Summary:

- People often buy presents on Amazon.

- However, I’m looking at Amazon stock as the perfect gift for my 2023 portfolio.

- Amazon’s stock got punished, dropping by about 50% from the highs last year.

- Yet, Amazon remains a dominant market leader with significant growth prospects and substantial profitability potential.

- Amazon’s stock should go much higher in the coming years.

HJBC

People buy many presents on Amazon (NASDAQ:AMZN). However, I’m looking at Amazon as the perfect present for my 2023 All-Weather Portfolio. Amazon has been one of the worst-hit big tech companies during this bear market, and the giant’s share price dropped by a whopping 50%, declining to its lowest level in almost three years. In other words, Amazon is now on a giant sale at a 50% discount.

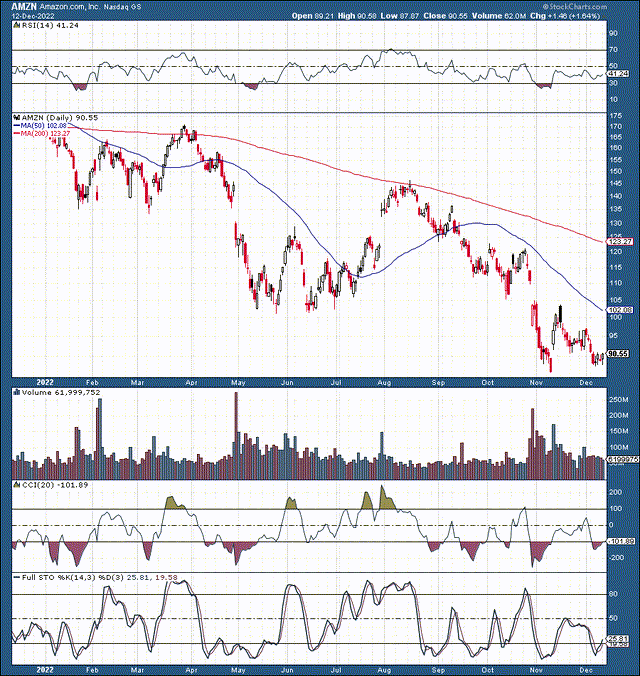

Amazon 3-Year Chart

Amazon’s stock price recently cratered below its pre-COVID high, dropping from an ATH of around $190 to below $90, almost hitting the post-COVID panic-induced low near $80. Selling has been extreme in Amazon’s stock, resembling panic and capitulation in recent selloffs. Amazon is around its critical long-term support range of $90-80, and downside risk is likely limited now. Also, Amazon’s technical picture is improving, and its stock may form a double bottom around the recent lows.

Amazon – The King of All E-commerce

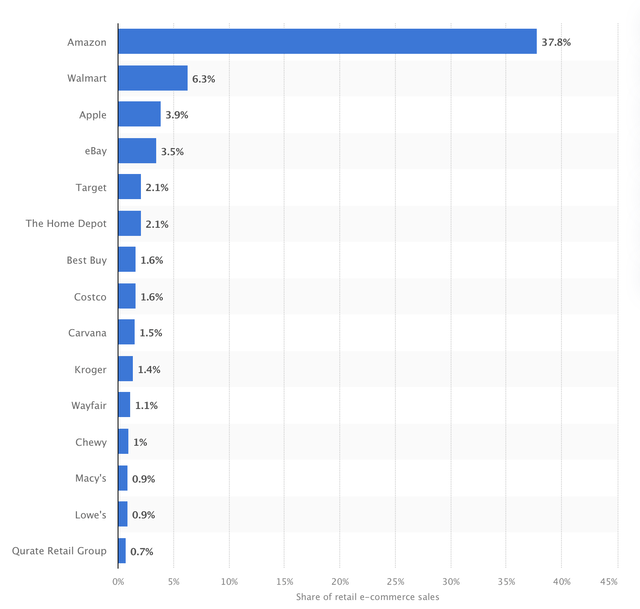

E-commerce Market Share U.S.

E-commerce market share (Statista.com )

Amazon has a 38% market share in the massive U.S. e-commerce market. Amazon’s tremendous market share dwarfs online competitors, such as eBay (EBAY), Walmart (WMT), and others. Also, while Walmart and others have gained some market share in recent years, Amazon continues to lead, innovate, and should continue expanding sales in its online retail business.

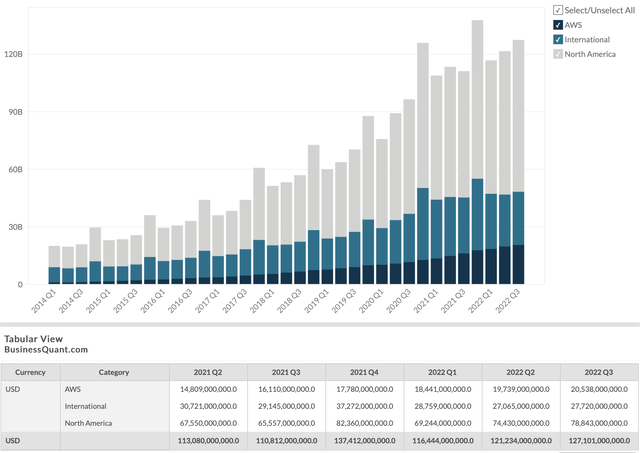

Revenue by Segment (Quarterly)

Segment revenue (Businessquant.com )

Last quarter Amazon’s North American segment brought in nearly $79 billion in revenues, a 20% YoY increase. Moreover, while growth internationally has been lackluster in recent quarters, Amazon’s overseas revenues will likely increase significantly once the transitory global slowdown concludes. Amazon’s brightest spot is its growing AWS cloud business. The unit delivered about $20.5 billion in revenues last quarter, surpassing the previous year’s results by 28%.

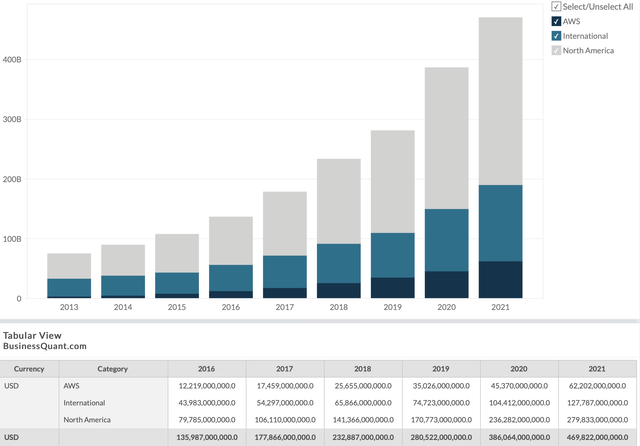

Revenues by Segment (Annually)

Revenues by segment (Businessquant.com)

Last year, Amazon reported nearly $470 billion in revenues, a jump of 18% over 2020. AWS revenues increased by about 38% in this time frame. From 2017 to 2021, Amazon expanded revenues by a staggering 163%. While the economy continues churning through this temporary slowdown, Amazon’s growth has slowed modestly. However, provided its momentum and track record, we should see plenty of revenue growth in the coming years from Amazon.

AWS – The Best in Cloud

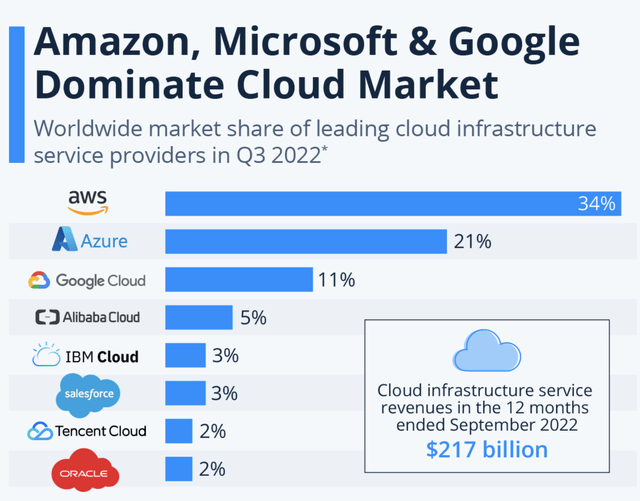

Cloud market share (Statista.com )

While Microsoft (MSFT) and Alphabet (GOOG) (GOOGL) control about 32% of the global cloud market, Amazon’s AWS is the undisputed leader with a 34% market share. There are numerous reasons why Amazon’s AWS is considered the top cloud service by many, and AWS’s leading position will likely remain strong for a long time. AWS continues expanding, and the unit should power revenue growth and profitability potential as Amazon advances in the coming years.

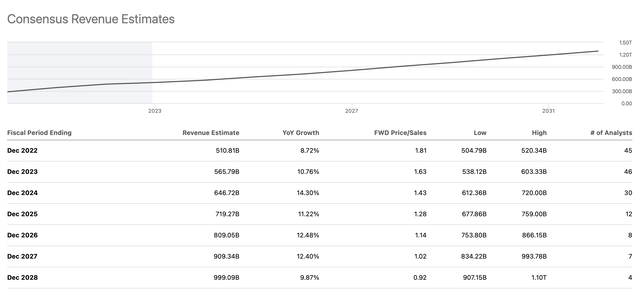

Revenue Expectations

Revenue estimates (SeekingAlpha.com )

Due to the challenging macroeconomic atmosphere and the transitory slowdown, Amazon’s revenues will probably increase by about 9% to roughly $511 billion this year. However, as the temporary slowdown passes, Amazon’s revenue growth should return to 12-15% or higher in future years. Consensus estimates are for around $1T in revenues in 2028, but the company could achieve the $1T sales mark sooner. Also, next year’s revenues could come in at around $570-580 billion, placing Amazon’s forward P/S ratio at approximately 1.5, which is relatively inexpensive for a dominant market-leading company in Amazon’s position.

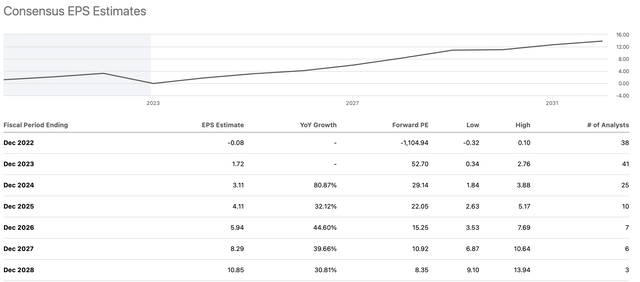

Earnings Estimates

EPS estimates (SeekingAlpha.com )

Amazon should become increasingly profitable as it progresses because of its size, AWS, and multiple operational advantages. However, the company will show little to no EPS this year due to several temporary or “one-time” (i.e., Rivian) challenges. Nevertheless, as the transitory issues pass, Amazon’s EPS growth should stabilize and increase, expanding by 30-40% in the coming years.

What Wall St. Thinks

Price targets (SeekingAlpha.com )

Despite significantly lowering estimates (35%), Wall St. appears to have very high hopes for Amazon. The average price target on the street is around $142, suggesting a potential upside of 58% in the next twelve months. Moreover, higher-end price targets go up to $250, implying a possible return of nearly 180% over the next year. While I am not that optimistic in the near term, Amazon’s stock should climb much higher in the coming years. Amazon has tremendous growth prospects coupled with enormous profitability potential. Therefore, once the economy stabilizes and improves, Amazon should have a long runway to go much higher, making the company’s stock a perfect present for the new year.

Where Amazon’s Stock Could be in a Few Years

| Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| Revenue Bs |

$585 |

$698 | $777 | $880 | $985 | $1,090 | 1,200 |

| Revenue growth | 14% | 19% | 11% | 13% | 12% | 11% | 10% |

| EPS | $2.52 | $3.88 | $5.40 | $7.70 | $10.50 | $14.40 | $20 |

| Forward P/E | 23 | 26 | 28 | 30 | 29 | 28 | 27 |

| Price | $90 | $130 | $215 | $315 | $420 | $560 | $650 |

Source: The Financial Prophet

I’m using relatively modest revenue growth projections, illustrating that Amazon should hit around $1T in sales by 2028. Amazon should become increasingly profitable as revenues increase and costs come down. Therefore, I’m projecting 30-40% EPS growth as the company expands and grows its highly profitable AWS business. In prior years, Amazon has commanded high forward P/E ratios (40-80). Yet, I am applying a relatively low P/E ratio of 30 or lower in future years. Therefore, Amazon’s stock could climb higher faster than my projections imply. Nevertheless, even with the modest P/E ratio, we can still see Amazon’s stock appreciate considerably in future years. I expect a stock price in the $500 range by 2028 or sooner, implying a potential return of approximately 455% over the next few years.

Risks to Amazon

Investing in Amazon is not without risk. However, the most significant risk could be the worsening macroeconomic outlook. There’s also the risk of increased competition, where other companies could take more market share from the e-commerce giant. There’s the risk of growth being slower than expected. Furthermore, Amazon may not become as profitable as estimated, and it may take the company longer to achieve significant ($10 or higher) EPS. Please consider these and other risks carefully before investing in Amazon stock.

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I’m long a diversified portfolio with hedges.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2021 return 51%), and achieve optimal results in any market.

- Our Daily Prophet Report provides the crucial information you need before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

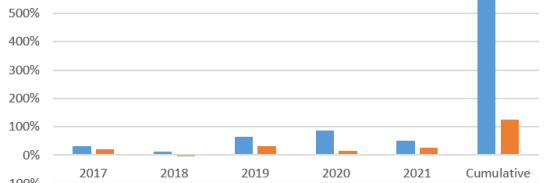

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!