Summary:

- Tilray prices $150 million convertible debt offering.

- TLRY shares plunge to new low under $2.00.

- Tilray Brands’ revenue target does not look obtainable.

DNY59

Last Friday, Canadian cannabis firm Tilray (NASDAQ:TLRY) was one of the market’s biggest losers. Shares fell more than 21% on the day, plunging to a new low, after the company priced a $150 million offering of convertible notes. While the name has made a decent move to improve its balance sheet and financial flexibility, investors hoping for major upside here continue to be disappointed.

It was just about a year ago when my latest Tilray article was published, at that time talking about a new high in short interest for the stock. Those that bet against the stock at that time have been rewarded nicely with shares down more than 55%. Since then, we’ve seen the number of shares short come down by about a third, with the latest update from NASDAQ showing less than 50 million shares short at the middle of May update.

Last week, the company priced $150 million of convertible debt at a 5.20% annual interest rate, maturing in 2027, and underwriters will have the option to buy up to an additional $22.5 million. Most of the funds will be used to repay other convertible borrowings that mature this year and in 2024. While the company noted that it will lock in a lower rate as compared to the 2024 offering, this new deal will result in a slight increase in total interest expense mainly due to its size.

Tilray will have more cash on hand, however, so it could in theory reinvest some of that in short term cash equivalents and earn some interest back in the near term. At the end of the February quarter, the company had $408 million in cash and short term investments. On the other side of the balance sheet, there was almost $600 million in total debt reported.

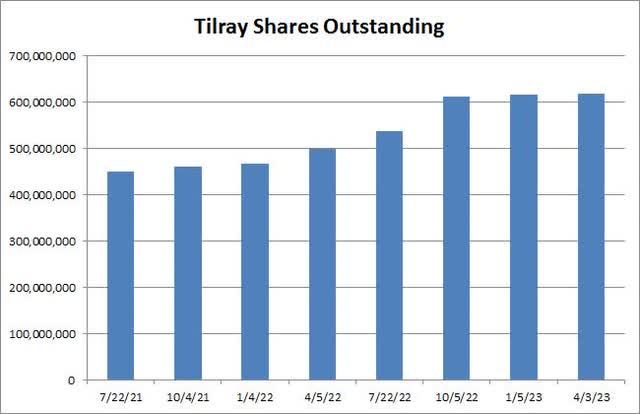

The initial conversion rate for shares is $2.66. While on a percentage basis that’s well above Friday’s close, it’s still a world away from the $300 peak that Tilray once traded at during the cannabis euphoria days. If those notes do get converted, it would mean tens of million shares of dilution to clear the debt. As the chart below shows, Tilray’s outstanding share count has surged in the past couple of years, and this is after the Aphria deal. The number of shares was well below these levels before that merger was completed.

Tilray Shares Outstanding (Company Filings)

The bigger problem though for Tilray is that the company’s major growth plan has just not materialized as hoped. Efforts to federally legalize cannabis have not been successful to date, despite numerous efforts and a good portion of US states approving it at the state level. Tilray management had previously planned to get to $4 billion in revenue by 2024, but unless we see some incredibly dramatic improvement in a very short time, that number is just a dream at the moment.

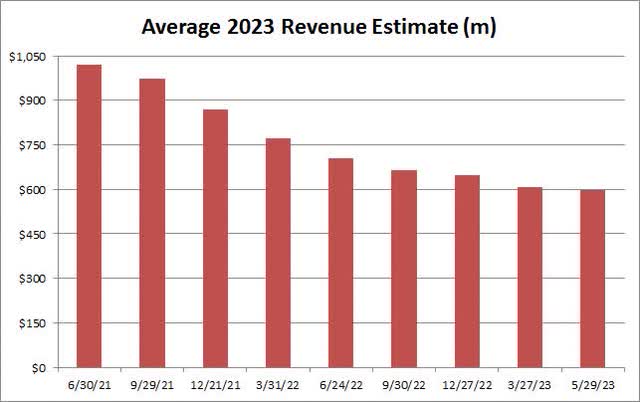

To illustrate just how bad the revenue picture is, Tilray has missed street revenue estimates in 7 of the past 8 fiscal quarters. That has resulted in a dramatic reduction to analyst estimates for the current May 2023 fiscal year. As the chart below shows, the street average has come down by more than 40% since just after the Aphria deal was completed.

Analyst Revenue Average (Seeking Alpha)

The current expectation is for revenues to decline by almost 5% year over year for Tilray. The company lost over $1.3 billion in the first nine months of the fiscal year, but the majority of that was due to an impairment charge. These losses have resulted in a little bit of cash burn, with more cash used for acquisitions, even with some purchases being done via equity.

Interestingly enough, analysts are quite positive on the stock. The average price target of $3.52 implies about 90% upside from last Friday’s close. However, that average was approaching $9 just a year ago, and it was in the low $20s right after the Aphria deal went through. The stock was very close to its 50-day moving average of a little less than $2.50 recently, but last Friday’s drop will send that key technical line heading lower in the coming weeks.

In the end, Tilray shares dropped to a new low last week after the company’s convertible debt deal. The move will push out the maturity of some borrowings by a few years, but with a slightly higher total interest cost and the potential for sizable dilution. Right now, the main problem though is in regards to revenue generation, which continues to disappoint almost every quarter. Until Tilray gets its sales growth path back on track, investors won’t see the tremendous upside that many are hoping for.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.