Summary:

- An Artificial Intelligence (“AI”) arms race could play out in Nvidia Corporation’s favor.

- AI has been already commercialized in a multitude of applications ranging from image recognition to autonomous vehicles.

- And ChatGPT further demonstrated the possibility for AI to become more affordable and accessible to the general public.

- Nvidia has a solid footprint and technological lead in all these application areas, as highlighted by its A100 chip.

NanoStockk/iStock via Getty Images

Thesis

Readers familiar with my past coverages know that I have been cautious about Nvidia Corporation (NASDAQ:NVDA) stock for a variety of concerns. These concerns included the possible collapse of cryptocurrency prices, its overstocking issues, and also the risks associated with the tension between the U.S. and China, one of its key markets.

However, the recent development triggered by ChatGPT revealed a positive catalyst that could be tremendously beneficial to NVDA. And it is the main thesis of this article to argue that the market excitement about ChatGPT has marked the beginning of an Artificial Intelligence (“AI”) arms race. And the race could play out in NVDA’s favor.

The AI arms race has begun

Recent developments at ChatGPT have the market excited about the potential prospects of AI. Many NVDA investors (or potential investors) do recognize NVDA as a (if not the) leader in the AI field, even for people like myself who are lukewarm about the stock. It is just that my view had been that the commercial implementation of AI technology is still far away. And my above view is changing given the recent excitement and also success demonstrated by ChatGPT. After test-driving ChatGPT for a variety of tasks, I have to conclude that it is indeed very useful. And I can see a path forward to make it become an indispensable tool, the way Google and Wiki have been. When the facts change, I have to change my mind.

Of course, ChatGPT is not the first successful commercial application of AI, but certainly one with a landmark flavor. Besides ChatGPT, AI has already been used commercially in many applications, such as image recognition, natural language processing, predictive analytics, and autonomous vehicles, to name a few. But ChatGPT has certainly demonstrated the possibility for AI to become more affordable and accessible to the general public.

The enthusiasm (and real money investment) from giants like Microsoft Corporation (MSFT) and Alphabet Inc. (GOOG, “Google”) following the ChatGPT excitement officially marks the beginning of an AI arms race, the way I see things. And next, I will explain how NVDA can benefit.

NVDA’s $10,000 AI chip

As just mentioned, the AI race is intensifying. Both established giants (like Microsoft and Google) and new entrants (like OpenAI and Stable Diffusion) are racing to develop AI algorithms and integrate them into their existing products.

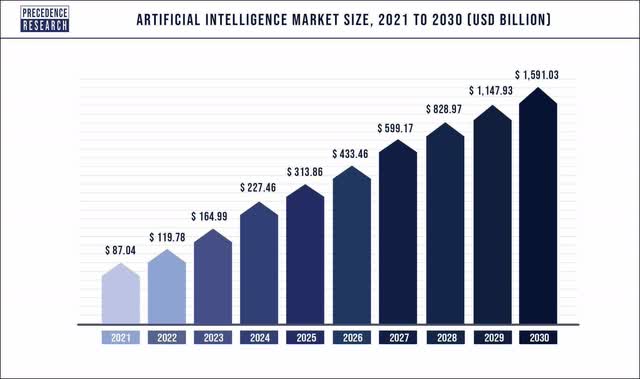

The enthusiasm is for good reasons, as the predicted total addressable market (“TAM”) size for AI is huge. According to a report by Precedence Research, the global AI market size was valued at USD $119 billion in 2022 and is expected to reach USD $313 billion by 2025 and $1.59 trillion by 2030, implying a CAGR of 38% between 2022 and 2030. The market size is driven by various AI-based solutions across industries such as healthcare, finance, retail, and automotive, among others.

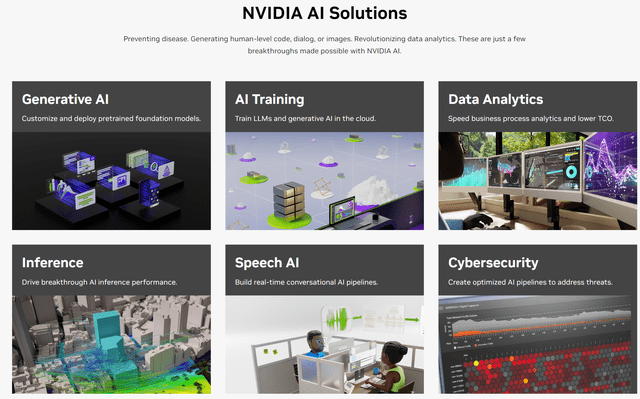

If these AI applications are the gold mine, then NVDA is one of the few sellers of the shovels to dig. NVDA specializes in chips for a variety of AI applications. And its AI products include a full line of hardware and software (see the next chart below), ranging from NVIDIA GPU Cloud (targeting cloud applications), to NVIDIA Jetson (targeting autonomous machines), and NVIDIA TensorRT (targeting high-performance deep learning).

A highlight of the NVDA products line is its A100 chip. Powering this multitude of applications is its A100 chip, with a price tag in the range of $10,000. This chip has become a cornerstone in a variety of AI applications. The A100 is the workhorse for AI professionals now.

It offers the capability to run many simple calculations simultaneously, a key capability for training and using neural network AI algorithms. Thanks to such unique capabilities, Nvidia took the top spot in the AI processor market with an 80% share according to this 2020 report from Omdia. Fast-forward to 2022, NVDA took 95% of the market for GPUs that can be used for machine learning, according to this CNBC report.

Earning outlook and valuation

Thanks to its bright prospects in the AI race, although its overall sales decreased by 21% YOY in its most recent quarterly (“MRQ”) earnings report, its stock price still has soared substantially since then. The key reason is precisely that its AI chip segment, reported as the Data Centers segment, reported an 11% YOY sales growth despite the overall sales decline. As its CEO (Jensen Huang) commented during the Q4 earnings call, the market demand for its AI products is surging as more companies began to board the AI train:

“The activity around the AI infrastructure that we built, and the activity around inferencing using Hopper and Ampere to influence large language models has just gone through the roof in the last 60 days. There’s no question that whatever our views are of this year as we enter the year has been fairly dramatically changed as a result of the last 60, 90 days.”

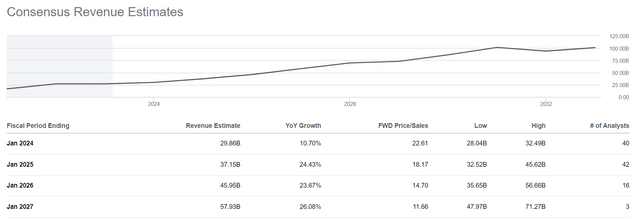

Fueled by such an upbeat outlook, consensus estimates have increased the estimates for the company. As shown in the chart below, consensus estimates now anticipate that the company will post significantly higher top and bottom lines growth in the coming years. To wit, sales are projected to reach $29.8 billion in 2024, representing a 10% YOY growth. Meanwhile, 2024 earnings are projected to be in the ballpark of $3.98 and $5.80 per share, with the midpoint representing a 34% YOY advancement.

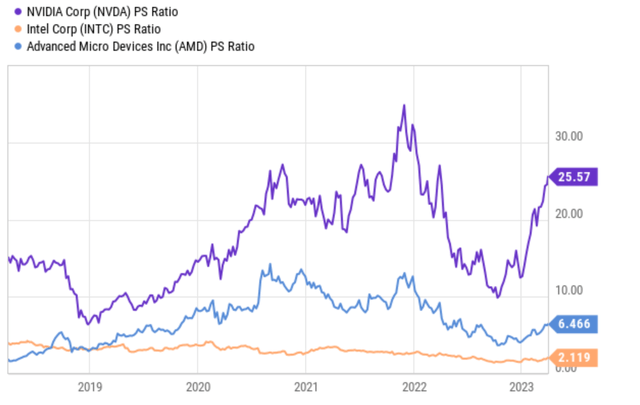

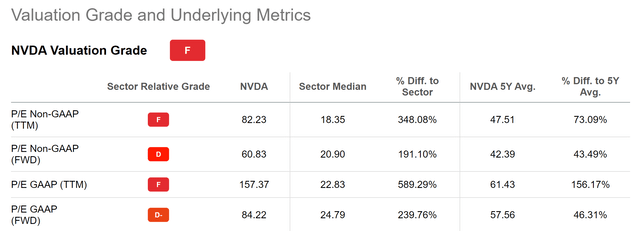

Despite the rapid growth projected, NVDA valuation is quite lofty and could suffer contractions in the near term. As seen in the chart above, the FWD price/sales ratios hover in the 22.8 range. Such a valuation is both lofty in absolute and relative terms (see the next two charts). Compared to close peers such as Advanced Micro Devices, Inc. (AMD) and Intel Corporation (INTC), the 22.8x P/S ratio NVDA is about 4 times higher than AMD and more than 10 times higher than Intel.

Seeking Alpha Seeking Alpha data

Other risks and final thoughts

Besides the valuation risks, NVDA faces a couple of other risks. NVDA is a leading player in the AI space, but it is not the only player. Other companies that are making chips for AI applications include not only direct competitors such as AMD and Intel just mentioned but also cloud users such as Google and Amazon.com, Inc. (AMZN). These software-oriented companies are also developing their own chips specially targeting their AI applications. And also, the A100, being the flagship AI chip, has also been the target of export controls lately because of national defense reasons. For example, last year, the U.S. government restricted NVDA to export its A100 (and also its H100 chips too) to China, Hong Kong, and Russia. Such export restrictions could reoccur or even worsen in the future if geopolitical tensions escalate.

To conclude, I have been quite concerned about NVDA in the past due to issues like high valuation, exposure to cryptocurrency, export control, et al. However, with the recent developments triggered by ChatGPT in the AI space, I am warming up toward its shares. In my view, ChatGPT has clearly demonstrated the possibility of commercial AI applications to become an affordable and indispensable tool to the general public. All of my past concerns still remain and could still cause large price corrections in the near future. However, the AI potential could be a strong reason to become Nvidia Corporation investors with a long-term view.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.