Disney: Management Challenges

Summary:

- The Walt Disney Company CEO transition is really the most important issue facing the company.

- The ability of employees to go around the CEO to the Board Of Directors undermined the CEO from the start.

- Similarly, Bob Chapek, the former CEO, was not able to gain that consensus agreement that most CEOs need to be successful.

- This highlights how resistance to change can undermine a new CEO unless careful planning is done ahead of time.

- The “Direct-to-Consumer” losses at Disney were unlikely the reason for the CEO change despite a fair number of media assertions otherwise.

FrozenShutter

(Note: This article was in the newsletter on November 29, 2022.)

Bob Iger is now back as CEO of The Walt Disney Company (NYSE:DIS). But the dismissal of the previous CEO for really any reason highlights a succession problem that has plagued this company for some time. Companies need to be able to handle transitions, or when the CEO finally cannot do the job anymore, there is very likely to be some years of at-best muddling along, and it could be considerably worse.

Far more worrying was that employees were going around the previous CEO Bob Chapek to the board, where they evidently got a friendly reception. This undermines any CEO really from the start, as it establishes that the old CEO really never left or that the new CEO will be constantly second-guessed. It is almost like having an appeals court system in the company, with the result that it takes “forever” to get things done. The board running things directly would likely have been better than all the extra management time spent doing things in a roundabout way.

This situation also highlights that many times things at the top are done by consensus. Therefore, a job of the CEO is to make sure that he has that consensus before he makes a formal strategic move. Replacing someone with the reputation of Bob Iger was never going to be easy. But the board likely should have made plans for a gradual transition rather than a sharp retirement which really appears to never have happened.

Most people do not like change. Yet a new CEO will often seek to put his imprint on an organization. But in this case, the employees had a ready board that would stop any type of change to aid their cause of keeping things the same way. That likely was compounded by Bob Chapek’s inability to build a consensus on the direction he wanted to take the company.

Of course, the coronavirus demand destruction challenges made it hard for even experienced CEOs to navigate fiscal year 2020. Missteps were likely to be the rule of the day at many companies. The difference here was a very experienced former CEO in the form of Bob Iger, who appeared to be able to second-guess the new CEO every move. Such a situation stopped progress (and created a lot of indecision) in the company at the time that the markets served by the company have been rapidly changing.

Streaming

The media appears to have put at least some of the blame on streaming. Yet Disney, like many competitors, rapidly grew a business from nothing within a few years. Competitor Netflix (NFLX) took far longer to grow that same business, and initially began with losses and small profits as well.

What appears to matter to the media is the losses. What should matter instead is the strategy and whether it is time to turn from growth to profitability in the eyes of management. Much of the industry decided to jump in once it became apparent that the streaming channel would be large enough to be significant. That is not all that unusual (a reference would be Michael Porter’s “Competitive Strategies“).

Changing from growth as to media is largely an arbitrary event that can be argued back and forth. In and of itself, it is unlikely to be the sole reason for a CEO turnover.

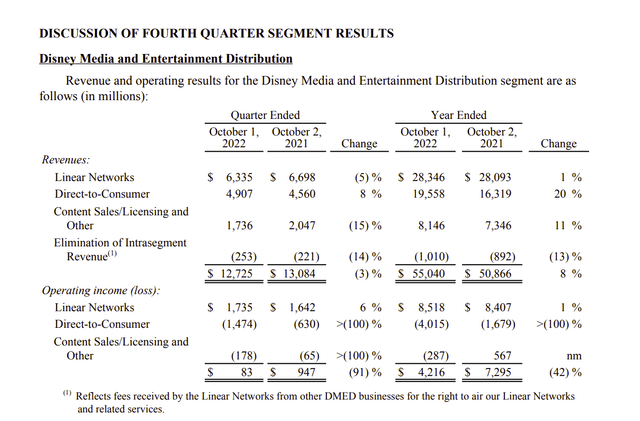

Disney Media And Entertainment Distribution Fiscal Year 2022 (Disney Earnings Report Fourth Quarter Fiscal Year 2022)

There has been a fair amount of finger-pointing at the “Direct-to-Consumer” loss for the fiscal year, followed by a jump to conclusion that the loss led to the CEO change. But most personnel changes are usually (by far) caused by people issues. So, it is very unlikely that the loss shown above led to the CEO change.

Furthermore, Disney executives have been stating for some time that they had a future profitability goal in the conference calls. A company as large as Disney needs time to change strategic directions. Usually that change will occur over a period of years. The growth strategy that led to the losses shown above was decided years ago. Three years would not be unusual (as discussed below). To know that losses would be as large as they turned out and to therefore do something about it would have required planning also a long time back. That is something that is beyond a lot of managements and frankly not realistic. It is a weakness of large businesses that planning needs to be done far ahead of time before the future is clear.

Warner Bros. Discovery (WBD) management mentioned or alluded to the fact that the latest results of the acquisition were from decisions made a few years (like maybe 3 but sometimes more or less) back. Disney, for much of the fiscal year, has noted that there is a goal to make streaming profitable. But that does not mean the losses “turn around on a dime,” as much of the market appears to expect. Instead, those losses like occurred as a result of management decisions made to prioritize growing the business.

Netflix History Recap

Netflix went public back in 2002. The market cap of the company at the time was in the hundreds of millions of dollars. But a company like Disney, Amazon (AMZN), or what is now Warner Bros Discovery will usually only become interested in what was to become streaming if they see a billion-dollar opportunity with sufficient profits.

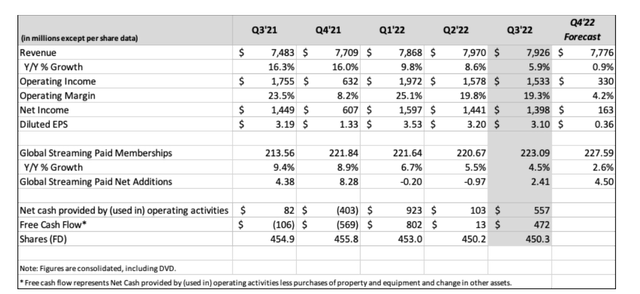

The company has reported profits fairly consistently since going public. The main issue with the company model has been the cash flow.

Netflix Summary Of Operating Results Third Quarter 2022 (Netflix Earnings Press Release To Shareholders Third Quarter 2022)

This is a company with a current market cap that is over $100 billion. Yet the cash flow in a year of minimal subscriber growth (if any) has been virtually non-existent, as shown above given the market value of the company.

The advantage that Disney sees is that Disney has franchises that translate into television series, prequels and sequels. Of course, there are also clothing lines and other profit centers like DVD sales (and rentals). But Disney has a far easier way to turn out reliable hits than does a pioneer like Netflix that does not really have a comparable catalog.

More importantly, those of us who went to business school “know” that a quick way to estimate cash flow (very roughly before changes in accounts) is reported profits plus depreciation. When the profits as shown above are greater than cash flow without a lot of growth, that points to allowed but aggressive accounting that could mean the depreciation charge should be adjusted for a far more reasonable profit outlook. That is especially noteworthy if it persists. It is very much a danger signal for accountants and investors looking for conservative management. That lack of cash flow from operating activities compared to profits belies management’s long touted profit advantage as something to thoroughly investigate as the situation is not exactly the way it should be.

Most investors fail to realize that management has a lot of choices in choosing accounting for reporting purposes. GAAP itself often allows several choices. The auditors are in no position to really question the lifespan of shows when you have an industry pioneer. So, it is really up to investors to decide the reasonability of management decisions that allow the reporting of profits. Mr. Market often focuses on profits when he really should be paying attention to the cash flow statements. True disrupters, like Apple (AAPL) under Steve Jobs, produced a ton of cash flow with the reported profits.

Disney, therefore, is willing to quickly grow its market share and then make that market share profitable. But it will do so only after it sees a chance to make a decent return in that market sector. That requires a reasonable opportunity for at least $1 billion in revenue to allow the profit percentage management planned in most cases. Disney followed a well-trod route by growing fast to establish market share and will now make it profitable. Large companies often do exactly this.

Clearly Netflix now shows revenue numbers where it is possible for large competitors to jump in and make money. But the competitors jumping in to compete are going to want to generate far more cash flow than is shown above.

Disney, in particular, can do that with movies that have long been paid for and are on the books at zero basically. That gives them a huge cost advantage. Those movies or streaming shows can also make money elsewhere in the corporation. So those losses shown previously for the “Direct-to-Consumer” division may not have to disappear entirely in order for the company to increase profitability at a satisfactory rate that makes streaming a welcome addition. That accounting is known as incremental accounting and is rarely, if ever, reported publicly.

Netflix does not really have those established other profit centers to the extent of a Disney or a Warner Bros Discovery. (Note that Amazon and Apple are somewhere in between with some diversification but not as much as Disney).

The Future

Disney has a CEO transition issue that Bob Iger now has to give a top priority. Evidently the previous CEO tried to change too many things without first getting a necessary consensus of senior management and likely the board of directors as well and lost key support in the process that led to his ouster.

However, that failure is something for Bob Iger to improve upon in the future. Should the day come that he can no longer do the CEO job, then it is imperative to have a CEO that performs at a satisfactory level to take his place.

The number one issue of just about any employee turnover is usually people related as opposed to performance related. Therefore, that is the issue that needs to be addressed so the next CEO does not fail.

That means that the common press conclusion, that losses at the “Direct-to-Consumer” division were the cause of the CEO change, was an incorrect conclusion. Most likely the decision to grow the division was made years ago and was well underway before the CEO transition.

Similarly, the statement of making profits in the streaming business was likely well before management ever stated that goal. However, putting in place the means to make profits with a strategy probably took some years to put in place because the streaming business itself is large enough to not “change on a dime.”

It is not unusual for companies like Disney to wait for a pioneer like Netflix to develop the industry enough to make it worthwhile to compete. Large competitors often “jump in” by establishing a decent market share and then make that market share profitable. So far it looks like Disney is pursuing that script like many predecessors in different industries.

But that means that the new CEO needs to finish what he likely began. In the process he needs to develop a successor who will not fail this time because Bob Iger cannot “keep coming back forever.” Similarly, the board and the senior management need to be able to support that new CEO rather than undercut him (as it appears to have been the case). They both need to realize that sooner or later a new CEO will be what has to happen for the future.

Disclosure: I/we have a beneficial long position in the shares of DIS WBD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor and this is not a recommendation to buy or sell a security. Investors are recommended to read all of the company’s filings and press releases as well as do their own research to determine if the company fits their own investment objectives and risk portfolios.

I analyze oil and gas companies, related companies and Disney in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.