Summary:

- Meta stock has rallied massively, almost doubling year-to-date. The stock is significantly above last year’s levels after a massive selloff on the panic regarding the Metaverse capex.

- The management implemented several cost optimization initiatives which improved the company’s short-term financial performance and are likely to save even more money as severance costs will diminish.

- My valuation suggests the stock is still undervalued even after a massive year-to-date rally.

Chip Somodevilla

Investment thesis

My initial analysis of Meta (NASDAQ:META) stock worked well, rallying more than 25% during the last few months. I am still bullish on the store given its very attractive valuation, its strong position in the secular shift toward digitalization, and new opportunities arising from artificial intelligence (AI) solutions.

Recent developments

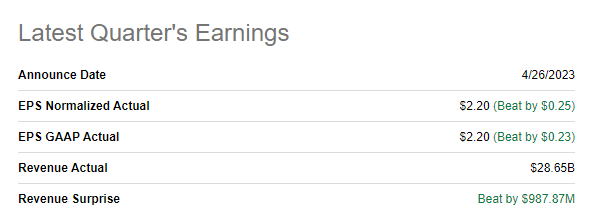

The company reported its latest quarterly earnings on April 26, beating consensus estimates in revenue and EPS.

Seeking Alpha

Following a series of declines in the three preceding quarters, sales increased by 3% YoY. Unfavorable currency effects negatively impacted sales, reducing them by $816 million or three percentage points.

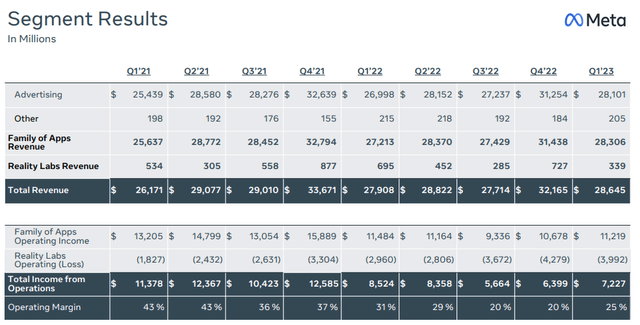

Meta’s latest earnings presentation

In Q1 2023, revenue from the flagship “Family of Apps” segment increased by 4%. This growth was due to a 4.1% increase in advertising revenue, which reached $28.1 billion. This performance represents a significant improvement over the declines seen in the previous three quarters. I would also like to underline that the average price per ad decreased by 17%. However, what is crucial, the decline in cost per ad was offset by a significant 26% increase in the number of ad impressions, which is a more critical metric for evaluating overall advertising performance, in my opinion.

Despite challenges such as pressure on overall pricing due to business expansion in regions with lower monetization, currency devaluation, and advertising demand, the management is highly convinced that its improved targeting and measurement strategies will consistently deliver positive results for advertisers. The company’s leadership is consistent in its expectations, mainly due to the focus on increasing efficiency, which we already saw in two rounds of layoffs: last November and in March 2023. Also, it was recently confirmed that there will be a third round of layoff with 6,000 more jobs to be cut. These measures enabled Meta to lower its 2023 expense guidance for the second time, this time to $86-92 billion, down from a prior $89-$95 billion and an original forecast of $94-$100 billion.

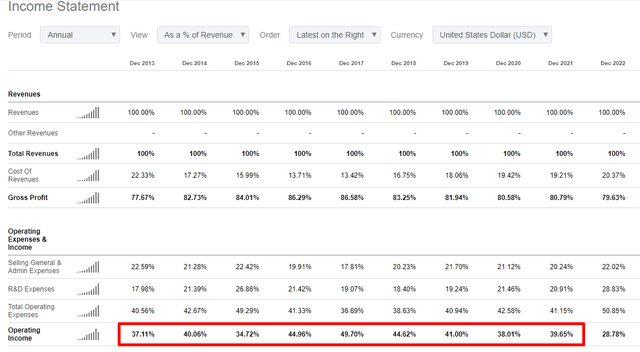

Overall, I look very positively at Meta’s cost-cutting initiatives to deliver increased shareholders’ value and to return to its path of stellar profitability, which we have seen for a long time except for the last fiscal year.

Another excellent news for me as a Meta investor is the potential ban of the major competitor, TikTok, in the U.S. Last week, Montana’s governor banned using TikTok across the state. There will likely be a powerful tailwind for Meta if the ban unfolds across other states. I believe geopolitical tension between China and the most developed countries makes the probability of a TikTok ban across the developed world much higher than zero.

Overall, I believe that a very tough 2022, when Meta suffered from the bad press due to rapidly rising costs, was a good lesson for management. This year, the company is striving towards its “Efficiency Year“, and I consider the momentum is strong for Meta.

Valuation update

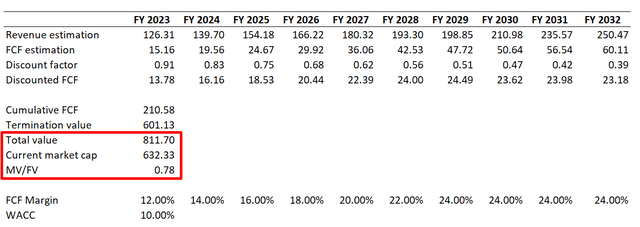

For valuation, I use discounted cash flows [DCF]. Meta’s earnings consensus estimates have been revised upward, so I should update my last valuation analysis to determine how the fair value looks. Also, I use a more conservative FCF margin of 12%, which I expect to expand by two percentage points yearly until it reaches 24% in FY 2029 and then stay flat. The discount rate is also revised by using a more conservative WACC at 10%, given the high Fed rates environment with little clue about the Fed’s “pivot” timing.

Incorporating all revised assumptions into the DCF template gives me a fair value of Meta’s business at above $800 billion, which means that substantial upside potential remains.

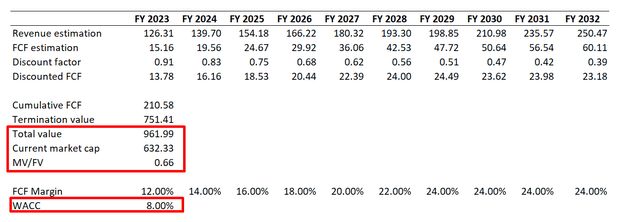

I would also like to simulate DCF valuation with a softer WACC since the era of low rates will return, as history suggests. Let me simulate an optimistic scenario with 8% WACC. It affects fair value massively, expanding fair value closer to $1 trillion, and Meta was already in the “trillionaire’s club” during the 2021 rally. Therefore, returning to the club is just a matter of time for Meta, given underlying solid fundamentals.

Overall I have high conviction that Meta’s stock has vast upside potential even under conservative assumptions. Please also keep in mind that my DCF incorporates only growth expected from the expansion of the digital advertising business, and potential moonshots like Metaverse are not even included.

Risks update

Apart from the demanding macro environment, which includes potential recession and credit crunch, I see legal risks as the most significant for Meta. As a digital advertising company and, by far, the most prominent social media family, Meta is subject to a vast number of regulations both in the U.S. and worldwide. Meta was fined a record $1.3 billion this week for violating EU privacy rules. Besides the fact that it is a substantial amount, such fines also add reputational risks to Meta. Especially when we speak about the privacy of users. The company holds many users’ private data, so this risk is substantial.

We have also seen in recent years that Meta’s business can be affected by disruptors like TikTok. In 2022, Mark Zuckerberg admitted that his company has been facing “unprecedented competition” from TikTok. Indeed, Meta managed to cope with it by implementing TikTok-like features in its social platforms. Still, we have to underline that the case with TikTok means that Meta’s over 3 billion users are not a guarantee of high barriers to entry for new players.

As I highlighted in recent developments, there is a possibility that TikTok will be banned in the U.S. with a precedent in Montana, which has already happened. While the TikTok ban is suitable mainly for Meta since it will decrease competition, this might also mean that Meta’s social networks might be banned sometime in the future if the U.S. government or local state authorities decide that there is a threat to the security of the country. Despite being remote, this risk’s impact will be massively adverse if it unfolds.

Bottom line

Meta stock is still a buy even after a massive year-to-date rally. The company is well-positioned to capture a secular shift to digital and social media advertising. Moreover, I would not underestimate the company’s ability to deliver new products and services to the market, given Meta’s strong business expansion history. The stock is still a strong buy, in my opinion.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.