Summary:

- I have been following Tilray closely since it went public, and I closely followed Aphria, which it acquired, even earlier.

- The stock is way down from its IPO price and its peak price, but it’s not attractive in my view.

- I think the stock is trading at about 2X the right price.

- The Q3 financials on 4/10 aren’t likely to change my perspective.

Eugene Gologursky/Getty Images Entertainment

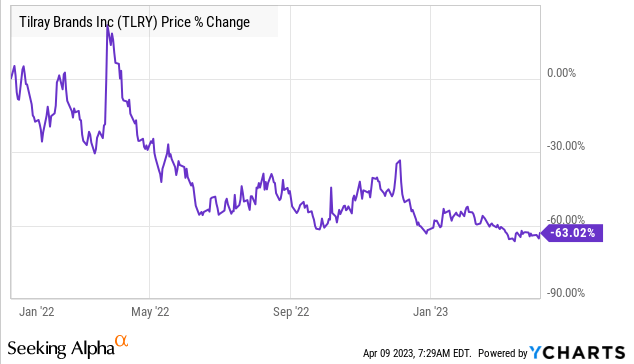

Tilray (NASDAQ:TLRY) is a very different company from the one that went public in 2018 at $17 a share. The company, which is now run by Irwin Simon, merged with Aphria, one of the better Canadian cannabis companies, in May 2021. Despite the collapse in the price to an all-time low, the stock is doing better than most cannabis companies in 2023. The New Cannabis Ventures Global Cannabis Stock Index dropped more than 70% in 2022 and is down 15.9% so far in 2023. Tilray fell 61.7% in 2022 and is down just 3.4% in 2023. It is down 63.0% since the end of 2021, while the GCSI has dropped 75.1%:

yCharts

While Tilray is down a lot, the stock isn’t attractive in my view. In this piece, I discuss the company’s operations and its financials, and I assess the valuation. It reports its Q3 on 4/10 after the close, and I don’t think this will change its recent trajectory.

What does Tilray do?

Tilray is a cannabis company, but cannabis is not even close to being the majority of its business. This diversified company generates the most of its revenue from a low-margin German pharmaceutical distribution business, CC Pharma, that Aphria bought in early 2019 for €18.92 million in cash and potential earnouts that were paid and boosted the total acquisition cost to €42.42 million, which is equivalent now to $46.3 million. In the first half of FY23, this business represented 40.6% of revenue. The $120.8 million was down 11.2% from the first six months of FY22. It had a gross margin of only 11.0%.

In the first half of its fiscal year, net cannabis sales have represented only 36.5% of total revenue at $108.5 million, down 16.1% from a year ago. The gross margin has been 44.5%. Looking at the sales more closely, Canadian medical cannabis sales have been 11.9% of cannabis revenue, down in sales by 21% from a year earlier. Adult-use sales at $76.8 million net of excise taxes, have represented 70.8% of cannabis revenue and have declined by 9.6% from the prior period. Wholesale cannabis sales at just $628K have dropped 84.1%. International, at $18.1 million, is down 24.4% and represents 16.7% of overall cannabis net revenue.

Other parts of TLRY include beverage alcohol and wellness, which is hemp food (Manitoba Harvest). The company has been aggressively adding to its alcohol business, which represented 14% of total revenue in the first half of the fiscal year at $42 million, up 44.2% from the prior year’s first half. The gross margin there has been 47.0%. The hemp business has represented just 8.8% of revenue at $26.1 million, down 9.3% from the prior year. Its gross margin has been 28.4%.

This is what Tilray does. What they don’t do is important to note: The company is very poorly positioned in the U.S. cannabis market. CEO Simon had talked up entry into the U.S. and had discussed the future revenue of the company as being much higher because of the move. Nope. Nothing at all.

Do they make money?

Tilray’s 10-Q from its Q2 illustrates its financials well, and they aren’t good. Total revenue in Q2 of $144.1 million fell 7.1% from a year ago. This was worse than the analysts had projected, which was $159 million. Adjusted EBITDA at $11.7 million trailed the $17 million analyst projection too. The gross margin did improve to 27.8% from 21.1% a year ago, but operating expenses grew over 4%. The operating loss was $51.8 million, which was an expansion from its Q1 while down marginally from a year ago. The company generated cash during the quarter, but its operations consumed $17.1 million in the first half of the fiscal year.

Tilray’s operations aren’t creating any financial returns for the shareholders, and its balance sheet is not in good shape. It has cash and marketable securities of $433.5 million, a large amount, but it is outweighed by total debt of $577.7 million as of 11/30/22. A lot of that debt is convertible debt that is very much out-of-the-money.

Where TLRY is Headed

Tilray trades at 2.6X tangible book value, which is very high relative to cannabis peers. The Canadian LPs that I like have little or no debt and high cash, and they trade below tangible book value. Given that it has net debt of $144.2 million and is burning cash in its operations, this premium to tangible book value is way too high in my view.

For valuation purposes, I see the company as likely to trade at less than 3X enterprise value to projected revenue. For FY24 ending May 31, analysts currently project that the company will generate revenue of $673 million, up 10.6% from FY23. Using 3X, this works out to a price of $2.95, up just 13.6%. This works out to 21.5X projected adjusted EBITDA of $94 million, which I think is a high ratio off a forecast that is likely too high. Using 2025 estimates of $750 million revenue and $121 million adjusted EBITDA, the price would be $3.32 a year out, up just 27.7%, substantially less than I forecast other stocks will rise. Again, my target is probably overly aggressive, as I detail below. It works out to 18.6X projected adjusted EBITDA for FY25.

I think that the right way to look at the company is to analyze it by operating segment. First, the pharmaceutical distribution is probably not worth much more than the cost, which works out to be about $46 million. The hemp business at 2X revenue would be valued about $110 million. This is less than the C$419 million maximum that Tilray paid early 2019 (C$277.5 million at closing was cash of C$150 million and the balance in stock). The alcohol business is probably the highest valued sales. Using 4X and using $100 million, would yield $400 million.

The total value before its cannabis business, then, would be about $556 million, leaving $1.24 billion of its current enterprise value to justify. I can’t do that, not even close. The business loses money, and sales are likely to be $213 million or so for the year, 35% of the analyst forecast for FY23 revenue and down 10.3% from FY22. In the current market, 2X revenue would be too high! This works out to $426 million, bringing the total to $982 million, which is way below the current enterprise value of $1.79 billion. Using these numbers, the current price should be 49% lower at $1.32. This would be about 1.3X tangible book value, which is still a premium to peers in the cannabis space, even Canopy Growth (CGC), which trades at 1.0X.

Maybe things will change when the company reports its Q3 on 4/10 after the market closes, but I doubt it. Analysts currently expect the company to see overall revenue decline 1% from a year ago to $151 million. Adjusted EBITDA is expected to rise 72% from a year ago and 45% sequentially to $17 million. I don’t really focus on EPS at Tilray, but they are projected to be -$0.06. The company isn’t expected by analysts to have a positive annual EPS until 2026.

Conclusion

If Tilray were doing well in the cannabis market, I might have a different view, but I don’t care for the stock at all based on its valuation. I have also written negatively about Canopy Growth, but I do like a few Canadian LPs a lot: Cronos Group (CRON), Organigram (OGI) and Village Farms (VFF), which I wrote about after it collapsed in price following its equity raise. It has dropped even more and still looks very attractive to me. I also think that there are better opportunities than Tilray in other parts of the cannabis market. For alcohol investors, I would note that Boston Beer Company (SAM) trades a lot cheaper than this stock at just 17.4X EV/EBITDA and 1.8X projected revenue for 2023.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.