Summary:

- Shopping advancements on the platform yield valuable, first-party data to feed targeted advertising efforts, and thereby augmenting the appeal of Instagram’s ad solutions.

- Meta is encouraging merchants to enable ‘Checkout on Instagram’ through offering exclusive e-commerce/ marketing capabilities.

- The excessive 5% selling fee charged on sales through Instagram checkout could discourage merchants from using ‘Checkout on Instagram’, undermining Instagram’s ability to generate e-commerce revenue.

- Instagram’s exclusive features for checkout-enabled merchants can also be found on other rival platforms, undermining the exclusivity appeal of Instagram’s marketing features.

- The company has not offered any meaningful data on conversion improvements, putting into question whether ‘Checkout on Instagram’ has actually improved sales conversions for merchants on a wide scale.

Kerkez/iStock via Getty Images

Amid an increasingly intensifying competitive landscape in the advertising industry, a shift towards e-commerce has become a vital strategy in the race to offering high-conversion ad solutions. Over the past few years, Meta (NASDAQ:META) has been steadily advancing Instagram’s shopping functionalities, including the initiative to allow business owners to set up storefronts on Instagram. While merchants are able to run Instagram Shops for free, Meta has been introducing various strategies to better monetize e-commerce activity through Instagram overtime, primarily through its ‘Checkout on Instagram’ solution. Though intensifying competition encumbers Meta’s e-commerce ambitions.

Instagram’s e-commerce push

Over the past few years, Meta has been rolling out various shopping tools to facilitate e-commerce activity through Instagram. This endeavor accelerated amid the onset of the pandemic, as Meta enabled U.S. business owners to set up storefronts for free on Instagram in May 2020. The company is striving to monetize e-commerce activity primarily through its ‘Checkout on Instagram’ feature, which was introduced in March 2019.

‘Checkout on Instagram’ enables consumers to complete their purchases within Instagram, as opposed to being re-directed to a merchant’s third-party website, and saves consumers from having to repeatedly fill out their details on various external websites. Hence, the smoother checkout process aims to improve conversion rates for merchants on Instagram.

Business owners pay a 5% selling fee on each product sold when consumers checkout on Instagram, though this fee is currently being waved until June 30, 2023. Note that merchants are not obliged to enable ‘Checkout on Instagram’. They can still set up storefronts on Instagram for free, and can continue directing consumers to their own websites to complete purchases, thereby avoiding the excessive 5% selling fee even beyond June 2023. Nevertheless, Meta is encouraging merchants to enable ‘Checkout on Instagram’ through offering exclusive e-commerce/ marketing capabilities. Moreover, by temporarily waiving the 5% selling fee, the company is striving to deeply imbed the exclusive features into merchants’ core marketing activities, reducing the likelihood of business owners disabling ‘Checkout on Instagram’ after June 30, 2023.

Promoting ‘Checkout on Instagram’ through exclusive features

Product Launches/ Drops: ‘Product Launches/ Drops’ is one of the exclusive features available to checkout-enabled merchants, which allows businesses to announce the upcoming launches of their products to the Instagram audience. Drops appear at the top of the Shop tab on the Instagram app, and allows merchants to create a buzz across Instagram shoppers. Consumers are able to discover and browse new products, as well as set purchase reminders upon availability. This feature aims to enhance the stickiness of Instagram as a shopping destination, encouraging consumers to recurringly visit the platform to discover the latest product launches. As more and more shoppers visit the ‘Drops’ section on a recurring basis, it enhances the appeal of the ‘Product Launches’ feature, in turn inducing more merchants to enable ‘Checkout on Instagram’ to take advantage of it.

Shopping Partners: Checkout-enabled merchants also have the option to extend ‘product tagging’ capabilities to Shopping Partners. Product tagging used to be only available to professional creators, but earlier this year, Meta expanded this function to all Instagram users in a specific list of countries. This feature enables businesses to grow their audience faster through accelerated product awareness and a broader source of shoppers beyond professional affiliate creators. Furthermore, this feature enables general Instagram users to more easily become influencers and earn income through product promotions. The potential to earn income through Instagram could indeed induce greater engagement and time spent on the platform.

Live-stream Shopping: The ability to host live-stream shopping events is also exclusively available to merchants that have enabled ‘Checkout on Instagram’. Businesses and creators can sell products in a more inspiring and interactive manner, and tag products to enable viewers to shop while watching. Live-stream shopping can be a great way to leverage popular creators’ follower-bases.

E-commerce should improve effectiveness of advertising solutions

The aforementioned Instagram shopping advancements should improve Meta’s ability to attract shoppers and collect valuable, first-party data on consumers. A key reason Amazon (AMZN) has been able to successfully penetrate the advertising market over the past several years has been primarily due to its recurring stream of purchase-minded website visitors, improving the conversion potential of its advertising solutions. Likewise, Instagram’s transformation into an e-commerce destination should also improve its ability to attract high-intent shoppers, conducive to higher conversion-rates for its advertising solutions.

Apple’s (AAPL) iOS change in 2021 and the general crackdown on data privacy across the digital economy have only pronounced the importance of first-party data to facilitate targeted advertising. Instagram’s e-commerce push yields valuable insights on how consumers are interacting with shoppable content like product tags and live-stream videos, and consumers’ ability to set reminders for product launches offers better understanding of consumer preferences. Furthermore, encouraging ‘Checkout on Instagram’ as opposed to off-site re-directions also improves data collection on consumer behavior/ shopping activity, granting the company more insights into whether engagement with shoppable content actually resulted in sales conversions.

Counteractive considerations

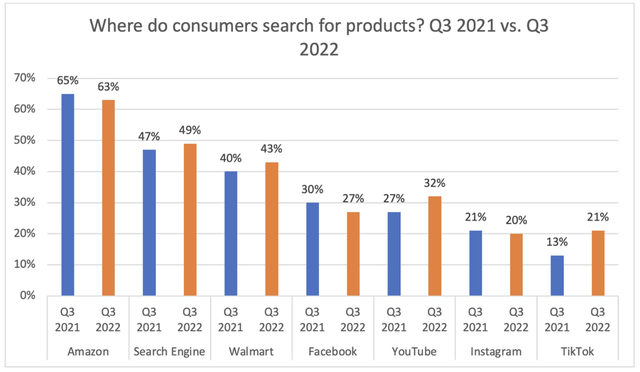

While the e-commerce initiatives are essential to drive engagement and augment the appeal of Instagram’s ad solutions, other social media platforms like YouTube and Pinterest are also transforming into e-commerce platforms, encumbering Meta’s ability to attract purchase-minded web visitors over rival platforms. In fact, results from JungleScout surveys (based on 1000 U.S. consumers) reveal a decline in people searching for products on Facebook and Instagram in Q3 2022, compared to Q3 2021. Simultaneously, TikTok and YouTube saw notable improvements in their ability to attract consumers.

Source: Generated using data from JungleScout Consumer Trends Report Q3 2021, JungleScout Consumer Trends Report Q3 2022

Note that the JungleScout study is based on a sample of 1000 U.S. consumers, and larger sample sizes could indeed yield different results. Nevertheless, despite Instagram’s e-commerce advancements, the platform is struggling to become the preferred shopping destination among social media platforms.

Furthermore, the 5% selling fee charged on sales through Instagram checkout is very steep, which could discourage merchants from using ‘Checkout on Instagram’, and instead direct consumers to their own websites to complete purchases, once the selling fee waive period ends on June 30, 2023. While Instagram is trying to augment the appeal its in-house checkout solution through exclusive features, the appeal of those features relies on Instagram’s ability to continue attracting purchase-minded visitors. If the aforementioned decline in consumers searching for products on Meta’s platforms persists going forward, merchants will become less willing to incur excessive selling fees through ‘Checkout on Instagram’, or worse, become reluctant to advertise on Instagram altogether. Moreover, Instagram’s exclusive features for checkout-enabled merchants can also be found on other rival platforms, offering alternative marketing avenues for business owners. For instance, rival YouTube has partnered with Shopify (SHOP) to facilitate seamless live-stream shopping through the video-sharing platform, undermining the exclusivity appeal of Instagram’s live-stream shopping feature.

The 5% selling fee not only seeks to cover third-party payment transaction fees, but is also intended to raise capital to fund other programs to facilitate e-commerce activity through the platform, as Meta reveals on its website. This strategy is a competitive disadvantage given the highly-competitive nature of the fintech industry, where companies are striving to offer the most competitive processing rates to embolden their merchant acquisition strategies. The availability of cheaper processing fees hinders Meta’s ability to encourage the enablement of ‘Checkout on Instagram’ across its merchant base. Meta’s strategy of funding e-commerce endeavors through excessive selling fees is misguided, and instead should be subsidizing e-commerce features through its high and recurring stream of free cash flow, to better penetrate the e-commerce market. To the contrary, intense resources are currently being allocated towards building the metaverse, the potential of which is up for debate.

‘Checkout on Instagram’ strives to ease the checkout process for consumers, and thereby improve sales conversions for businesses on Instagram. Amid launch of the ‘Checkout on Instagram’ feature in 2019, Meta proclaimed that the more seamless checkout process would result in higher conversion rates. However, the company has not offered any meaningful data on conversion improvements since then, despite analysts directly asking executives for insights during earnings calls, putting into question whether ‘Checkout on Instagram’ has actually improved sales conversions for merchants on a wide scale.

Summary

Meta has been striving to steadily transform Instagram into an e-commerce destination, through the ability to set up free storefronts and marketing features exclusively available to merchants that have enabled ‘Checkout on Instagram’. Shopping advancements on the platform also yield valuable, first-party data to feed targeted advertising efforts, and thereby augmenting the appeal of Instagram’s ad solutions. Though intensifying competition undermines Meta’s ability to attract purchase-minded web visitors. Despite Meta’s e-commerce endeavors, Meta is struggling to become the preferred product search destination among consumers. Investors will be able to better judge Meta’s ability to generate e-commerce revenue through Instagram when the temporary waive on the 5% selling fee ends in June 2023, putting to test how valuable merchants find Instagram’s commerce solutions relative to the steep selling fee.

Any buying or selling decisions in Meta stock should take into consideration all business divisions/ product lines aggregately. Given that this article focuses particularly on Instagram, a neutral ‘hold’ rating will be assigned to the stock.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.