In the month of July, the total market capitalization of cryptoassets surpassed $4 trillion for the first time, following the passage of the first-ever federal legislation for stablecoins.

Bitcoin prices breached past $123K during the month.

Crypto-linked stocks saw a mixed response from short sellers, with an equal number of companies seeing short interest rise as well as fall.

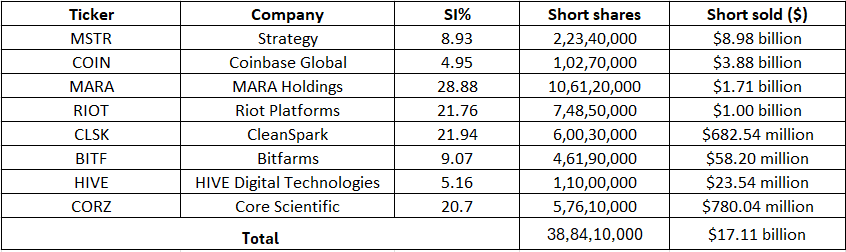

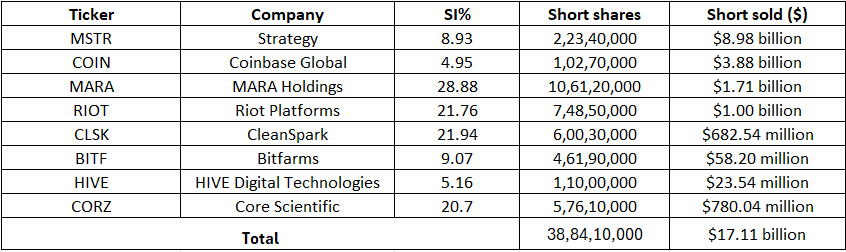

Short interest in Strategy (NASDAQ:MSTR) fell to 8.93% from 9.41% the previous month, while that in Coinbase Global (NASDAQ:COIN) declined to 4.95% from 6.95%. Riot Platforms (NASDAQ:RIOT) saw short interest dip to 21.76% from 25.05% earlier. For Cleanspark (NASDAQ:CLSK), it was down to 21.94% compared to 25.7% earlier.

Meanwhile, short interest in MARA Holdings (NASDAQ:MARA), Bitfarms (NASDAQ:BITF), HIVE Digital Technologies (NASDAQ:HIVE) and Core Scientific (NASDAQ:CORZ) rose to 28.88%, 9.07%, 5.16% and 20.7% respectively.

According to short interest data as of July 31, the short dollar volume in the crypto stocks was $17.11 billion compared to $18.50 billion the previous month.

In August so far, Bitcoin has had another record-breaking run. On August 14, it hit $124.2K setting another record as investors bought riskier assets on expectations of Fed policy easing next month.

MarketBeat