Mullen Automotive: Risk-Reward Is Unfavorable

Summary:

- Mullen Automotive ended Q1 with ~$116 million in cash as its net loss jumped to $114.9M.

- The company will likely need to raise additional capital soon as it invests in both R&D and manufacturing.

- Fundamentally, the stock will likely continue slipping in the long term. Technicals suggest that a short squeeze is likely.

Mario Tama

Mullen Automotive (NASDAQ:MULN) stock has crashed to a record low despite important milestones by the company. It has started vehicle deliveries and is on schedule to boost its deliveries later this year. Mullen’s development of its solid-state batteries in collaboration with Global EV Technology is coming along well, with recent testing results showing encouraging signs.

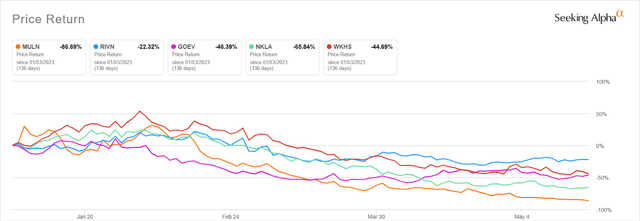

Mullen, like many other EV companies, has seen its stock crash by double-digits this year. As of May 5, the stock was down by over 85%, making it one of the worst performers in the industry, as shown below.

In all, Mullen shares have crashed by ~97% from its all-time high as investors question its business strategy, its balance sheet, and the overall state of the EV industry. Mullen’s crash has also coincided with the performance of other companies that went public through SPACs or reverse mergers. The S&P SPAC Index has dropped by ~28% in the past 12 months.

In 2022, Mullen made two acquisitions: Bollinger Motors and Electric Last Mile Solutions (ELMS) to boost its manufacturing capacity. While these acquisitions gave it important facilities and IP, they also left Mullen’s balance sheet dented.

Biting more than it can chew

Mullen Automotive is a cash incinerator whose prospects of breaking even are extremely narrow. The experience of most EV companies shows that many of them take many years before they break even after starting their vehicle deliveries.

For example, Rivian (RIVN), which is backed by Amazon (AMZN) started its vehicle deliveries in 2021. Rivian produced ~24k vehicles in 2022 and sold ~20,332 cars. Despite this progress, the company’s cash burn came in at a record $6.4 billion. Data compiled by Seeking Alpha shows that analysts expect Rivian will break even in 2027, six years after starting deliveries.

Lucid Motors, which burnt over $3 billion in 2022 and had to raise cash from Saudi Arabia, it biggest investor. Tesla, which is the most profitable company in the EV industry, lost billions before it turned profitable in 2020.

Therefore, despite its vehicle deliveries, I expect that Mullen Automotive will continue bleeding cash for several more years. Besides, the company has numerous projects in development that will need cash injection without generating any income.

For example, Mullen needs to spend huge sums for its Mississippi assembly plant that is set to become operational in July. If Mullen is correct, the plant should start making money by September this year. Based on its long record of missed guidance, Mullen’s estimates should always be taken with a grain of salt.

Mullen is still developing its battery technology, with testing using its Class 1 cargo van expected to take place in Q4. Other projects include Mullen Five family of crossover and Bollinger Motors Class 4 and 6 commercial vehicles.

Its Mullen Five SUVs will start at $55,000 and compete with vehicles from companies like Rivian and Tesla. The company is still designing the vehicle, which will be unveiled in next year’s CES event. It will take billions of dollars to compete with these companies.

Dilution to continue

The bottom line is that Mullen is building too many vehicles and has inadequate capital to achieve that. Historically, EV companies that have turned a profit like Tesla and Li Auto (LI) do so by focusing on one brand first and then using this cash flow to build other products.

Therefore, I believe that Mullen Automotive will need to raise additional capital in the coming months. In its most recent results, the company said it had over $116.1 million in cash for operations as of April 30 this year. It needs much more money than that considering that its top competitors like Tesla, Rivian, and Lucid have billions of dollars to deploy.

Mullen is still burning millions of dollars. In the first quarter, the company’s net loss attributable to shareholders came in at over $114 million. Therefore, even if it reduces its Q2, its loss will reduce its cash and short-term investments substantially.

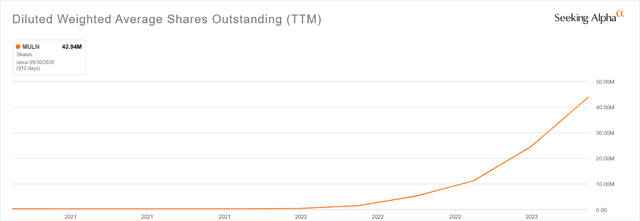

Mullen has historically funded its business using convertible bonds and stock sales. As shown below, the company’s diluted weighted average outstanding shares have jumped from 207k in 2021 to over 43.9 million today. With Mullen’s stock sitting at a record low and its market cap coming at $162 million, there are limits on how much money the company can raise.

Mullen has another source of cash: its orders. In its recent report, Mullen said that its order from Randy Motor Corporation stands at $279 million. This is important since Randy is the primary buyer of its product, which is risky in the first place.

Randy Motors has not paid for these orders, as evidenced by its most recent results when the company did not publish any revenue figures. Even if Randy Automotive provided the entire $279 million, Mullen would still need to raise capital because it is losing millions of dollars per month.

The other alternative for raising capital is through debt. With interest rates at an elevated level and bank liquidity tightening, Mullen will likely struggle to raise cash cheaply.

Mullen faces several other challenges in its business. The most important one is the competition across its key segments, especially its Mullen Five product. Companies like Tesla, GM, Ford, and Rivian are all in a better stage than Mullen and other EV upstarts.

MULN stock is oversold but risky

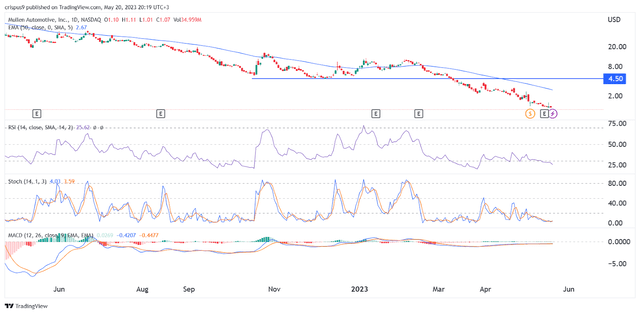

The daily chart shows that MULN stock has been in a freefall in the past few months. It attempts to rebound have always been met with more selling pressure. As a result, the shares remain below all moving averages and the important support at $4.50, the lowest point on December 2.

Oscillators like the Relative Strength Index (RSI), Stochastic Oscillator, and the MACD show that the shares are still in the oversold territory. Therefore, with the stock in an oversold zone, some buyers could be tempted to buy.

However, in this case, I believe that Mullen Automotive is a value trap whose shares will likely continue falling as investors price in another dilution in the coming months. If this continues, the shares will likely drop below $1 again, which will likely trigger another reverse stock split if the bid remains below $1 for 180 days.

Risks to thesis

The main risk to the bearish thesis is that the cheap stock price could attract buy-the-dip traders who could trigger a short-squeeze, which I warned about in this report. This is likely since Mullen is one of the most popular meme stocks on Wall Street. Therefore, while the shares have more downside fundamentally, we can’t rule out a situation where it rebounds albeit briefly.

The other risk to the bearish case is where the company’s business strengthens. Some of the likely scenarios is where it makes a breakthrough in its battery business and where it receives a major purchase order.

Summary

Mullen Automotive is biting more than it can chew by investing in numerous vehicle brands while burning millions of dollars every month. Its path to profitability – if any – is substantially long based on expectations of other well-known EV companies like Lucid and Rivian. Also, based on the ongoing cash burn, I suspect that the company will need to raise cash soon.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of MULN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.