Summary:

- Micron’s FQ2 report was horrendous, and FQ3 is actually worse on an EPS guide basis.

- But the worst arriving is a boon to bulls as there’s no bear thesis left.

- With Samsung admitting to cutting production (I knew it would months ago), the supply-demand imbalance will further reduce inventory at OEMs and customers.

- Selling Micron here is the worst move you could make – there’s nowhere left to go but up because AI is buoying the end market.

blackred/iStock via Getty Images

I hadn’t been more relaxed going into a Micron (NASDAQ:MU) earnings report than I was for its FQ2 earnings two weeks ago. Why? Because it’s easier to sit back and watch the worst play out instead of anticipating when the worst is coming. It didn’t matter how bad the numbers were as long as they were the worst they could be; it meant the bottom had arrived. The good news is Micron provided all of the best worst news possible. Therefore, if you think the stock will revisit new lows – like everyone else – you might want to reconsider how history will repeat for Micron.

It Really Doesn’t Get Any Worse

It’s not an understatement to say the report was riddled with massive financial bombs. The only thing near sanity was revenue, and even then, it missed the midpoint of guidance provided three months earlier, coming in at $110M below at $3.69B. The rest was as bad as could be. Gross margins were reported as negative 31.4% after it was expected to be positive 8.5% at the midpoint, and EPS came in at -$1.91 after being guided for -$0.62 at the midpoint (with -$0.72 at the low end). And this was primarily due to a $1.4B write-down on inventory, not due to obsolescence but “projected selling prices falling below the cost of inventory…”

Oh, and two other key points. One, the company went from net cash positive to a net debt position for the first time in several years after being net debt positive for a very long time. And two, production cuts for DRAM and NAND are at 25%, up from 20% last quarter, and are likely at the highest they have ever been in company history.

Negative margins, write-downs, 75% utilization – this is about as bad as it gets.

But guidance for FQ3 was pretty bad too, and, in some regards, worse if you peel back the layers. It only appeared better because of the comparison to the FQ2 write-down-included results.

For the current quarter, gross margins are expected to be negative 21%, with EPS at -$1.58. At first glance, it seems to be a “nice” improvement. However, revenue is expected to come in flat sequentially at $3.7B. Since DRAM and NAND pricing is expected to remain pressured, it means the initial improvement is only internal. And much of that internal improvement in FQ3 comes with “only” $500M in write-downs as opposed to the $1.4B it just completed.

So if I do some normalization, the $1.4B write-down accounted for a $1.21 loss in EPS, which would have resulted in a -$0.62 EPS (right in line with FQ2’s guidance). If I do the same math for FQ3 with the -$1.58 EPS guide, 1.091B shares, and subtract the $500M write-down, it results in a “true” EPS of -$1.12. So EPS will actually be worse in FQ3, and on a normalized basis, it technically means it’ll be the low quarter (so far), not FQ2.

This is great!

Some of you might think I’m off my rocker. But you must understand the market is not logical; it rallies off the worst news because there’s no one left to pile on. The same goes for when the best news hits the wire; by then, there’s no one left to pile on to the rally.

Therefore, Micron’s bottom is in plain view.

What Happens After The Worst

Now, for those bears entrenched in the view Micron’s terrible quarters mean it’s now time to sell, let’s look at what’s likely to happen going forward.

Recession is at the top of bears’ minds, along with Samsung (OTCPK:SSNLF) (OTCPK:SSNNF) somehow overproducing to take market share. I’ll cover the first in this article; you can read the latter here in full detail. Plus, Samsung admitted to meaningfully cutting production last week during its preannounced earnings, but keep telling yourself Samsung can and will overproduce.

Getting back to today’s topic, recession is a two-sided coin.

The first side is inventory at OEMs and clients. The second is layoffs being switched out for AI.

Pricing can’t drop forever. It reaches a place of moderation, as demand doesn’t work in a vacuum. Supply and demand, if the bears are right about “commodity Micron,” has its limits, too – it’s not a one-way street. Therefore, if the supply of the DRAM market falls below the demand of the DRAM market, eventually, clients need to buy. When clients need to buy, the price, at the very least, stops falling. And once buying picks up steam, pricing rises.

Micron said if everyone cuts – which, surprise (not to me), Samsung has joined in on the cuts – then DRAM and NAND bit supply will be below demand bit growth. If all producers reduce utilization enough, bit supply will be negative for the year versus last year, accelerating the situation.

Public reports indicate that… utilization rates have declined at all DRAM and NAND suppliers. We now expect that the industry bit supply growth for DRAM and NAND in calendar 2023 will be below demand growth…

…Market recovery can accelerate if there is a year-to-year reduction in production or, in other words, negative DRAM and NAND industry bit supply growth in 2023.

– Sanjay Mehrotra, CEO, FQ2 ’23 Earnings Call

Micron is leading by example with its “year-on-year bit supply growth to be meaningfully negative for DRAM.”

This leads to drawdowns of inventories at customers as more is going out of inventory than going into it. This reduction in inventories is expected to continue throughout 2023. As such, as inventories reach “normal” levels, buying will accelerate.

“But what if the market conditions worsen and demand slows down further, Joe?”

Yes, thanks for the segue into the other side of the recession coin.

Recession, to many people, means an industry-agnostic destruction of jobs, spending, and the whole nine (yards). But that is a very naive way of looking at it.

The slowdown in the economy due to inflation and reduced spending has led to hundreds of thousands of tech jobs being lost – that much is undeniably true.

However, what have we seen at the same time? An influx of AI and a push to add it as quickly as possible. Why?

AI replaces the jobs of many of these laid-off workers while advancing the business in a more efficient, more productive manner. So not only is AI a replacement, it’s the new paradigm for former manual technology work.

So instead of investing in headcount, which so many tech companies have done over the last two-and-a-half years, they have moved to massively building out AI data centers. This has been true for Meta Platforms (META), Alphabet (GOOG) (GOOGL), Microsoft (MSFT), and many other tech companies adapting to the positive feedback loop driven by AI. I’ve gone over this quite a bit since last summer, showing how Nvidia (NVDA) and Micron specifically have huge potential to benefit.

This connects back to inventories being drawn down. Cloud providers, including those I just mentioned, continue to expand their AI capabilities, drawing down server component inventories in the process. This is why Micron has seen data center revenue bottom in FQ2.

In data center, we believe that our revenue bottomed in fiscal Q2, and we expect to see revenue growth in fiscal Q3. Data center customer inventories should reach relatively healthy levels by the end of calendar 2023.

– Sanjay Mehrotra, CEO, FQ2 ’23 Earnings Call

We’re talking less than nine months for inventory levels to return to normal while revenue for data center has already bottomed. If the push toward AI continues to accelerate, inventory levels could moderate sooner. But, again, because AI is at the top of all cloud provider’s priority lists, this isn’t just an assumption on the part of Micron’s management, which admittedly hasn’t forecasted this bottom well. We see in real-time the build-out of AI to support internal products like Meta and externally for customers of Microsoft and ChatGPT.

Nvidia proves all of it with the demand for its H100 and AIaaS.

To put a bow on this, pricing for DRAM and NAND will firm as long as the cycle of inventory drawdown and build-up happens. Once pricing firms, the supply and demand balance shifts toward producers. And once inventory is down to normal levels, it only takes a small increase in end demand to push that inventory to drought levels. It’s then when customers realize they can’t get the amount of chips they need and begin ordering; pricing increases massively, and Micron benefits. Moreover, the risk of demand not increasing is buoyed by AI remaining resilient; a tailwind to a recession, so demand isn’t going to decrease further.

Selling Now Is What Terrible Investment Decisions Are Made Of

When the worst financials arrive for Micron, the stock is already beyond the most bearish sentiment; it’s much more palpable – and driving the stock – leading up to the bottom, not the bottom itself. With the worst financials for the company in over a decade in the reporting quarter and current quarter, combined with supply underrunning demand, creating an inventory drawdown, there’s meaningfully more upside risk than downside risk.

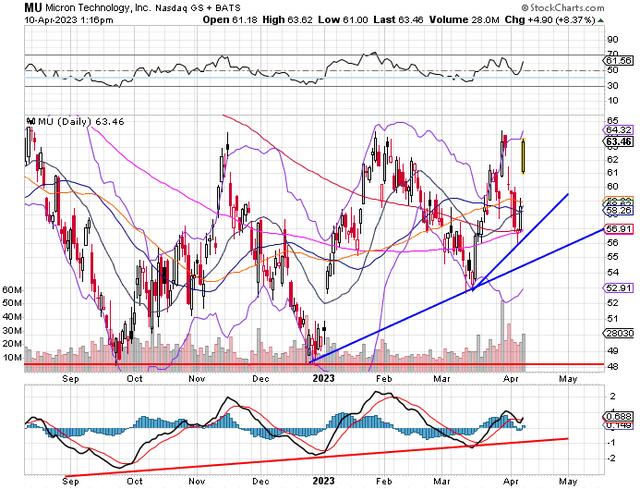

This can be seen on the chart with a higher low in place and a potential second higher low forming now. There’s much more building on the chart, but this is a peek at a piece of what I’ve analyzed for Tech Cache members.

The technical picture doesn’t support breaking through September and October’s lows, though, as is anything, not impossible. However, there’s a reason the worst news is met with bullish formations on the chart.

Forget Samsung overproducing, forget selling Micron at the bottom, and forget all of these terrible investing habits. You’re in the middle of the moment where you buy when it doesn’t seem like you should buy because it “feels” really bad out there. Buying when the reports are bleak is never easy, especially for Micron. But I plan on adding to my MU options position in the coming week.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU, META, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Decrypt The Cash In Tech With Tech Cache

Do two things to further your tech portfolio. First, click the ‘Follow’ button below next to my name. Second, become one of my subscribers risk-free with a free trial, where you’ll be able to hear my thoughts as events unfold instead of reading my public articles weeks later only containing a subset of information. In fact, I provide four times more content (earnings, best ideas, trades, etc.) each month than what you read for free here. Plus, you’ll get ongoing discussions among intelligent investors and traders in my chat room.