Summary:

- Micron Technology, Inc. should get a major boost from Generative AI opportunities, which need 5-6 times more memory than traditional applications.

- Despite short-term headwinds off falling ASPs, the cyclical semiconductor memory industry is close to its trough from where it should rebound strongly.

- Micron, the largest U.S. manufacturer of memory semiconductors, is currently undervalued and close to the bottom of this cycle. Micron is worth buying and holding for at least two years.

- Micron reports fiscal Q3 earnings next week with dismal expectations of a 57% revenue drop, which I have accounted for in my estimate of a 49% annual revenue decline for FY2023.

- I believe terrible Micron earnings are already priced in and guidance for AI progress will be key.

vzphotos

Micron Technology, Inc. (NASDAQ:MU) has gotten the short-shrift ever since the semiconductor industry went into a cyclical tailspin last year. One of the largest of the cyclicals dotting the semiconductor landscape, Micron is beaten down to a point where there seems no other way to go but up. And if the rising artificial intelligence, or AI, tide lifts all boats, this one will also make it to the shore – and then some.

Even though Micron is severely down in the dumps, in the last 10 years there have been tremendous opportunities to buy at troughs, like with every cyclical. Buying around $48 when it was a pariah would have yielded a hefty 40% to the $66 it is today.

I believe Micron stock is worth buying and holding for at least 2 years.

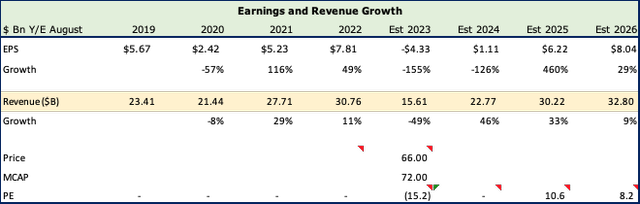

Micron reports fiscal Q3 FY2023 earnings next week; consensus estimates call for a drop of 57% in revenues to $3.68Bn, which is a 3% lower revision in the past month alone. Similarly, consensus EPS is -$1.56, but revised slightly higher by 1.5% in the past month. I believe the FY2023 EPS of -$4.52 per share and the revenue drop of 49% to $15.6Bn are mostly priced in. More importantly, I believe Micron will recover strongly with revenue growth of 46% and 33% in FY2024 and FY2025, respectively, bringing revenues back to the FY2022 level of $30Bn.

Revenue Segments

Micron derives 72% of its revenues from DRAM and 25% from NAND.

Micron DRAM and NAND (Micron, Fountainhead)

DRAM stands for Dynamic Random Access Memory. It is used mainly for low latency, high-speed data retrieval semis used heavily in PCs, Graphic Cards, and servers. Low-cost and high-capacity memory being the key differentiators.

NAND products are non-volatile and re-writeable semis used in flash drives, solid-state drives, and memory cards, in which large files are frequently uploaded and replaced. They’re used mainly for USB flash drives, MP3 players, and digital cameras.

Micron operates in 4 end user segments: Compute and Networking, Mobile, Embedded Business and Storage.

Micron User Segments (Micron, Fountainhead)

Micron Revenue Segments (Micron, Seeking Alpha, Fountainhead)

All four segments took a severe beating in the first half of FY2023 and given the 20 to 40% drop in ASPs, total revenues are going to crater by 49% in FY 2023, which ends this August. The only silver lining of sorts is the embedded business unit, which is expected to decline only 22% on the strength of Auto, that is still seeing decent demand and selling prices. In Q2-FY23, this was the only segment that grew 5% and management expects this growth to continue with increasing memory content in autos.

Based on my estimates, Auto will increase to 26% of sales in FY2023 and continue to take up more share in the next decade.

The Semiconductor and Memory Industry Cycle

Semiconductors

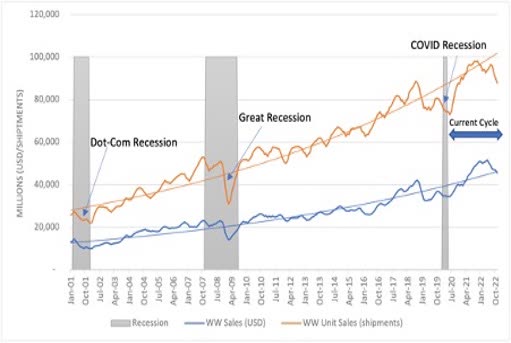

Historically, semis have always been cyclical, both because of demand fluctuations and because of overcapacity among large scale commodity players where size is crucial. Still, given the significant needs of cloud service providers, Hyperscalers and now AI, growth has been decent in the last 20 years with the total industry annual sales growing from $139 billion in 2001 to $573.5 billion in 2022, an increase of 313 percent or a CAGR of 7%, while its unit sales increased by 290 percent or a CAGR of 5.2%.

Semiconductor Growth (SIA and WSTS)

Going forward, I do believe that there is tremendous potential for the industry, as the SIA (Semiconductor Industry Association) points out.

The semiconductor industry has a long history of investing big during down cycles to be ready for the inevitable rebound in demand. New company investments will lead to more domestic semiconductor production and innovation, which will help avert future chip shortages and ensure the industry meets the growing demand from sectors like the automotive, data storage, and wireless connectivity industries. The automotive industry, for example, is estimated to be responsible for 20% of chip demand, and the wireless communication industry is projected to drive 25% of growth by 2030. The strong growth drivers of these sectors will power demand in the chip industry in the next decade.

A 2020 study by SIA and the Boston Consulting Group found that global demand for semiconductors is projected to increase by 5% a year in the next decade, with an addition of 56% semiconductor manufacturing capacity by 2030. I believe that given the recent excitement in Generative AI and the animal spirits that it has unleashed, this 5% estimate is likely on the lower side.

Memory

2017 and 2018 saw strong revenues for the memory sector, and like all good things came down with a thud in 2019. Demand stagnated, but capacity grew instead of getting cut, so inventories rose till there was the inevitable aggressive price cuts. The pandemic turned out to be a massive boom, with “Work From Home” needing plenty of computer infrastructure, followed by the even bigger indigestion from producing too much, which led to the huge price cuts of 40% that the industry is suffering from today.

Memory Revenue (Omdia Tech)

The global NAND Flash Memory and DRAM market size is estimated to be worth $153Bn in 2022, and is forecast to grow to $215Bn by 2028 with a CAGR of 5.9%.

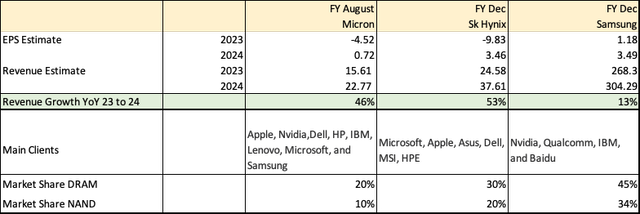

Cost is the only real differentiator between the oligopoly of giants like Samsung Electronics Co (OTCPK:SSNNF, OTCPK:SSNLF), SK Hynix, and Micron, the big three that dominate the memory segment. Falling ASPs are routine every 4-5 years with DRAM and NAND prices falling 40% between FY22 and FY23, halving Micron’s revenues from $30.7Bn to $15.6Bn as we can see from the chart below. I don’t expect any improvements in revenue or pricing in calendar 2023, and the bulk of improvements to only start in calendar 2024 after stabilizing in Q4 calendar 23.

Even then, the 39% improvement in revenues for Micron in FY24 brings it to the same revenue of $21Bn it had in 2020 – Clearly, we have a lot of ground to cover. And it’s the same for SK Hynix and Samsung, with expected increases of 53% for SK Hynix in 2024 and 13% for Samsung (Memory is only a part of Samsung’s revenues)

Memory Competitors (Seeking Alpha, WSJ, Statista, SK Hynix, Fountainhead)

As we can see below, it would take another 2 years to FY2025 for Micron to get back to $30Bn in revenues.

Micron Revenue and Earnings Growth (Seeking Alpha, Fountainhead)

Micron’s SWOT Analysis

Strengths

Micron is the largest U.S. supplier of Memory chips worldwide and given its position, it will benefit the most should there be a shift in supply chain geographies.

It’s the largest and in some cases the only supplier of Nvidia Corporation’s (NVDA) products, higher than the RTX3070. Its GDDR6X is one of the faster memory chips in the market and essential for many AI or high-speed applications.

Weaknesses

Like it’s competitors, Micron has no pricing power, and a 40% drop in Average Selling Prices led to a 49% forecasted decline in revenues in FY2023, besides the 50% drop in its share price from peak to trough. Not for weak-hearted investors.

Also like its competitors, Micron tends to get wrong footed about demand and this invariably leads to a glut of unsold inventory. Despite taking a $1.5Bn charge in the 1H of FY23, Micron still held a massive $8Bn in inventories.

Opportunities

Memory chips will likely be a key factor in AI expansion and given Nvidia’s pole position and Micron’s supplier relationship with it, I believe there will be sufficient opportunities way beyond the regular business cycle for Micron.

CEO, Sanjay Mehrotra spoke of future opportunities on the Q2-earnings call, emphasis mine.

And particularly, keeping it in mind the strong demand trends. I talked about 2025 being — we think will be a record revenue year for the industry because last 2 years have been slow demand growth in terms of shipments. We think ’24 and ’25 will be strong years that will drive strong growth. You are seeing actions on the supply side. The health of the industry will be restored in the future quarters.

And no doubt that AI — and we talk about generative AI, right? I mean this is very, very early stages of generative AI, and these are the trends that ultimately really drive greater demand for a long time to come for memory and storage. I mean when you look at really the future, it equals AI and AI equals memory, and Micron is well positioned with our technology and product roadmaps to address the growing opportunities there.

Generative AI needs gobs of processing power, connectivity, and memory to become the default and ubiquitous standard. Chat GPT servers need about 5 times more memory than a regular server. Innovative solutions, which will be only the discernible competitive advantage for AI providers will require memory and logic to blend. Based on another estimate, AI servers will require six times the amount of DRAM and twice the amount of SSDs compared with standard servers.

Cloud and Datacenter end user segments should grow faster than smartphones, with the average DRAM content growing 12% YoY in 2023 versus 7% growth for smartphones.

Micron and other memory chipmakers should also see a significant demand tailwind once overcapacity winds down, from the burgeoning importance of autonomous vehicles, medical technologies and devices, and the speed of drug discoveries.

The Chips and Science Act with about $52Bn in funding will help American manufacturers such as Micron fill the Non Asian supply gap. About 98% of memory chips are made in Asia and this subsidy will go a long way in helping U.S. manufacturers like Micron compete. I suspect that beyond the initial funding, the importance of semiconductors will compel the US government to protect U.S. manufacturers in this arms race for decades as Micron is the only U.S. manufacturer of DRAM and NAND.

Threats

The biggest threat to Micron is Geopolitics, with semiconductors being the weapon of choice between the USA and China.

In October 2022, the U.S. Government tightened the rules around the export of advanced semiconductor technologies to China.

On 21 May 2023, Beijing announced sanctions on Micron’s products citing cybersecurity risks, preventing operators involved in critical information infrastructure projects from purchasing its products.

More recently, on June 16th, Micron suggested that the security probe led by the Chinese government targeting it, could reduce 10-12% of revenues this year.

The Investment Case for Micron

The Bull Case

Riding the AI coattails: As I mentioned above, Generational AI needs 5 to 6 times more memory in datacenter applications than traditional applications. Micron will benefit in the next 2-3 years and if the demand is even 70% of projections, the next peak cycle will be extremely good for Micron. Nvidia shocked the world in May with a guidance that was 69% above expectations and is now slated to jump to a revenue of $43Bn in FY2024, a whopping increase of 59%!.

Demand improvement: There should be significant demand increases from PCs, smartphones, cloud, and Hyperscalers in FY24 compared to FY23, with data center and autos leading the way.

Management in its 2nd quarter earnings call, also guided to sequential volume improvement in all segments in calendar 2023 and inventory improvements at its clients. While still a horrible YoY comparison because of much lower prices, it suggests that we may be at the trough of this cycle.

Micron has a solid balance sheet, and like the others has no qualms about cutting production for better pricing.

Good operating leverage: As a pure play memory cyclical, Micron earned 30% operating profits between 2018-2022. Comparatively, Samsung only eked out 17% and SK Hynix 25%. This is good for a cyclical and shows that trough to peak periods with robust prices and demand generates a lot of profits and cash. Micron’s SG&A is a paltry 4% of revenues and R&D 10%. Micron also has a very solid balance sheet with a debt / equity ratio of only 17%, compared to Samsung’s 26% and SK Hynix’s 38%.

Production cuts should restore prices: Both SK Hynix and Micron have indicated over 50% and over 40% production cuts, respectively, to weather this storm.

The Bear Case

Cyclicality and weak pricing power: In Micron’s second fiscal quarter, average DRAM selling prices declined by 20% quarter over quarter, while NAND ASPs declined at an even higher rate, reflecting a fundamental change in operating conditions in the market for memory products.

You must be a low-cost producer based in Asia: Asian giants such as Samsung & SK Hynix as well as other Asian producers have significant advantages in low-cost production due to the abundance of cheaper labor and chip materials; besides the proximity of large markets such as China and the rest of Asia allows them to keep monetizing any excess production.

7 out of Micron’s 9 locations are in Asia as well, with another $2.8Bn plant slated to come up in India, and while it does get the same advantages, it too is still subject to overcapacity like its Asian counterparts. $52Bn from the U.S. government under the Chips Act will help Micron but only up to a point.

Conclusion

I don’t believe this industry cyclicality will dissipate in a hurry.

Consider buying Micron Stock between $60 and $66.

The best way to invest in Micron would be keeping its cyclicality in mind. This is not a buy and hold story, and I don’t believe AI opportunities make this a secular growth story, at least not yet. I missed the entry in the low fifties and only started buying Micron stock over $60. I don’t believe it is too late and I am prepared to ride out bumps, which could take this down another 10% should the market weaken. I believe Q3-2023 earnings, due next week is already priced in to the stock. I plan to hold Micron for two to three years to the likely peak in 2025-2026, hoping to get a total return of 80 to 100%.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.