Summary:

- Meta Platforms reported an impressive rebound in Q1’23, but the company is only now returning to growth, providing more upside ahead.

- The social media giant is still spending aggressively on the Metaverse, leading to an ~$5 EPS hit currently.

- The stock is cheap based on a core business, ex-Reality Labs, trading at ~12x ’25 EPS targets.

Kelly Sullivan

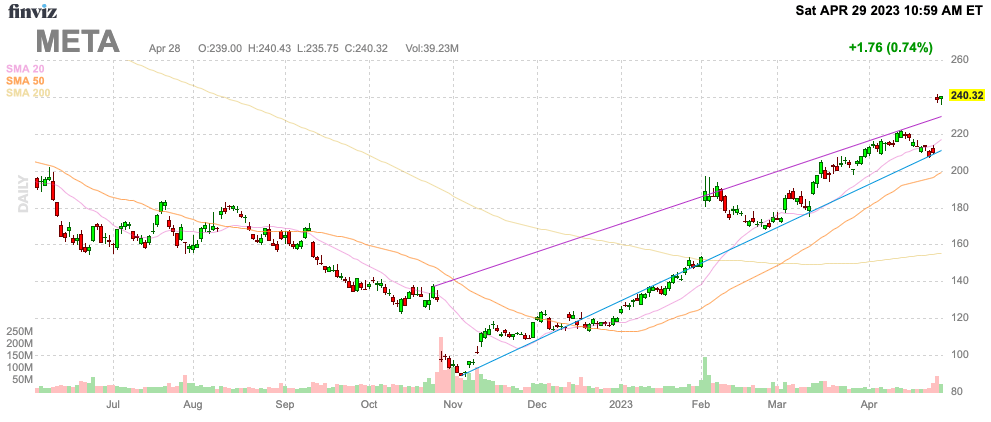

Considering Meta Platforms (NASDAQ:META) once traded near $400, the stock rallying to $240 following better than expected quarterly results is just a continuation of the overdue rebound. The social media stock should’ve never traded below $100 on the irrational fear of overspending on the Metaverse. My investment thesis remains Bullish on the stock as the company still isn’t maximizing profits while investing for the future.

Source: Finviz

Solving Revenue Problem

All of the focus over the last year was the excessive spending from Reality Labs and wild growth in the workforce. In reality, the solution to the problem all along was the revenue side of the equation.

For Q1’23, Meta reported revenues of $289.7 billion, beating analyst estimates by a wide $990 million. The Q2’23 guidance was far more impressive with a target of $29.5 to $32.0 billion versus the $29.5 billion consensus estimates.

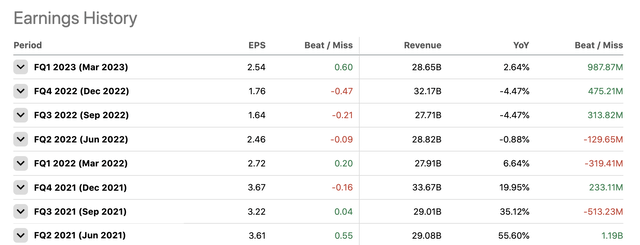

The social media giant had reported a string of earnings reports going back to Q2’21 where Meta didn’t beat revenue estimates by this much. In fact, during the period of 8 quarter, the tech giant missed revenue estimates 3 times.

While playing the expectations game can be misleading, the big key to Q1 actual numbers was a return to growth after 3 quarters of YoY revenue declines. The average analyst estimate for Q2 is for revenues to jump 6% YoY to $30.6 billion and a quarterly figure above $30 billion would be a record non-holiday quarter.

Meta can solve a lot of the overspending issues from the last year by returning to sales growth. Considering the economy hasn’t improved, the numbers suggest the social media giant has solved some of the IDFA issues caused by the privacy changes at Apple (AAPL) and Reels is gaining momentum.

The company will solve a lot of the ailments by returning to double-digit growth making the spending issue easier to solve. CEO Zuckerberg can gain efficiency by maintaining costs as much as cutting costs.

A prime example of how the market got off center on the Metaverse is that Meta is seeing substantial gains from using AI to boost time on Instagram via Reels. On the Q1’23 earnings call, CEO Mark Zuckerberg reported the following impressive metrics:

Since we launched Reels, AI recommendations have driven a more than 24% increase in time spent on Instagram. Our AI work is also improving monetization. Reels monetization efficiency is up over 30% on Instagram and over 40% on Facebook quarter-over-quarter. Daily revenue from Advantage+ shopping campaigns is up 7x in the last six months.

These numbers support Meta solving the issues from IDFA to the market share shift to TikTok in prior quarters. On top of this, the company continues to reduce the workforce to provide a double boost to the bottom line while still investing aggressively in the future.

Reality Labs Will Pay Off

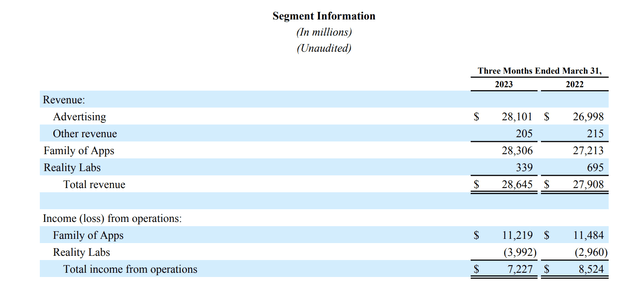

The amazing part is that Meta made all of this progress to improve profits while still investing an insane amount in Reality Labs. The company spent over $4 billion on the segment during Q1’23 leading to an annualized loss rate at a massive $16 million.

Source: Meta Platforms Q1’23 earnings release

Considering the Metaverse has been slow to ramp, Meta has a long runway to reduce the losses in this area and boost profits going forward. In fact, Reality Labs revenues were down nearly 50% in the quarter due in part to weakness from the headsets.

The Meta Quest Pro released last year hasn’t had an impressive uptake while the Quest 2 has failed to maintain momentum as the device ages. With the company solving the ad revenue problems, Zuckerberg will have the cash flows to continue investing in the promise of the Metaverse along with AR/VR devices.

According to Verge, the company has the following schedule outlined for future AR/VR headsets:

- 2023: Quest 3 – 2x thinner, twice as powerful

- 2023: Smart glasses – 2nd generation device

- 2024: Quest 4 – photorealistic, codec avatars

- 2025: Smart glasses – 3rd generation with a display and a neural interface

- 2027: AR glasses

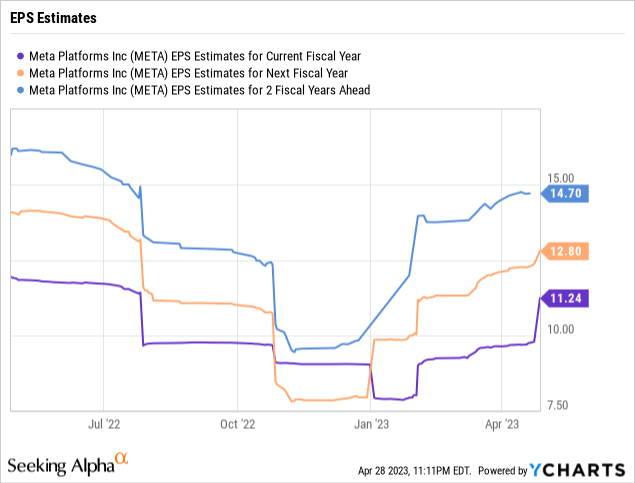

Too much opportunity exists in this area for Meta to reign in most of the investment in this category. Analysts have the company producing the following EPS targets over the next 3 years with the 2025 target approaching $15 per share.

Investors can decide how to value the business based on the excessive spending on the Metaverse. Meta is losing $16 billion annually, amounting to about ~$13 billion after taxes.

The company now has 2.6 billion shares outstanding leading to about a $5 EPS hit from the aggressive spending on Reality Labs. At a 20x EPS target, the comparing is giving up about a $100 per share worth of market cap from investing in the Metaverse.

Investors have to know Meta either turns this into a future profitable growth driver or Zuckerberg will implement another year of efficiency for the Metaverse.

Takeaway

The key investor takeaway is that Meta is too cheap trading below 20x official 2024 EPS targets. In reality though, investors should slap a $20+ EPS target on the 2025 earnings and view the stock trading at 12x a more normalized EPS target once the business is fully back in growth mode (along with efficiency improvements) and adding back the temporary Metaverse losses.

After this huge rally, investors should probably expect a near-term pause, but ultimately the stock still has legs.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause after several bank closures, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.