Summary:

- In this note, we will discuss Micron’s Q2 FY2023 report, and discuss the potential of a near to medium-term turnaround at the memory chipmaker.

- Furthermore, we shall look into Micron’s long-term demand drivers and re-evaluate MU’s fair value & expected returns.

- Lastly, we will review Micron’s technical charts and quant factor grades to see if it is a buy, sell, or hold at current levels.

knowlesgallery/iStock Editorial via Getty Images

Introduction

Micron Technology Inc. (NASDAQ:MU) is one of the world’s leading manufacturers of memory and data storage solutions, including dynamic random-access memory [DRAM] and flash memory [NAND]. Now, as the semiconductor industry grapples with a significant downturn for the first time in over a decade, Micron’s business performance has been taking a severe hit in the last couple of quarters due to an oversupply of memory chips in a weakening demand environment.

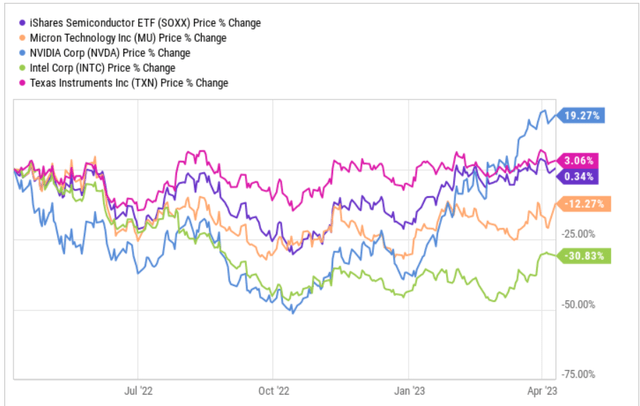

Despite recording poor financial performance in recent quarters, semiconductor stocks have rallied in recent months as investors seemingly look beyond the current cyclical downturn in semis. With memory chip industry leaders like Micron and Samsung cutting supplies and clearing out excess inventories, it is only a matter of time before the demand-supply balance in the memory chip market is restored. Hence, we could be close to a trough for this memory chip cycle, which historically has proven to be a good time to buy Micron shares.

In this note, we will analyze Micron’s Q2FY2023 quarterly numbers. Furthermore, we will review Micron’s valuation, technical chart, and quant factor grades to see if it is a good buy at current levels.

What Were Micron Technology’s Expected Earnings? Did It Beat Estimates?

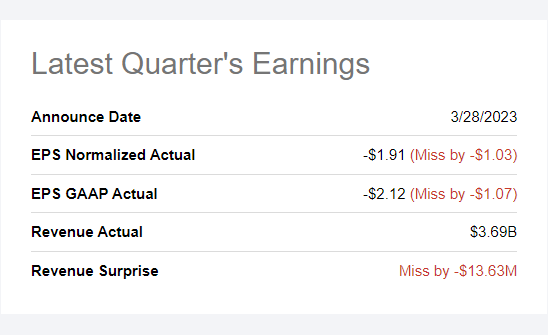

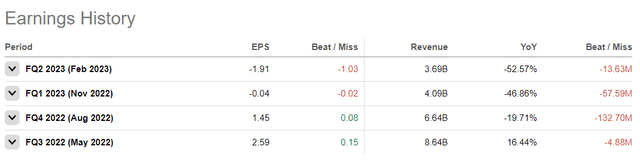

Going into its Q2FY2023 report, Micron was expected to announce quarterly revenues of $3.82 billion and normalized EPS of -$0.88. As shown below, Micron missed on both revenues (actual: $3.69B, miss by -13M) and normalized EPS (actual: -$1.91, miss by -$1.03).

Despite reporting widening losses, Micron’s stock has held up quite well after the latest earnings release, and in my view, Mr. Market’s neutral to positive reaction is a reflection of growing investor optimism on Q2FY2023 results marking the trough in the memory chip industry for this cycle. Let’s dive deeper into Micron’s report to learn more.

Micron Stock Key Metrics

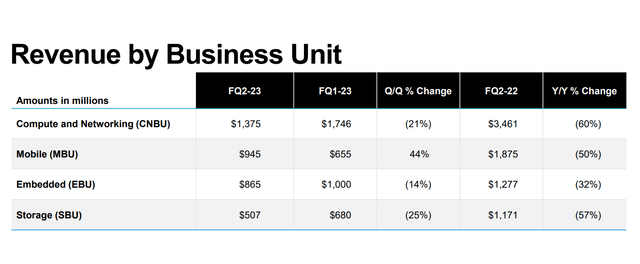

In Q2FY2023, Micron’s revenues shrunk at an alarming rate of -47.4% y/y on the back of a ~40%+ decline in average selling prices [ASPs] of both DRAM and NAND products. With Micron taking aggressive measures to clear excess inventory, gross margins turned negative during Q2.

Micron Investor Relations Micron Investor Relations

As the following data tables depict, the weakness in Micron’s financial performance is spread across the board, i.e., across technology (DRAM, NAND, and Other) and business units (Compute & Networking, Mobile, Embedded, and Storage).

Micron Investor Relations Micron Investor Relations

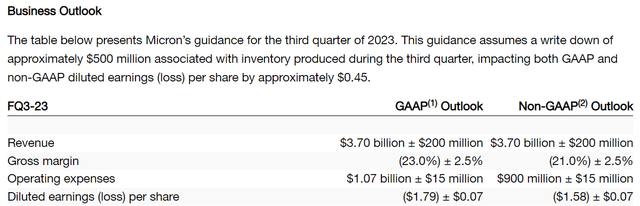

With Micron and its peers cutting supplies to restore the demand-supply balance in memory chip markets, the pricing environment should improve in upcoming quarters. However, Micron’s near-term business performance is likely to stay under pressure. For Q3FY2023, Micron’s management has guided for revenue and gross margin to be in the range of $3.5B to $3.9B and -25.5% to -20.5%, respectively.

As per Micron’s CEO, Sanjay Mehrotra –

Customer inventories are getting better, and we expect gradual improvements to the industry’s supply-demand balance. We remain confident in long-term demand and are investing prudently to preserve our technology and product portfolio competitiveness.

For the rest of this fiscal year, Micron’s financial performance is set to remain under pressure; however, numbers should gradually improve in upcoming quarters as the demand picture gets better and supply falls back into balance.

In addition to higher revenues, Micron’s profitability will also depend on efficient management of costs. In Q2FY2023, Micron’s gross margins were pressurized due to a $1.43B inventory write-down. For Q3FY2023, Micron has guided a further inventory write-down of $500 million. Owing to its strategy of supply cuts, Micron is facing an underutilization impact of $1.1 billion in FY2023, part of which may be carried to the next fiscal year. And this is why, I think Micron’s operating margins are unlikely to rebound to positive territory for the next few quarters.

Under Micron’s ‘2023 restructuring plan’, management is targeting quarterly cost savings of around 60% in COGS, 30% in R&D, and 10% in SG&A from Q4FY2023. Despite undertaking a business restructuring, Micron’s near-term profitability remains challenged, with operating margin and free cash flows projected to be negative for fiscal 2023.

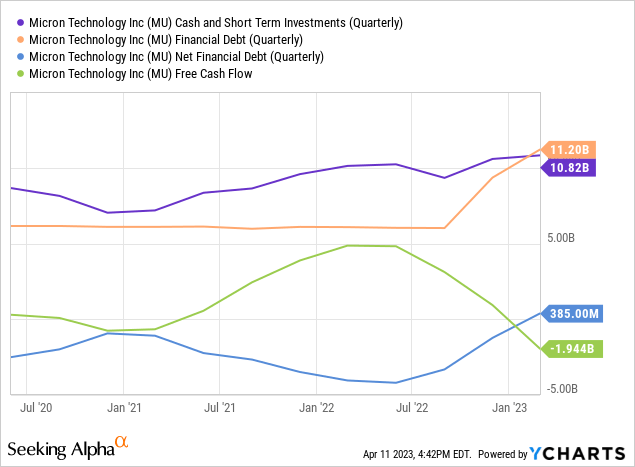

At the end of Q4FY2022, Micron boasted a healthy net cash position of $1.3B on its balance sheet. However, the first half of FY2023 has seen Micron load its balance sheet with more financial debt, and the company now has a positive net financial debt of $385M (as on March 02, 2023). While Micron has ample near-term liquidity on hand, its interest expense is not sufficiently covered by EBITDA, making Micron’s debt profile quite risky.

Now, despite recording negative free cash flows, Micron has announced an improved quarterly dividend of $0.115 per share, which is clearly a sign of management’s confidence in Micron’s long-term business outlook.

Micron’s Long-Term Future Still Looks Bright

While the memory chip industry is experiencing a cyclical downturn right now, the long-term demand drivers are still in place. And here are some of the demand drivers for memory chips:

- Increasing adoption of smart devices, such as smartphones, tablets, computers, TVs, and wearables

- Growth of the cloud computing market, and

- The emergence of new technologies, viz. 5G, IoT, AI/ML, autonomous vehicles, and virtual reality

With the demand for memory chips expected to rise at a healthy clip for years to come, Micron’s addressable market opportunity is set to expand considerably over the long run. And this is why, Micron’s management is confident about their long-term business prospects. Talking about the industry demand trends for FY2024 and FY2025 on the latest earnings conference call, Micron’s CEO, Sanjay Mehrotra, asserted –

Keep in mind that before this period of last 2 to 3 years with all these events that I just mentioned, the industry for 10 years plus has been disciplined particularly in DRAM. So, I do believe that the investments in the future that require healthy levels of profitability and, of course, supply discipline will be back and the industry will grow.

And particularly, keeping it in mind the strong demand trends. I talked about 2025 being — we think will be a record revenue year for the industry because last 2 years have been slow demand growth in terms of shipments. We think ’24 and ’25 will be strong years that will drive strong growth. You are seeing actions on the supply side. The health of the industry will be restored in the future quarters.”

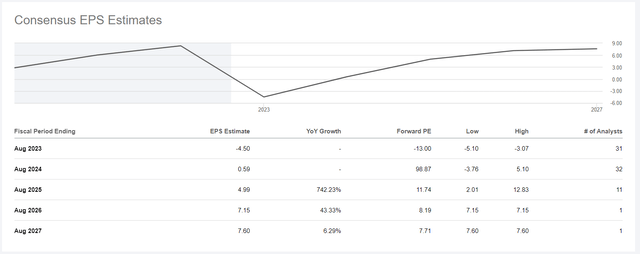

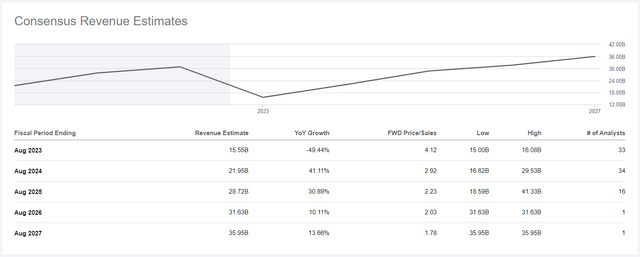

According to consensus analyst estimates, Micron is set to record ~$15.5B in revenue for this fiscal year (Q3FY2023 and Q4FY2023 included), which is around 50% lower than the revenue recorded for FY2022. Further, Micron’s FY2023 EPS is predicted to come in at -$4.5 against FY2022 EPS of $7.75.

While analysts do not see Micron’s earnings getting back to peak levels until FY2027, revenues are projected to bounce back sharply and reach new highs by FY2025-26 (within two years). That said, we could yet experience a hard landing in the economy, and a deep recession could easily delay the recovery in Micron’s financial performance. Despite the near-to-medium outlook for Micron being uncertain, I am cautiously bullish about the business due to robust long-term fundamentals. Let us now see if Micron’s stock passes the remaining checks of TQI’s Quantamental Analysis process, i.e., valuations, technicals, and quant factor grades.

Micron’s Fair Value And Expected Returns

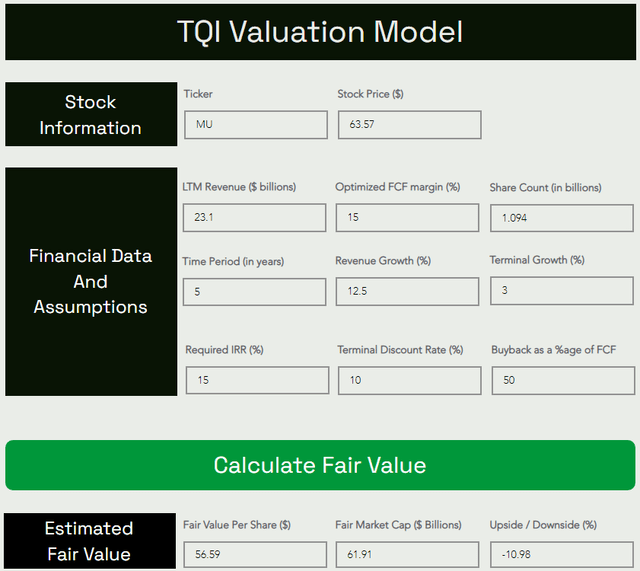

Using conservative estimates shared below, we deduced that Micron’s stock is somewhat overvalued at current levels:

However, what kind of returns can I expect from Micron Technology?

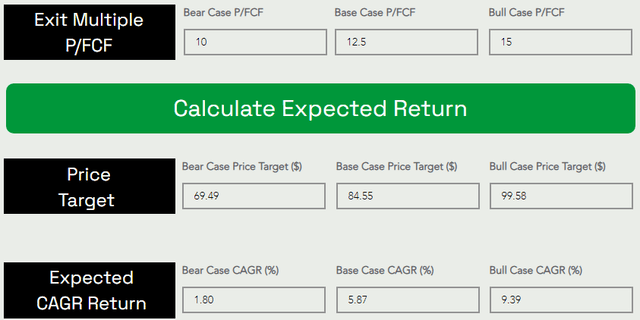

Assuming a base case, P/FCF exit multiple of ~12.5x in 2027-28, we could see MU stock could be trading at ~$85 per share five years from now, implying a CAGR return of ~6%.

Since Micron’s 5-yr expected CAGR falls decidedly short of my investment hurdle rate of 15%, I am not fond of the risk/reward on offer.

MU’s Technical Chart

Micron Technology’s stock has largely been trading sideways for the last several months in what appears to be a Stage-I base formation. And, in my view, the sideways trading in Micron could continue for some time as there is no imminent catalyst in sight, and as we noted earlier, the company’s financials will only recover gradually. Since Micron stock is already fully valued, I can’t see much upside from here in the near to medium term.

Now, a notable number of Wall Street analysts have rated MU stock a “Strong BUY”; however, the average 12-month price target of Micron is just $68.59, indicating an upside potential of <8%. While Micron’s solid track record and robust long-term outlook are allowing analysts to look beyond the ongoing cyclical downturn, I think these analyst targets are a wee bit generous. Heading into a potential economic recession, I am taking a more conservative stance on Micron and the memory chip market in general because this industry is heavily exposed to the macroeconomic environment.

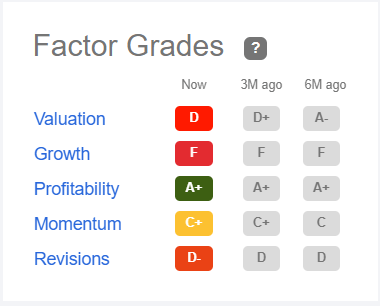

According to Seeking Alpha’s Quant Rating system, Micron’s “Valuation” factor grade has deteriorated from “A-” to “D” in the last six months. In a similar vein, the “Revisions” grade has deteriorated from “D” to “D-“. During this period, “Growth” and “Profitability” grades have held up, but these will likely deteriorate in the coming months. While Micron’s “Momentum” grade has improved from “C” to “C-“, the overall quant factor rating for Micron [3.12/5] suggests the stock is currently a “Hold”.

SeekingAlpha

With Micron’s quant factor grades likely to deteriorate in the coming months, I think the stock could be rated a “Sell” according to SA’s Quant rating system by the end of this year. Hence, Micron is clearly not a buy from a quant factor grade perspective.

Concluding Thoughts: Is Micron Stock A Buy, Sell, or Hold?

Micron may be past the worst of this memory cycle in Q2FY2023; however, the business is set to remain under pressure for the time being. In the event of a hard landing, Micron may face further demand issues, and its supply cuts may prove to be inadequate at restoring the supply-demand balance. Furthermore, China’s recent cybersecurity probe into Micron’s products is an added negative catalyst for its stock.

While I remain bullish on Micron’s business due to its robust long-term outlook, the risk/reward on offer here is unattractive, with the stock being more than fully valued. The technical setup and quant factor grades are uninspiring. Hence, I prefer to remain on the sidelines and wait for a better buying opportunity in Micron.

Key Takeaway: I rate Micron Technology “Neutral/Hold/Avoid” at $64.

Thank you for reading, and happy investing. If you have any questions, thoughts, and/or concerns, please share them in the comments section below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The Time to Upgrade Your Investing Operations Is Now!

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

We have recently reduced our subscription prices to make our community more accessible. TQI’s annual membership now costs only $480 (or $50 per month) for a limited period only.