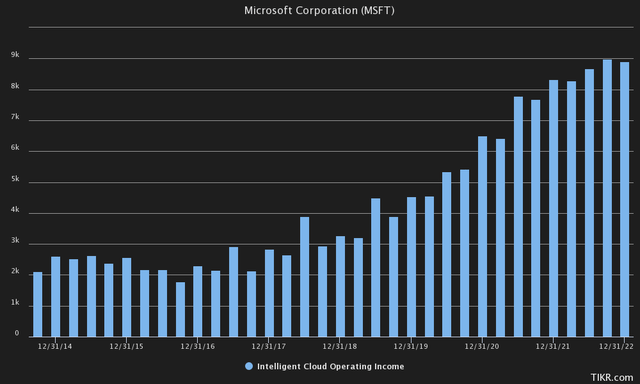

Microsoft’s cloud segment is actually one that most investors still expect a lot of growth from, given the popularity of cloud computing. Over the past two quarters, however, cloud revenue has grown, but operating income has remained flat, meaning that scaling up could be less lucrative than some expect.

The Storm Is Here

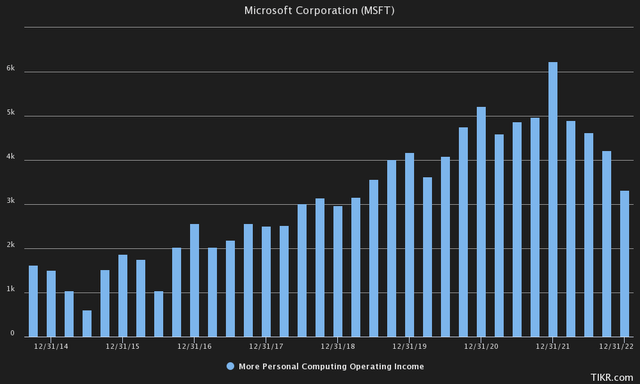

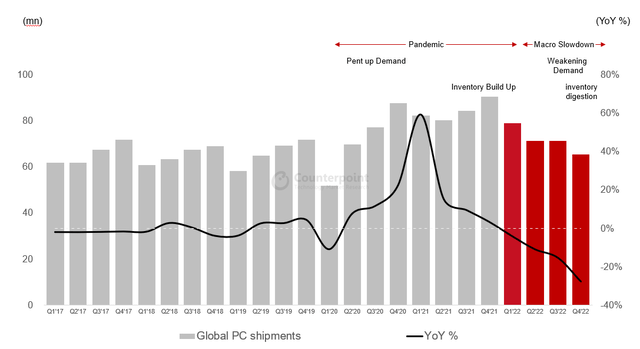

Currently, however, it is mainly the personal computing segment that is depressing profitability, as global PC sales have declined over the past few quarters.

However, it seems perfectly rational, as we have departed from a situation where PCs were in extremely high demand in 2020 and 2021 and more capital was spent while working from home became the norm. Now a return to the office combined with a macroeconomic slowdown could, in our opinion, hold back this segment for quite some time.

As some know, global PC sales fell a remarkable 27.8% year-on-year in the fourth quarter. Even for fiscal year 2022, shipments fell 15% year-on-year. And yet, for investors expecting a rosy 2023, we are yet to see much improvement.

Quite the opposite, in fact, as IDC just lowered its outlook for PC sales in 2023, from 429.5 million units shipped to just 402.1 million units. The figures they display predict that sales of traditional PCs will fall 10.7% year-on-year, following an already sluggish 2022.

The memo also states that this could reverse in 2024 and 2025 due to the “sunsetting” of Windows 10 by then. We are convinced that these headwinds in Personal Computing and Cloud Computing, combined with the CapEx boom of setting the stage for AI, could give Microsoft tough times ahead. Perhaps things will get worse before they get better.

Since AI is already currently favoring Microsoft’s Bing in terms of gaining market share, the cost of a search using AI is estimated to be 10 times more expensive than a regular search, making it more of a headwind for Alphabet (GOOG) than a tailwind for Bing.

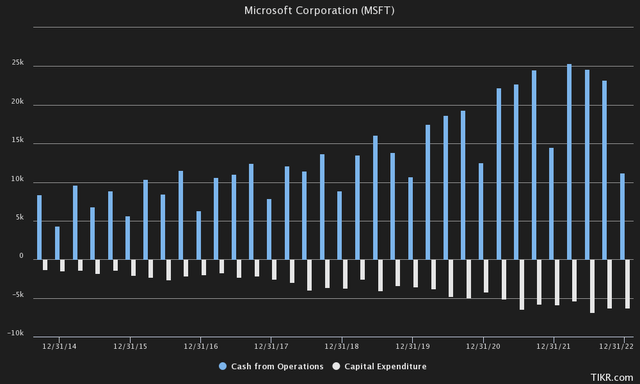

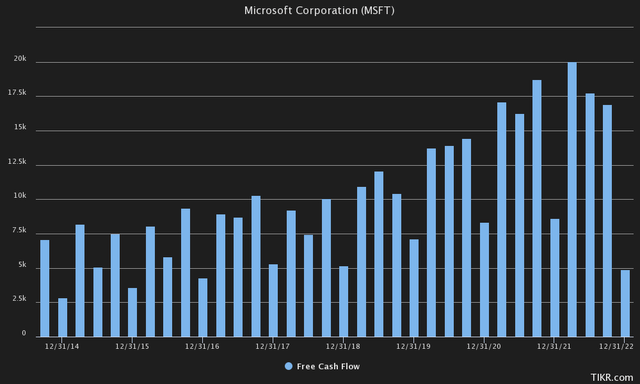

We estimate that, as with cloud, it may be some time before AI becomes widely magnetizable, and will continue to be a drag on Free Cash Flow, which is already starting to soften in recent quarters. The $10BN investment in OpenAI’s ChatGPT, which expects $200M in revenue by 2023, is a case in point.

Still, we think these investments could also help Microsoft tremendously in their Productivity and Business Processes segment, by creating opportunities to even integrate search into applications such as Word, Excel and other programs, eliminating much of the search altogether.

Both Sides Of The P/E Ratio

Now that we have looked at earnings and our estimates on why earnings could be lower than expected for a while, it is also important to look at both sides of the equation.

Not only could Microsoft experience margin compression in a recession, it could experience multiple compression as liquidity is taken out of the economy as the Federal Reserve raises interest rates and rolls securities off its balance sheet. In recent history, investors have felt very comfortable just looking at multiples, as earnings of the S&P 500 have risen across the board over the past 15 years and were mostly taken as a given.

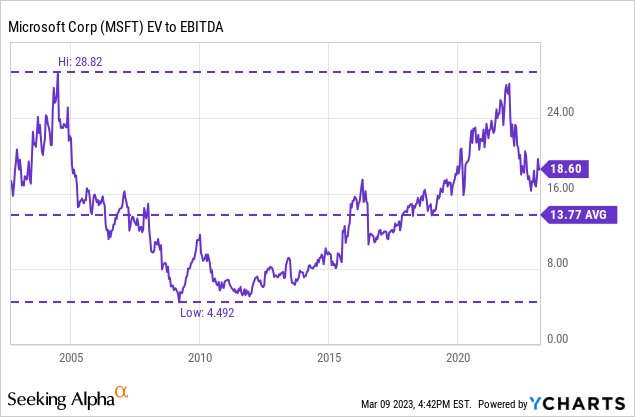

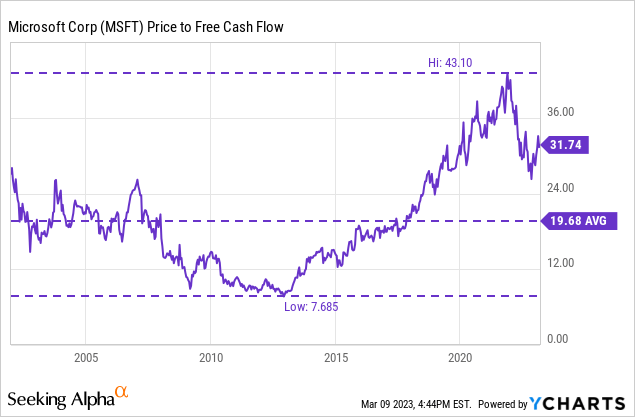

Yet looking at those multiples, Microsoft is still trading quite expensive in terms of EV/EBITDA, EV/EBIT and P/FCF. We think this again indicates that investors are mistakenly expecting strong earnings growth for the next few years, which is at odds with the yield curve that expects a recession.

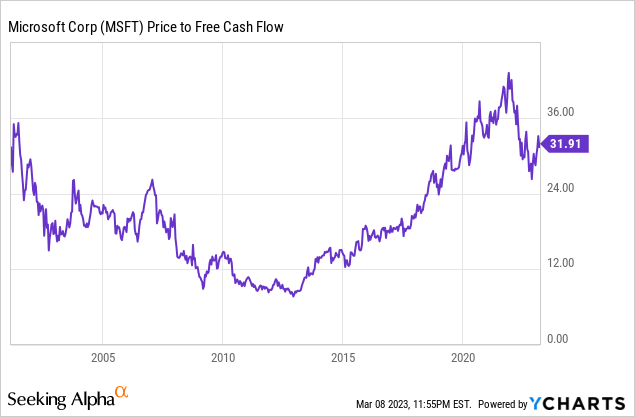

Especially on a P/FCF basis, in which Microsoft returned to a P/FCF multiple of less than 12 times during and after the last recession in 2008 after profits went sideways for quite some time. Currently, paying a 31.74 times free cash flow multiple could be a rude awakening for investors if earnings stagnate or decline outright over the next few quarters.

Nor is it a foregone conclusion that Microsoft will have a monopoly on AI in the future. Indeed, they are currently paving the way forward by making meaningful investments in AI. Although it cannot be denied that other large cap tech is doing the same, such as Tesla (TSLA) with Dojo and FSD, Meta (META) with LLaMA, Alphabet with Bard and many other small-caps with dedicated teams.

The future expectations in terms of high earnings growth, accommodative monetary policy, margin growth seem to weigh too heavily on us at the moment and take away our margin of safety.

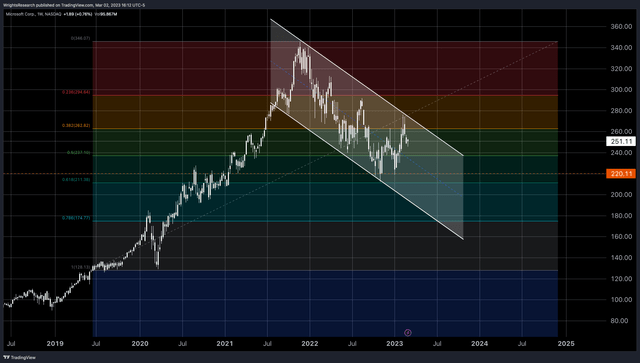

Therefore, we currently see Microsoft as a hold. Also from a technical perspective, we see Microsoft continuing to trade in a downward channel. We think the previous lows around $220 will be retested, which would give us a better opportunity to enter with a larger margin of safety. On a technical basis, there also seems to be major support at the $220 level.

In fact, we would even go as far as to wait until the $180-$210 level to take a significant position, again referring to our macroeconomic outlook that the U.S. will enter a recession later this year or early 2024. That would bring the stock back to its baseline on a Fibonacci Retracement, where it was when it entered 2021.

Tradingview, Wright’s Research

The Bottom Line

We currently have Microsoft as a “hold”, based on an overly optimistic outlook for earnings growth, a very potential earnings recession and increased historical multiples, along with increased capital spending on AI growth, which we expect could take a while to become monetizable.

We think the stock could be trending sideways for quite some time, after the exponential rise we saw in 2020 and 2021 thanks to an overly accommodative monetary policy. In short, we would be very skeptical of the current AI hype, continue to focus on earnings and fundamentals and we are following our recessionary playbook.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.