Summary:

- A lot has happened since our last note on Micron; reports of weaker data center capex spending, the CAC announcing its investigation, and Samsung pledging to cut memory chip production.

- We remain buy-rated on Micron as we believe the memory market demand-supply dynamics are about to turn more favorable.

- We expect Samsung’s production cut alongside that of Micron and SK Hynix to accelerate the inventory correction cycle and fast-track memory market recovery toward the end of the year.

- We also believe that the recent reports of weaker datacenter spending have already been discounted by Micron’s outlook.

- While the stock remains under pressure in the near term, we believe longer-term investors should look for entry points as DRAM pricing rebounds due to bit shipments improving toward 2H23.

vzphotos

Micron (NASDAQ:MU) has been on a rollercoaster since we published on the stock late last month- the Cyberspace Administration of China (CAC) announced an investigation into the U.S. memory company, and on a more positive note, industry leader Samsung pledged to cut memory chip production. There have also been reports of weaker data center spending spilling into this quarter. The stock price remains volatile in the near term. Still, we continue to see favorable entry points for long-term investors into the stock at current levels as we believe memory market recovery will be accelerated after Samsung joined the production cut efforts.

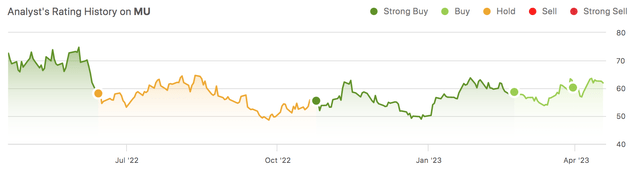

The following graph outlines our rating history on MU.

Samsung‘s production cut is good news

Samsung announced it would significantly reduce memory chip production to a “meaningful level” due to a downturn in semiconductor demand. The news came after the company flagged its worse-than-expected plunge in operating profits; in a short preliminary earnings statement, the company estimated operating profits to drop to 600B won between January and March from 14.12T a year ago. We believe Samsung’s production cut was more or less inevitable and signals just how bad the current demand slump is; PC and smartphone markets continue to contract this year as macroeconomic headwinds pressure consumer spending. We’re also seeing the weaker spending environment spill into data center demand, further pressuring the memory market on the DRAM front. We’re not too concerned about reports of softer data center capex spending as this headwind has already been de-risked from MU’s outlook. MU has been at the forefront of efforts to cut capex and reduce production to improve industry supply-demand dynamics.

To quickly recap, MU dropped roughly 46% in 2022. The company announced it would reduce memory chip supply and cut capex spending to help digestion of build-up inventory levels from pandemic-led demand. In 2Q23, MU reported it would reduce capex for FY2023 further to $7B, down 40% from last year, with WFE spending down more than 50%. SK Hynix has also played an important role in cutting spending to improve industry dynamics; late last year SK Hynix announced the company would cut its 2023 capex by 50% Y/Y in light of excess supply in the memory market. Samsung has resisted cutting production in attempts to be a freeloader and expand its market share while others in the industry slashed capex; earlier this year, Samsung stated it wouldn’t slash spending, hopeful of memory market recovery in 2H23. Now that Samsung has reversed its strategy and joined efforts to improve industry dynamics, we expect things to improve in 2H23, especially concerning memory chip prices. Memory chip prices fell by double-digit percentages last year, and we’ve seen the drop continue this year. Still, market recovery takes time; DRAM prices are expected to continue dropping slightly this quarter, following a 20% slide last quarter and a 30% drop in 4Q22. We expect DRAM pricing to rebound as bit shipments improve toward 2H23.

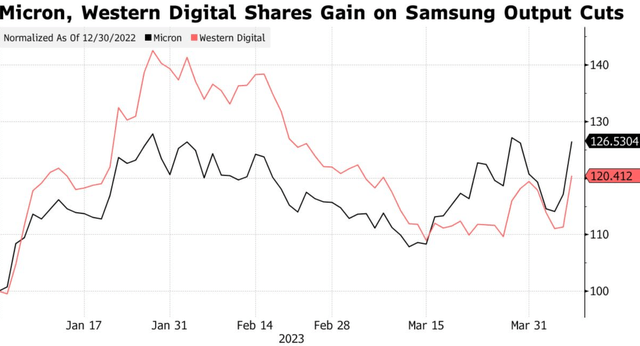

We upgraded MU stock from a hold to a buy back in late October, driven by our belief that DRAM industry dynamics would improve toward 2H23. We now believe it’ll take a bit longer for DRAM supply-demand dynamics to come back into balance. However, we expect Samsung’s production cut to accelerate the process as Samsung holds the largest global share in DRAM and NAND markets, at 40.7% and 31.4%, respectively. MU’s stock surged on the news; the following graph outlines MU and Western Digital’s (WDC) share gain after Samsung’s output cuts earlier this month.

Chip Wars & CAC investigation

Roughly a day after our last note on MU, the CAC announced it would be investigating MU. The CAC’s investigation is aimed at “safeguard[ing] key information infrastructure supply chain security” and “prevent[ing] cyberspace security risks due to problematic products,” according to a CAC statement.

MU is caught in the Chip Wars between the U.S. and China; it seems the cyberspace review is China’s retaliation against the series of stingier U.S. regulations against exporting semiconductors to China. The company signaled earlier fears that China could limit its growth in the Chinese market in 2021. We expect MU is taking the grunt of the Chinese retaliation due to the replaceable nature of MU’s products, compared to other U.S. semi companies, such as Nvidia (NVDA). This is because China can more or less replace MU with local suppliers, including Yangtze Memory Tech or even Samsung and SK Hynix. Details about the investigation remain unclear, but we don’t expect the CAC will take any further action against MU as limiting domestic Chinese companies’ access to MU’s products will only make China less competitive.

Valuation

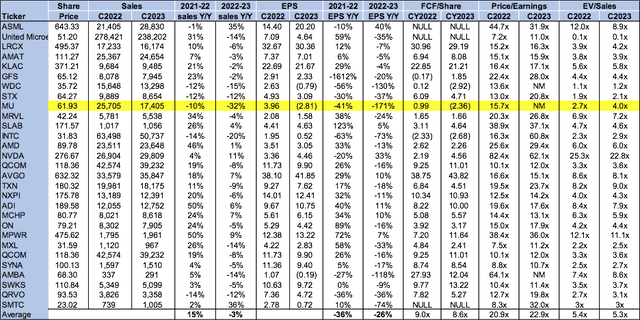

MU stock is relatively cheap, trading at 4.0x EV/C2023 Sales versus the peer group average of 5.3x. The stock price remains volatile in the near term as the memory market recovery will take time. Still, we see favorable entry points into the stock for long-term investors.

The following table outlines MU’s valuation against the semiconductor peer group.

Word on Wall Street

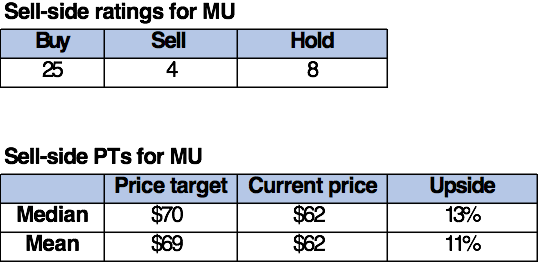

Wall Street shares our bullish sentiment on the stock. Of the 37 analysts covering the stock, 25 are buy-rated, eight are hold-rated, and the remaining are sell-rated. The stock is currently trading at roughly $62 per share, trading nearly 19% lower than its 52-week-high of $76.23. We expect investors buying the stock at current levels will be well rewarded in the mid-to-long run.

The following table outlines MU’s sell-side ratings.

TechStockPros

What to do with the stock

We continue to be bullish on MU. We expect Samsung’s production cut to alleviate the supply glut in the memory market that’s caused MU and peers to reduce prices. Memory market recovery is now expected to accelerate towards the end of the year, further improving DRAM industry supply-demand dynamics and DRAM pricing. We still don’t see market recovery happening overnight, but we’re on the right track to see industry dynamics come back into balance. We believe MU provides a favorable risk-reward scenario and recommend long-term investors begin looking for entry points into the stock at current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.