Summary:

- We continue to be bullish on Micron for long-term investors.

- We expect DRAM industry demand-supply dynamics to come into balance towards the end of 2H23, improving Micron’s financial performance.

- Still, we expect continued soft demand in NAND markets due to the weaker end-market demand for smartphones and PCs.

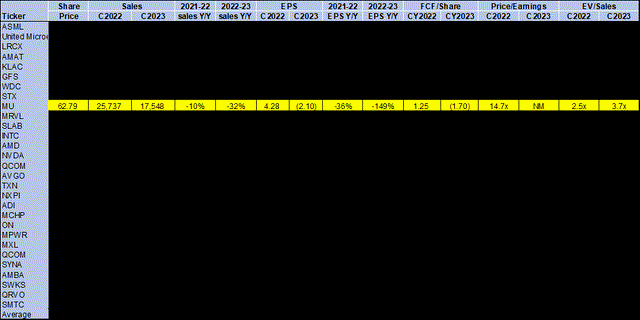

- Micron stock remains relatively cheap, trading at 3.7x EV/C2023 sales versus the peer group average of 5.3%.

- We continue to see favorable entry points for long-term investors at current levels, as we expect the stock to outperform further towards 2024.

vzphotos

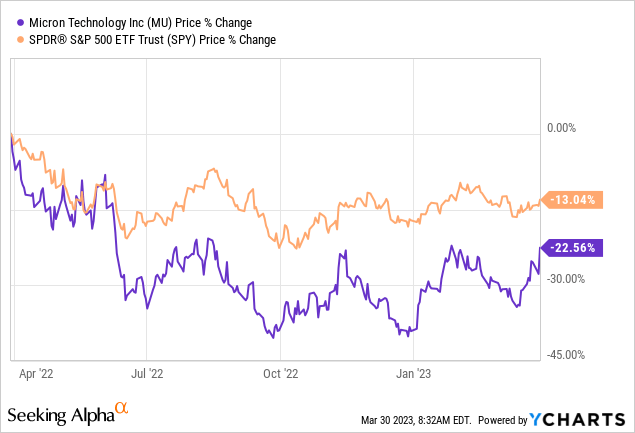

We remain buy-rated on Micron (NASDAQ:MU), seeing favorable entry points for long-term investors at current levels. We expect DRAM industry demand-supply dynamics to come into balance towards the second half of the year. We see MU stock rallying towards FY2024 – the stock is up 13% since we upgraded it to a buy in late October, outperforming the S&P 500, which is up 4% during the same period. Over the past year, MU is down 13%, while the S&P 500 is down nearly 23%. The following graph outlines MU stock performance compared to the S&P 500.

YCharts

MU’s 2Q23 earning results missed bottom and top lines, reporting Non-GAAP EPS of -$1.91, missing by $1.03, and revenue of $3.69B, missing by $20M. In spite of the not-so-pretty financial results, we expect MU is better positioned for a long-term stock rally towards FY2024. Our current note is focused on analyzing MU’s 2Q23 earning results and the DRAM industry dynamics in 1H23. The stock price remains volatile in the near term due to a softer NAND demand environment, as consumer spending on PCs and smartphones remains muted. Still, we expect the DRAM demand to improve as MU ships below demand to accelerate the inventory correction process. We see DRAM inventory correction cycles approaching their end towards 2H23. We believe investors buying the stock at current levels will be well-rewarded in the mid-to-long term, as we see MU outperforming towards 2024.

2Q23 earnings results & DRAM industry dynamics

Our bullish sentiment is driven by our belief that MU will outperform towards 2024 as DRAM industry demand-supply dynamics recover after the downward memory trend last year. Consistent with our expectations, MU’s revenue “bottomed” in 2Q23 as data center customers work through excess inventories built up by pandemic-led demand levels. MU reported revenue of $3.69B in 2Q23, down 10% sequentially and 53% Y/Y. The company reported a net loss of 2,312M in 2Q23, compared to 2,263M in 2Q22; the quarter’s results included an inventory writedown of $1.43B. Our investment thesis on MU revolves around DRAM industry dynamics, as the company achieves 74% of its revenue from DRAM end-markets as of 2Q23, while NAND accounts for 24% of total revenue. We expect DRAM industry demand-supply dynamics to reach healthy levels faster than NAND. NAND is generally used for PCs and smartphones, and we don’t see either market recovering towards 2H23; PC Client TAM is forecasted to shrink 14-18% this year to 240-250M compared to 292M in 2022, while smartphone TAM is forecasted to decline 2.5% from 1.21B to 1.18B, still below pre-pandemic levels. We recently upgraded Seagate (STX) to a buy based on our belief that HDD dynamics will improve towards the end of the year. We see something similar happening with MU and the DRAM industry.

We expect MU to experience sequential bit demand in DRAM markets. MU is reducing bit supply growth to accelerate the inventory correction processes and bring DRAM industry demand-supply dynamics back into balance. MU made further reductions to their FY2023 Capex plan and now expects to invest around $7B in FY2023, down 40% from last year. We upgraded Micron late last year from a hold to a buy based on our belief that memory weakness had been priced in. Now, our bullish sentiment is driven by our belief that the weakness has not only been priced in, making the stock undervalued at current levels but also that DRAM industry dynamics will come into balance towards the end of the year. In 3Q23, MU expects sales to be sequentially flat at $3.7B, trailing consensus at $3.75B. Still, we expect the company’s financial performance to improve more meaningfully towards the end of the year and recommend investors begin looking for entry points at current levels.

Ready for a bull market

MU dominates the DRAM industry alongside SK Hynix Inc. and Samsung, among others, and we expect the company to be well-positioned to expand its DRAM solutions and product mixes. MU retains a 26.4% market share in the DRAM industry, third after SK Hynix and Samsung. Both SK Hynix and Samsung experienced DRAM revenue declines last year, with global DRAM revenue falling more than 32.5% sequentially in 4Q22. Samsung has been impressive in its competitive pricing and was able to increase shipments despite the demand slump; the company successfully expanded its market share from 40.7% to 45.1%. MU’s ASP for DRAM and NAND declined by 20% and mid-20s percentage range sequentially this quarter. Simultaneously, MU is reducing shipments to push along the inventory correction cycle. We expect MU is on the right track to help balance demand-supply dynamics and grow more meaningfully in FY2024.

We expect adoption for MU’s DDR5 to increase towards 2H23, further boosting revenue even in a weaker spending environment. We also believe MU will benefit from the Artificial Intelligence (AI) boom. An average AI server utilizes up to 8x more DRAM content and 3x more NAND than a traditional server. We expect MU to experience the next leg of growth driven by increased demand for AI technology, boosting chip sales to data centers more meaningfully going forward.

Valuation

Micron is relatively cheap. The stock is trading at 3.7x EV/C2023 sales versus the peer group average of 5.3x. We believe Micron is a value stock at current levels. We see the stock rebounding meaningfully towards the end of the year and recommend investors buy the stock at current levels.

The following table outlines Micron’s valuation.

Word on Wall Street

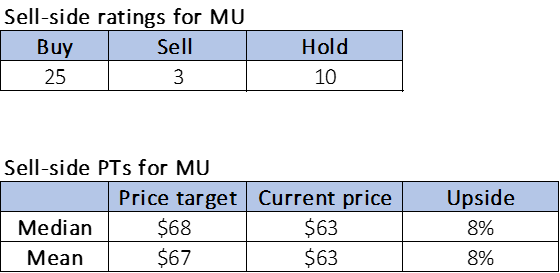

Wall Street is bullish on the stock. Of the 38 analysts covering the stock, 25 are buy-rated, ten are hold-rated, and the remaining are sell-rated.

The following table outlines Micron’s sell-side ratings.

Tech Stock Pros

What to do with the stock

We’re buy-rated on MU. We believe the memory company has been recovering since late October, with the stock gradually climbing. We see more upside ahead as inventory correction cycles near their end towards 2H23, improving DRAM industry demand-supply dynamics and, by extension, MU’s financial performance. We expect the stock to outperform towards 2024 and see favorable entry points for long-term investors at current levels.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.