Summary:

- All eyes are set on Nvidia’s Q1 FY 2024 results, which are set to be released on May 24th after the market closes.

- I believe Nvidia may miss consensus estimates with regard to sales by ∼6% and earnings by ∼14%, likely prompting a sharp drop…

- …as the post-2025 AI frenzy meets early 2023 earnings reality, pressured by a likely worse-than-expected cloud and gaming business.

- Going into earnings, buying time-sensitive Put spreads might be an interesting trade opportunity.

- Personally, I like the risk/reward of the 90/80%-moneyness Put spreads with June 16 expiration for a 4:1 payoff.

Justin Sullivan

I have previously presented a deep dive on Nvidia’s (NASDAQ:NVDA) AI software business (~end of April), so I am well aware about the company’s AI strength and value. However, I would like to point out that every investment opportunity is both a function of value and price. And with that frame of reference, Nvidia’s ∼x85 price per FY24 earnings is simply too high to merit an investment.

Now, all eyes are set on Nvidia’s Q1 FY 2024 results, which are set to be released on May 24th after the market closes. Although I acknowledge that expectations have come down versus unsustainable high estimates set in 2022, I believe the company may still miss consensus estimates with regard to sales by ∼6% and earnings by ∼14%, likely prompting a sharp drop for the stock, as the post-2025 AI mania meets early 2023 earnings reality.

For reference, since the start of the new year Nvidia stock is up approximately 100%, outperforming the ∼8% return for the S&P 500 (SP500) by a factor of 10x.

Nvidia’s Q1 FY 2024 Preview

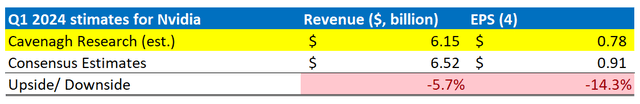

Based on information collected by Seeking Alpha, 33 analysts have submitted their projections for Nvidia’s Q1 FY 2024 results, as of May 14th. These projections anticipate that the chip designer’s total sales for the first quarter of 2023 will likely fall between $6.31 billion and $6.71 billion, with the average estimate being $6.52 billion. Using the average analyst consensus estimate as a reference point, it is suggested that Nvidia’s Q1 sales may contract by about 21.3% YoY as compared to the same period in 2022 – quite a steep drop for a company whose shares have outperformed the S&P 500 by about x10 YTD.

With regard to profitability, analysts estimate that Nvidia’s Q1 FY 2024 EPS estimates vary from $0.81 to $0.97, with the average being $0.91, which implies a YoY earnings contraction of about 33% according to consensus ad mid-point. Again, this is quite a notable decline and blows Nvidia’s significant outperformance completely out of earnings reference.

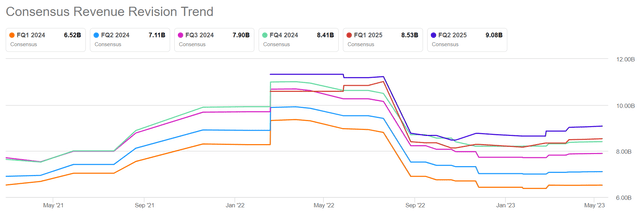

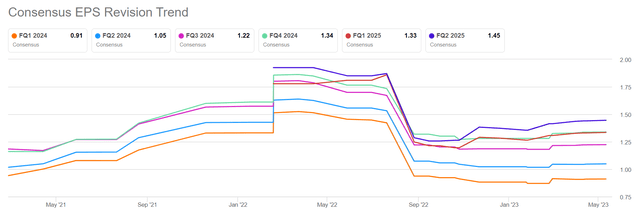

I would like to point out that the consensus revenue projections have consistently declined over the last 12 to 14 months, with current sales expectations falling around 30% below estimates made in May 2022.

Similarly, EPS expectations for Q1 FY 2024 have slumped. As compared to EPS of close to $1.5 predicted in early 2022, analysts now expect less than $1.

The Industry Is Still In A Slowdown

Although I appreciate that expectations have come down quite significantly, I think they are still somewhat too high, making it difficult for the chip designer to meet or even beat estimates, pointing out relatively weak Q1 results from AMD (AMD), Qualcomm (QCOM), and Intel (INTC).

A key argument why I see Nvidia’s Q3 financials at the lower end of consensus is anchored on my opinion relating to the outlook for data centers, where consensus estimates a 9% QoQ business expansion. However, while AI investments will likely result in a H100 product ramp-up long-term, implications from Microsoft’s (MSFT) and Amazon’s (AMZN) slowing cloud businesses paint a depressed picture for Q1/Q2 2023 cloud infrastructure investments.

Another key uncertainty factor for NVIDIA’s Q1 results and Q2 guidance potentially relates to a weak gaming sector, as discretionary consumer demand for game consoles, PCs, and smartphones remains sluggish.

Taking everything into consideration, I see Nvidia’s Q1 FY 2024 closer to $6.15 billion of revenues and $0.78/share of earnings, implying consensus downside of about 6% and 14% respectively.

Analyst Consensus; Author’s Calculation

AI Commentary Will Likely Not Be Enough To Support Confidence

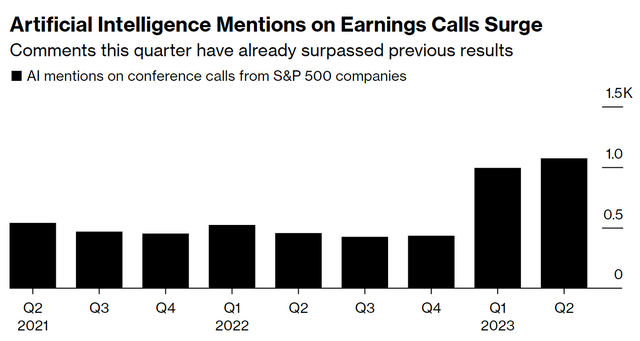

In my opinion, Nvidia will miss Q1 FY 2024 expectations relating to the company’s business fundamentals; and I argue that AI-related commentary will likely not be enough to support investor confidence at x85 FWD price per earnings valuations, given that investors are already pricing sky-high expectations relating to Nvidia’s AI business.

Moreover, I would argue that markets are already quite fed-up with the AI push in context of analyst conference calls. According to data compiled by Bloomberg, management of the S&P 500 companies has mentioned AI and AI-related initiatives 1,072 times in the Q1 reporting season so far. And in that context, Alphabet (GOOG) (GOOGL) has mentioned the AI keyword 50 times, Meta 49 times, and Microsoft 46 times.

Investors should also consider that AI-related commentary could skew to the downside, as Nvidia management could potentially highlight accelerating competition in AI tech development, for both silicon and software. In that context, investors should also not forget that the AI mania will likely prompt a wave of new market entrants and business partnerships amongst tech giants aimed at challenging NVIDIA’s dominant position in AI-related technology. As a validation of this argument, I would like to point investors’ attention to rumors about a potential partnership between Microsoft and AMD pursuing an AI-optimized silicon development project. And reportedly, Microsoft has already allocated a workforce of about 300 employees and approximately $2 billion of investments to AI chip initiatives, according to Bloomberg. In any case, in my opinion, it is only a matter of time until giants such as Meta Platforms (META), Google, and Amazon (AMZN) will push into AI chip development, adding to the already considerably competitive landscape in the chip industry.

Conclusion

Personally, I believe Nvidia will miss on Q1 FY 2024 analyst consensus expectations, given a likely worse-than-expected cloud infrastructure business, a still depressed consumer environment for gaming, and already sky-high expectations for AI commentary/opportunity. In detail, I model Q1 2023 topline for NVDA at $6.15 billion, versus $6.52 billion estimated by consensus (about 6% downside), and earnings at $0.78/share versus $0.91/share estimated by consensus (14% downside). Following a likely miss on revenue and earnings estimates, I believe Nvidia stock has room to trend towards about $250/share, which would imply a more reasonable P/E of close to x60, while still preserving an enormous implied growth premium.

As a short-term strategy, I am building bearish exposure to NVDA stock going into Q1 2024 buying time-sensitive put options. Given the speculative nature of options trading/speculation, I suggest investors consider 90/80%-moneyness call spreads with a June 16 expiration date, as they have the potential for an approximate 4:1 payoff if NVDA stock closes at or below $250/share, while limiting downside to the options premium paid.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is not financial advice, but expresses the opinions of the author only.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.