Summary:

- Investors are abuzz with excitement after Nvidia Corporation’s Spring 2023 GTC, as the company’s dominance in the generative AI space is poised to unlock significant opportunities.

- Wall Street is roaring with applause as analysts’ Nvidia Corporation price targets have surged over 35% since November, signaling analysts’ confidence in its market leadership.

- Buyers eagerly rushed on board, hoping to ride the train to even greater heights. As such, Nvidia’s recovery from its October lows catapulted it into well-overvalued zones.

- Investors should avoid adding new positions now and consider layering out to reduce exposure.

Justin Sullivan

NVIDIA Corporation (NASDAQ:NVDA) recently concluded its 2023 Spring GTC, which showcased the company’s breakthroughs in one of the world’s most keenly-watched AI developer conferences.

As a full-stack company building the AI hardware and software ecosystem, Nvidia has made another giant leap to be the infrastructure that undergirds our transformation toward “AI being in every industry.“

CEO Jensen Huang emphasized that the world is staring at the “iPhone moment of AI.” Huang alluded to the urgency of how generative AI has not only become the new buzzword for companies but also “created a sense of urgency for companies to reimagine their products and business models.”

As such, Huang’s assertion that his company is leading this transformation by providing the technological stack to enable it brings forward Nvidia’s upgraded total addressable market (“TAM”) significantly.

Huang is confident that “generative AI will account for a ‘quite large‘ portion” as the company’s growth driver over the next twelve months.

NVDA average analysts’ price target (TIKR)

As such, analysts’ price targets, or PTs, have been raised significantly from their November/December lows, reflecting improved buying sentiments and upgraded revenue and profitability projections.

Accordingly, Wall Street analysts lifted NVDA’s average PTs from a low of $198 in November to about $271 currently.

However, before investors jump on the bandwagon, it’s critical to consider whether the market’s optimism has already been priced into the stock?

The upgraded estimates suggest that Nvidia could see a sharp inflection over its revenue growth over the next two FYs, likely driven by the surge in AI training and inferencing opportunities.

The consensus estimates imply a revenue CAGR of about 17.3% from FY23 to FY25, recovering from last FY’s negligible revenue growth of 0.22%. Moreover, the company is expected to drive significant operating leverage over the next two FYs.

Accordingly, Nvidia’s adjusted EBIT is projected to improve by a CAGR of 37.2%, leading to an adjusted EBIT margin of 45.9% as of FY25, relative to FY23’s 33.5%.

Therefore, Nvidia’s data center growth is expected to play a significant role here, driven by generative AI. Morningstar highlighted that Nvidia’s margins could be lifted even higher as “data center margins are high, ranging from 65% to 70%, and should expand as software becomes a bigger piece of the revenue mix.”

But, we believe it’s essential for investors to recognize that market operators have likely already rewarded the company’s market leadership in building the AI infrastructure.

The optimism is palpable, as Nvidia opens up its cloud-based supercomputer for enterprises to incorporate into their AI development. DGX cloud’s AI supercomputer-as-a-service allows companies “immediate access to the infrastructure and software needed to train advanced models for generative AI and other groundbreaking applications.”

In addition, it has also become a major cloud player on its own now, even as it partners with the leading hyperscalers such as Alphabet Inc./Google (GOOGL), Microsoft Corporation (MSFT), and Oracle Corporation (ORCL). Amazon Web Services (AMZN) will also be adopting the “newest AI chips” as the cloud service providers compete in the new era of generative AI to drive demand and growth after the momentum has slowed recently.

Even China’s Baidu, Inc. (BIDU), which built the Ernie Bot to compete with OpenAI’s ChatGPT, also needs Nvidia’s downgraded A800 GPUs for AI training. DIGITIMES reported that while the company has its customized Kunlun chips, it’s suitable for AI inferencing but not “AI model training.“

As such, Baidu reportedly “asked Nvidia to sell as many A800 chips as possible” as it levels up its ambitions in the generative AI space.

We think there’s little doubt that Nvidia’s competitive moat against its peers in the AI training space has been clearly demonstrated.

However, the inference space is more competitive, even as it launched “four inference platforms,” allowing developers to build multimodal AI applications.

But, with all that optimism and frenzy by buyers looking to hop onto NVDA’s bandwagon, has it been priced in?

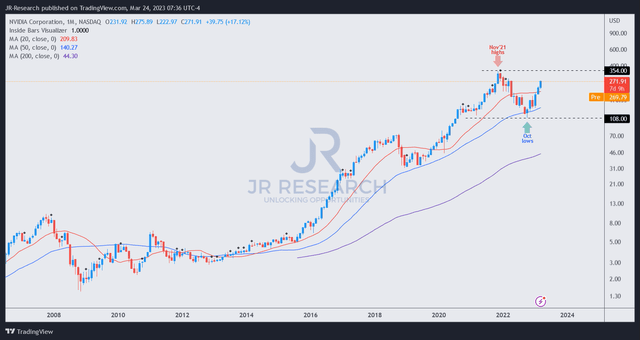

NVDA price chart (weekly) (TradingView)

The $108 level proved to be Nvidia’s bottom in October, as long-term buyers returned to defend its long-term uptrend bias, bolstered by its 50-month moving average, or MA (blue line).

Momentum buyers likely jumped on board subsequently, but the vertical surge since October has also brought it into well-overvalued zones.

NVDA’s NTM EBITDA multiple of 68x recently reached the two standard deviation zone over its 10Y average, suggesting significant overvaluation.

While we have not gleaned any signs of a bull trap or false upside breakout, we believe the opportunity to cut more exposure is attractive. Investors heavy on Nvidia Corporation stock might want to consider layering out progressively and rotating it to less expensive semiconductor stocks.

Rating: Sell (Reiterated).

Important Note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice.

Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOGL, NVDA, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the S&P 500 had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!