Summary:

- Meta Platforms is up well over triple-digits from lows.

- The company is showing resilient revenue and user growth in spite of a tough macro environment and stiff competition.

- I discuss the potential ramifications of the shift in capital allocation strategy.

- The stock remains deeply undervalued, in light of the rapidly evolving thesis – I reiterate my strong buy rating.

grinvalds/iStock via Getty Images

Meta Platforms (NASDAQ:META) has finally found its groove. Just one year ago, between META, Alphabet (GOOG, GOOGL), and Amazon (AMZN), I would have not expected META to be the strongest performing stock. META seemed to have the highest risk due to its market positioning, but the stock has nonetheless outperformed due to management’s surprisingly aggressive commitment to operational efficiencies. After a thunderous rally from the lows, META stock might not look so cheap anymore based on trailing earnings, but earnings are set for considerable growth as the company reaps the benefits of a leaner cost structure. I am also warming up to the long-term opportunity of the metaverse, and management appears to have struck an optimal balance between investing for growth and doing right by shareholders. The hardest part in investing can oftentimes be holding on to one’s winners, especially as the stock price rewards a developing thesis. I reiterate my strong buy rating for the stock.

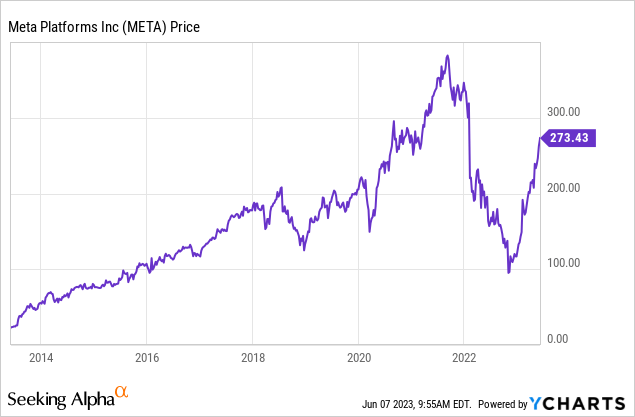

META Stock Price

It may be hard to believe, but META has made up much of the losses it suffered during the tech crash.

I last covered META in March where I rated the stock a strong buy even as the stock was already up triple digits from the lows. The stock has since returned another 38%, but I continue to maintain my bullishness. The stock should never have gotten as low as it did, and it is now making up ground.

META Stock Key Metrics

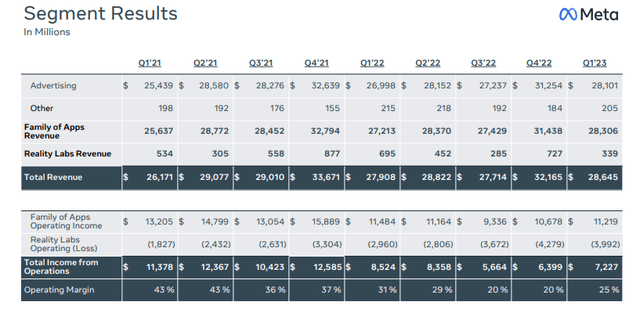

In its most recent quarter, META delivered surprisingly resilient growth, with revenues growing 2.6% to $28.6 billion. That came above the high end of management’s guidance of $26 billion to $28.5 billion.

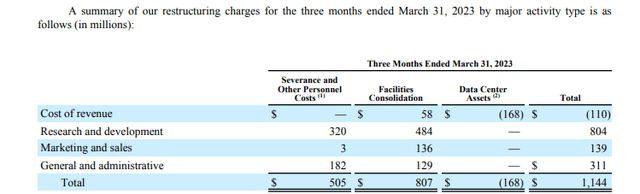

The operating margin declined 600 bps to 25%, but that included 400 bps of headwinds from restructuring charges. Management noted that they expect to record around $1 billion of restructuring charges as a result of the layoffs announced in March. The company recognized $523 million of those charges in this past quarter.

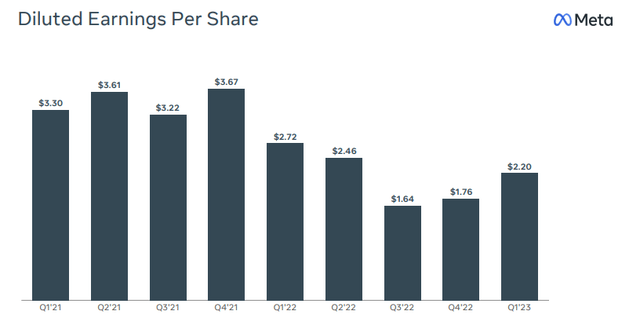

Excluding the restructuring charges recognized in the quarter, diluted EPS would have been 20% higher at $2.64. Operating margin would have declined by only 100 bps, which is arguably a strong result considering that Reality Labs losses increased by $1 billion.

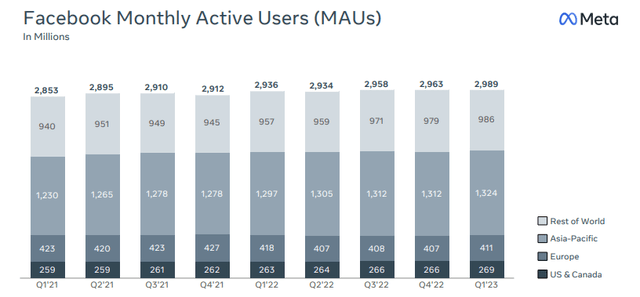

META also showed solid business fundamentals, with Facebook monthly active users (‘MAUs’) growing 0.9% sequentially. It was only four quarters ago that MAUs declined sequentially, and the market seemingly gave up on the stock.

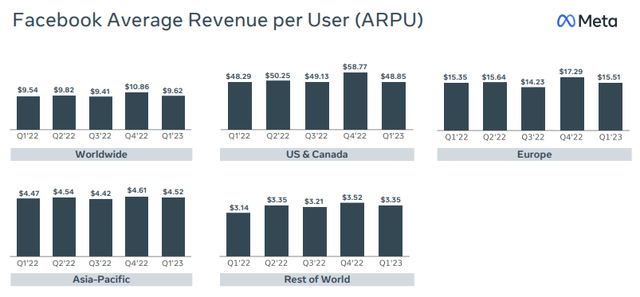

Also impressive, META was able to slightly increase its average revenue per user (‘ARPU’) on a worldwide basis. These are very strong results considering the tough macro environment.

META had previously been seeing considerable headwinds from its increasing adoption of Reels, as the new video format has a lower rate of monetization. On the conference call, management cited the “structural supply constraints” due to the greater engagement associated with Reels, but is still guiding for Reels to be neutral to revenues within three to four quarters.

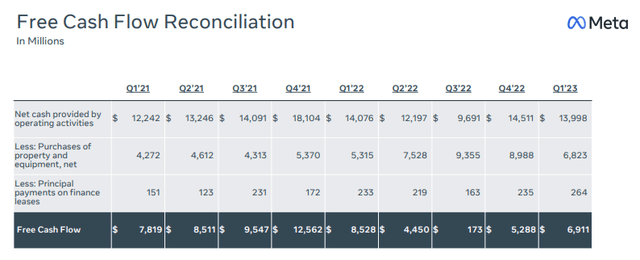

The company generated $6.9 billion in free cash flow in the quarter yet repurchased $9.22 billion of stock – showing clearly management’s commitment to the share repurchase program.

META ended the quarter with $37.44 billion of cash versus $9.92 billion of debt, as well as $6.2 billion in privately held securities. Management made a surprising and somewhat overlooked comment regarding their capital structure, stating intentions to maintain a “positive or neutral net cash balance over time.” In plain English, that means that management is willing to issue debt to fund accelerated share repurchases. For an illustration of how much this could boost the stock price, just look at the tape action of Apple (AAPL). If investors were concerned that heavy investment in Reality Labs would take away from shareholder returns, then those concerns have now been thoroughly addressed.

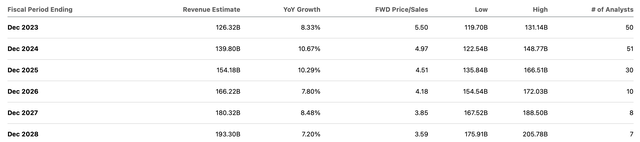

Looking ahead, management has guided for revenue between $29.5 and $32 billion. The high end of that range implies double-digit YOY growth, with management justified as being due to the fact that this will be the first comparable quarter without Russian revenues.

Management reduced their full-year operating expense guidance to between $86 and $90 billion, which is inclusive of $3 to $5 billion of restructuring costs and is down from the $89 to $95 billion range given in March. I note that two quarters ago, the expense outlook was a range of $96 to $101 billion.

Yet, management did not stop there. Management committed to maintaining a lean-operations mindset moving forward, stating that a slower pace of hiring and flattened management structure “will improve the speed and quality of our work.” The exception appears to be in the company’s Reality Labs and artificial intelligence operations. Management noted that these two areas would be the primary areas of future hiring and represent their top two core priorities. Management noted that more than 20% of content in Facebook and Instagram feeds are recommended by AI, representing content from accounts that one doesn’t follow. I view that metric as being highly relevant in showing that the company has been able to move past the data privacy changes by iOS in the past, as it may be able to eventually drive its content generation primarily from in-app use. Management estimates that these AI recommendations have increased time spent on Instagram by 24%.

This appears to be the quarter in which META has simultaneously attacked many of the main bearish points: capital allocation, profitability, iOS data privacy changes, and TikTok competition. It is quite amazing that META has been able to accomplish such a task while continuing to invest so heavily in the metaverse.

Is META Stock Buy, Sell, or Hold?

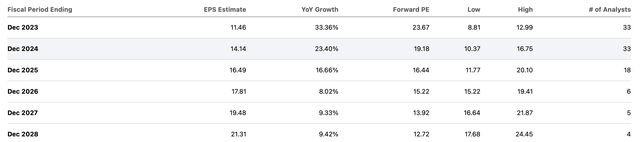

While META is trading at around 30x trailing earnings, consensus estimates have the stock trading at just 24x this year’s estimates. The discrepancy is likely due to both expectations for a macro recovery as well as a financial boost from the company’s aggressive cost-cutting initiatives.

Consensus earnings estimates look reasonable, if not conservative, considering that they are implying a mere 27% net margin by 2026.

Yes, META stock is up a substantial amount from the lows. I suspect that this point alone may make many readers uncomfortable with the stock. But I pose a counter: if META had instead fallen from a higher price to current levels, would that change the stock’s outlook? Depending on one’s balance of fundamental and technical analysis, answers to that question may differ, but those with a fundamental tilt should argue to the contrary. META appears to be doing everything that shareholders could want – in particular, the focus on profitability and potential for accelerated share repurchases stand out. But in addition to those welcome measures, I am also warming up to the long-term opportunity in the metaverse. Investor enthusiasm for this business unit, despite the company’s significant investment in it, has been lukewarm, and I can understand why given my personal experience with virtual reality headsets. But one day, as I was playing with my toddler, I wondered if it would be possible to re-live such memories even after she grows older. I wondered if artificial intelligence and metaverse developments would make it possible to transform a photograph or video into a virtual reality experience. I may be dreaming, but this appears to be the direction that META is heading, and this is the kind of narrative that can help drive a premium valuation. With Microsoft (MSFT) trading at 35x earnings due to enthusiasm for search and artificial intelligence, in spite of its slowing growth profile, I can see META getting to a similar valuation on account of the faster growth profile. A re-valuation to 30x earnings would imply around 30% potential upside over the next 12 months.

What are the key risks? Relevance remains the most important risk. META is not enterprise tech and thus is much more correlated with the broader economy. Demand for online advertising may weaken in weak economic conditions, as seen currently. Moreover, META’s platforms might not resonate with future generations, as technological prowess plays a lesser role than popularity for social networks. While META appears to have staved off competition from TikTok for its core user base, I am of the view that TikTok remains the social network of choice for newer generations. That may pose a tail-end risk, though admittedly this risk might not appear for many decades. It is also possible that management reverses course from its shareholder-friendly practices, perhaps by investing too aggressively in the metaverse. While I am optimistic for the future of the metaverse as described above, technology and social appetite might not be ready to welcome such developments. It is possible that META is too early in investing for the metaverse, though I suspect that Wall Street is underestimating the impact that artificial intelligence can have in this field. META remains a top pick due to the visible catalysts playing out – I reiterate my strong buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, GOOGL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!