Summary:

- Amazon Web Services (AWS) is the market-leading provider of cloud infrastructure to B2B customers and operates a different business model to Amazon’s core e-commerce business.

- AWS generates 14.35% of total revenue but over 188% of Amazon’s total operating income, effectively offsetting the losses.

- My Sum of Parts Valuation model indicates that if Amazon split into 6 segments, it would have an upside of ~67%.

HJBC

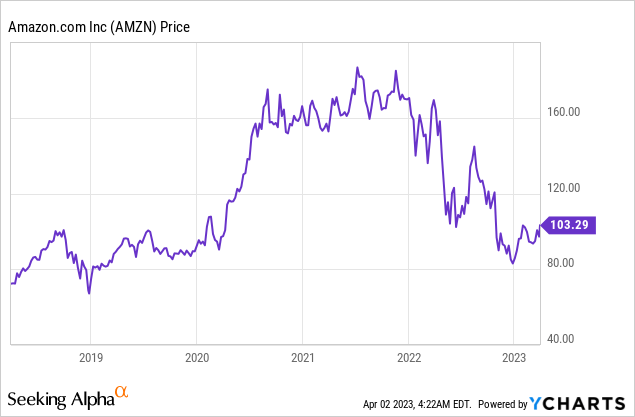

Amazon (NASDAQ:AMZN) has grown into a $1 trillion giant with multiple business segments. But recently, the slowing growth rate and shuttering of “unprofitable” business units have highlighted the lack of focus that the company currently has. Now of course, Amazon’s core philosophy is about making a series of “bets” and experiments, some will fail (Amazon FirePhone) and some will succeed tremendously such as AWS Cloud. However, now I believe Amazon is at a stage where a spin-off of its fastest-growing and most profitable business unit, AWS, would make sense. This is an idea I spoke about over 1 year ago, but the recently announced split of the “Amazon of China”, Alibaba (BABA) has resurfaced this in my mind as a strategy to unlock shareholder value. Getting larger as an organization only makes sense, up to a point and I believe Amazon is now at that point (trillion-dollar market cap). My post-split valuation model indicates ~67% upside potential. Thus, in this post I’m going to break down the reasons why a spinoff or company split would make sense, before diving into my sum of parts valuation of AMZN stock. Let’s dive in.

Why Amazon Should Spin Off AWS?

AWS is Amazon’s Growth Engine

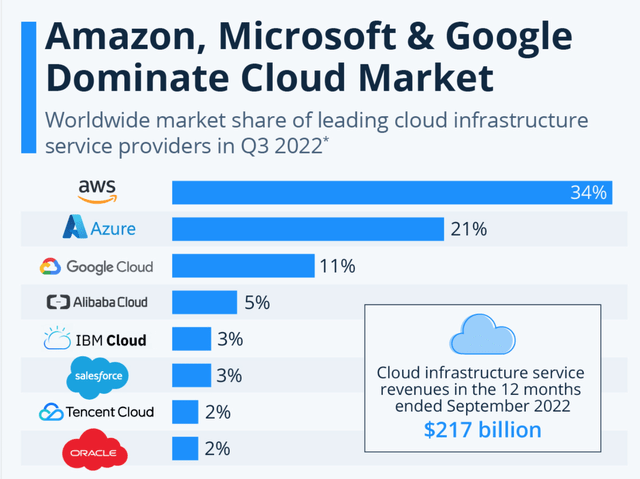

Amazon Web Services [AWS] was founded in 2006 and was a true pioneer in Cloud infrastructure, which is effectively computing as a service. Vast data centers were developed, across multiple “regions” and the value proposition was strong. Organizations should outsource their IT to the “cloud”, in order to improve the flexibility of operations, benefit from potential cost savings, and save time/effort managing its own IT infrastructure. Therefore, it is no surprise that AWS has grown to become the largest cloud infrastructure provider in the world, with ~34% market share, beating Microsoft Azure which had ~21% market share and Google at ~11% market share as of Q4 ’22.

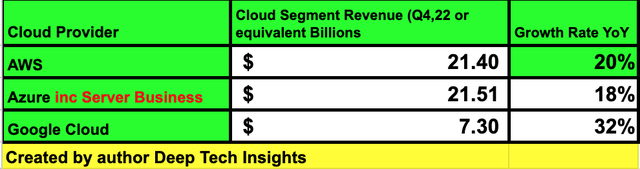

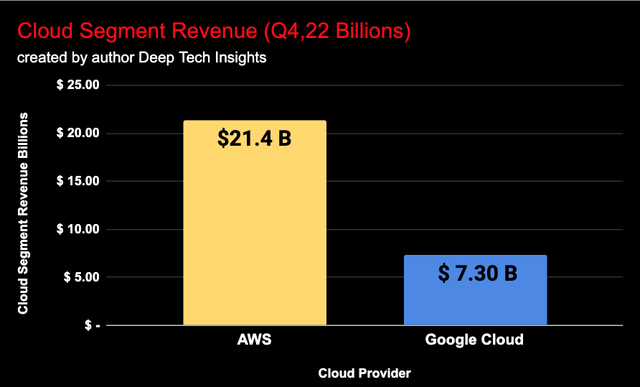

Breaking down the numbers in more detail, you can see AWS reported a staggering $21.4 billion in revenue for Q4 ’22, which has grown at a rapid 20% growth rate. Whereas Amazon’s entire business revenue increased by just 8.58% in Q4 ’22 and slowed to a snail’s pace of 2.35% in the trailing 12 months. Thus, it is clear AWS is the “growth engine” of Amazon.

Big Three Cloud Providers (Created by author Deep Tech Insights (Ben Alaimo))

The below graph I have created also shows AWS is ~3 times larger than Google Cloud by revenue and thus it is a substantial business in its own right and extremely dominant. The cloud industry was valued at $480 billion in 2022 and is forecast to grow at a rapid 19.9% compounded annual growth rate [CAGR], reaching a value of $1.7 trillion by 2029. AWS is poised to benefit from this trend.

Cloud Segment Revenue (Created by author Deep Tech Insights)

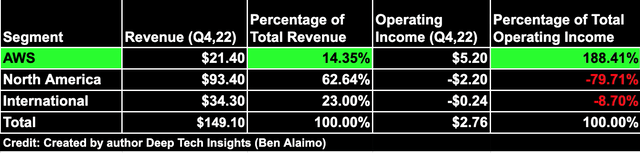

Of course the game of business is about “profits”, which has had an ironic resurgence in popularity over the past year. From my calculations below, AWS generated $5.2 billion or 188.4% of Amazon’s entire operating income in Q4 ’22. Keep in mind, this is despite AWS only contributing to 14.35% of revenue.

Amazon Revenue and Income by Segment (Q4 ’22)

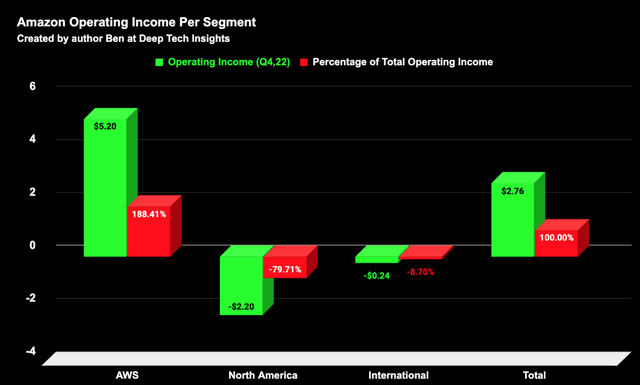

Amazon’s “North America” segment is the largest revenue driver of the company with $93.4 billion generated in Q4 ’22 which is 62.6% of the total. However, e-commerce is a lower margin business than the cloud, mainly due to high fulfillment costs, and thus the segment reported a loss of $2.2 billion, or negative 79.71% of total operating income, as you can see on the chart I have created below.

Amazon Operating Income Per Segment (created by author Ben at Deep Tech Insights)

In the trailing 12 months, Its North America segment TTM operating margin has fluctuated between 2.6% (at the high end in Q4 ’21) and negative 0.9% (by Q4 ’22). Whereas the margin of AWS has fluctuated between 28.5% in Q4 ’22 and an impressive 31% in Q1 ’22.

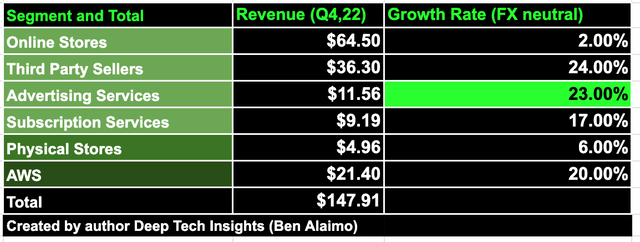

AWS is Not Related to its Core Ecommerce Business

On the below chart, I have broken down Amazon’s key business segments by revenue and growth rate. In addition, I have added color coding to show which business segments are “related” (in light green) or not related in dark green, in my opinion. Starting at the top is “Online Stores” which is Amazon’s core e-commerce business, that generated $64.5 billion in revenue or 43.8% of the total in Q4 ’22. Next we have the Third Party Seller segment which is deeply related to the core business and generated $36.3 billion in revenue for Q4 ’22. I will also add this segment grew its revenue at a rapid 24% growth rate YoY, which is a positive sign that isn’t picking up on the top line, due to unfavorable foreign exchange rates from its international segment.

Amazon Revenue by Segment (Created by author Ben at Deep Tech Insights)

Next we have Advertising Services revenue, which is also fairly related and one of my favorite parts of Amazon from a growth rate and margin perspective. Its Advertising Services business generated a staggering $11.56 billion in revenue or 7.85% of the total and grew by a rapid 23% year over year. The next segment is its Subscription services which includes its Prime membership (which is deeply related) to its core business, in addition to its Prime Video and Prime Music, which aren’t as related but can be considered value-added service to its retail customer base. In this case, its Subscription services grew its revenue by 17% year over year to $9.19 billion. Then we have Amazon’s Physical stores, such as its “Fresh” stores. This is not as related to its core e-commerce business, but still in the same industry (retail). I am not a fan of this business due to lower margins, but it did generate $4.96 billion in revenue, up 6% year over year.

Finally, we have the elephant in the room, AWS, which as I discussed prior is an IT infrastructure business, which is completely different to Amazon’s core e-commerce business. The customer/model of AWS is mostly B2B and not B2C, like Amazon’s core retail business. In addition, large organizations demand strict SLAs (Service Level Agreements) and brand trust is vital. Therefore, it could actually be a negative for AWS to be tied to Amazon’s e-commerce. Here is a simple example, imagine a decision maker at a Fortune 500 enterprise, is having a nightmare dealing with Amazon’s customer service (which isn’t the best). This experience could psychologically make him feel less trust in AWS, which is not tasked with delivering a parcel, but securing and maintaining his organization’s entire IT infrastructure, a vital role. The number of protests at Amazon’s warehouses, which state “poor working conditions”, could also rub off on those thinking about a career at AWS, which is a completely different ball game (mostly hires IT architects and business development reps).

In addition, I have personally done contracts for AWS in the past (as I’m AWS certified) and it is clear that it is seen as a “separate business” already inside Amazon by most employees. Now I do admit Amazon’s core e-commerce business uses AWS infrastructure to flexibly scale demand, during events such as Prime Day. However, if Amazon spun off AWS, they could have a non-profit agreement in place between the two entities, win/win.

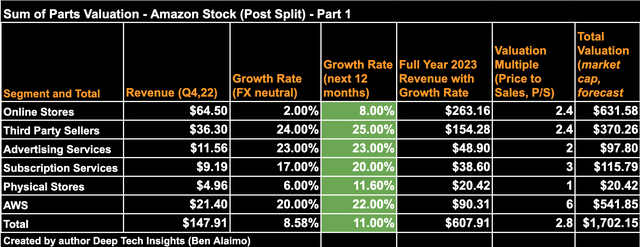

Sum of Parts Valuation

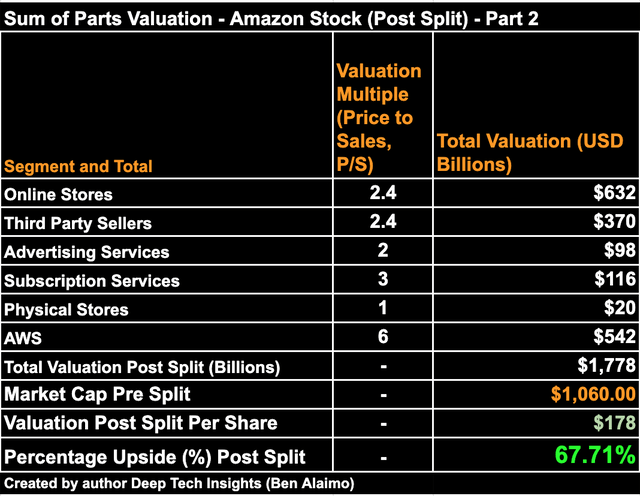

In order to value Amazon, I have created a Sum of Parts valuation for the stock, this is assuming Amazon was split into 6 distinct business segments. In this case, I have forecast growth rates for each individual segment, based on historic growth rates and analyst forecasts. Starting at the top (and looking at the middle column in green) I have forecast an 8% increase in its Online store revenue over the next 12 months, as the e-commerce industry rebounds and foreign exchange rates correct, as per the current trend. For its Third Party Seller revenue, I have forecast a rapid 25% growth rate, which is just 1% higher than the Q4 ’22 rate. I have forecast Advertising services to maintain its 23% growth rate, and Subscription services to grow at a slightly faster growth rate of 20%.

Amazon Sum of Parts Stock valuation 1 (created by author Deep Tech Insights (Ben Alaimo))

For the Physical Store segment, I have forecast an 11.6% growth rate and AWS a 22% growth rate, 2% higher than Q4 ’22, due to the aforementioned trends in the cloud industry. For each segment, I have added a valuation multiple (Price to Sales ratio), based on industry averages, with a slight enhancement, as Amazon is a “better than average” company in my mind as the market leader in e-commerce and the cloud, and thus deserves a slightly higher multiple. You will notice that Amazon’s core e-commerce business (Online stores, third-party sellers) trade at similar multiples, whereas I have forecast the cloud segment to trade at a higher price-to-sales ratio = 6. This may seem optimistic but it is only slightly higher than the 4.91 average for the internet services and infrastructure industry, as per Seeking Alpha screen data.

Amazon Sum of Parts Valuation 2 (created by author Deep Tech Insights (Ben Alaimo))

Bringing everything together, I get a post-split company valuation of $1.778 trillion for Amazon or $178 per share. Given the market capitalization at the time of writing is $1.06 trillion and its share price is ~$103/share, this gives a potential upside of ~67%, according to my valuation and forecasts.

Now to clarify, I believe Amazon could gain a substantial portion of this “value unlock” through the spinning off of AWS, as opposed to splitting the whole company into 6 segments. This valuation is also not including the potential capital raise which could be done by each segment or AWS alone, or Amazon’s “Other” segment. It should also be noted even if Amazon doesn’t spin off AWS, the stock is still undervalued relative to my DCF valuation covered in prior posts. Either way, I believe if AWS was separate, it would attract more tailored investors, who want to invest in the future of cloud computing, but are not as bullish on e-commerce (such as myself).

Final Thoughts

Amazon has dominated the e-commerce landscape for decades but has faced a number of challenges over the past couple of years. I believe the birth of AWS, has saved Amazon, but now this “child” segment has grown into its own adult mammoth (and highly) profitable business and thus now needs to move out on its own. I believe this would unlock greater shareholder value across all segments. From improved brand credibility to faster decision-making and more accountability. AWS is seen as the “cash cow” of Amazon and funds many of its failed experiments. However, if it separated, each of Amazon’s other segments would be forced to focus. Given my sum of parts valuation indicates an upside of ~68% on a full split, I believe a spin-off for AWS would provide value to all shareholders. This is not meant to be an “open letter” to Jeff Bezos or Andy Jazzy, but if they are reading this post, I hope the logic is apparent.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.