Summary:

- Mastercard operates one of the best businesses in the world, as one of the two payment processing giants which form the duopoly responsible for processing most of the world’s transactions.

- Even after decades of market outperformance and high double-digit growth, the company has plenty of room for growth, with cash still being a major portion of global transactions.

- Even though Mastercard is trading below its historical valuation, it’s still trading at a significant premium over Visa, a premium that I find unjustified.

- I rate Mastercard a Buy with a fair value of $425.5 per share, reflecting a 16.5% upside compared to its current market value. However, If I had to pick one, I’d pick Visa over Mastercard.

Justin Sullivan

Mastercard Incorporated (NYSE:MA) is a global brand, trusted by billions of people to process their payments all over the world. Even after decades of outperformance and impressive high double-digit growth, I believe there’s still plenty of room for upside, as cash still takes a major portion of global transactions, and the company is diversifying its offerings to new value-added services. The company is trading below its historical multiples and below my estimated fair value of $425.5, reflecting a 16.5% upside. Thus, I rate the stock a Buy.

However, I find Visa (V) more attractive at current prices and advise investors who seek to invest only in one of the payment giants, to pick Visa.

Company Overview

Mastercard is a technology company in the global payments industry. The company connects consumers, financial institutions, merchants, governments, digital partners, businesses, and other organizations worldwide by enabling electronic payments instead of cash and checks and making those payment transactions safe, simple, smart, and accessible.

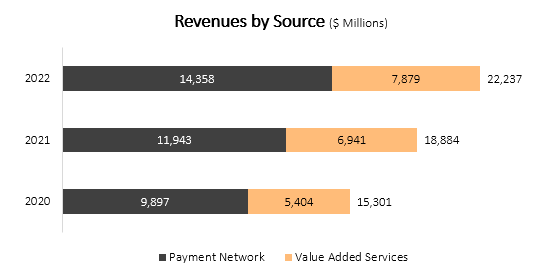

Even though we’re all users of Mastercard in one way or another, understanding the revenue streams of Mastercard isn’t as clear as it seems. The company divides its revenues into two reported sources – Payment Network and Value Added Services & Solutions.

Created by the author using data from Mastercard’s 10-K

Payment Network Revenues

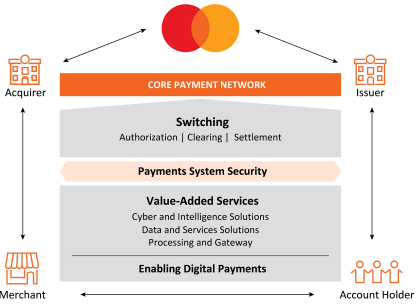

The core product of Mastercard is its payment network, which facilitates the typical four-party transaction which occurs when an account holder (a person or entity who holds a card or other payment device) transfers funds from an issuer (the account holder’s financial institution) to the merchant’s acquirer (the merchant’s financial institution).

Mastercard 2022 Financial Report (10-K)

For its facilitation services, which include authorization, clearing, settlement, and security, Mastercard collects charging fees from its customers based on Gross Dollar Volume (GDV), of which cross-border volume carries extra fees.

It’s important to understand that all parties to a transaction are Mastercard’s customers. The party that ends up paying the fees in the transaction varies, as it depends on the specific terms between the four parties.

Value-added Services Revenues

Up until 2022, Mastercard divided its revenue sources into four different categories, similar to Visa. Last year, the company has decided to restructure its revenue reporting, and thus the Value-added Services category was born.

Under this category, the company generates revenue primarily through six sub-categories: cyber and intelligence, data and services, processing and gateway, open banking, digital identity, and automated clearing house (ACH) real-time batch.

Most of these solutions are directly linked and intertwined with Mastercard’s payment network. However, the real difference is that most of the revenues under this category aren’t based on GDV.

Investment Thesis – Cash Is No Longer King

Mastercard and Visa are not only riding the trend of electronic payments, they are making it happen. Throughout the years, the two payment giants continued to innovate in many ways, making non-cash transactions more accessible, easy, and simple than anybody could’ve imagined. Both companies’ results clearly reflect that trend. Since its IPO in 2000, Mastercard’s revenues grew by more than 15X, as cash became less and less popular. Similarly, Visa’s revenues grew by more than 10X since its IPO in 2005.

Even though the decline in cash use is a thing for many years now, there’s still plenty of room to grow for electronic payment enablers. According to most forecasts, the decline of cash use is projected to continue with ~6% CAGR through 2026. Even today, cash is used in 16% of global point-of-sale payment methods. While it might not sound like much, we’re talking about over $7.6 trillion in global consumer spending.

Additionally, we’re seeing both Mastercard and Visa expanding their offerings. Today, the two payment giants are much more than just transaction facilitators. In 2022, 35.4% of Mastercard’s revenues were attributable to value-added services. With Visa those revenues are spread out across segments, so we don’t have a comparable number.

Overall, I view Mastercard’s and Visa’s business as one of the best in the world. The companies aren’t sensitive to inflation or changes in consumer preferences. Nor do they have any real competitors. Every time market participants think they found a real disruptor, it usually ends up being another customer which is dependent on the old payment duopoly. Just think about it – Apple’s (AAPL) Apple Pay, Alphabet’s (GOOG) Google Pay, PayPal (PYPL), and Buy-Now-Pay-Later companies like Affirm (AFRM), all of them were considered challengers, and all of them are just accelerating the demand for the services of Mastercard and Visa.

Is The Premium Over Visa Justified?

Investors who are interested in one or both of the payment giants have encountered a flux of “Mastercard vs. Visa” analyses. Well, I guess I’m going to have to add another one to the list, but I’ll give my best shot to provide a different angle.

First and foremost two things need to be cleared out – One, the truth is both companies are almost identical and provide very similar offerings, and two, I strongly believe that at current prices, both companies will outperform the market in the long term. However, as an individual investor, I try to keep my stock portfolio as concentrated as I can, which means I’m not going to buy both Mastercard and Visa, just like I wouldn’t buy both PepsiCo (PEP) and Coca-Cola (KO).

So, as we acknowledged there are no material differences between the companies qualitatively, let’s try to differentiate between the two based on their financial fundamentals.

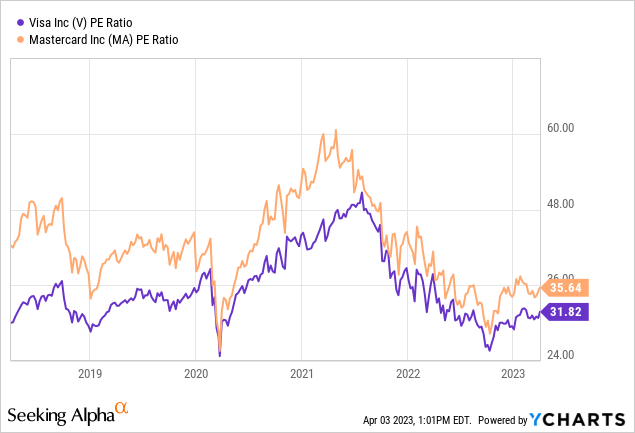

During the past 5 years, never has Visa traded at a premium compared to Mastercard in terms of their PE ratio. In fact, Visa’s 5-year average P/E is 16.3% lower than Mastercard’s. As we can see, at the time of writing the gap between the companies is slightly below the average, at approximately 10.8%. Another thing we can see is that during market downturns, the gap is contracting, whereas when the market is bullish, the gap widens.

In my view, the main reason the market values Mastercard at a premium compared to Visa is simply its size. Generally speaking, if all else is equal, a smaller company has a higher potential to outgrow a larger peer. Looking at 2022, Visa is 1.3X larger than Mastercard in terms of sales. Thus, it’s understandable the market assumes Mastercard will outgrow Visa, meaning that there isn’t a real gap if we’re going to base our multiple on future earnings.

Revenue Growth – No Clear Winner

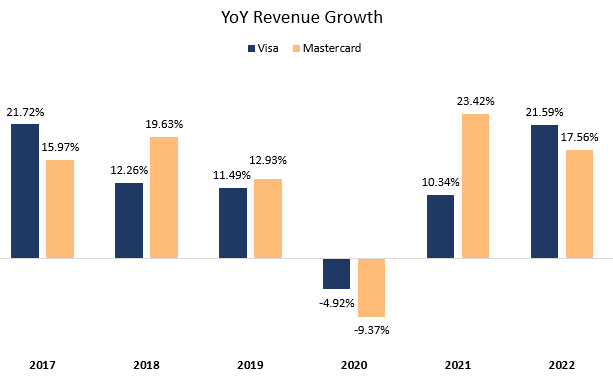

Created and calculated by the author using data from the companies’ 10-K

As we can see, in 3 out of 6 years, Visa outgrew Mastercard. Looking at the entire period between 2016-2022, Mastercard grew revenues at a 12.8% CAGR while Visa’s revenues grew at an 11.7% CAGR. While Mastercard did grow faster, it wasn’t by a wide margin. One important thing to note is that Visa’s and Mastercard’s fiscal years aren’t perfectly aligned, as Visa’s Q1 is Mastercard’s Q4. This could sway some of the annual numbers, but it has no real effect on the long-term CAGRs.

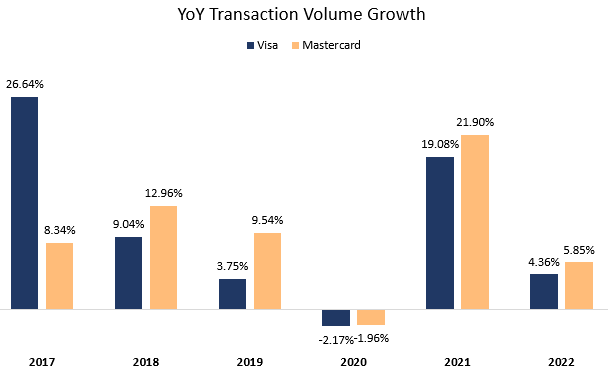

Volume Growth – No Clear Winner

Created and calculated by the author based on data from the companies’ operational reports

The volume growth is somewhat confusing. The huge outperformance of Visa in 2017 affects the entire comparison. While Mastercard outgrew Visa in 5 of the 6 years, Visa’s CAGR for the entire period is slightly higher at 9.7% compared to Mastercard’s 9.2%.

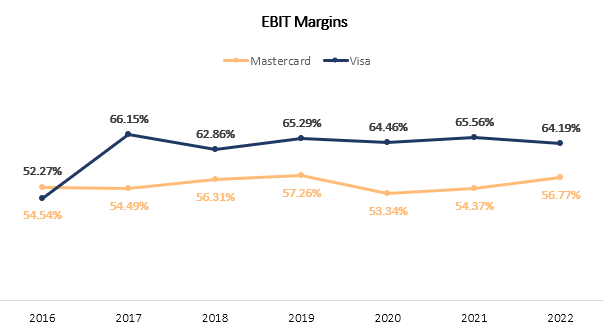

Margins

Let’s look at another metric – profitability.

Created and calculated by the author using data from the companies’ financial reports

Visa is the clear winner here, with significantly better EBIT margins. Some market participants claim this is the result of cheaper labor, but the truth is Visa is just more efficient, as it generates over $1.1M revenue per employee, compared to Mastercard’s $0.7M. It could be argued the lower margin is actually one of the reasons for Mastercard’s premium, as investors might believe Mastercard could eventually get to Visa’s margin. I don’t see any sign that leads me to believe this is possible in the foreseeable future.

I Find The Premium Unjustified

Overall, looking at both the transaction volume and revenue growth numbers, I can’t say I’m convinced Mastercard is growing faster than Visa. Additionally, for the last comparable quarter (Visa’s Q1-23, Mastercard’s Q4-22), Mastercard lagged Visa in terms of revenue growth, but it beat Visa in the volume category. As I find the companies tied-in in terms of growth potential, and Visa is expected to generate more profits from its incremental revenue, I just don’t see a reason for Mastercard’s premium. However, I still believe Mastercard is an amazing company, that is currently undervalued.

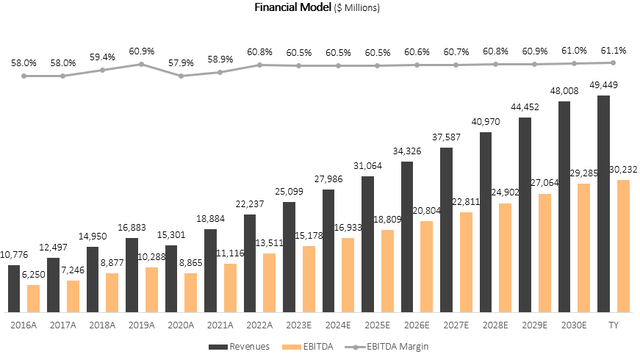

Valuation

I used a discounted cash flow methodology to evaluate Mastercard’s fair value. I assume the company will grow revenues at a CAGR of 10.1% between 2022-2030, which is according to the company’s long-term growth targets. I believe revenues will grow at that pace due to sequential declines in cash usage which will result in high GDV growth. Additionally, I expect the continued introduction of new value-added services and the growth of existing ones. I find this growth rate to be reasonable, as there’s still a huge untapped market, which amounts to $7.6T worth of volumes.

I project Mastercard’s EBITDA margins to increase incrementally up to 61.1%, which is slightly above the company’s all-time highs which occurred pre-pandemic. This projection results in EBITDA growth slightly above revenue growth, which is based on my assumption Mastercard will benefit from operational leverage.

Created and calculated by the author using data from Mastercard’s 10-k reports and the author’s projections

Taking a WACC of 7.5%, I estimate Mastercard’s fair value at $405.5B or $425.5 per share, which represents a 16.5% upside compared to its market value at the time of writing. While this does represent an arguably high P/E multiple on 2023 earnings (36.8), it’s below the company’s 5-year average forward P/E of 37.7.

Risks

When it comes to Mastercard, the only risk I can think of is regulatory intervention in its business. Both Mastercard and Visa occasionally find themselves the subject of regulatory pressure, being that these two companies are essentially a duopoly that processes most of the world’s transactions.

As investors in those companies, you should expect the occasional legal settlement or the occasional governmental program to increase payment processing competition. However, at least historically, none of those risks have materialized into anything more than a bump in the road for outperformance. Actually, I find times when regulatory pressures make the headlines to be the best times to buy Mastercard or Visa, as they are usually accompanied by a very short-lived dip.

Conclusion

Mastercard operates one of the best businesses in the world in a duopoly with Visa. There is no sign of slowing down for the company, and its growth prospects are still immense, with a whole lot of cash transactions still occurring, even after many years of cash-use declines. As the company currently trades 17% below its historical average P/E, I rate it as a Buy and estimate its fair value at $425.5 per share. The only reason I don’t rate it a Strong Buy is that I find Visa more attractive at current prices, and I plan to write an article about it in the near future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.