Summary:

- In a quarter ripe with one-time adjustments, non-core FX impacts and accounting assumption changes, it is important to extract the hidden, like-for-like comparable truth behind the numbers.

- Search revenue is more resilient than it looks.

- Margin and productivity levers are abound.

- Cloud margin expansion thesis is not playing out.

- Overall, the positives outweigh the negatives.

Michail_Petrov-96/iStock via Getty Images

Introduction

In early April, I posted a view that Google’s (NASDAQ:GOOG) (NASDAQ:GOOGL) Cloud business is likely to surprise positively on margins as it benefits from price hikes. A day before the Q1 FY23 earnings release, I shared a case for a revenue beat on the core advertising business to boot, with a materially above-consensus view on the revenue print ($71.8bn vs $68.8bn consensus). The earnings release came out as directionally expected, with a 1.4% beat on revenues and a 131bps beat on EBIT margins vs consensus estimates.

Now, as I update my thesis, I see room for further upside as I am encouraged by the Google Search segment’s resiliency, multiple margin and productivity levers. However, when I compare on a like-for-like basis after accounting for the accounting adjustments, I believe Google Cloud’s margin expansion is yet to play out.

Assessing my pre-earnings estimate

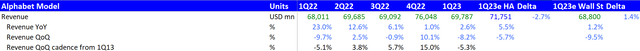

Now, I’m not a big forecaster of quarterly revenues. I only do quarterly forecasts when I want to see where and how I differ vs consensus in my views to understand my variant positioning better. In this case, I thought the Street was not adequately factoring in the industry research that pointed to a faster ad spending rebound. For curiosity’s sake, let’s compare my guess with what materialized:

Revenue Performance vs Expectations (Company Filings, Author’s Analysis)

Q1 FY23 revenues came in 2.7% below my estimate, but I am encouraged by the fact that on a constant currency basis, revenues grew 6.0% YoY. This beats what I was assuming at a 5.5% YoY. I believe this is a reasonable comparison since I did not factor in any currency impacts in my view.

The Hidden Truth

In a quarter ripe with one-time adjustments, non-core FX impacts and accounting assumption changes, it is important to extract the hidden, like-for-like comparable truth behind the numbers. After doing this exercise, I come to the following 3 key conclusions from my Q1 FY23 earnings analysis:

- Search revenue is more resilient than it looks

- Margin and productivity levers are abound

- Cloud margin expansion thesis is not playing out

Search revenue is more resilient than it looks

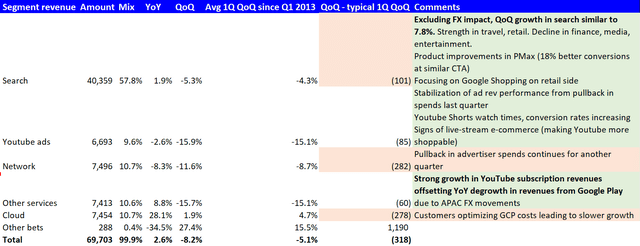

The following shows my summary notes of Google’s top-line after the Q1 FY23 results:

Q1 FY23 Segmental Revenue Summary (Company Filings and Q1 FY23 Transcript, Author’s Analysis)

As expected in the current macro environment, Alphabet posted a top-line that was worse than the typical Q1 quarter. The segments that lagged historical Q1 growth levels the most were Google Search, Google Network and Google Cloud. However, the commentary was more positive, particularly on Google Search and Youtube, which make up more than two-thirds of the company’s total revenues. Of particular note is what management said regarding Google Search’s advertising revenues:

Excluding the impact of foreign exchange, the revenue growth of Search was similar to last quarter.

– CFO Ruth Porat in the Q1 FY23 earnings call

Google Search Revenues (Company Filings, Author’s Analysis)

In Q4 FY22, Google Search grew 7.8% QoQ. Based on the CFO’s comments, on a constant currency basis, Google Search for Q1 FY23 would have printed a 7.8% QoQ growth instead of a -5.3% decline, leading to an additional revenue increment of $5,548 million. Adding this impact to the overall revenue line gets us -0.9% QoQ instead of the -8.2% QoQ that materialized with FX headwinds included. So the underlying Google Search advertising revenues are ticking alone quite well; it’s just masked behind FX headwinds.

This reaffirms my earlier thesis that the digital ad spend slowdown is proving to be resilient and rebounding. I continue to use eMarketer’s 10.5% YoY growth in digital ad spends for CY23 as a base-line.

I believe Google Search is on-track to continue surprising positively to the upside, especially as FX headwinds wane down:

Foreign exchange headwinds have moderated, and we expect less of a foreign exchange headwind in the second quarter based on current spot rates.

– CFO Ruth Porat in the Q1 FY23 earnings call (Author’s bolded emphasis)

Margin and productivity levers are abound

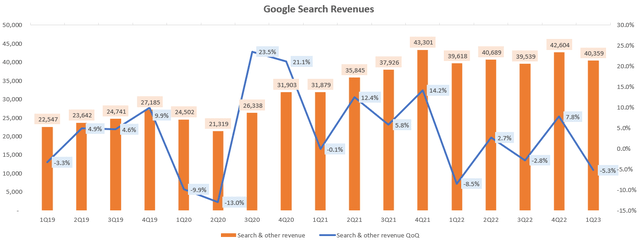

The normalized EBITDA margin printed a sharp jump of 378bps to 33.2%:

Normalized EBITDA Margin (Company Filings, Author’s Analysis)

This metric does not include the depreciation benefit arising from extended useful life assumptions of servers and network equipment. Nor does it include the one-time severance and office space reduction costs incurred. Noteworthily, this margin expansion occurred even when Google still had most of the 12,000 employees they fired in January 2023 on their payroll:

The reported number of employees at the end of the first quarter includes almost all of the employees impacted by the workforce reduction we announced in January.

– CFO Ruth Porat in the Q1 FY23 earnings call

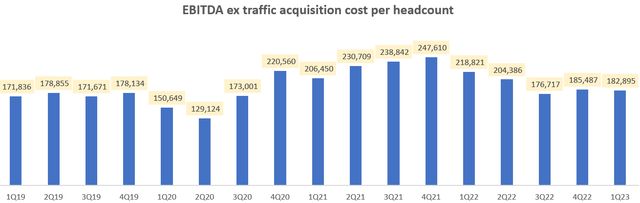

I believe the exit of these employees in the quarters ahead will provide a further boost to margins and improving unit economics. I anticipate a rapid return to 37% normalized EBITDA margins and peak unit-level productivity figures back to $250,000 and beyond:

EBITDA per employee (Company Filings, Author’s Analysis)

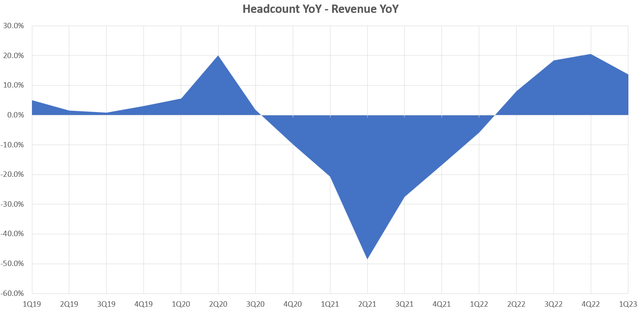

Over most of 2022, Google’s headcount outgrew revenues:

Headcount YoY – Revenue YoY (Company Filings, Author’s Analysis)

Now, I anticipate a more prolonged period of limited hiring additions as the company focuses on using generative AI technologies to further optimize its workforce. I was amused by management’s commentary, which used some euphemisms to communicate the same thing:

We have significant multiyear efforts underway to create savings, such as improving machine utilization…

– CEO Sundar Pichai in the Q1 FY23 earnings call (Author’s bolded highlight)

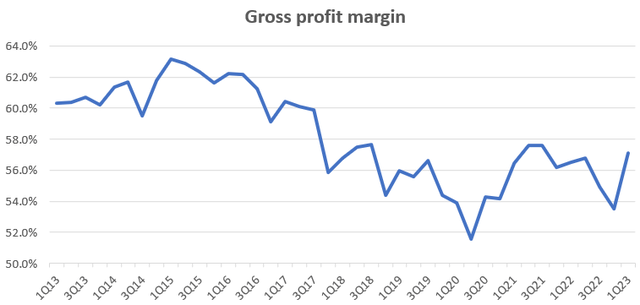

I anticipate these productivity gains and reduced reliance in “external procurement” to lead to an uplift in gross profit margins back above the 60% range in the quarters ahead:

Gross profit margin (Company Filings, Author’s Analysis)

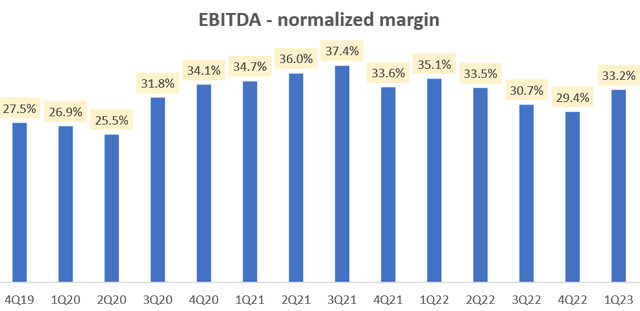

Cloud margin expansion thesis is not playing out

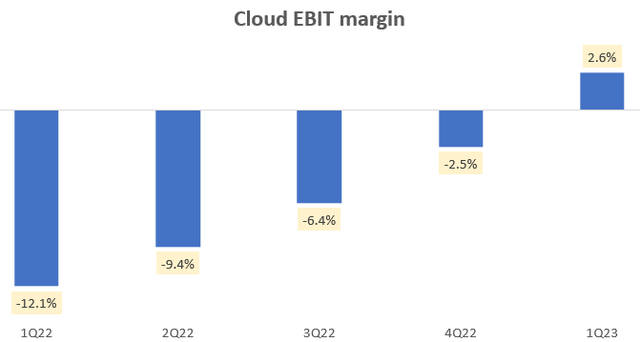

Google Cloud reported positive EBIT margins:

Cloud EBIT Margin (Company Filings, Author’s Analysis)

However, this was boosted by an accounting assumption wherein the useful life of servers and network equipment was extended 1-2 years. With this move, management noted a cumulative earnings boost of $988 million. By looking at pre-cloud revenue depreciation rates as a base line and assuming fixed asset turns for Alphabet’s revenues ex of Google Cloud, I estimate an attribution of ~42% of Google’s gross block to belong to Google Cloud. Applying the D&A accounting benefit proportionately, I see that Google Cloud’s EBIT margins remained flat:

Cloud EBIT Margin Adjusted for Like-for-Like Comparison (Company Filings, Author’s Analysis)

This is contrary to my initial thesis which anticipated genuine margin expansion without the benefit of accounting tricks.

The revenue commentary on Google Cloud suggested a slowdown driven by cost optimization initiatives. Given this context, it is possible that Google had trouble passing on the price increases in April 2023, without impacting demand.

Takeaway

Alphabet gave us a heads-up before the Q1 FY23 result release that there are many reporting and accounting adjustment changes. In my earnings preview article, I shared the recalibrations required to assess the company’s performance on a like-for-like basis.

Post-earnings, I have worked through the various one-time adjustments, non-core FX impacts that do not represent the true operating performance that is more within management’s control, and changes in accounting assumptions that boost margins, making relevant corrections to arrive at truly comparable numbers. I observe 3 key things:

- Google Search is more resilient than what the headline numbers represent

- There is strong progress on margin expansion, with further scope for productivity boosts as the company uses AI to optimize on headcount

- Like-for-like profitability of Google Cloud shows little progress in margin expansion, which is contrary to my original thesis

On the whole, I retain my bullish view but despite the expected revenue beat, Wall St and Seeking Alpha Quant Ratings’ ‘Strong Buy’ stance, I am not upgrading my rating just yet.

Rating: Retain ‘Buy’

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.