Summary:

- After initiating bullish coverage of Abbott in March, the company’s stock has risen 15%, boosted by fantastic quarterly earnings.

- While COVID remains a headwind, other segments confirm that ABT enjoys strong secular and innovation-driven growth.

- This dividend king enjoys a fair valuation. However, given recent momentum, I’m looking to add on stock price weakness if I get the opportunity.

Tim Boyle

Introduction

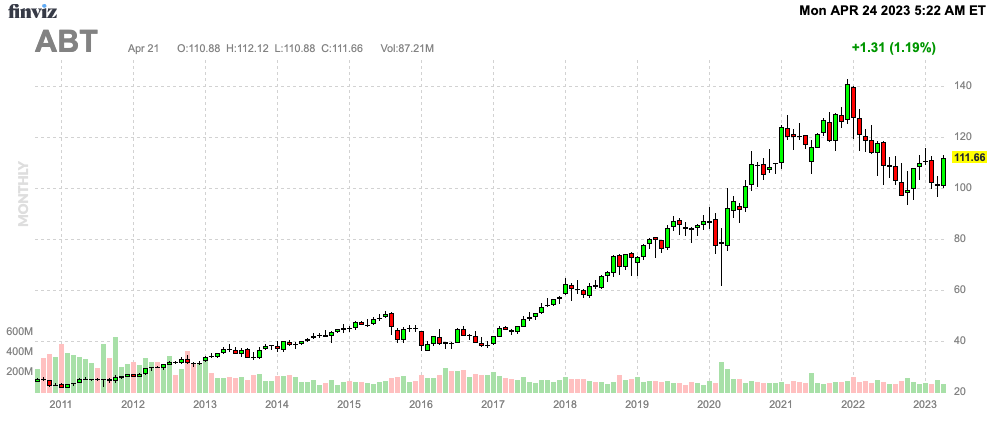

Last month, I wrote an article titled Abbott Laboratories: A Dividend King At A Discount. In that article, I highlighted the tremendous value this trusted dividend stock brings to the table for investors seeking a decent yield and satisfying capital gains. Since then, Abbott Laboratories (NYSE:ABT) has rallied 15%.

FINVIZ

While I’m happy that I got the timing right, I’m disappointed as I didn’t pull the trigger myself. Not only that but the recently-released quarterly earnings show that Abbott is making tremendous progress in what has become a post-COVID world. While lower testing demand did a number on organic growth, the company showed high organic growth in other areas, making it likely that investors remain in a very good spot for many years to come.

In this article, we’ll assess all of it and more.

So, let’s get to it!

1Q23 Was A Fantastic Quarter*

In 1Q23, Abbott generated $9.7 billion in revenue. This was $60 million more than analysts expected and 18.5% lower compared to the prior-year quarter.

Diluted earnings per share fell from $1.73 to $1.03 during this period.

In other words, it’s a bit unusual to call this a great performance.

However, it is a great performance. After all, Abbott Laboratories was one of the biggest beneficiaries of the pandemic, thanks to its advanced testing products. It was obvious that revenues would suffer after the pandemic. What matters is that ABT continues to show growth in its non-COVID segments.

And that’s exactly what the company did.

COVID-Adjusted Organic Growth Was Strong, Underlining The Company’s Growth Capabilities

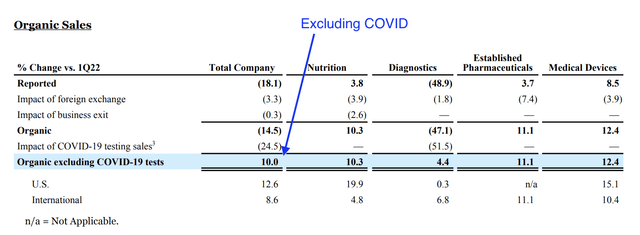

Organic sales growth, excluding COVID testing, increased by 10%, led by double-digit growth in Medical Devices, Established Pharmaceuticals, and Nutrition. Including COVID, the company reported growth in all segments but Diagnostics.

Abbott Laboratories (Author Annotations)

The company credits this growth to a shift in global healthcare priorities with increased emphasis on getting healthy and staying healthy. This has led to increased routine diagnostic testing volumes, improved medical device procedure trends, and strong demand for consumer-based health products.

According to Robert Ford, Chairman and CEO of Abbott:

A much more relevant and important behavioral shift that we’re seeing in healthcare globally has been the increased priority people are putting on getting healthy and staying healthy. And for our businesses, the impacts have been increased routine diagnostic testing volumes, improved medical device procedure trends and strong demand for consumer based health products.

Taking a closer look at the drivers of this performance, we find strong underlying demand across all non-Diagnostics segments.

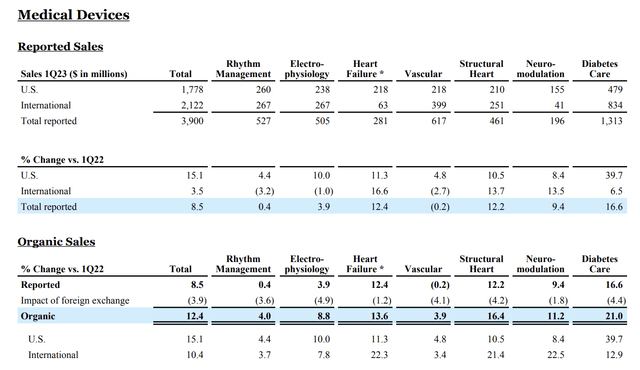

The company’s Established Pharmaceuticals, or EPD, recorded 11% sales growth in the quarter, with a strong performance in Brazil, China, and Southeast Asia and across several therapeutic areas, including cardiometabolic, gastroenterology, CNS, and pain management. The Nutrition sector recorded more than 10% sales growth, driven by the strong performance of the company’s market-leading Ensure brand. In Medical Devices, sales grew 12.5% globally, led by mid-teens in the US and double-digit growth internationally.

Just two subsegments of the Medical Devices segment reported single-digit organic growth. All other segments saw double-digit growth.

Abbott Laboratories

With regard to the impact of COVID, in its Diagnostics segment, sales growth was negatively impacted by a significant decrease in COVID testing sales compared to the first quarter of last year. However, excluding COVID testing, organic sales growth was led by mid to high single-digit growth in Core Lab, Rapid, and Point of Care Diagnostics.

The Outlook Confirmed The Ongoing Growth Trend

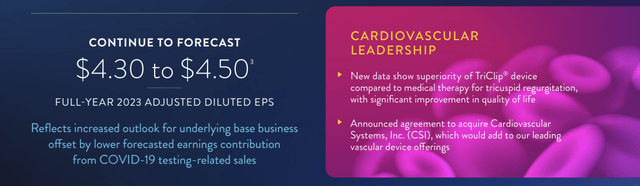

So far, so good. However, what propelled the stock price was the company’s outlook, which confirmed that its 1Q23 results weren’t just outliers (not that anyone expected that, but still).

Abbott has updated its full-year outlook for 2023, expecting at least high single-digit growth in total underlying base business organic sales, excluding COVID testing sales. The company has also forecasted COVID testing-related sales of around $1.5 billion, which is below its previous forecast of approximately $2 billion due to current testing dynamics in the market.

Abbott Laboratories

This translates to full-year adjusted earnings per share guidance of $4.30 to $4.50, which remains unchanged versus prior expectations.

However, it now reflects a lower earnings contribution from COVID testing sales compared to expectations in January. This is offset by raising its underlying base business earnings forecast by a little more than $0.10 based on the company’s strong performance and outlook, which makes this outlook look even better.

Based on this context, Larry Biegelsen, an analyst at Wells Fargo (WFC), asked the company to shed some more light on these developments. After all, expecting higher growth in non-COVID segments is a big deal.

Essentially, this is what it comes down to (emphasis added):

- The company is seeing a better environment with improving top-line on the base business, better diagnostic testing, and more procedures.

Specifically in Devices, we’re starting to see already the hospitals and the systems start to get the handle on staffing shortages. From an inflation perspective, we talked about some of the commodity starting to turn a little bit, not all of them, but some of them starting to turn. So that’s really translated, I’d say, in improving top line on the base business, better diagnostic testing, more procedures.

- Abbott is forecasting high single-digit growth for the base business, which is being driven by reinvesting some of the COVID-19 revenues and profits.

- The company is targeting double-digit EPS growth going into 2024 with a strong top line on the base business and margin expansion.

Shareholders Remain In A Great Place

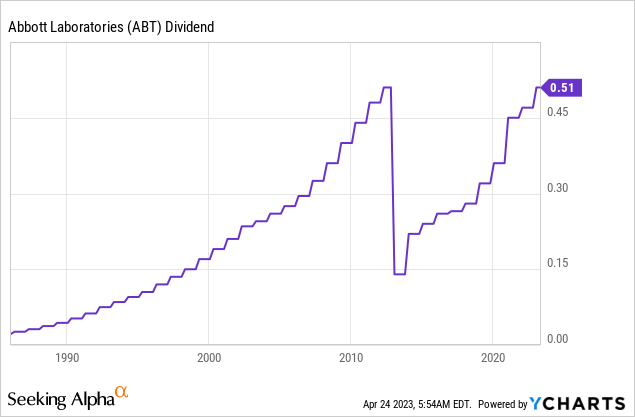

397- That’s how many consecutive quarterly dividends Abbott has paid to its shareholders. The current dividend is $0.51 per share per quarter, which translates to a yield of 1.8%. That’s nothing to get extremely excited about. At least not when looking for a high income.

What makes ABT so special is the fact that it’s a dividend king, which means it has hiked its dividend for at least 50 consecutive years. The only reason why some websites display a nine-year growth streak is the spin-off of AbbVie (ABBV) after the Great Financial Crisis. That lowered total dividend payments. However, nothing changed for existing investors in terms of total dividends.

Also, for what it’s worth, AbbVie has hiked its dividend every single year since the spin-off.

Over the past five years, the average annual dividend growth was 12.5%, which is a big deal, given the company’s age. It’s also backed by the aforementioned strength in its business segments.

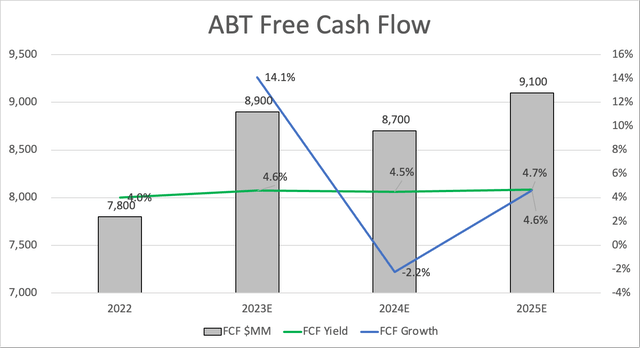

The payout ratio is 42%. The cash payout ratio is 40% and is supported by a consistent stream of free cash flow in the upcoming years, with projections indicating even stronger free cash flow growth beyond 2024.

Additionally, the stock has a net debt ratio of less than 0.4x EBITDA, and it enjoys a credit rating of AA-.

Leo Nelissen

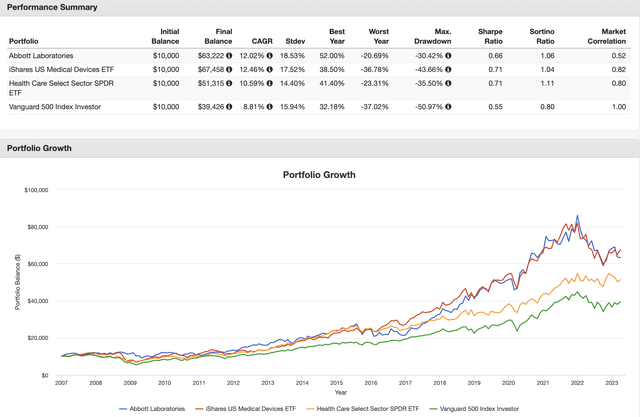

Furthermore, the stock has consistently outperformed the market and the healthcare industry.

- Going back to 2007, ABT has returned 12.0% per year., outperforming the S&P 500 and the Health Care Select Sector SPDR (XLV). However, it failed to outperform the iShares U.S. Medical Devices ETF (IHI). ABT has a 14% weighting in this ETF. Thermo Fisher (TMO) has a 16% weighting. The yield on this ETF is 0.5%. Even if IHI continues to outperform by a narrow margin, I won’t make the case that investors need to replace ABT with IHI.

Portfolio Visualizer

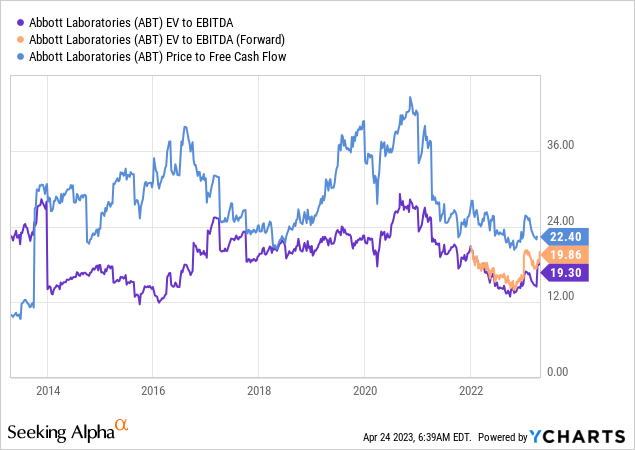

With regard to the valuation, ABT shares are trading at roughly 22x free cash flow, which is a good value. However, it’s not deep value. The company is trading slightly below 20x 2023E EBITDA, which is also fair.

After the recent surge, I believe the valuation has gone from attractive to fair.

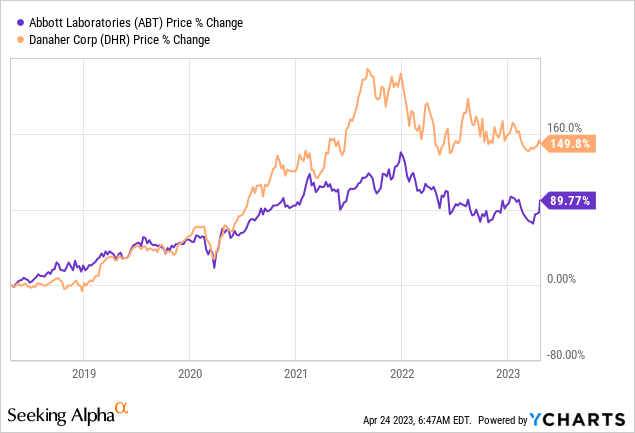

The only reason why I didn’t buy the stock after my last article is the fact that I had already aggressively added to other investments. Now, I’m waiting for a new buying opportunity. If I don’t get it, I will likely stick to buying Danaher (DHR) shares, which I already own. It’s also highly correlated to ABT, as it’s a supplier of high-tech healthcare equipment.

That said, (dividend) investors should look beyond the company’s relatively subdued yield. I believe that ABT will remain a source of high total returns for many years/decades to come.

Takeaway

In this article, we discussed what has become one of my favorite dividend growth stocks on the market. Healthcare giant Abbott continues to impress with strong growth in all segments except for COVID testing. The company sees secular health tailwinds, innovation-driven growth, and the simple ability to deliver the tools and products behind some of the most important healthcare problems we’re currently facing (like diabetes and heart health).

Furthermore, the company is a terrific dividend growth stock with more than 50 consecutive annual dividend hikes, strong free cash flow, a healthy balance sheet, and an expected growth rebound in 2024.

My strategy is to watch the stock for another correction. If it happens, I will likely make ABT a large part of my dividend growth portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.