Summary:

- Tesla, Inc. plans to invest billions of dollars to increase its cell production to support the growing market for grid-scale energy storage systems.

- While lithium-based energy storage systems have proven to be cheaper than fossil-fuel peaker plants, this doesn’t mean they’re the best stationary storage solution.

- As cheaper energy storage systems gain traction, Tesla may be left with nothing to show for its massive investments in stationary storage manufacturing.

Bilanol

At the Tesla, Inc. (NASDAQ:TSLA) Investor Day event a couple of months ago, the company unveiled the third iteration of its Master Plan, highlighting how it envisions the world might transition to net-zero. One of the cornerstones of that plan is the advancement of stationary storage deployments, with products such as the Megapack. This article will take a closer look at those plans and discuss why I believe these ambitions may be misguided.

Tesla’s Plans

To introduce the Master Plan, CEO Elon Musk presented the issue of battery energy storage. According to Tesla, the world will need 240 TWh of battery energy storage in order to achieve carbon neutrality. Musk goes on to clarify that this is a combination of electric vehicles (“EVs”) and stationary storage, with a need for 24 TWh of stationary storage capacity.

Tesla itself wants to reach a place where it is able to produce at least 1 TWh of batteries per year. It’s unclear how much of this is for batteries versus stationary storage, but it seems fair to assume that the company is hoping to increase its capacity to at least 500 GWh for stationary storage. That won’t come cheap.

It’s estimated that new battery facilities cost around $60 million per GWh, though, Tesla seems to believe it can do it for around half of that. Even with Tesla’s ambitious cost target of $33 per GWh, it estimates that it will cost around $800 billion to create the manufacturing power necessary for the deployment of 24 TWh.

To reach 500 GWh, Tesla’s looking to spend over $16.5 billion and, to reach its short-term goal of 40 GWh per year, the company will need to spend in excess of $1.32 billion.

With research indicating that lithium-based energy storage systems are around 30% cheaper than gas-powered peaker plants when it comes to filling in for energy demand intermittencies, Tesla’s massive investments here seem to make sense. However, there are a number of other methods of storing energy, other than using lithium-based chemistries, that may be able to bolster profitability even further.

An Issue of Chemistry

At a chemical level, lithium is simply not optimized for stationary storage. Its high electrochemical potential means it can store more energy per unit of mass than any other element, making it the perfect chemistry when weight and space are at a premium. While those are two of the most critical issues to solve for an EV, they’re not at the top of the list for stationary storage, especially at the grid level.

Instead, upfront cost becomes, by far, the most critical factor, followed by stability. A more stable cell lowers operating costs by reducing on-site infrastructure, such as climate control systems, and improves operational efficiency, thus improving profitability. More stable batteries will also need to be replaced less frequently, again reducing the required capital investments.

Power density is also important, but very few battery chemistries would struggle to meet the requirements. As opposed to energy density, which measures how much energy can be stored per unit of mass, power density measures how quickly a battery can be charged or discharged. Power density can impact a system’s operating efficiency, especially during rapid fluctuations in electricity demand.

If we look at lithium-based batteries, some of their greatest flaws are cost and stability. At this point, there isn’t a whole lot that can be done about the cost of lithium-based batteries. Raw materials now account for over 80% of the cell, implying a pretty efficient production process. As raw material prices remain elevated, they will likely offset any further gains in manufacturing efficiency.

The internal stability of lithium batteries is also quite poor. While iron-based chemistries, namely LFP, will likely be the lithium chemistry of choice for stationary storage, due to its low cost and high stability relative to other lithium chemistries, it too is far from perfect.

Saying that it has the best stability and cost of other lithium chemistries is really just saying that it’s the least bad option of this battery group. An LFP cell lasts no more than 10 years in grid applications and their ideal operating window is between 0°C to 40°C, with a maximum temperature of 60°C.

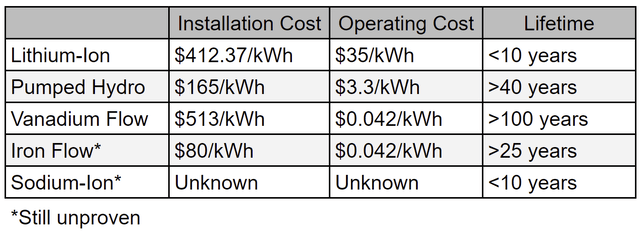

The National Renewable Energy Laboratory (“NREL”) estimates that it will cost ~$35 per kWh each year to maintain and operate a lithium-ion battery in a grid system. While that may seem inconsequential relative to the large upfront cost of $412.37 per kWh for a Tesla Megapack, other systems are far cheaper to run. Furthermore, as battery costs fall, this figure will begin to represent a greater portion of the lifetime cost of operation.

Superior Alternatives

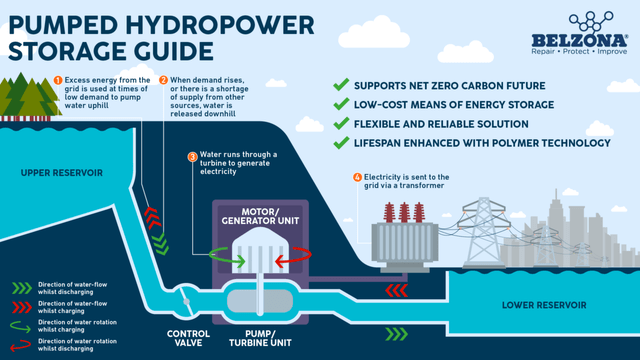

A more comprehensive review of alternative storage systems is available to subscribers of Green Growth Giants and GGG Lite, but I’ll cover the basics here. When space and weight aren’t a premium, we can completely rethink the classic concept of a battery. When we do that, we get solutions like pumped hydro.

As the name suggests, during times of excess electricity generation, water is pumped from a lower reservoir into an upper reservoir. When the grid needs more electricity, the water from the upper reservoir is released, going back down to the lower reservoir and spinning a hydroelectric turbine on its way. It’s the same way a hydroelectric dam generates power, but now with an added storage capability.

More importantly, pumped hydro stations cost an average of $165/kWh to install, or as low as $100/kWh when the geographical conditions are more favorable. Furthermore, with an operation cost that’s usually just about 2% the cost of installation, your average pumped hydro facility will run you just $3.3/kWh per year to operate. Finally, whereas lithium-ion batteries typically need to be replaced at least once every ten years, a pumped hydro facility could easily operate for at least 40 years.

While pumped hydro isn’t perfect, the biggest issue being its geographical limitations, it is a significantly better option for large-scale energy storage than lithium-ion.

For companies looking to deploy energy storage systems that are co-located with renewable power generation, vanadium flow batteries offer a chemical-based alternative to lithium-based chemistries. In a standard lithium-ion battery, there are four primary components. A solid cathode, an anode, a liquid/gel electrolyte, and a solid, semipermeable, membrane.

These four components work together to store electricity, facilitating a controlled discharge when needed. The redox flow battery has a bit of a different structure.

The electrolyte is split into two different solutions, the catholyte and the anolyte. These are stored in separate tanks, separated in the middle by one or more cell stacks. The cell stack contains a porous electrode, to allow the flow of the solutions, as well as a separator to prevent mixing of the solutions.

The catholyte and anolyte solutions are pumped into the cell stack, cycling into the bottom of the electrode to eventually make its way back into the top of their respective storage tank. The catholyte side of the cell stack’s electrode is the battery’s cathode, while the anolyte side houses the anode.

The power and energy capacity of the overall system is highly modular and can be altered to fit the project’s needs. By adding more cell stacks, operators can increase the power capacity of their battery. By increasing the size of the two electrolyte tanks, operators can increase the energy capacity of their battery.

As a reminder, power is a measure of the rate at which electricity can flow, while energy is a measure of the total quantity of electricity that can be stored. Think of power as the width of the hose, with energy being the reservoir the hose is connected to.

Determining the lifetime of a vanadium flow battery is a bit difficult because most manufacturers assign 25 year warranties for their product, but the system can, theoretically, last forever. The battery’s primary component, the electrolyte, can last upwards of 100 years, though some more minor components may need to be replaced intermittently.

In other words, unlike lithium-based batteries, these batteries will maintain the same capacity over their lifetime, limited by equipment rather than chemical degradation.

However, vanadium’s high sticker price does reduce its utility compared to a lithium-based system a bit. At $17 per kg, the cost of vanadium brings the overall cost of a vanadium flow battery anywhere from $475/kWh to $550/kWh. However, with almost no regular maintenance, costs are limited to conversion inefficiencies, which works out to be about $.042/kWh.

So, with significantly lower operating costs, and a much longer lifetime to expense the battery, vanadium flow batteries are still a cheaper option than lithium-ion over the course of their life.

Alternative flow systems, such as ESS Tech, Inc.’s (GWH) iron-based flow battery, seek to overcome the initial cost issue while retaining many of the same advantages, their utility has yet to be proven at scale. Furthermore, unlike vanadium flow batteries, iron flow batteries lose capacity as the catholyte and anolyte mix over time. As such, the fluid needs to be replaced every 25 years, according to ESS Tech.

Still, given the low cost of iron, this is a far cheaper solution over the course of each battery’s life. Rather than spending up to $550/kWh for a vanadium system, ESS plans to be able to install its iron-based systems for just $80/kWh. Operating costs are about the same as a vanadium-based system too, so it’ll be interesting to see if ESS can get off the ground.

Sodium-ion batteries may also prove to be a viable replacement for lithium-ion batteries. While their inferior energy density (~160Wh/kg according to CATL) may make it hard for them to catch on in the automotive industry, their lower cost may present a much greater opportunity in the stationary storage market.

Contemporary Amperex Technology Co., Limited (300750.SZ) (“CATL”) expects their cells to initially cost around $77/kWh, but it sees a path down to $40/kWh. While the battery cell is just one component of a larger energy storage system, lithium-ion battery cells still hover around the $100/kWh mark. I would expect the remaining ancillary components to have a similar cost, meaning the lower cell cost of sodium-ion batteries should result in a notably lower overall system cost.

So, while it’s unclear what the overall cost of a grid-scale sodium-ion battery may be, it does seem fairly apparent that it is better positioned for stationary storage than lithium-ion.

There are a few other technologies that could become important parts of the energy storage picture, such as compressed air energy storage and hydrogen, but they’re geared more toward long-term storage and, as such, aren’t really competitors with lithium-based solutions. For that reason, I’ve excluded them from this analysis.

Summary of Findings

As we take a look at the figure below, it should become fairly evident that lithium-ion, while great for EVs, may not be the best option for stationary storage. Its high installation cost, coupled with a short lifespan, makes it one of the costliest options available. While its high power density may make it an okay choice for short-duration storage, under four hours, sodium-ion batteries look to challenge this as well.

However, despite its many shortcomings, one advantage that remains present for lithium-based chemistries is the existing industry for the technology. The EV market has created a massive industry to support lithium-ion manufacturing at a level that simply doesn’t exist for any of these other technologies. That makes it far easier for companies to get their hands on lithium-based storage systems, which can be critical in avoiding multi-year delays that may come with other technologies.

In other words, it may not matter if lithium-ion batteries aren’t the best solution if they’re the only solution that customers can get their hands on.

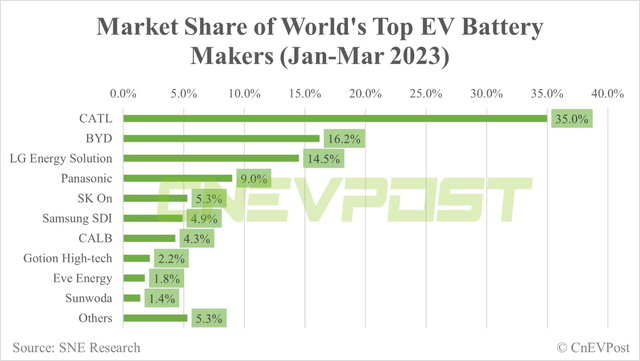

That being said, while sodium-ion batteries are still a very new technology, it’s introduction has largely come by way of CATL. The Chinese battery company dominates the global battery market with a 35% market share, almost double that of BYD Company Limited (OTCPK:BYDDF) in second place.

With that kind of manufacturing power behind it, CATL looks set to produce sodium-ion batteries at a significant scale. So, as far as availability is concerned, lithium-ion batteries might not have as long of a runway as it may seem today. Couple this with a looming lithium shortage and the case for sodium-ion adoption only grows.

Investor Takeaway

I wouldn’t argue that stationary storage is currently a key element of the Tesla, Inc. business, but the automaker is poised to make massive investments in an effort to change this. Unfortunately, the way its plans are currently laid out, I don’t foresee Tesla achieving long-term success with its vision in this sector.

Instead, given the high upfront capital investment, this growth plan may end up being a massive source of wasted capital for Tesla, with the company ultimately unable to live up to the expectations it has set for investors.

While Tesla, Inc. maintains an impressive hold on the EV market, the company’s current valuation is based on extreme growth that can only come from other business ventures. Tesla Energy is one of those ventures that has been hailed as an area for explosive growth. Unfortunately, I don’t really see a scenario in which the business is able to achieve the success that Tesla, Inc. has conditioned investors to expect.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Now, for a limited time, you can get one year of Green Growth Giants Lite for just $99! GGG Lite is an entry-level subscription for investors looking to explore the decarbonization economy, a rapidly growing industry birthed from calls around the world to rein in carbon emissions. Subscribe to GGG Lite now for access to my first stock pick later this week and to see why subscribers of Green Growth Giants rate it 5 stars!