Summary:

- I wrote negatively about Tilray before the Q3 report and shared a target of $1.32 and then reviewed it again afterwards, lowering my target to $0.96.

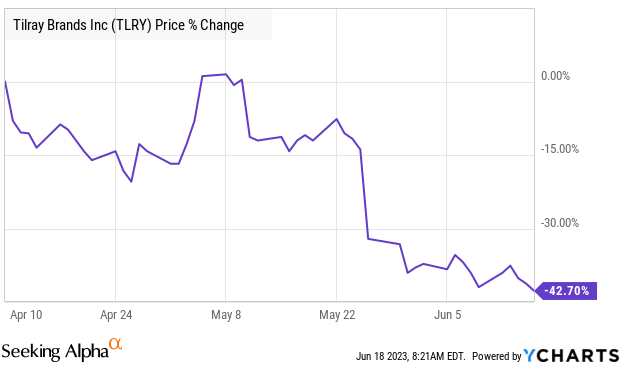

- The stock has now dropped a lot since my first article, but I remain very cautious on the name.

- In this follow-up, I explain why I am lowering my target.

Eugene Gologursky

I reviewed Tilray (NASDAQ:TLRY) ahead of its fiscal Q3 report and shared a target that was much lower than where it was trading, warning readers to stay away from the stock. After it reported, the price had not yet fallen substantially, and I predicted that it was likely to fall more. It has!

YCharts

Of course, the entire cannabis market remains mired in a tremendous bear market. The New Cannabis Ventures Global Cannabis Stock Index has declined 20.4% despite the 14.9% rally in the S&P 500 so far this year. Tilray has dropped 41.6%.

Of course, Tilray has broken to an all-time low now, down more than 99% from its peak price in early 2021. Some may want to buy the dip, but I highly discourage that move. In my last piece, I shared a revised target of $0.96 based on being priced at 1.5X tangible book value. Today, I look at several factors and lower my target again ahead of the fiscal Q4 report in July or August. The current price of $1.56 is too high in my view.

Falling Analyst Estimates

The Q3 financial report, as I wrote a month ago, was a big disappointment, and analysts cut their forward estimates for revenue and adjusted EBITDA sharply. I think even worse was the plunge in tangible book value, though that hasn’t changed since then due to no further financial reports. The analyst outlook is the same as a month ago though is much lower than ahead of the Q3 report. Analysts are expecting FY24 revenue of $667 million and adjusted EBITDA of $78 million. For FY25, they project revenue of $747 million and adjusted EBITDA of $113 million. The estimates ahead of the report were adjusted EBITDA in FY24 of $94 million and in FY25 of $121 million.

Another Look at Valuation

In my review four weeks ago, my target of $0.96 was based on achieving 1.5X tangible book value, which was a big premium to other leading Canadian LPs. Of course, Tilray is more than just a cannabis company, with two large focus areas, pharmaceutical distribution and alcohol, and a smaller one too, hemp-based food. In my initial write-up, my target of $1.32 was based on sum-of-the-parts at the time.

The stock’s price-to-tangible-book-value is very high at 2.5X, which is about where it traded in April ahead of the Q3 report. This is outrageously high and compares to Canopy Growth (CGC) at 0.40X, Cronos Group (CRON) at 0.60X, Organigram (OGI), my favorite cannabis stock, at 0.42X and Village Farms (VFF) at just 0.34X. My target in April worked out to be 1.3X, and I began using this as a primary method for targeting in May. My new target, though, is just 1.0X tangible book value, which works out to be $404 million, a price of $0.64, which is 59% lower.

The targeted enterprise value to adjusted EBITDA projected for FY25 would be 4.3X, which seems very low. It currently trades at 9.8X, which seems too high. I am comfortable with my valuation by this metric for two reasons. First, the estimate for adjusted EBITDA has been falling and is likely to fall further. Second, the American MSOs have worse legal position but incredibly better business operations. They trade at lower valuations by this metric. My favorite large MSO, Trulieve (OTCQX:TCNNF), trades at just 3.5X the projected adjusted EBITDA for 2024.

Conclusion

Tilray remains one of the most followed publicly traded cannabis companies at Seeking Alpha (138K followers), just behind Canopy Growth. The collapse in Canopy Growth, down now 72.6% year-to-date and 77.3% since I wrote about why it was not a good stock for cannabis investors 5 months ago, may be a good sign of just how bad it could become for Tilray.

The stock remains terribly expensive relative to peers, and there are better ideas in the Canadian LP space in my view. Tilray’s attempt to build strong brands does not appear to be working, and the company lacks the capital to expand. The last capital raise, a convertible note, illustrates this point well. If the stock price continues to fall, as I predict will be the case, it could face NASDAQ delisting for breaking $1.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

420 Investor launched in 2013, just ahead of Colorado legalizing for adult-use. We are moving to Seeking Alpha and will let our followers know when that occurs. Historically, we have provided great coverage of the sector with model portfolios, videos and written material to help investors learn about cannabis stocks.