Summary:

- Technological innovation may have reached a point beyond which it is difficult to improve.

- I would not be surprised if Apple may struggle to increase its revenues in the coming years.

- It may not be the right time to invest in Apple.

Justin Sullivan/Getty Images News

Continuous innovation is what has made Apple (NASDAQ:AAPL) one of the best companies ever created whose brand has become a status symbol. It is virtually impossible to question its achievements to date; however, it would be a mistake to assume that past performance can be replicated in the future regardless. Even the best company in the world can go through difficult periods, and I believe we are currently on the doorstep of one. My expectation is that as early as FY2023 the first signs of trouble may appear and the current price per share is not low enough to justify an investment.

Apple over the past 10 years

Before I set out my doubts about Apple, I think it is proper to discuss the company’s achievements to date as they deserve to be brought to the forefront.

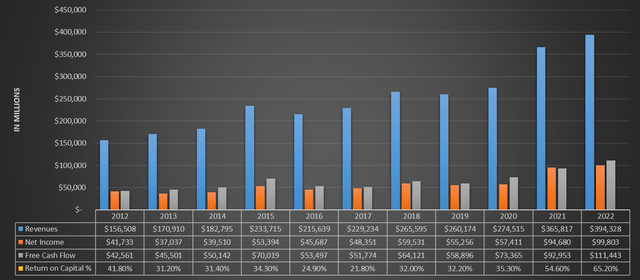

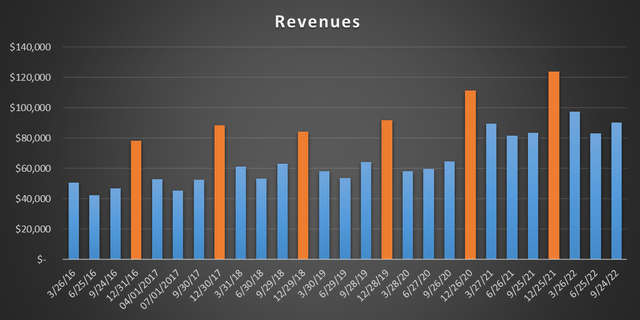

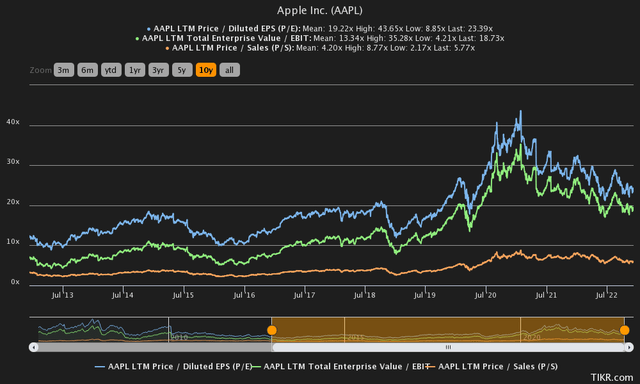

TIKR Terminal

From 2012 to 2022 Apple managed to sharply improve its soundness despite already posting profits of $41 billion ten years ago. Both profits and revenues are growing over the long term, and free cash flow in 2022 even exceeded $100 billion. Except for Saudi Aramco (favored by high oil prices), Apple was the best company in the world at generating cash.

Given these figures, it is virtually impossible to find a weakness other than to expect that something may change in the future. Apple has never been more solid than it is today, and what is most surprising is the improvement achieved since 2020. From 2012 to 2020 growth was sustained, but in 2021 revenues beat the estimates of even the most positive analysts, and in 2022 the trend did not stop. The outbreak of the pandemic has affected the revenue growth of major tech companies, and this has also led to a change in their valuation.

TradingView

As positive as this was initially, we are already seeing today the negative consequences of sudden growth versus sustained growth over time. Anything that goes up too fast will often collapse quickly.

Apple’s free cash flow has improved by $38 billion in just two years to an incredible $111.44 billion. I do not dispute that this figure is sustainable in the long run; my doubt is mainly related to how much Apple can improve in the coming years. For financial markets, expectations are everything, and I don’t think the market is currently pricing in a negative scenario for Apple where there will be no growth in the next few years.

Overall, I do not question the current strength of this company, but its future prospects. I believe it has reached such a dominant position that any deterioration in the future is more likely than further improvement.

Innovation is in trouble

The concept of innovation is certainly one of the central themes when it comes to Apple, which is why consumers have always been willing to spend more to buy the latest models just released. But there is a problem: technology is a deflationary force.

Following Moore’s law, computers over time get smaller, faster but also cheaper. This means that a smartphone costing $300 in 2010 was far inferior to one of the same price purchased this year. For consumers this process favors them as they get better products at a better price over time, but for companies it is a problem as they are forced to innovate so that they can justify the high price of their top-of-the-line products.

The smartphone market

The smartphone market has changed profoundly since its early days. Initially, the players in the game were only Nokia and Motorola; it was basically a duopoly. Today the situation has totally changed and these two companies, once reputed to be market leaders, are only a distant memory. Apple and Samsung currently dominate this market, but over the past 10 years Chinese brands such as Huawei, Oppo, and Xiaomi have been gaining in importance. The efficiency of their smartphones combined with a very cheap price has been crucial in fostering more and more choice for consumers.

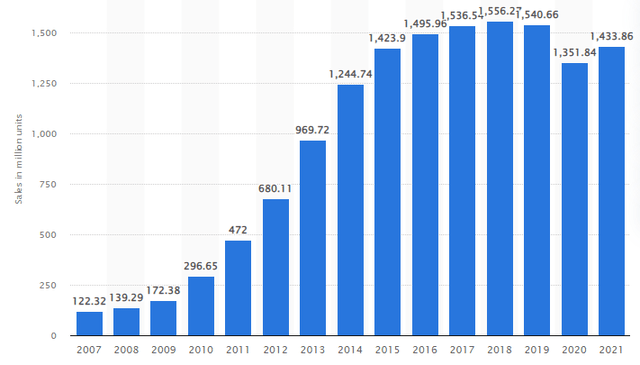

Statista

The units of smartphones sold since 2007 have increased significantly, but since 2015 this trend has stabilized. Contributing to this growth has certainly been the increasing importance of smartphones in our lives, to such an extent that without them we feel out of touch with the world. Currently 83% of the world’s population owns a smartphone and this figure is expected to increase slightly in the coming years.

This market is undoubtedly one of the most relevant in the world, but objectively it is becoming completely saturated and the models offered have now undergone a process of homogenization that makes them very similar to each other. The design of all new smartphones, with the exception of a few models, lacks the sense of novelty that distinguished previous years. In addition, the best technologies that caused a stir in the past have also been integrated on the currently cheaper models. When in 2017 Apple launched the new iPhone X capable of having the first security system based on facial recognition (Face ID) everyone was eager to buy it and try this new technology. Five years later today even the new $200 smartphones have Face ID and this technology is considered almost obsolete.

The more time passes, the more difficult it will be for companies such as Apple and Samsung to succeed in implementing new technologies that can draw consumers’ attention to themselves. The top-of-the-line devices of previous years are already extremely powerful and can do everything we need. What’s more, today for the average consumer it is not even necessary to buy an expensive smartphone anymore since even the mid-range ones manage to meet almost all of his or her needs. Being able to surprise today’s consumers is more difficult than in the past, and this is the biggest problem for companies in this sector.

Apple’s main problem

As previously anticipated, it has already been years since top-of-the-line smartphones such as iPhones have reached such a level of efficiency and speed that the improvement between one model and the next is of little relevance. In any case, the main risk for Apple isn’t losing (it has one of the highest loyalty rates in the market) but the possibility by customers to postpone the purchase of their new iPhone, thus hurting Apple’s revenues. I expect that this process could begin as early as 2023, and now I will explain why.

Why should I change my iPhone?

One of the reasons Apple has become synonymous with quality is because its products are designed to last. If maintained well, an iPhone can last as long as 5-7 years since it always maintains high performance. The limit of life expectancy, more than anything else, is due to a device’s inability to upgrade to the latest iOS operating system.

However, although an iPhone can potentially last that long, consumers are unlikely to wait 5 years to purchase a new model. The reason for their choice lies mainly in their desire to get a new iPhone with unique features compared to the model they owned despite the fact that the latter is still functional. Following this reasoning, what most drives a customer to buy the new iPhone is therefore not the obsolescence of the owned model but how innovative the latest model released on the market is.

Let me give you an example to explain further.

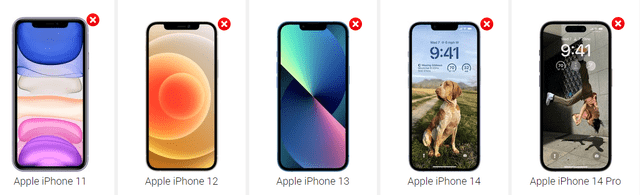

pianetacellulare

When the iPhone X was released in November 2017, the new features compared to the previous models were such that even those who had purchased the previous models just released were interested. The iPhone 7 ($649) had come out the year before, the iPhone 8 ($699) a month earlier, yet those who owned one of these new models felt a strong need to buy the iPhone X ($999).

But why so much hype? Beyond the usual improvements related to device speed, camera, and battery, new technologies such as face ID had been implemented. Also, from the image above, it can be seen that its design was at the time totally innovative compared to previous models. Although it was the first model to cost $999, at its release its price mattered very little to people. When there is innovation no price is too high.

Five years later, we can say that the iPhone X has been one of Apple’s biggest successes and is still popular today. Since its release the average price per iPhone sold has increased and today it is no longer a surprise to spend $1000 for the newly released model.

Apple’s history is full of such successes and examples, however, in recent years I believe something is changing. As anticipated at the beginning of the article, technological progress is reaching such an level that it is difficult to improve further; therefore, recent iPhone models do not have significant improvements over previous ones. Basically, I believe that those who own the latest generation of iPhones will tend to postpone the purchase of a new one since there are not such big differences.

Again taking the iPhone X as an example, it is amazing to note how its performance does not disfigure in front of the new iPhone 14 Pro. Obviously the gap is noticeable, but the iPhone X remains a good smartphone 5 years after its release and also aesthetically it still has a modern design. If you tried to make the same comparison with the iPhone 5 released 5 years before the iPhone X, the difference would be far more obvious, not only in performance, but also in design.

hdblog

Speaking of design, the latest iPhones are basically the same, and having all been updated to the latest iOS operating system, the difference between them is almost imperceptible in daily life. Obviously the iPhone 14 Pro is the best of all, but I don’t think the recent innovations are a strong incentive to buy it if you already own the previous models. Having an iPhone 11,12 or 13 already means you have an extremely powerful device that can perform all the necessary functions.

Personally, I don’t think the average consumer just needs to know that the new iPhone 14 Pro has a slightly better camera and is slightly faster to spend $999. What’s more, the new feature called “dynamic island” is nothing innovative or even surprising. Leaving aside the fact that this feature has already been implemented in a 2018 HONOR V20, so it cannot be called an innovation, its actual usefulness is yet to be assessed. Apple introduced it to try to solve the problem related to the bulky camera notch, but there are still many doubts if the best solution was to make it interactive for some apps.

I certainly don’t doubt that there are millions of people willing to buy the new iPhones because they are excited about the dynamic island, but from such a company I honestly expect more. How long will Apple be able to sell its new products at high prices without making significant innovations? And by significant innovation I don’t mean being able to open Instagram 2 tenths of a second earlier or having a 3x zoom instead of 2x.

Someone might respond that Apple’s brand perception is so positive in the eyes of fans that it can sell almost the same product for $1000 every year. I agree with this and would never question its competitive advantage, but how long will customers be willing to accept this? And what will keep them from buying an iPhone every 5-6 years if there are no significant differences with the new models?

Technological innovation in the last decade has been unprecedented in history, and it is getting harder and harder to improve. Apple has all the money in the world to fund new projects, but sometimes it’s not just a matter of money, there simply aren’t the ideas.

azquotes

Different iPhone cost outside the United States

Since the release of the first iPhone, prices of new models on the launch date have increased considerably. However, since the iPhone X, prices have at least stabilized, and only the Pro Max models have reached $1099. If we considered inflation-adjusted prices, the new models are even cheaper than their predecessors. It is definitely not a walk in the park to buy a smartphone for $1099, but being one of the best around it might be worth it. However, there is one important aspect to consider: 63% of Apple’s revenue is generated internationally where the prices of its products are higher than those in the U.S.

phonearena

In this chart we find the prices of an iPhone 14 Pro Max around the world.

But what is the reason for this price difference between countries? There are several:

- Different taxation

- Import costs

- Regulations related to different insurance costs

- Hedging against foreign exchange risk

As can be seen, the United States is the cheapest country to buy an iPhone, while Brazil and India are the most expensive. Europe is certainly not at a discount either. In any case, to understand how expensive it is to buy an iPhone, it is not enough just to know its price, but we must also consider how rich that particular country is.

Calculated by me through the sources already mentioned

In this other graph I have related the price of an iPhone 14 Pro Max and the average net monthly income of these countries. The result is that a U.S. person will be able to buy it with about ¼ of his net monthly income, while a Brazilian will have to set aside 5 monthly salaries to be able to afford it. In Europe the situation is better, but in the case of Italy, for example, an entire monthly salary will be needed. Moreover, this graph obviously does not take into account the different propensity to spend between countries. For example, unlike Americans, Europeans are much more conservative when it comes to buying something so expensive as they are not prone to debt. The way and frequency with which credit cards are used is completely different.

All this does not mean that Europeans will not buy the new iPhone, but that they will think twice before doing so at these prices and especially if they already own a previous model not too different from the new one. But this is not the end of the story, because we must also consider a possible recession just around the corner.

The major central banks around the world are rapidly raising interest rates to defeat a 40-year high inflation. As we all know, the effects of monetary policy do not occur immediately, but with a time lag of months. Compared to last year, we are in a situation where inflation is eroding consumer purchasing power, access to credit has become difficult, and households are paying higher interest rates.

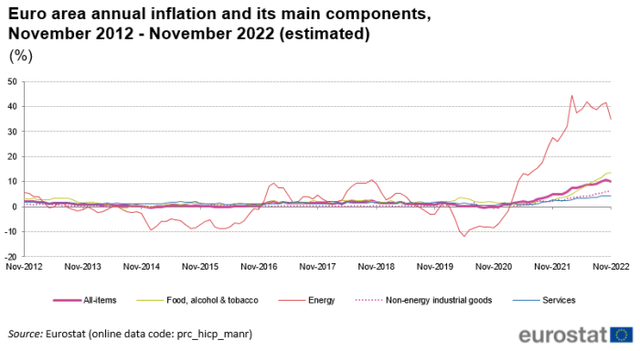

Eurostat

To make matters worse, unlike the U.S., inflation in Europe is still in double digits due to high energy prices.

Whether or not all this can lead to a severe recession, objectively we are in a more complicated phase of the business cycle than in previous years, and I do not see how Apple can benefit from this. In my opinion, it is likely that households in 2023 will have more problems to think about than in the past, and buying a new iPhone may not be among them.

Slowdowns for the next quarter

Last month hundreds of workers revolted against the inhumane conditions they were subjected to inside the Foxconn manufacturing plant. Due to a Covid-19 outbreak, the Chinese government prevented the 200,000 employees from returning to their homes and they were forced to remain on the job. To date, the problem has been resolved, but continued protests in November stopped operations from running smoothly, and the entire plant has been operating below its production capacity. Since the Foxconn plant is critical to the assembly of iPhone 14 Pro and iPhone 14 Pro Max this is a potential damage of some magnitude for Apple (AAPL). In fact, as there are fewer models available, demand may not be fully met and deliveries may be delayed by several weeks.

- Bloomberg estimates that the damage amounts to an underproduction of about 6 million iPhone 14 Pro and Pro Max.

- Analyst Ming-Chi Kuo is more pessimistic and estimates that total iPhone 14 Pro and 14 Pro Max shipments in the next quarter will be 15-20 million units less than expected.

Figuring out which estimates are more correct is difficult to determine now, what we do know, however, is that Foxconn employees have been protesting during the worst period for Apple.

TIKR Terminal

Historically, the last 3 months of the year have always been the best for Apple being in conjunction with the Christmas season and the release of new models. However, this year may be different since those who order an iPhone 14 Pro and Pro Max now will receive it in early January 2023.

In my opinion, such a delay in delivery could be an additional incentive to avoid buying the latest models. A Christmas gift delivered after the holidays could lose significance, which is why I believe that some of the unmet demand will not be recovered in the first quarter of 2023.

In addition, I would like to make one last personal point. In late 2023, the new iPhone 15 Ultra is scheduled to be released, and there is already a lot of hype about it as it is expected to contain significant innovations compared to previous models. Spending $999 or more for an iPhone 14 Pro that will be delivered in early January might not be that exciting considering that after 7-8 months you will have the opportunity to buy a “revolutionary” iPhone. In my opinion, I would be very surprised if revenues in the last quarter of 2022 managed to exceed those of the previous year.

Main risks of my bearish thesis

In this article I have highlighted the reasons that might lead consumers to gradually become disinterested in buying a new iPhone, however, it’s always possible that my view turns out to be incorrect. Customer loyalty has been a key factor in recent years for Apple, and its customers are unlikely to deprive themselves of the latest products just released. To give you an idea of what I’m talking about, let’s take a look at a recent survey discussed on thestreet.com.

- About 21% said that it is worth going into debt for a new iPhone; thus, consumers do not seem to be frightened by the rising interest on their credit cards.

- About 31% of respondents said that a new phone is a necessity. This figure may signal that respondents are still reluctant to change iPhones every 4-5 years as I previously speculated in my bearish thesis.

- About 20% said that not having the latest model is a sign that someone is struggling financially. As explained earlier, Apple also represents a status symbol of wealth, so such a result is not all that surprising. In any case, I find it disconcerting that such a large amount of the respondents answered in this way.

- About 34% said that their phone was their most valuable asset.

In light of these results, it is evident how Apple has been able to create a highly addictive relationship with its customers, who are willing to do anything to get the new iPhone. Moreover, it would seem from these results that the purchase of an iPhone is regardless of its technical features, as its main role is to gain community approval. People who buy an iPhone feel part of an elevated social class, which is why they are also willing to go into debt in order to appear that way. It is as if part of those who buy an iPhone wants to escape from their unfavorable economic condition, not realizing that in doing so they further harm it. When a brand elicits such behavior from consumers, it is unlikely that the situation will change in the short to medium term. Nevertheless, I stand by my view, but I realize that the risks of my thesis are high. Apple fans may act beyond all market logic.

Quantitative valuation and final considerations

As you may have guessed, my expectations for Apple’s revenue growth are low, at least in the short to medium term. I do not doubt that it can return to faster growth in the long run, but it will have to exploit new business segments.

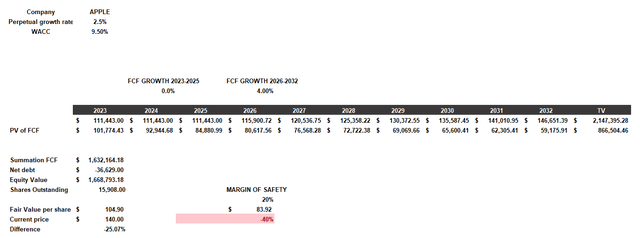

In this section I will turn what I have said so far into numbers, and through a discounted cash flow I will calculate Apple’s fair value. This model will be constructed as follows:

- Having negative net debt, I have considered the WACC equal to the cost of equity. The latter, was calculated using a beta of 1.22, a country market risk premium of 4.20%, a risk-free rate of 3.50%, and additional risks related to technology development of 1%. The result is 9.50%.

- Net debt and shares outstanding belong to TIKR Terminal.

- Starting with FY2022 free cash flow, I have considered a stall in growth until FY2025, and then restarting until 2032 at an annual rate of 4%. The perpetual growth rate will be 2.50%.

Discounted cash flow

According to my assumptions, to achieve an annual return of 9.50% we would have to buy Apple at only $104 per share. Wanting to consider a 20% margin of safety, around $80 per share would be an ideal price. At first glance this may seem too conservative a valuation, but as I have repeatedly said in this article, I believe Apple is unlikely to grow as it has in the past. There are structural limits to be met, and to believe that it will grow every year by 10% is pure speculation. Under current assumptions Apple would have a stable free cash flow reaching $146 billion in 2032; I don’t see that as such a bad scenario at all.

In addition, the price multiples support what is expressed with discounted cash flow as they are above the 10-year historical average.

TIKR Terminal

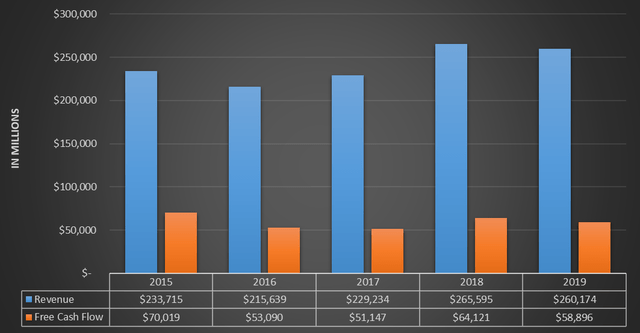

In conclusion, for those who firmly believe that Apple’s growth cannot stall I recommend looking at the last image in this article.

TIKR Terminal

Although in 2015 Apple was already a successful company and everyone wanted the new iPhone, the 2015-2019 period was not easy. Free cash flow only recovered in 2020, while revenues took 3 years to exceed 2015 levels.

I have noticed that it is often taken for granted that Apple is seen as a long-term certainty no matter what. In my opinion this is wrong, whatever the company in question. If all it took to make a good investment was to invest in the best company in the world then we would all be rich. There are so many other components to evaluate and I hope I have clarified some of them.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I would like to make it clear that this article does not express my willingness to short Apple, but to invest in it at a much lower price than the current one.