Summary:

- AMZN has been under pressure amid the challenging macro backdrop.

- A confirmation of declining inflation supports higher margins going forward as a tailwind for the company into 2023.

- We are bullish on the stock and see an upside to current consensus earnings estimates.

Sundry Photography/iStock Editorial via Getty Images

Amazon.com, Inc. (NASDAQ:AMZN) has had a year to forget, with shares off more than 40% amid the challenging macro environment and broader stock market volatility. In many ways, the company’s performance as the world’s largest e-commerce retailer and major tech player is a reflection of the trends in the global economy. Stubborn inflation and poor consumer spending dynamics have translated into slowing sales and weaker earnings.

All that said, there is a big reason to look up and turn more positive on the stock into 2023. The latest November CPI report confirms inflation is cooling off, which has massive implications for the company’s forward outlook. Improving macro conditions with easing cost pressures can be very positive for margins and earnings, allowing the stock to outperform. We are bullish on AMZN, which has a significant upside against a low bar of expectations.

Amazon Wins As Inflation Trends Lower

To understand why the latest inflation data is positive for Amazon, consider that the trend has been one of the biggest headwinds all year. The impact was evident not only in a surge of expenses that hit margins but also observed through weaker demand on the retail side as consumers got squeezed while businesses pulled back on AWS spending.

This has been part of the narrative for Amazon all year, which was specifically cited by management at the Q2 earnings conference call back in July:

Our macroeconomic issues are principally on inflation and pretty transparent on that. I think the new thing this quarter is additional pressure on the energy, electricity rates in our data centers because of the ramp up in natural gas prices, if you’ve seen that.

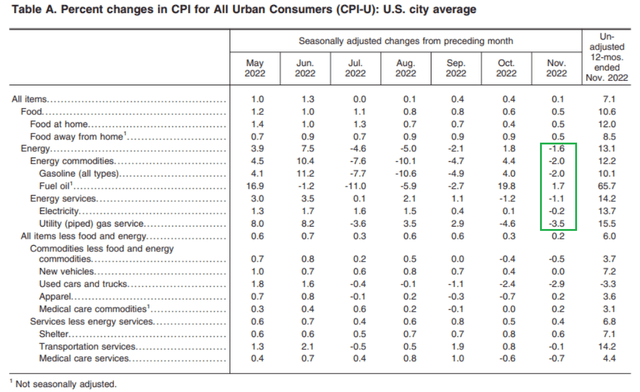

From those comments, it’s been an impressive turn of events in recent months with energy prices, in particular, reversing sharply lower. Indeed, the official CPI data confirms that November saw the first month where electricity prices declined on a monthly basis all year.

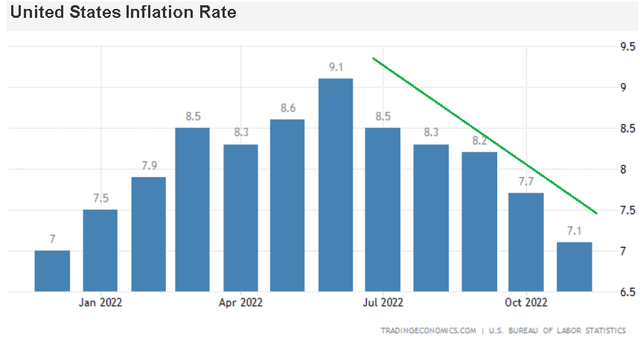

The November CPI came in under expectations, rising just 0.1% during the month compared to a 0.3% estimate. The annual rate also slowed to a headline 7.1% which was below expectations closer to 7.3% and a long way from the cycle peak of 9.1% back in June. The expectation is that there is more downside with the components facing tougher comps over the next several months.

Taking a step back, the bigger trend is evident when looking at gasoline prices which are trending towards $3.00 a gallon as a national average, back to levels from 2021. Amazon and its fleet of contracted drivers across more than 100,000 delivery trucks are getting some relief. The impact here translates directly into higher margins on both the retail side and with the AWS data centers connected to utility costs.

What’s important when looking at the inflation data is to read between the lines and connect the dots. The signal here is how the Fed will respond to its monetary policy following the recent string of aggressive rate hikes. While a 50-basis point increase to the Fed funds rate may be nearly penciled into the upcoming December FOMC rate decision, the trend of lower inflation means the urgency for more rate hikes and the higher terminal rate gets reset lower. This will be favorable not only for interest rate dynamics including consumer credit card charges but also for the investing environment as a positive tailwind for stocks.

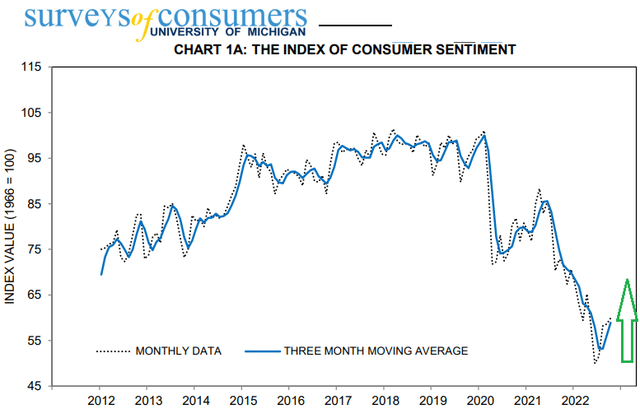

One factor that doesn’t get enough attention is the impact of the latest headline on consumer confidence and retail spending. It’s not a stretch to expect benchmark surveys like the Michigan Consumer sentiment indicator to get a lift for the next few months from near-record low levels as consumers begin to feel better about the outlook and shifting narrative. Again, Amazon wins here because the backdrop of improving confidence supports higher spending on the e-commerce site.

We can take it a step further and see a path where broader retail spending gets a lift into 2023 because declining inflation means consumers are getting a boost to their discretionary budgets. Anecdotally, anyone saving $10-$20 filling up each tank of gas compared to the prices at the start of the year has more money for “stuff” on Amazon. Keep in mind that Amazon maintains a market share of nearly 40%.

Bullish on AMZN

Any bullish call on AMZN will need the macro picture to cooperate. Keep in mind, the company controls an estimated 38% of all e-commerce spending in the U.S. and nearly 15% globally, meaning it moves with the macro tide. We want to see a “soft landing” scenario where the U.S. and global economy remain resilient despite higher interest rates while inflation trends lower. The latest November CPI report along with recent trends in Europe is a step in the right direction.

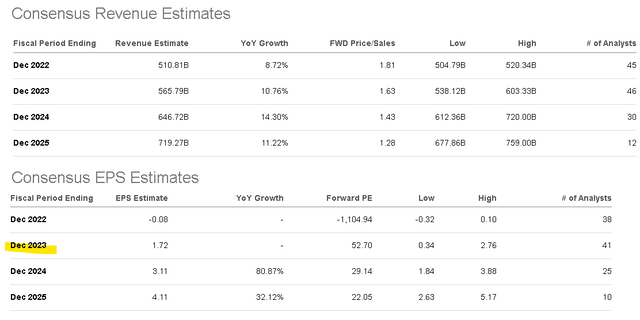

Putting it all together, the bullish case for AMZN is simply that the company has room to outperform expectations. According to consensus, the forecast is for 2022 revenue of $511 billion, representing an 8.7% increase over 2021. The market also sees a full-year EPS loss of -$0.08 as an average of 38 Wall Street estimates ranging from a low of -$0.32 to a high of $0.10.

Depending on how the holiday shopping season plays into the Q4 report, set to be released in late January, we see a good chance Amazon could beat on the top and bottom line. What’s more interesting is looking out into 2023 where the market only sees a modest recovery of EPS towards $1.72.

The upside to that figure is the potential that the next few quarters come in stronger than expected – supporting a sharp revision to estimates higher. All this is in the context of EPS, which reached a record $3.24 in 2021. Getting back closer to that level sooner rather than later will make shares of AMZN appear increasingly cheap. By this measure, the current 1-year forward P/E multiple of 53x is a bargain assuming an outlook of accelerating earnings momentum through the next decade.

As it relates to valuation, one metric we’re focusing on is the EV-to-sales ratio sits at 1.8x. This is the lowest multiple for the stock going back to 2015. A lot has changed for the company over the period, but there is a good argument to be made that the long-term outlook is stronger than ever considering the scale and logistical network Amazon has built in the period since. We are in the camp that just the AWS segment alone may be worth more than the total company’s market value listed at $930 billion. In other words, AMZN is fundamentally undervalued based on its earnings potential.

AMZN Stock Price Forecast

Recognizing the 20-for-1 stock split earlier this year, AMZN is trading at its lowest levels since Q1 2020 near the depths of the pandemic. With shares trading under $100, we believe it’s a great opportunity to start a new long position in AMZN or add to an existing holding. 2022 has been tough, but the sense is that extreme pessimism has taken over while there is real room for the pendulum to swing in the other direction. More positive momentum in risk assets and the stock market should allow Amazon to lead higher.

We rate AMZN as a buy with an initial price target of $130 implying a forward P/E of 72.5x on the current consensus EPS for 2023. The way we see it playing out is that there is room for 2023 EPS to ultimately trend towards a stronger $2.50, at the top range of current estimates. This would imply a 1-year forward P/E of ~50x on our $130 price target and nearly 40% upside from the current level.

The main risk to consider would be for a more concerning deterioration in the global macro outlook. Any setback in the path of lower inflation, possibly driven by sharply higher energy prices and significantly higher interest rates would undermine the bullish call. Free cash flow trends and the operating margin are key monitoring points for the company over the next few quarters.

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.