Summary:

- Nvidia Corporation’s shares have more than doubled in the past 5 months on the hopes of continued rapid growth in the midst of recessionary times.

- However, the latest channel data reveals the ground reality is still grim and investors may have gotten far too enthusiastic.

- Nvidia Corporation stock seems ripe for correction.

Justin Sullivan

Nvidia Corporation (NASDAQ:NVDA) shares are up by 145% since its October lows, but the elevated stock price might not be sustainable for long. The entire premise behind this ferocious rally has been the narrative that Nvidia’s business has been growing by leaps and bounds, even though we’re in a recessionary environment.

But the ground reality isn’t as bright as it seems. In this article, I’ll highlight the monthly sales data for some of Nvidia’s channel partners and explain why NVDA stock is due for a major correction. Let’s take a closer look to gain a better understanding of it all.

Examining Channel Sales

Let me start by saying that Nvidia is a chip designer and it outsources many aspects of its business to its channel partners. For instance, Nvidia’s silicon engineers design the chip architectures and send them for fabrication at Taiwan Semiconductor (TSM), Samsung (OTCPK:SSNLF) or GlobalFoundries (GFS). This silicon is then sent to companies such as Gigabyte, Micro Star International, ASUS, and ASRock to package them in the form of usable GPUs and distribute them globally through their respective sales networks. A few of the aforementioned firms also manufacture a few other computing peripherals, such as motherboards, networking gear, and other similar products, that complement Nvidia’s ecosystem of products.

Let me be clear, there’s nothing wrong with this operating model. It gives Nvidia the flexibility and agility to move product, innovate, focus on what it does best, and reduce its capital expenditure burden. But at the same time, having multiple channel partners allows for the easy flow of information to investors. We can track the monthly sales data for the aforementioned companies, to gauge how Nvidia’s ongoing quarter may be progressing. For instance, if sales at these partner firms fluctuate in either direction, then we can look at possible catalysts behind those moves and reassess our investment thesis in Nvidia, before it formally releases quarterly results.

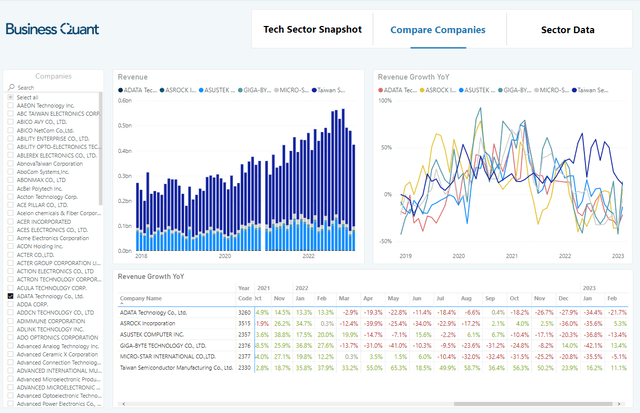

We, at Business Quant, have developed a tool for exactly this purpose, that tracks the monthly sales figures for over 1300 Taiwan-listed firms. Note in the chart below how sales for Nvidia’s partner firms have continued to decline in December, January, and February on a sequential basis. The launch of new RTX 40-series GPU launches as well semiconductor shortages getting over, would’ve ideally triggered a sales surge, but it’s evident that sales of these partner firms have declined sequentially instead. This goes to show that PC demand recovery isn’t happening yet, contrary to what many bears have been leading us to believe in recent weeks.

There are a few nuances to this data, though. I believe inflationary pressures and a recessionary environment weighed down on consumer spending in January and February, which is why sales numbers are sequentially down. Besides, the mainstream RTX 4070, 4060ti and 4060 GPUs are yet to be launched, so gamers en masse, including yours truly, may be deferring purchases until these budget SKUs become commercially available.

Research firm IDC has actually grown pessimistic about the demand resumption of personal computing devices. They’re now forecasting 2023 shipments to be lower than pre-pandemic levels of 2019. This lines up with the bleak monthly sales numbers that we just saw in the chart above. But this leads us to an important question – what does this all mean for Nvidia and its shareholders?

Impact for Shareholders

I’d like to clarify that the partner firms mentioned above aren’t pure-play companies, and they don’t necessarily have exclusive contracts with Nvidia. They, in fact, have a number of other SKUs in their product portfolios as well, and they also manufacture components for some of Nvidia’s key rivals, that is, Advanced Micro Devices (AMD) and Intel (INTC). So, the bleak monthly sales figures seen above, highlight the weak sell-throughs in the personal computing and peripherals industries in general and are not indicative of just Nvidia’s sales performance.

Having said that, Nvidia isn’t immune to industry trends and consumer buying patterns. If the overall demand for PC and peripherals is weak, then it’s only natural that Nvidia will also experience softness in consumer demand to a certain degree at least. These soft sales numbers could be driven by poor pricing or volume mix, or just slow demand that’s caused by the currently-prevalent recessionary environment and strained consumer budgets across the globe. So, I believe that Nvidia will be revenue challenged in its ongoing Q1 FY24 and its management will issue a conservative outlook for Q2 FY24.

This forecast is in stark contrast with Nvidia’s stock price action. On one hand we have a business that’s poised to register a growth slowdown, and on another, NVDA shares have risen 145% in the past 5 months, presumably because of over enthusiastic shareholders. So, I believe Nvidia’s shareholders will be in for a rude awakening when the company reports a slowdown in its growth trajectory in its upcoming earnings call and its shares will inevitably crater.

Final Thoughts

See, If Nvidia’s products were selling like hotcakes and the demand for computing products was high, then these brand agnostic channel partners would’ve posted breakneck sales growth, especially now that the semiconductor shortages are over. But they’ve posted 3 months of consecutive sales declines, indicating that consumer demand for personal computing products and peripherals isn’t as strong as many bulls believe it to be.

So, the takeaway here is that Nvidia’s sales is likely to plateau and its growth trajectory will likely simmer, at least in the foreseeable future, as the world gradually enters into a full-blown recession. The stock may have had a meteoric rally, but that’s not necessarily indicative of the ground reality. If anything, the stock price movement now seems decoupled from the ground reality, for the time being at least.

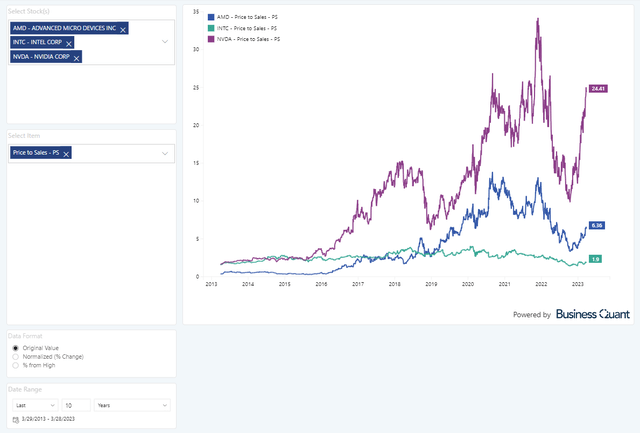

Besides, Nvidia’s stock is trading at 24.7-times its trailing twelve-month sales. This Price-to-Sales value is very high on a standalone basis, it’s inching closer to the highest level it has ever been for Nvidia, and it’s also significantly higher than the chipmaker’s closest rivals, AMD and Intel’s, respective figures. All these factors lead me to believe that Nvidia’s shares are overextended at current levels and overdue for a steep correction in the months to come. Good Luck!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.