Summary:

- To keep things simple, this was a monstrous quarter by almost all means.

- Satya Nadella may go down as the most transformative CEO in history.

- The only weaknesses I spot are either by design or because the company and stock have done way too well.

jewhyte

Microsoft Corporation (NASDAQ:MSFT) has just reported its Q3 earnings as Seeking Alpha has covered here. Microsoft is one of my favorite and most profitable stocks of all time and I cannot be happier with the stock action afterhours. I recently reviewed the earnings report from another favorite stock of mine, The Coca-Cola Company (KO) using the trichotomy “The Good, the Bad, and the Ugly”, which also happens to be one of my favorite movies of all times.

It is easy to give an all-too-rosy picture in the light of a stock rising after what appears like a strong earnings report. But writing the Coke article in this format made me look deeper for things that may be hiding in plain sight or under a few layers of positive data. This ensures readers get a balanced view of the earnings as well as the stock’s outlook post-earnings. Let us evaluate Microsoft’s earnings and its effect on MSFT stock price using the same format.

Good

- With smaller companies, I look for earnings beat because they have a tougher time reining in expenses and many tend to show revenue growth simply by acquiring revenue. With larger companies, they have more room to cut the fat in terms of expenses, so I look for revenue beat. Microsoft impressed here in Q3 with a massive revenue beat by almost $2 Billion or about 4%. That’s a 10% revenue increase YoY. The law of large numbers makes this all the more impressive. If you are still not convinced, let me put it this way. The additional revenue by itself covers 40% of the company’s quarterly dividend commitment to shareholders.

- Forget PCs, of course. Forget Office 365, who cares anymore. Yes, forget Azure too. From a vision and communication stand-point, it appears like Microsoft has transformed itself overnight (okay, a quarter) into an Artificial Intelligence pioneer. And the market is lapping it up, especially Microsoft’s well publicized generative AI investments.

- Satya Nadella. I might as well move onto the next point after simply stating his name. What a turnaround he has championed at Microsoft and he looks far from done. As an example of his acumen, his opening remark in the Q3 report reads as follows:

“The world’s most advanced AI models are coming together with the world’s most universal user interface – natural language – to create a new era of computing.”

In a simple sentence, he has married the company’s present with its future. Wall Street likes a great vision, no doubt. But when the likes of Mark Zuckerberg have struggled to clearly communicate, let alone execute, lofty visions, Nadella is doing all three: laying out a vision, communicating that clearly, and executing it with precision.

Bad

- Microsoft defines “More Personal Computing” as the segment consisting of Windows, Devices (Surface etc.), Gaming, and more importantly of late, Search and News (Bing). Overall revenue for this segment fell by 9% with Windows and Devices falling by almost 30%. In an encouraging sign, the search and news sign of this segment had a 10% increase in revenue. Overall, the weakness in this segment shows the Microsoft of today is far more reliant on Intelligent Cloud and Productivity/Business Processes segment that we’d have imagined a year or so ago. This is almost definitely by design but do not ignore the stickiness and the reliability that the Personal Computing brings in. Hence, the ongoing weakness here is to be monitored.

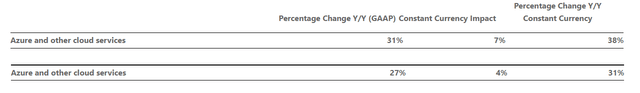

- Going into Q3 earnings, worries about a slowdown in Azure after Q2’s result were justified. While the market is celebrating overall Q3 results, Azure actually did worse in Q3 compared to Q2 based on their respective YoY comparison as shown below. The first line (31% growth) is Q2 and the second line (27% growth) is Q3. Those numbers are still impressive but it needs to be pointed out since Azure weakness was noted as the primary reason for the stock action after Q2.

Azure Q2 and Q3 (Microsoft.com)

- Q3’s Free Cash Flow (“FCF”) decreased 11% YoY. This is still quite handy and easily covers the dividends and other expenses but it was surprising to see this.

Ugly

- This is the first of my two cheats. When a report is so good, you need to grasp at the straws to find the negatives. In the just reported quarter, Microsoft added nearly $11 Billion to its cash and cash equivalents pile. Granted, the company is now heavily investing in AI but Microsoft is facing the problems Apple, Inc. (AAPL) did a few years ago: bringing in more cash than what the company has plans for. No wonder, Seeking Alpha readers are calling out the company to increase its buybacks and dividends, despite spending about $10 Billion in Q3 on those. I do agree with our SA readers here, a yield of 1% is not large enough for income investors and funds to be enticed. That said, I’d rather have this particular company retire more shares through buybacks to boost EPS and to save money on dividend payments.

SA Comments (Seekingalpha.com)

- This is the 2nd and last cheat code that is not directly related to the earnings report. But despite enjoying the stock’s returns, I cannot deny that Microsoft’s stock valuation has gotten well ahead of itself. A forward multiple of 31 is too hard to justify in the current macro environment of higher rates and tighter monetary policies. With an expected earnings growth rate of 12%/yr, Microsoft stock is trading at a Price-Earnings/Growth (“PEG”) above 2.50. As I’ve written before, gone are the days of finding stocks of good companies trading at a PEG <1 but I’d be willing to buy Microsoft closer to a PEG of 2 given its pedigree. Till then, I am happy holding onto my shares in this juggernaut.

Conclusion

As I stated in the summary, this was a monstrous quarter from Microsoft. When you need to count the stock’s run up in price or a 27% growth in a leading segment as “Ugly” and “Bad” respectively, you know the report was almost spotless. I look forward to witnessing Satya Nadella continuing to play Chess against a field that is playing defensive Checkers at best.

What do you think about Microsoft’s report and the stock breaching $300 afterhours? Please leave your comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, KO, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.