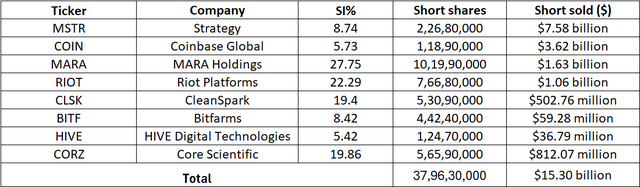

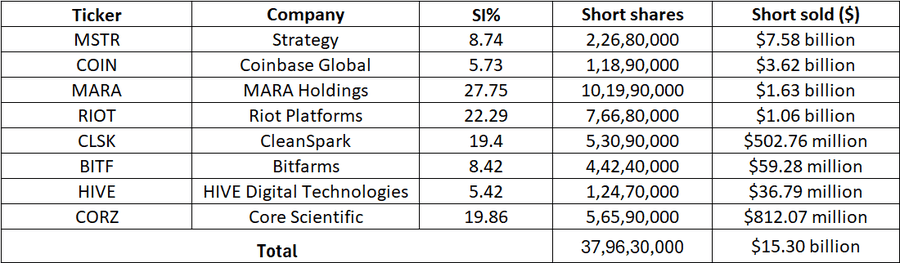

Short interest in crypto-linked stocks was mixed in the month of August. While five companies saw a fall in short interest in the month, three companies saw slight upticks.

Strategy (NASDAQ:MSTR), MARA Holdings (NASDAQ:MARA), CleanSpark (NASDAQ:CLSK), Bitfarms (NASDAQ:BITF) and Core Scientific (NASDAQ:CORZ) were among the companies that saw short interest decline in the month to 8.74%, 27.75%, 19.4%, 8.42% and 19.86% respectively.

Meanwhile, Coinbase Global (NASDAQ:COIN) saw short interest increase to 5.73% from 4.95%. Riot Platforms (NASDAQ:RIOT) and HIVE Digital Technologies (NASDAQ:HIVE) saw the same rise to 22.29% and 5.42%.

The short dollar volume in the crypto stocks fell to $15.30 billion compared to $17.11 billion the previous month, according to short interest data as of August 31. Of these, Strategy attracted the most interest from short sellers, despite falling from July, accounting for $7.58B of the total bets.

Throughout August, Bitcoin (BTC-USD) closed above the $100k mark. It has been following the same trend in September so far.

Over the past decade, September has been a tough month for Bitcoin, according to eToro’s U.S. investment analyst, Bret Kenwell. It is one of the three months that have recorded average declines over the period, along with January and August, he noted.

MarketBeat