Summary:

- Micron Technology’s fundamental performance has been obliterated by a worsening cyclical downturn over the past year, and faces continued uncertainties ahead of looming recession risks.

- The memory chipmaker has been cautiously conservative about its near-term outlook, diverging from peers that have become incrementally optimistic for a fast-approaching recovery in demand.

- The rut is further exacerbated by Micron’s exposure to China risks, with recent findings from Beijing’s cybersecurity review putting half of its sales generated from the region on the line.

Sundry Photography

Micron Technology (NASDAQ:MU) remains one of the worst-performing semiconductor stocks in the market. While Micron’s peers have largely cited optimism for a recovery in the second half of the year for the industry that has been upended by the post-pandemic bust, the memory chipmaker – prone to the looming recessionary slowdown in consumer electronics demand – has offered a more tepid outlook on the pace of ongoing inventory adjustments across its end markets.

Following a cybersecurity review on the company’s operations in the Chinese market, the region’s Cyberspace Administration (“CAC”) confirmed last month that some of Micron’s products have been found to pose a “significant security risk to [China’s] critical information infrastructure supply chain, which would affect national security.” While analysts and management alike have initially expected an immaterial impact on Micron’s fundamental performance given the findings would only affect components exposed to “critical information infrastructure” – such as hardware for data center, cloud and high-performance computing (“HPC”) workload applications, which do not form a key sales vertical in the region for the memory chipmaker – recent developments show the related regulatory changes could affect up to half of its sales tied to “China-headquartered clients.”

The following analysis will aim to quantify the potential impact of China’s regulatory changes imposed on Micron’s operations, and gauge the related impact on the stock’s prospects amid ongoing industry headwinds. Currently trading at about 4x estimated sales, which trails the broader Philadelphia Semiconductor Index’s average of about 7x, Micron stock has likely already priced in much of the bad news facing its underlying business, effectively reducing the shares’ susceptibility to incremental news-induced volatility ahead.

Stuck in the Beijing-Washington Crossfire

Micron was subjected to a cybersecurity probe by the CAC in March, which comes on the heels of Washington’s curbs on exports of advanced chip technologies to China last year. The regulatory changes ensuing from Washington’s order had initially roiled the broader semiconductor sector, especially amongst HPC, AI, cloud and other advanced chipmakers, including Intel (INTC), Nvidia (NVDA), and Advanced Micro Devices, Inc. (AMD), before the impact was overshadowed by the latest AI frenzy. While Micron’s fundamental prospects had largely been spared from the impact of export curbs announced last year, given its limited exposure to HPC-specific and other advanced workload applications, the memory chipmaker has recently found itself at the center of regulatory interest amid the ongoing Beijing-Washington crossfire.

Following the CAC’s probe initiated in March, the Chinese regulatory body has recently found unspecified, “relatively serious cybersecurity risks in Micron products” that would put the country’s national security at risk, echoing Washington’s reason provided for its decision to curb U.S. chip exports to China. The findings have encouraged calls from Chinese regulatory authorities to “operators of key infrastructure against buying [Micron’s] goods.” Micron had initially sought to assuage market’s concerns, citing that the probe has not affected its shipments to China – a region that represents approximately a fifth of its quarterly sales.

“Micron’s product shipments, engineering, manufacturing, sales and other functions are operating as normal,” the company said in an updated response to the March 31 announcement of an investigation by Beijing. “Micron is committed to conducting all business with uncompromising integrity, and we stand by the security of our products and our commitments to customers.”

Source: Bloomberg News.

Similarly optimistic sentiment was recently echoed by Wall Street analysts, citing Micron’s limited exposure to “critical information infrastructure” end markets targeted by the CAC’s recent findings and decision:

Analysts at Jefferies including Edison Lee said in a research report that the CAC’s decision will likely have a small impact on Micron because it focuses on “critical information infrastructure,” meaning operations like data centers and cloud computing services with security risks. Most of Micron’s memory chips sold in China are actually used in consumer electronics, like smartphones and notebooks, they said.

Source: Bloomberg News.

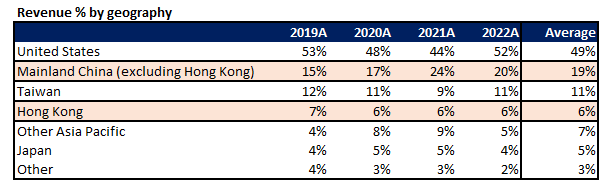

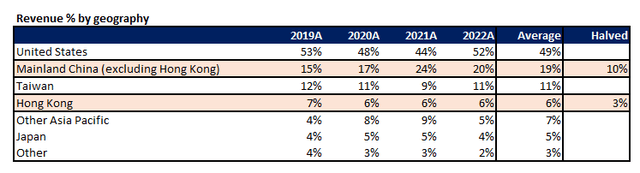

Yet, in the latest turn of events, Micron warns that the CAC’s decision could affect as much as half of its shipments to “China-headquartered clients.” Considering Micron’s sales to mainland China represent on average 20% of its annual consolidated revenue in recent years, the ensuing impact from Beijing’s cybersecurity probe and decision is expected to affect a “low-double-digit percentage of its global revenue.” The company has labelled the situation as “uncertain and fluid” in a recent SEC filing, citing several of its customers “headquartered in mainland China and Hong Kong”, which together represent approximately a quarter of Micron’s annual sales, have been ordered by Chinese authorities to limit their “future use of Micron products.”

Author, with data from Micron’s SEC filings

Understanding Micron’s Fundamentals

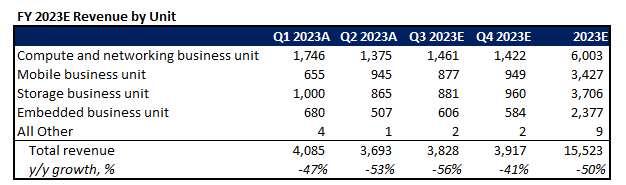

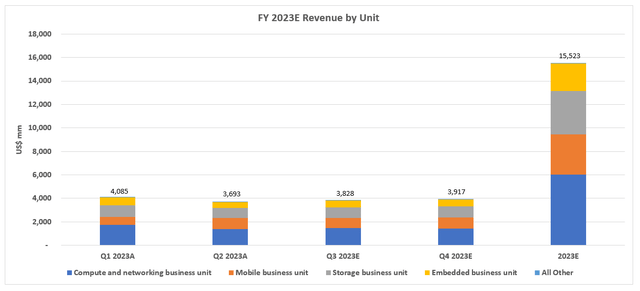

Before sensitizing Micron’s estimated exposure to fundamental and valuation risks ensuing from the Chinese government’s recent regulatory restraints, we turn to understanding the company’s base case financial performance. Micron has been one of the hardest hit stocks over the past year, as its underlying business’ fundamental performance continues to be challenged by a cyclical downturn in memory chip demand across all end markets. The company’s underperformance is in line with the ailing demand environment for its core PC and smartphone end markets. Specifically, global PC and smartphone shipments have been on an accelerating decline over the past 12 months, with shipments down 30% y/y and 14% y/y, respectively, during the first quarter.

While Micron’s semiconductor peers are expecting an improvement to demand in the second half of calendar 2023, with optimism that the worst of ongoing industry inventory corrections have past, the memory chipmaker’s outlook on the situation remains conservative. Micron has cited expectations for a potential recovery in the data center end market to “relatively healthy levels” this year, with continued resilience in automotive applications during its latest earnings call.

In data center, we believe that our revenue bottomed in fiscal Q2, and we expect to see revenue growth in fiscal Q3. Data center customer inventories should reach relatively healthy levels by the end of calendar 2023…We expect continued growth in auto memory demand for the second half of calendar 2023, driven by gradually easing nonmemory supply constraints and increasing memory content per vehicle.

However, the remainder of its targeted end markets – particularly in industrials, mobile, graphics and storage – remain exposed to “significant near-term challenges,” with anticipation for gradual improvements in volume take-rates through fiscal 2023 to be offset by ongoing headwinds in the pricing environment.

While some customer inventories are back to normal levels, other OEMs’ inventories remain elevated…Our expectations for calendar 2023 industry bit demand growth have moderated to approximately 5% in DRAM and low-teens percentage range in NAND, which are well below the expected long-term CAGR of mid-teens percentage range in DRAM and low-20s percentage range in NAND. The reduction in calendar 2023 demand from our prior forecast is driven by an assessment of customer inventories as well as some degradation in end market demand…While the supply-demand balance is expected to gradually improve due to the high levels of inventories, industry profitability and free cash flow are likely to remain extremely challenged in the near term.

Source: Micron F2Q23 Earnings Call Transcript.

Looking ahead, without incremental consideration of recent regulatory limitations in its Chinese operations, we expect Micron’s fiscal third quarter results to have stayed tepid on sequential basis, with only modest signs of recovery through the fiscal fourth quarter. The assumption considers the company’s exposure to ongoing uncertainties in the demand environment among its core end markets. While shipments to the automotive vertical have been resilient due to “gradually easing nonmemory supply constraints and increasing memory content per vehicle,” looming recession risks could further cloud visibility on the end market’s demand prospects, compounding the persistent headwinds observed across its other core consumer-centric verticals.

However, Micron remains well-positioned to benefit from longer-term secular tailwinds, which we believe have not yet been adequately reflected in the stock’s value at current market levels. Specifically, Micron remains largely tangled in the narrative over impending recessionary pressures on consumer-centric verticals, with markets overlooking its longer-term prospects in HPC applications stemming from burgeoning interest in generative AI developments.

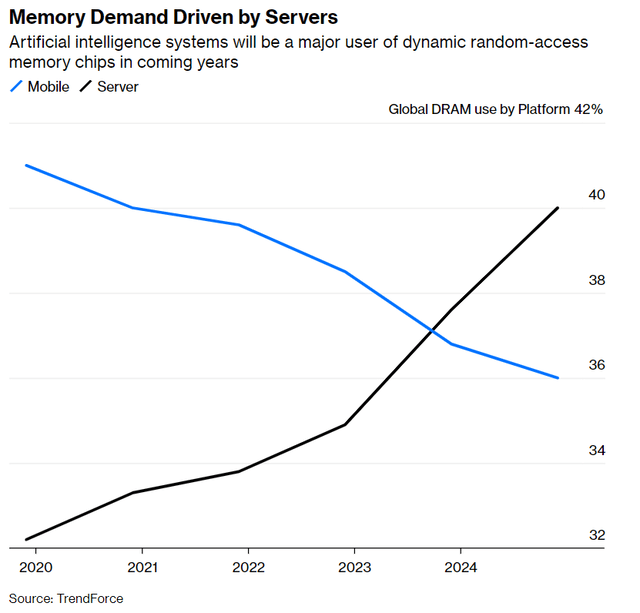

In addition to advanced server processors and data center GPUs used to facilitate accelerated computing needs, demand for memory chips are poised to get a lift from the burgeoning interest in generative AI developments. Specifically, increasingly data-hungry AI workloads are going to require significant temporary memory storage, such as DRAM, to complement the full potential of accelerated computing power:

When you’re processing billions of pieces of information in a single go you need that data close at hand and delivered quickly. A lack of adequate DRAM in a system will slow down a computer significantly, neutralizing the value of spending $10,000 on the best processors to run sophisticated chatbots. Which means that for every high-end AI processor bought, as much as 1 Terabyte of DRAM may be installed — that’s 30-times more than a high-end laptop.

Source: Bloomberg News.

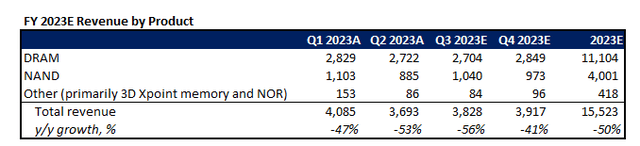

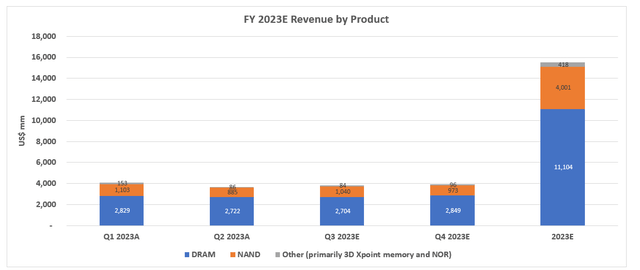

Meanwhile, NAND flash – which stores data without power requirements – will also be in high demand in the transformational change in computing brought upon by generative AI, given the need to “save large amounts of output nearby so that it can be read and written quickly.” Taken together, memory chips for server application are expected to outpace demand from Micron’s core mobile vertical over the longer-term, underscoring favorable secular trends ahead for further expanding the company’s global DRAM market share from the current 20% range.

And the memory chip maker has been bolstering its technological expertise in order to optimize capitalization of the impending secular growth opportunities. In addition to the ongoing ramp up of 1-alpha and 1-beta DRAM bit production – which delivers improved power efficiency without compromising performance – to facilitate “data-hungry applications…in everything from mobile devices and smart vehicles to the data center, industrial edge and beyond,” the company is readying start of productions of the 1-gamma node by mid-decade. The 1-gamma node will be Micron’s first process technology for DRAM production to be based on extreme ultraviolet lithography, which would allow for even “higher memory capacity in a smaller footprint,” further lowering both latency and power requirements, while also enabling greater performance needed to “accelerate AI applications.” The DRAM developments will also complement Micron’s latest 232-layer NAND, which represents the “industry’s smallest package” with industry-leading performance to “support advanced solutions and real-time services required in data center and automotive applications, as well as responsive, immersive experiences on mobile devices, consumer electronics and PCs.”

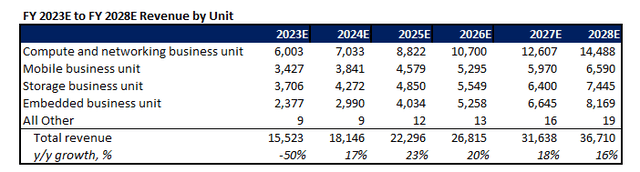

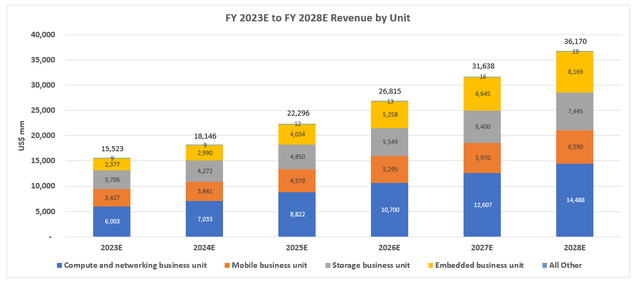

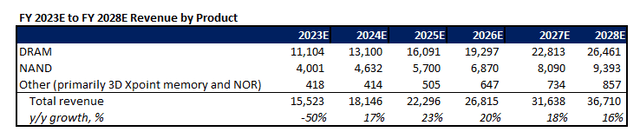

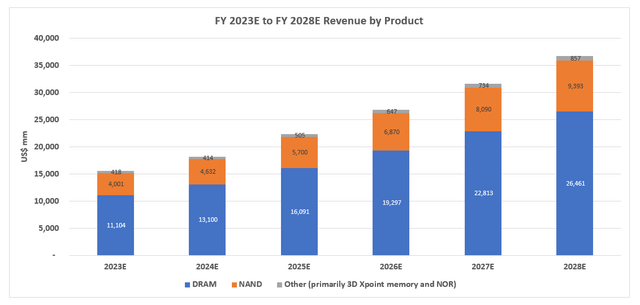

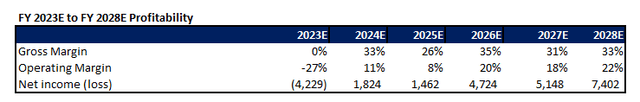

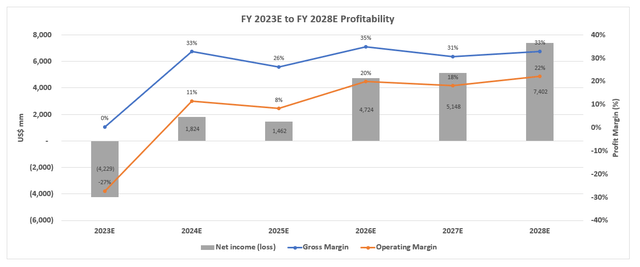

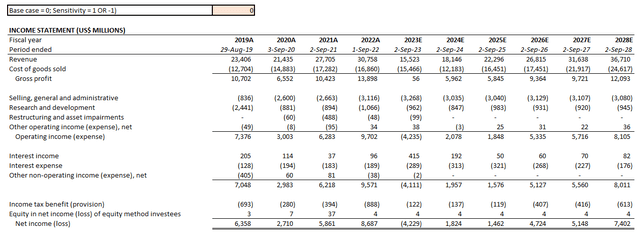

Taken together with the eventual return of cyclical tailwinds across its core consumer electronics, industrials, storage and automotive applications, Micron’s consolidated sales are expected to expand at a five-year CAGR in the mid-teens range, in line with management’s expectations in combined DRAM and NAND demand over the longer-term.

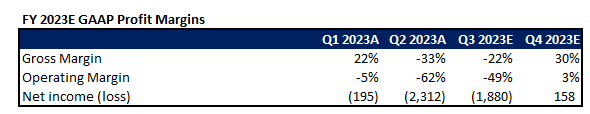

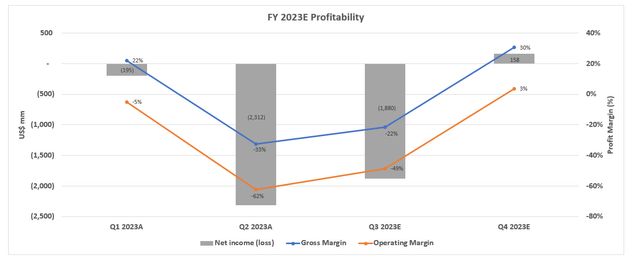

Meanwhile, on the profitability front, Micron’s margins are expected to stay impacted through fiscal 2023 due to the lingering effects of persistent inventory write-downs due to the challenging pricing environment, as well as other restructuring charges. Specifically, the company has already recorded an eye-watering $1.4 billion in inventory write-downs during the fiscal second quarter, due to average selling prices that have fallen below production costs in order to “remain competitive in the market.” And another $500 million is likely on the way for the fiscal third quarter based on management’s guidance, as the sales impact from improving volume shipments are expected stay compromised by persistent price declines in line with observations from the fiscal second quarter:

[Fiscal Q2] DRAM revenue declined 4% sequentially, with bit shipments increasing in the mid-teens percentage range and prices declining by approximately 20%…[Fiscal Q2] NAND revenue declined 20% sequentially, with bit shipments increasing in the mid- to high-single-digit percentage range and prices declining in the mid-20s percentage range.

Source: Micron F2Q23 Earnings Call Transcript.

However, margins are poised to re-expand over the longer-term, likely beginning 2024, as Micron comes off of inventory write-downs as transitory ASP reductions return to normal levels in tandem with ongoing improvements in the chip supply-demand balance. The anticipated improvements to Micron’s pricing environment are expected to complement the company’s cost optimization efforts implemented in recent months – including “executive salary cuts and suspension of fiscal 2023 bonuses, [as well as] headcount reductions” – which together will drive a more evident positive impact on its bottom-line performance through next year alongside ongoing production ramp-up of its latest 1-beta DRAM and 232-layer NAND nodes, and improved utilization towards normalized levels.

Micron_-_Forecasted_Financial_Information.pdf.

Valuation Analysis

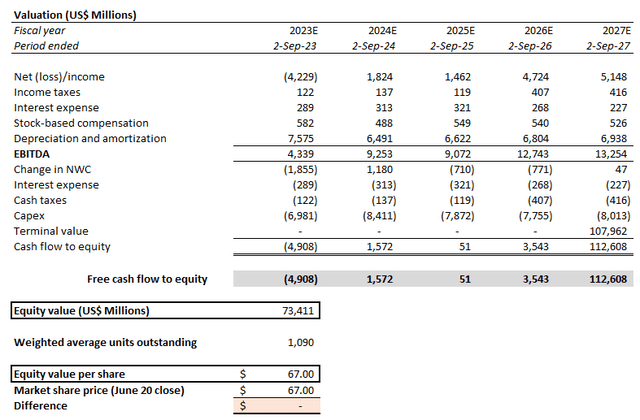

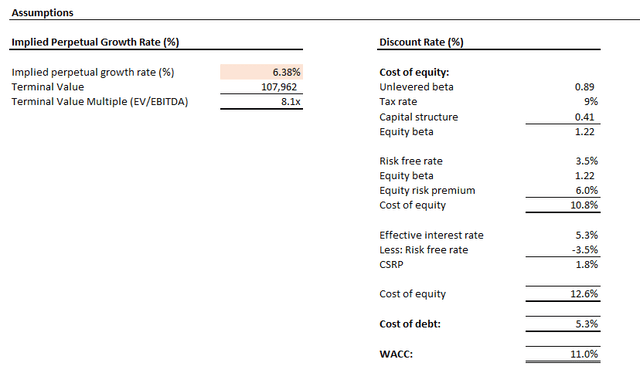

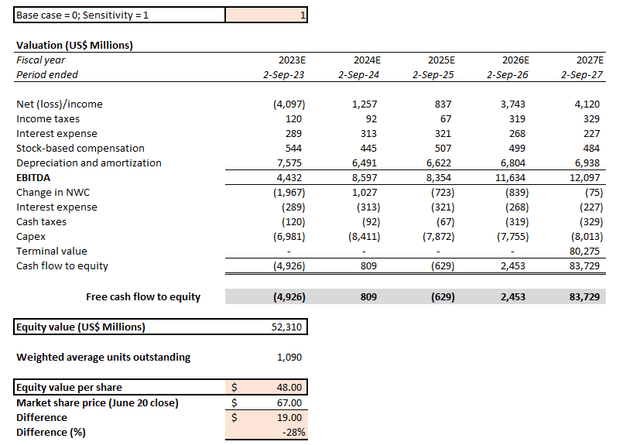

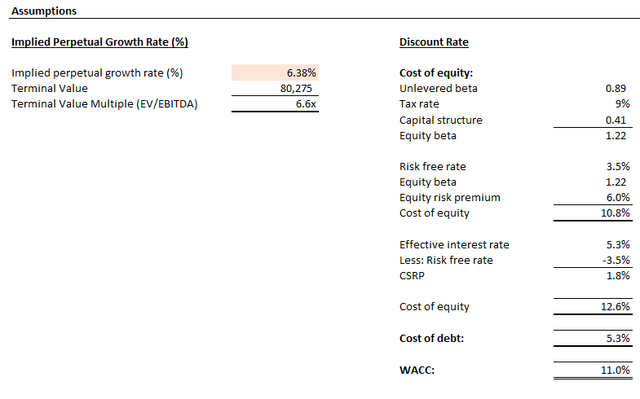

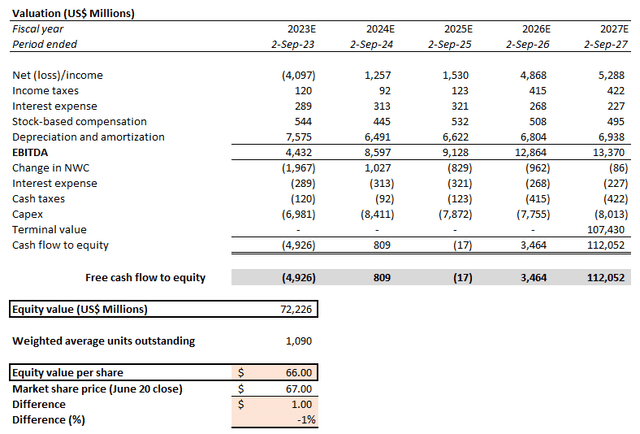

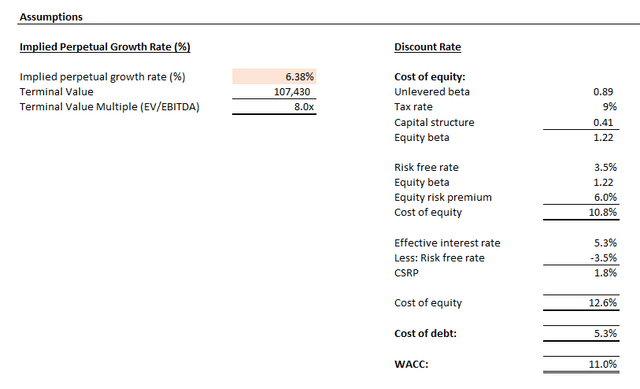

Considering Micron’s base case financial projections, without taking into considering the incremental impact of recent developments in its Chinese operations, the stock’s current market value implies a perpetual growth rate of about 6.4%.

While Micron’s estimated perpetual growth rate represents a premium to the pace of economic expansion across its core operating regions, it is a reasonable reflection of the company’s longer-term opportunities stemming from secular technology trends. Yet, the implied valuation assumption still trails behind its semiconductor peers. For instance, Nvidia, which boasts a market cap of more than $1 trillion following its AI-fueled rally, currently trades at a more than 10% implied perpetual growth rate.

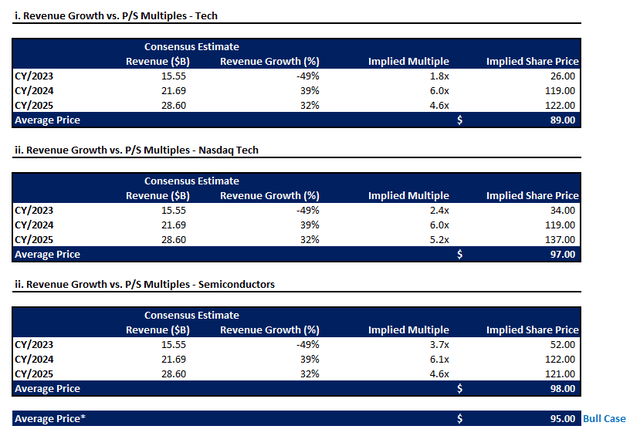

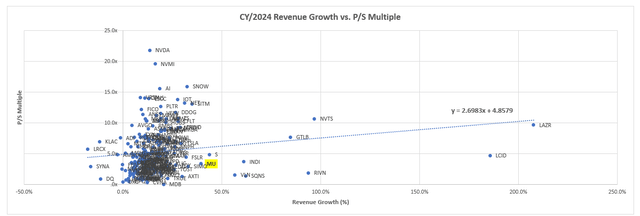

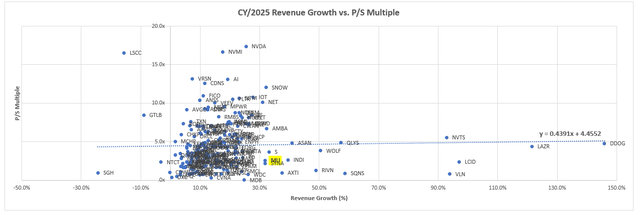

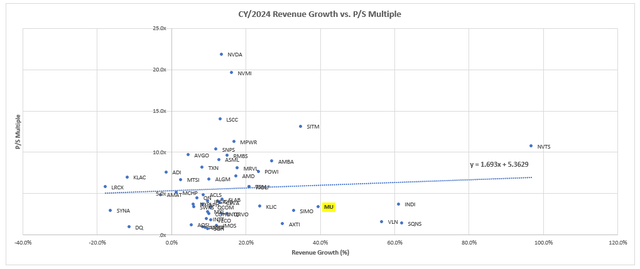

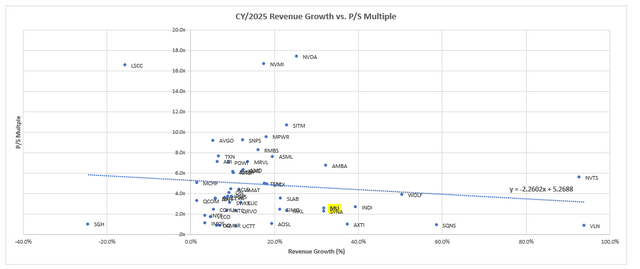

Micron’s discounted valuation on a relative basis to peers with a similar growth profile is also reflected through the multiple-based approach. Specifically, Micron’s anticipated growth reacceleration in calendar 2024 and 2025 remain underpriced relative to both the semiconductor and broader technology peer group. [peer comp]

i. Sales Growth vs. P/S Multiple – Technology Sector

Author, with data from Seeking Alpha Author, with data from Seeking Alpha

ii. Sales Growth vs. P/S Multiple – Semiconductor Sector

Author, with data from Seeking Alpha Author, with data from Seeking Alpha

If the Micron stock were to trade in line with peer valuations, then the shares could potentially reach the $90-range apiece.

However, the current discount to peers likely reflects the ongoing market challenges facing Micron’s underlying business (e.g. stymied growth due to cyclical downturn; challenged pricing environment weighing on profitability), as well as its exposure to geopolitical risks over the near-term (further explained in later sections). However, we believe that, at current levels, the stock remains mispriced for Micron’s longer-term growth prospects on several secular tailwinds ahead, including its technologies’ mission-critical role in supporting cloud, HPC and generative AI developments, as well as the eventual return of cyclical tailwinds to its core consumer-centric end markets.

Gauging the Impact of China’s Cybersecurity Review and Verdict

Recall from the earlier section that the CAC probe on Micron’s operations in China has resulted in a curb of sales to certain “Critical Information Infrastructure operators” in the region. Mainland China and Hong Kong together accounts for about a quarter of Micron’s annual sales. With the company expecting half of which to be impacted by ongoing uncertainties to the regulatory environment of its Chinese operations, the worst-case scenario implies a more-than-10% reduction to its top-line prospects going forward until there is a mitigation strategy in place, such as technology adjustments to ensure compliance to rules in the region, similar to industry peer Nvidia’s introduction of the A800 data center GPUs to bypass Washington’s export curbs announced last year.

Author, with data from Micron’s SEC filings

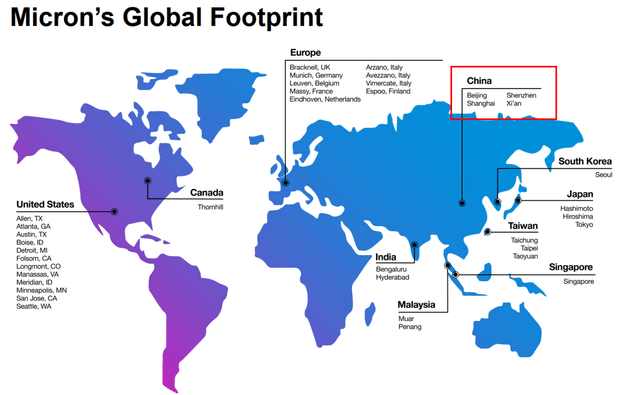

In the latest development, Micron has pledged to double down on its footprint in China, committing to invest more than $600 million in an expansion of its existing packaging facility in Xi’an. Specifically, the expansion plans includes the proposed acquisition of a “Xi’an-based subsidiary of Taiwan’s Powertech Technology Inc.,” a packaging equipment partner of Micron’s since 2016. The expansion roadmap will also include addition of production capacity for “mobile DRAM, NAND and SSD products,” underscoring Micron’s “unwavering commitment to its China business and team.”

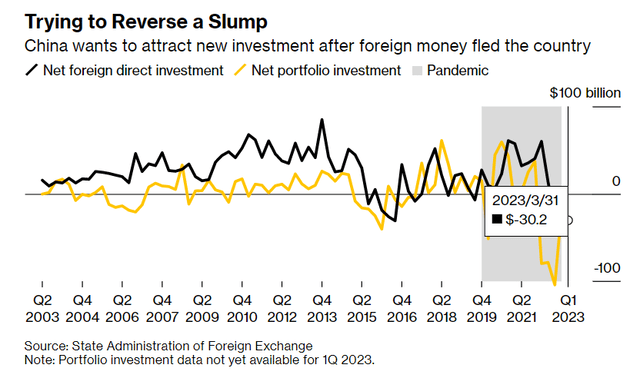

Micron Technology FY 2022 10K Filing

The decision largely diverges from peers’ ongoing effort sin diversifying operations beyond China amid intensifying geopolitical tensions with the U.S. The deviation in Micron’s latest investment decision from trends observed across its peers is further corroborated by plunging foreign direct investments in China over the past 12 months, as U.S. businesses in the region have become “increasingly pessimistic about the relationship between Washington and Beijing and geopolitical tensions escalate,” compounding concerns over existing regulatory uncertainties. VC funding from the West into China have also dried up, as confidence wanes given the “evolving risks of doing business in China.” Meanwhile, Washington is also contemplating new rules to scrutinize U.S. investments overseas that could “pose national security risks,” implying incremental hurdles to Micron’s aspirations for its Chinese operations.

While Micron’s latest investment in China underscores ambition to deepen its reach in the region’s burgeoning chip market, the undertaking will likely do little to excuse it from immediate regulatory and geopolitical risks facing its growth prospects in the Chinese market. Instead of adjustments to its technology to ensure compliance with China’s regulatory environment and preserve immediate demand without exposure to incremental geopolitical risks – in line with management’s optimism over “China’s reopening [as a] positive factor for calendar 2023 bit demand” express during the fiscal second quarter earnings call – the recently proposed investment outlay will not only take time to materialize, but also risks subjecting its operations to further regulatory hurdles within the foreseeable future, and introduce additional volatility to its shares’ near-term performance.

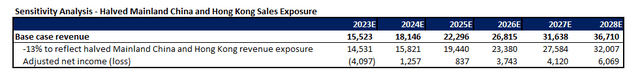

Sensitivity Analysis on Micron’s Valuation Prospects

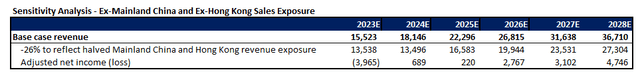

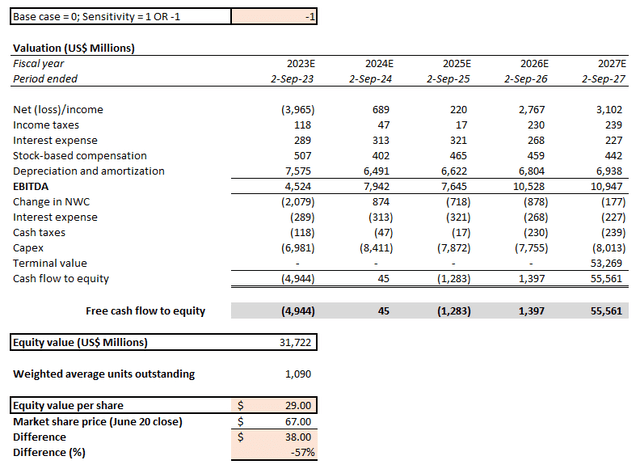

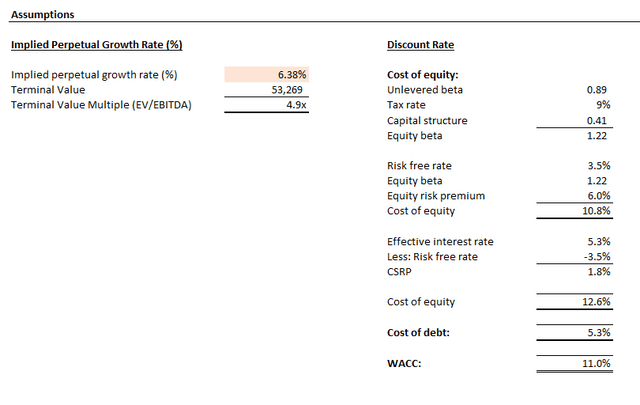

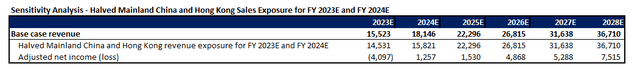

In light of recent developments in the regulatory environment surrounding Micron’s operations in China, we have sensitized its projected revenues generated from sales to Mainland China and Hong Kong to gauge the impact on the stock’s prospects. In the event that the recent cybersecurity probe in Micron’s Chinese operations results in a 13% reduction (i.e., -50% x 20% China sales mix + -50% x 6% Hong Kong sales mix) to forecast revenues going forward, the stock could decline as much as 28% to the $40-range from current levels, while holding all key valuation assumptions (i.e., implied perpetual growth rate of 6.4% and WACC of 11%) constant from the base case.

And in the highly remote scenario that the CAC’s regulatory restraints over Micron results in a full exit from Mainland China and Hong Kong operations, which would drive a 26% reduction to forecast revenues going forward, the stock could decline as much as 56% towards the $30-range from current levels, while holding all key valuation assumptions constant from the base case.

However, in a more reasonable setting, we expect Micron to find mitigation strategies and ultimately limit its exposure to the looming regulatory and geopolitical challenges. Under the scenario where our base case revenue projections for fiscal 2023 and 2024 are reduced by 13% to reflect halved Mainland China and Hong Kong exposure for the impacted periods, while sales from fiscal 2025 onwards are unchanged from the base case forecast, the stock will likely trade in line with current levels while holding all key valuation assumptions constant.

This is in line with market’s tepid response to the negative developments over the regulatory environment of Micron’s Chinese operations, with the stock down by less than 2% since the memory chipmaker warned of potential challenges to its near-term sales generated from the impacted regions.

The Bottom Line

The combination of persistent cyclical headwinds and being caught in the middle of a China-U.S. geopolitical crossfire has largely stifled Micron stock’s recovery prospects despite the rally observed across the Philadelphia Semiconductor Index this year. Despite Micron’s 33% rebound from its 52-week trough in the $40-range, it continues to trail the broader semiconductor peer group by wide margins over the same period. Considering Micron’s favorable prospects in partaking in the longer-term secular tailwinds bolstered by emerging generative AI-driven demand, and recovering profit margins once transient macro-driven pricing challenges roll off, Micron stock remains well-positioned for incremental upside potential from current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!