Summary:

- Micron Technology, Inc. will report Q2 earnings next week.

- Micron Technology stock along with other chip stocks have performed quite well to start the year as investors recently rolled out of financials and into technology.

- Micron stock key metrics have deteriorated.

- We’re looking for serious cost cutting from Micron Technology.

PeopleImages/iStock via Getty Images

The semiconductor sector was crushed last year. In 2023, technology stocks have performed pretty well, especially in recent weeks as investors flee financials and roll into tech. The fundamentals suggest there are still pressures on chip stocks, but likely we are still at long-term value levels. What is unclear is where the bottom of the semiconductor cycle is. It is our opinion that we are nearing the bottom, but there are no clear signs that we have troughed yet. What we do know is that despite all of the macro fears and chaos happening right now, it still seems we have a sufficient supply of chips, and many end users over-ordered when there was a supply shortage, and this has now hurt demand near-term. Pricing is also an issue in the sector because of this, meaning less revenues on each unit moved.

One stock our traders and members closely follow is Micron Technology, Inc. (NASDAQ:MU). Is Micron Technology expected to beat earnings? Hard to tell for sure, there is no crystal ball, but what we can tell you is that earnings expectations for 2023 suggest losses. We still think a best-case scenario is a breakeven year. We will remind you that a few months ago, Micron gave a pretty dismal business outlook for its 2023 fiscal year. While it is cutting production, what could help it beat on the bottom line are expected cuts to spending. Such expense reduction can help the bottom line, but we want to ensure it does not cut into growth. That will be key to watch for in Micron’s Q2 earnings. Let us discuss further.

Micron stock could easily get cheaper

When Micron first fell to $50 a few months ago, we were in the camp that believed the stock had become attractive for a tradeable bounce, and we indeed were able to see some quick returns as a trader, but now we have reverted back to the $50 level. If this cannot hold, we are going much lower.

Folks, the key metrics are simply still on the decline. It is a fact, regardless of if you are a bull or a bear. The company is likely to lose money here this year. So, a “cheap stock” could get cheaper, especially if bearish predictions for chips/memory play out. Obviously, the market is trying to figure out where earnings could go after this downturn, but the fact is some companies are simply better in the space.

Micron is a fine company, but an investment here relies on the thesis that the bottom is close. So, shares have sold off for months, with a few trading bounces, and here we are at the end of December 2022, and it looks like the market got this right. The reality is, both DRAM and NAND pricing were hit hard by the rather cyclical nature of the sector. Adding fuel to the fire, we saw analysts release downgrade after downgrade, mostly citing the same issues that were already known.

Expectation versus reality

Stock picking over the medium- to long-term is really a game of expectations. More specifically, it is a game of finding names that can outperform expectations, time and again. Expectations grew too high for Micron post-COVID, and just as quickly, reality set in over the last year period as the company’s performance dwindled relative to lofty expectations. Make no mistake: performance, as a company, is simply challenged thanks to a tough macro space.

This chart is ugly, though it has suggested $50 is a key level of support, but there just is not an earnings basis to back this level up. It is from a chart perspective only. Frankly, the technicals mean little here, when the fundamentals are in such tough shape. There were a few positives, but the thing is, we have changing expectations.

How were Micron Technology’s previous earnings?

The fiscal Q1 earnings showed a clear weakening of operations. When the company reported its fiscal Q1, the company slightly missed on the top and bottom lines. Revenues were expected to be around $4.1 billion while adjusted earnings per share were expected to be a loss of $0.02 per share. Actual results were revenues of $4.09 billion with adjusted earnings per share of a loss of $0.04. However, the results were within guidance ranges despite challenging conditions during the quarter.

When does Micron Technology report earnings?

Micron will report its fiscal Q2 earnings next week. The earnings will be reported after market close on Tuesday, March 28th.

Is Micron Technology expected to beat earnings?

What we know is that Micron’s strong technology, manufacturing, and financial position should let them navigate the near-term environment, and they have taken actions to cut supply and expenses. We think things pick up in late 2023. For fiscal Q2, the company is expected to lose $0.80 per share on revenues of $3.72 billion. The market has priced the stock higher in recent months, which suggests positivity on the horizon is possible but may also reflect a sector rotation. We think sales will come in around expectations within 2-3%; we see no reason for a complete blowout or whiff. On the earnings front, provided revenues track to about consensus, we expect earnings to slightly beat, based on the cost-cutting efforts.

CAPEX is key to watch. CAPEX was $2.47 billion for the first quarter of 2023, which resulted in adjusted free cash flows of a loss of $1.53 billion. Micron also repurchased approximately 8.6 million of its shares for $425 million. That is long-term helpful for investors. Micron ended the quarter with cash, marketable investments, and restricted cash of $12.08 billion, for a net cash position of $1.81 billion. We expect that to decline. CAPEX for the year will be reduced to $7.0-$7.5 billion.

We do know inventory is high, and memory pricing is down. We are pleased to see that a move to reduce inventory is underway. There have been labor cuts, and other controls already taken. But many competitors have not done this. That is something to consider. Of course, consensus has gotten more bearish from the company’s initial guidance after reporting Q1.

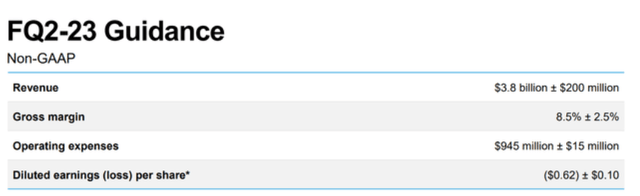

We are looking for operating expenses to come in under $940 million following a 10% cut of the labor force. Based on what the company is saying, revenue will fall to approximately $3.6 billion to $4.0 billion, and we are expecting revenues to be under $3.75 billion. What we find to be quite shocking, however, is margin outlooks. Margins were 22.9% in Q1, helping lead to a big earnings miss. For Fiscal Q2, Micron management guided margins of 7.5-8.5% for Q2. We do know they are reducing wafer starts by 20% to help battle inventory issues. That is actually good news long-term, even though revenues will suffer near-term.

When will it get better for Micron and the sector? Over at our service, we continue to discuss a turn for the sector by calendar Q3-Q4 2023. No one knows for sure, but we are estimating a bottom in performance by then for the sector. Micron is cyclical, and if we look back at the past downturns in the last two cycles, it takes 6-8 quarters to recover. So, considering peak performance was in fiscal Q3 2022, we would expect a ramp-up in late calendar 2023 at the earliest.

MU stock key metrics

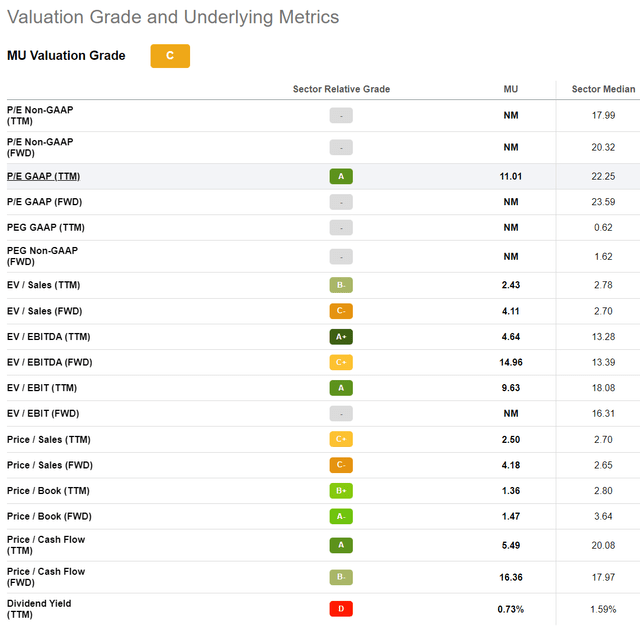

Our read of the chart continues to suggest pretty strong support around $50, though we are 20% above that mark. What about the valuation? Let’s take a look at the valuation grade here.

Valuation has deteriorated from being “A” rated just a quarter ago to a “C” rating, and this is because of the fact that performance is dropping. From a P/E perspective, you have losses, so, that’s useless here. If we look at a price-to-sales, we are 2.5X here. That is somewhat attractive. We also think the stock is somewhat cheap on a price to cash flow basis (3.6X) but FWD price to cash flow is worse as performance will dip (16.4X). Cheap can always get cheaper, here is the lesson.

Final thoughts

The $50 chart level is a strong support, and we are well above that. There is no evidence that we have hit the bottom of the cycle yet, but historically we may see signs of it at the end of this year, recession issues notwithstanding. Micron Technology Q2 will be reported Tuesday after the close, and we will bring you our take after the report lands. We suspect revenues to track around consensus but think that if the company is seriously cutting costs, Micron Technology, Inc. will lose less money than expected. Right now, we rate Micron Technology, Inc. stock a clear hold, but long-term investors using a buy-write strategy can do well with an elevated VIX, as premiums are high.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

We make winners. Come make money with us

Like our thought process? Stop wasting time and join the traders at BAD BEAT Investing at a ~60% off sale!

Our hedge fund analysts are available all day during market hours to answer questions, and help you learn and grow. Learn how to best position yourself to catch rapid-return trades, while finding deep value for the long-term.

- Available all day during market hours with a vibrant chat.

- Rapid-return trade ideas each week from our hedge fund analysts

- Crystal clear entries, profit taking, and stop levels

- Deep value situations

- Stocks, options, trades, dividends and one-on-one attention