Summary:

- Despite the double misses in the FQ2’23 earnings call and underwhelming FQ3’23 guidance, MU stock has maintained its overly optimistic support levels.

- We reckon there is a reduced margin of safety at these levels, since 2023 may be an uglier year than expected, with market demand unlikely to bottom by Q2’23.

- Therefore, we do not recommend anyone to chase this rally, since a realistic recovery may only occur by early 2024, attributed to the Fed’s projection of mild recession in H2’23.

Richard Drury

Investment Thesis

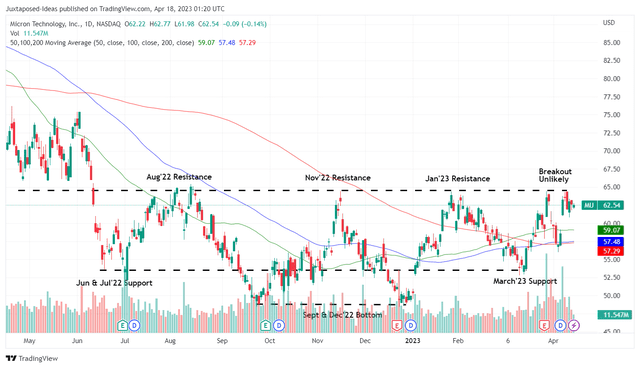

MU 1Y Stock Price

For now, the Micron Technology, Inc. (NASDAQ:MU) stock has already recorded an impressive recovery of +16.1% from the recent March bottom, likely to retest the January 2023 resistance levels ahead. The optimism in its stock price was surprising, due to the underwhelming FQ2’23 performance and FQ3’23 guidance.

The memory chip maker had posted double top and bottom line misses for the latest quarter, with revenues of $3.69B (-9.7% QoQ and -52.6% YoY) and adj. EPS of -$1.91 (-4675% QoQ and -189.2% YoY). Notably, much of the headwinds were attributed to the inventory write-downs of $1.43B, impacting its EPS by $1.34.

Due to the elevated inventory levels, MU had to reduce its Average Selling Prices to remain competitive in the market. As a result, it was no wonder that MU had recorded a drastic decline in its gross margins to -31.4% in FQ2’23, compared to 22.9% in FQ1’23, 47.8% in FQ2’22, and 49.1% in FQ2’19.

Its forward guidance was underwhelming as well, with revenues of $3.7B (inline QoQ and -57.1% YoY) and EPS of -$1.58 (+17.2% QoQ and -161% YoY), with another $500M attributed to further inventory write-downs.

With such numbers, we would have expected the MU stock to tank to its previous bottoms from March 2023 or even December 2022. Interestingly, it did not, suggesting the immense support the stock enjoyed at current levels.

On one hand, the memory chip maker had bullishly highlighted the possibility of recovery from H2’23 onwards, attributed to the increased demand for D5 DRAM from the transition toward the new generation server processors, such as Advanced Micro Devices’ (AMD) Genoa and Intel’s (INTC) Sapphire Rapids.

In addition, MU expected to see growing demand in the automotive industry, significantly aided by the easing supply chain issues for logic chips. On the other hand, it expected minimal growth in the personal electronics and industrial end markets, with “unit volume to be down slightly YoY,” implying sustained inventory correction through the next few quarters.

Therefore, it made sense that MU, along with its memory chip peers, Samsung (OTCPK:SSNLF) and SK Hynix, had announced drastic production and capital expenditure cuts in 2023.

The former had further reduced its Capex to $7B, compared to 2022 levels of $12B, with its Wafer Fab Equipment Capex impacted by over -50% YoY. In addition, the chip maker had guided for a sustained deceleration in Capex through 2024, to control production output through lower utilization rates.

The resultant cadence may then eventually moderate the current supply and demand imbalance, while limiting market supply. However, it remains to be seen how long this painful process may last, since MU is still reporting elevated inventory levels of $8.12B by the latest quarter, expanding by +60.4% YoY or +84.9% from FQ2’19 levels. Even South Korea still reported record-high inventory levels for memory chips at approximately $52B by the end of 2022.

Due to the higher likelihood of a mild recession by H2’23 and recovery only by 2025, we reckon the recovery process may be longer than expected, especially given the slowing public cloud spending and the resultant reduction in cloud Capex. Due to the ongoing year of efficiency, many tech companies also embarked on multiple headcount reductions while freezing investments, likely triggering a lower Capex on corporate electronics.

Despite market analysts highlighting that the recovery cadence may start from memory chips first, we reckon that MU’s near-term profitability and cash flow generation may still be drastically impacted in 2023, if not 2024, due to the ongoing market correction. This is despite the reduction in its operating expenses by -8.3% QoQ/ -5.9% YoY for the latest quarter and headcount by -15% for 2023.

We reckon that the chip maker may only witness an improvement in their top and bottom line by 2024 or by Q4’23 at the earliest, depending on when the Fed pivots with a rate cut. However, with the March CPI still showing rising inflationary pressure, we reckon market demand has yet to bottom, potentially triggering further uncertainties over the next two quarters.

Furthermore, the next replacement cycle for personal/ corporate PCs may only occur from 2024 onwards, if not 2025, attributed to the previous hyper-pandemic boom in 2020. The sales for automotive and smart devices have notably decelerated as well, with both market leaders, Tesla (TSLA) and Apple (AAPL) suffering from declining consumer demand and sales growth, mirroring IDC’s projections for smartphones.

While there has been a notable AI boom over the past few months, we reckon there are fewer tailwinds for MU, due to its focus on memory chips. Fellow WiFi (non-logic) chip designer, Broadcom (AVGO), only expects an $800M AI contribution in its top line in 2023, comprising only 2.4% of its 2022 revenues. Even Nvidia (NVDA) may only record a $250M boost from its GPU supply contract to OpenAI, the creator of ChatGPT.

While we are confident that both the cyclical demand destruction and recession shall pass eventually, the optimism baked into MU’s stock prices may have occurred too early, due to the uncertain macroeconomic outlook in the intermediate term. Therefore, we prefer to rate the stock as a Hold here, due to the reduced margin of safety at these levels.

Anyone hoping for a substantial dividend increase may be disappointed as well, due to the memory chip maker’s impacted earnings and committed expansion plans worth approximately $40B in Boise and New York through 2030. Therefore we believe its forward dividend yield may remain stagnant ahead, based on its annualized dividends of $0.46.

On the other hand, we also believe investors need not fret about MU’s growing long-term debts of $12.03B (+19.5% QoQ/ +82.4% YoY/ +253.1% from FQ2’19 levels), since only $1.18B will be due by 2024 with the rest well-laddered through 2051.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU, NVDA, AAPL, TSLA, AVGO, AMD, INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.