Tesla: Beijing Paves Way For Smoother Cruising Ahead

Summary:

- With Beijing relaxing its “Zero COVID” policy, I expect Tesla to benefit from China both as its main market and also as a key manufacturing site.

- In the past few years, Tesla was negatively impacted by production interruptions, lockdowns in Shanghai, and also the associated cost and logistic headwinds.

- Going forward, I foresee its production ramping up at an accelerated pace.

- As a result, recovery of the fixed cost will fasten too, and the margin will further expand.

- The current consensus estimates underestimate these second-order effects, in my view.

MikeMareen

Thesis and background

In the past few years, China’s “Zero COVID” policy has created substantial headwinds for Tesla (NASDAQ:TSLA) – both as a key end market and a manufacturing site. In 2021, China sales accounted for ~½ of TSLA’s sales in the U.S. and ~1/2 of its total pretax income. As a manufacturing site, operations at its Shanghai gigafactory have been disrupted and even suspended due to lockdowns and supply-chain disruptions. Recently, Beijing relaxed its “Zero COVID” policy. According to this New York Times report:

The Chinese government ordered officials to cut back on mass testing and hair-trigger regional lockdowns, in a pivot from stringent pandemic rules. The changes do not dismantle the policy, but they represent a loosening of measures that have dragged down the economy by disrupting daily life for hundreds of millions of people, forcing many small businesses to close and sending youth unemployment to a record high.

And the main thesis of this article is to analyze the impact, especially the second-order effects, of such policy change on TSLA. Of course, I expect such relaxation to help TSLA recover its production and deliveries in China. Just to get a taste of how large the impact could be (or how bad the disruption in the past has been), its Shanghai factory’s monthly domestic deliveries rose by 263% MoM in November 2022 according to this SA report. Its Shanghai gigafactory delivered 100,291 vehicles in November, setting a monthly record.

But the main idea here is to argue that a recovery in manufacturing and deliveries is only the first order impact for a more normalized life in China. Next, I will argue that there will be other high-order benefits too, probably more important benefits. As you will see, as a result of its production capability recovery, the pace of its fixed cost recuperation will quicken too, which in turn is expected to lead to accelerated margin expansion.

The first-order effects

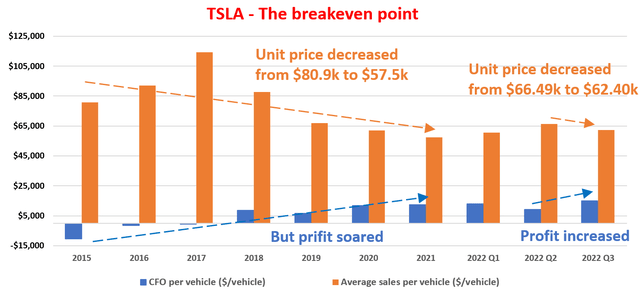

Before we dive into the second-order effects, let’s examine the first-order benefits a bit closer. The chart below displays TSLA’s CFO (cash from operations) and its average vehicle selling prices over the years. Note that the results between 2015 and 2021 are shown on an annual basis. And the results starting in 2022 are shown based on quarterly financials. The purpose is to better illustrate the challenges brought about by recent developments and to better illustrate the opportunities ahead.

Let’s first set a background. During 2015 and 2021, the average selling price per TSLA vehicle declined from around $80.9k to $57.5k. At the same time, its profits increased from a loss of $10.5k in 2015 to a remarkable profit of $12.2k in 2021. So, it is safe (and an understatement) to say that TSLA’s production has crossed the breakeven point by 2021 (it probably crossed that point in 2017~2018). Against this backdrop, you can see the challenges it started to face in the first quarter of 2022, which, to a large degree, were caused by the headwinds in China as mentioned above. To wit, TSLA raised its selling price from an average of $57.5k in 2021 to $66.49k in 2022 Q2, while the CFO per vehicle shrank from $12.21k to $9.23k.

Now with these disruptions large in the rearview mirror, its profitability resumed its upward trend as you can see from the latest Q3 data. To wit, TSLA was able to reduce its selling price from an average of $66.49k in Q1’22 to $62.40 in Q2 (a reduction of ~7%). And at the same time, the profit, measured by the CFO per vehicle, increased spectacularly from $9.23k to $14.83k (an increase of a whopping 61%). And in my view, the relaxed COVID policy in China will further sustain and accelerate this trend for TLSA to cut prices and at the same time improve profitability.

And next, I will explain why there are also other higher-order benefits to be expected.

Source: Author based on Seeking Alpha data

Fixed cost recuperation

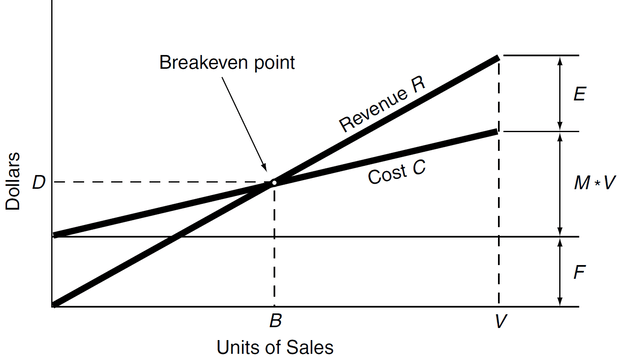

For a business like TSLA, the chart below (taken from A Modern Approach to Graham and Dodd Investing by Thomas P. Au) illustrates the basic economics that we are all familiar with:

Profit is a function of volume, price, and cost, as shown in the next figure. Costs come in two varieties, fixed costs and variable costs (shown as F and M * V in the figure, where M is the marginal cost of producing an additional unit and V is the production volume). Fix costs include things like plant and equipment (especially the depreciation thereon) and also most capital costs (such as interest expenses). Fixed costs were incurred upfront and do not vary with the level of output. A production business has to first pass the breakeven point to make a profit. After it breaks the critical volume of sales, the fixed costs are spread out on more and more units and profit margins will improve.

A Modern Approach to Graham and Dodd Investing by Thomas P. Au

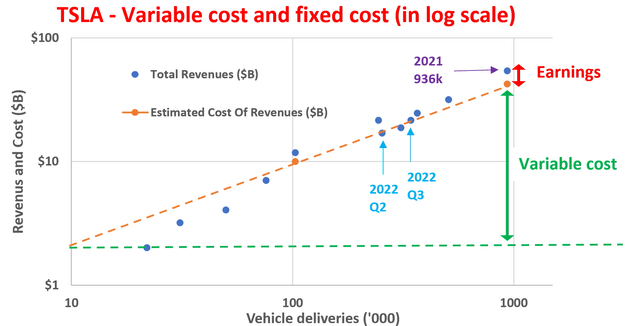

The chart below illustrates how TSLA’s data fit into the above model. Note that it’s plotted in double-logarithmic scales. The blue dots show TSLA’s total revenues as a function of its total vehicles delivered during a given period. And the orange dotted line shows the best fit of TSLA’s data since 2015 according to the above model. A few key observations:

- The variable cost was fitted to be ~$42.0k per vehicle (determined by the slope of the orange line). And the fixed cost is about $2 billion (determined by extrapolating the orange line to the left and reading the intercept).

- The most recent data points from 2022 Q2 and Q3 are those two dots highlighted by the blue arrows. And as seen, these fittings work even better for the most recent data points.

- Finally, by extrapolating the orange line to the right, we can project its future profitability when production further ramps up. Take a 1 million vehicle delivery as an example – a goal that TSLA has been shooting for.

- The rightmost data point on the plot (highlighted by the purple arrow) is from 2021, a year during which its production is closest to 1M (936 K to the exact). And as seen, its profit is even better than the orange line shows because of the better scale of economics – which is a second—order benefit. And the magnitude of the benefit is indicated by the distance above the orange line shown by the red arrow.

Due to the use of double-logarithm axes in this plot, it’s easy to be under-impressed by the magnitude of this distance. And I will examine the implications more quantitatively in the next section.

Author based on Seeking Alpha data

TSLA: Profitability implications of production ramp-up

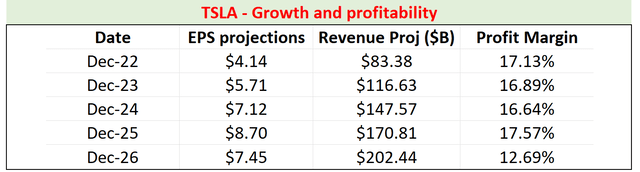

Here, I will examine the implications of its production ramp-up more quantitatively by its profit margins. The second column of the chart shows the consensus estimates of TSLA’s EPS in the next five years to 2026. And the third column of the chart shows the consensus estimates of its total revenues. Here I am going to assume its outstanding shares to remain constant at the current level of 3.45B shares. Based on this assumption, the fourth column shows the implied net profit margin (“NPM”) in the next five years.

As seen, the consensus estimates implied a profit margin hovering around an average of 16% ~ 17% in the next three years (2023 to 2025) and then expect a drop to 12.69% in 2026. In my mind, this is an underestimation of its margin potential based on the fitting result shown above. As aforementioned, its 2021 profitability (a year during which its production peaked at 936k) already led to better profitability due to the scale of economics. And its 2022 Q3 NPM already hovers around 15% (see the next chart below in the final section). As its production further expands, I expect its margin to further expand beyond 15% by a substantial gap. It’s almost certain for it to exceed 1M vehicle deliveries this year. It has already delivered a total of 909k vehicles in the first three quarters already. I see a 16% to 17% margin already an underestimate, let alone a contraction back to 12.7%.

Author based on Seeking Alpha data

Risks and final thoughts

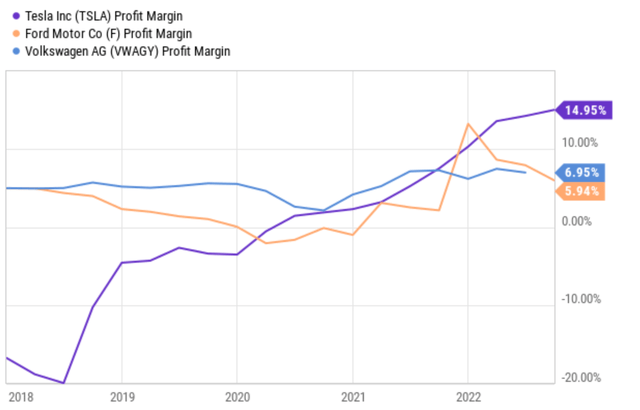

In terms of risks, my above analysis is subject to a few key uncertainties. The biggest one is, of course, that China’s COVID policy reverses back to a stricter one if the COVID pandemic worsens. Other near-term risks include the cost of raw material cost, labor costs, and inflation. These issues have been showing signs of easing recently. But the trend could reserve, at least temporarily. A more fundamental and longer-term risk comes from competition. Both pure EV and traditional players, such as NIO, Volkswagen, and Ford are competing directly with TSLA for market share around the world. TSLA currently enjoys a far better margin than these competitors as seen in the chart below, and the key point of this article is that its margin would further expand as it reaps the benefit of better scaling. But this ultimately depends on if TSLA can maintain its competitive advantage, both in terms of technical lead and brand imaging, in the EV space.

Seeking Alpha data

To conclude, with Beijing relaxing its “Zero COVID” policy, I expect TSLA to enjoy a smoother and faster growth curve ahead. The reasons include both first-order and higher-order effects. The first-order effects are relatively obvious. China is both a key market and a key manufacturing site for TSLA. And as such, as economic activities renormalize in China, TSLA should enjoy better operation efficiency, cost control, and production ramp-up. However, my main point is that there will be other high-order benefits too, which are even more important in my view. For instance, as a result of its production ramps up, I anticipate the pace of its fixed cost recuperation to quicken and margin expansion to accelerate. The current consensus estimates are underestimating these second-order benefits judging by the implied profit margins.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.