Summary:

- Tilray Brands’ shares plunged 21.2% on May 26th after the company priced $150 million worth of convertible senior notes.

- The new issuance is likely to cause significant dilution and increases the probability of the notes being converted.

- Despite the decline in price, the company’s financial condition continues to deteriorate, making it a decent ‘sell’ candidate.

Michael Fischer

May 26th was a rather painful day for shareholders of cannabis company Tilray Brands (NASDAQ:TLRY). After news broke that the company had priced $150 million worth of convertible senior notes, shares of the company plunged, falling down 21.2% for the day. This is not the only pain that the company has experienced recently. So far this year, the stock is down 32.4%. And from its 52-week-high, it is down an impressive 63.7%. By this point, many of the firm’s advocates might be thinking that now is a good time to buy in. But between this rather painful decision that management made, and a continued deterioration of its fundamental condition, the company is a decent ‘sell’ candidate at this time.

A painful decision

On May 25th, the management team at Tilray Brands announced that they were offering $150 million worth of unsecured convertible senior notes to investors. This was followed up one day later with the details of how those notes had been priced. According to the press release issued by the company, the firm is issuing $150 million worth of notes that will come due in 2027. They will have a fixed interest rate of 5.20%. And, if there is enough demand such that an overallotment scenario develops, the firm will issue up to another $22.5 million worth of notes under the same terms to its underwriters. After factoring in fees, the company is expecting net proceeds of $144.8 million. If the overallotment is successful, this can grow to as much as $166.6 million. For the purpose of this article, I’m going to assume that the overallotment is filled entirely.

At face value, this does not seem all that bad. After all, the fixed interest rate is quite low for a company in its condition and in this environment. What makes it even better at face value is what this cash is being used for. You see, management intends to repurchase $12.5 million of its 2023 convertible notes and $122.5 million of its 2024 convertible notes. These carry interest rates of 5% and 5.25%, respectively. And when you do the math, the effective annual interest payments that the company will be responsible for solely on the amount of debt that it is using to pay off these notes is essentially the same as what it was paying on them. So what this looks like is a simple refinancing that helps to push off principal repayments into the future a few years. It is worth noting that the ultimate price being paid for these notes is $12.6 million and $125.7 million, respectively, with the difference between that and the principal repayment in the form of accrued but unpaid interest.

What becomes problematic is when you look deeper into the picture. For starters, this new issuance is certain to carry with it significantly greater dilution. The original 2023 convertible notes were set up to convert at $167.41 per share. That translated to 5.9735 shares for every $1,000 of principal that was issued. The 2024 convertible notes were set to convert subject to an effective price of $11.20 per share. By comparison, the price set for these new notes is only $2.66. What this means is that, upon conversion, shareholders are giving up a much larger size than the pie than what they otherwise would have. They are also increasing the probability that the notes are ultimately converted.

Outside of the conversion issue, there is another problem with this transaction. But it’s rather an intriguing one. In order to hedge its bet, the investors who are issuing these notes are borrowing 38.5 million shares of common stock from Tilray Brands. Almost certainly, the goal of borrowing this stock is to sell it, take the cash, and invest it in some other way. This is interesting because it allows them to essentially lock in a price on a sizable chunk of the stock that they would be normally entitled to. For instance, if they are able to sell the shares for a weighted average price of $2, that would bring in $77 million. Without factoring in the possibility of reinvesting it, this would provide $77 million worth of guaranteed capital should Tilray Brands experience a significant decline in share price. For instance, if the stock ends up falling to $1, then downside protection of $38.5 million will have been afforded. The downside to this, obviously, is that significant downward pressure in the shares of Tilray Brands is almost certain to take place. With the stock falling already in response to this development, the market is pricing in the selling pressure that should be associated with the unloading of this extra stock onto the market.

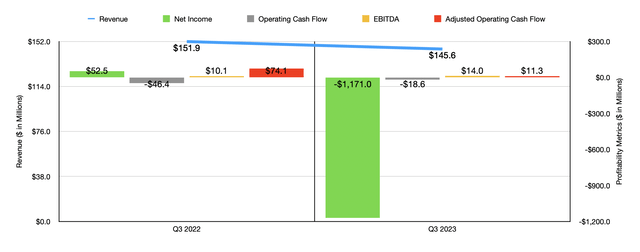

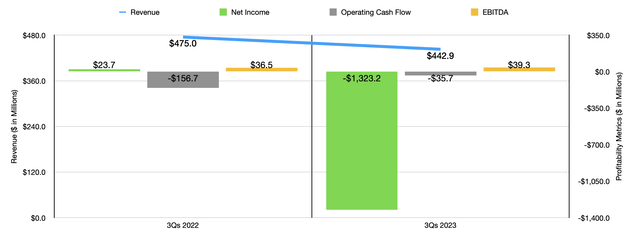

This refinancing looks awfully painful when you understand these deeper details. But it might be okay if the financial condition of the company was looking better. Consider recent financial performance achieved by management. In the chart above, for instance, you can see financial performance covering the third quarter of the company’s 2023 fiscal year compared to the same quarter last year. And in the chart below, you can see financial results covering the first nine months of the 2023 fiscal year relative to the same time last year. Almost across the board, the company has seen downside pressure when it comes to revenue. This is especially true of cannabis revenue. In the most recent quarter, for instance, cannabis revenue totaled $47.5 million. That’s down substantially from the $55 million reported one year earlier. The only bright spot for the company for the first nine months of 2023 seems to be net beverage alcohol revenue. This shot up from $48.8 million to $62.7 million. But even this was not because of organic growth. Rather, it was largely because of the company’s purchase of Montauk in November of last year.

The bottom line for the company has been, admittedly, quite mixed. We see a massive net loss in the most recent quarter, totaling $1.17 billion. But that’s largely because of a $1.12 billion impairment charge. Cash flow data is better. Operating cash flow, for instance, went from negative $46.4 million in the third quarter of 2022 to negative $18.6 million the same time this year. But if we adjust for changes in working capital, it would have worsened from $74.1 million to $11.3 million. Over that same window of time, EBITDA for the company inched up from $10.1 million to $14 million. Bottom line results for the first nine months of the year were just as volatile as what they were for the third quarter alone.

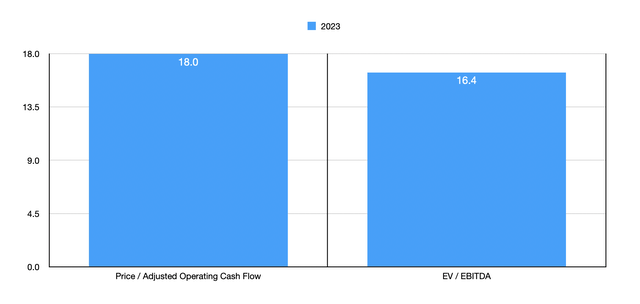

Usually when I see volatility like this on the bottom line, you have a scenario where management makes it worse by not providing any guidance. But this is an exception. According to management, EBITDA this year should be between $70 million and $80 million. If we take the midpoint, that would imply an EV to EBITDA multiple for the company of 16.4. And if we factor in interest expense to the picture to turn EBITDA into a proxy for operating cash flow, we would get a price to adjusted operating cash flow multiple of 18. Some investors might point out that Tilray Brands’ pending purchase of HEXO Corp (HEXO) could help change things considerably. After all, management is forecasting pre-tax cost synergies from that transaction of $25 million. But with that enterprise generating a net cash outflow in its most recent completed fiscal year of nearly $84 million, I don’t see that as a positive.

Takeaway

Right now, Tilray Brands is experiencing a great deal of pain. And frankly, the company deserves it. This is not a great move for the firm to be making. But at the same time, with debt maturities coming due, I can understand why management has done what they’ve done. If shares of the company were trading at very cheap levels, I could see this maybe making sense. But because of how shares are currently priced on a forward basis, I can’t see this generating any meaningful upside for the foreseeable future. In fact, I would go so far as to say that, even in spite of the decline in price, the company might warrant even further downside. As such, I’ve decided to rate it a soft ‘sell’.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!