Summary:

- Micron Technology, Inc. stock performance has been mediocre compared to Nvidia Corporation’s, but joint demand economics suggest potential growth opportunities.

- AI applications require more memory chips, which could positively impact Micron’s results for Graphics and Compute/Network areas in FQ3-24.

- Despite potential revenue loss from China, there is still upside potential for Micron, but investors should pay attention to earnings and guidance.

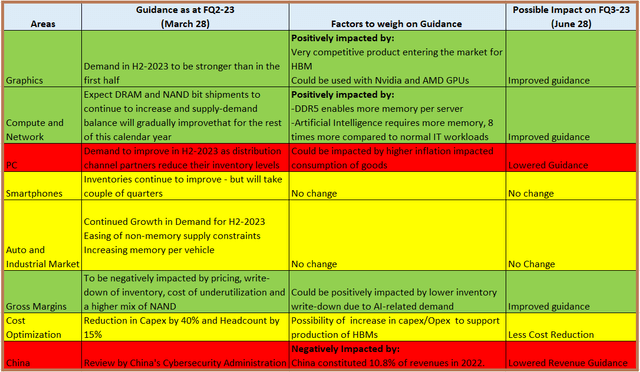

- For this purpose, I have provided a summary of what management guided during the second quarter.

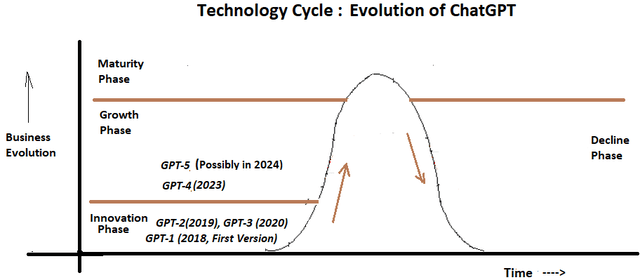

- I also make use of the Technology Life Cycle to make my point about why there is still time for Micron to play a role in HBMs which are used in conjunction with H100 GPUs.

BrianAJackson/iStock via Getty Images

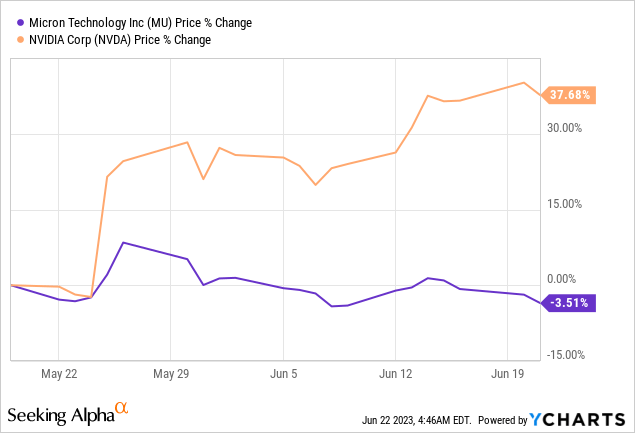

If you look at Micron Technology, Inc. (NASDAQ:MU) stock performance in the last month, it has been mediocre, at -3.5%, especially when compared to Nvidia Corporation’s (NVDA) glittering surge of above 37%.

Looking closer, the memory company’s stock initially did get a jolt from Nvidia, implying that some investors may be aware of the opportunities. It is precisely the aim of this thesis to highlight these and also assess how the company’s third-quarter financial results (FQ3-23) can benefit when they are expected to be announced on June 28.

For this purpose, I make use of “joint demand economics” and, through the technology life cycle, I will show that Micron is not late to the HBM (High Bandwidth Memory) game. I will also provide a target as to the share price while taking into consideration the risks of seeing Chinese sales evaporate.

Joint Demand, HBM, And The Technology Cycle

First, for any server that runs normal IT workloads or advanced AI applications, you need DRAM (Dynamic Random Access Memory) in addition to the CPU (Central Processing Unit). These two components work in conjunction with one another, in addition to others like the hard drive. The processor provides processing power the computer needs to do its job, while the DRAM is used as short-term storage to store data for quick access. Since you need both the processor and memory at the same time, demand for one will automatically entail demand for the other. This is an example of joint demand.

Pursuing further, the more DRAM, commonly available as DDR4, a server is equipped with, the more data it can juggle in parallel, but there is a limit as to the amount which can be added. To address this limitation, HBM was developed for ChatGPT-type applications that require the maximum possible bandwidth (or speed) for data transit between the memory and processor. Interestingly, HBM3 (or the third generation of HBM) is much faster than DDR4.

Few companies have the capacity to manufacture such chips, which can be considered premium DRAMs, with the list including Micron, SK Hynix, and Samsung (OTCPK:SSNLF). Out of these, it is SK Hynix which has already been qualified by Nvidia for its H100 GPU (Graphic processing unit) in the middle of last year, with mass production already started. Moreover, it has market leadership, with 50% of HBM shipments last year according to AnandTech, with Micron at 10% compared to 40% for Samsung. Specifically referring to HBM3, S.K. Hynix is the only manufacturer with mass-production capacity due to its earlier start.

Consequently, compared to the South Korean play, Micron is late, as its HBM3 was still at the roadmap stage as per its executives during its second quarter 2023 earnings call held in March. However, as pictured below, in the Technology Life Cycle chart, after emerging from the innovation phase back in 2020, ChatGPT may still be in the growth phase with GPT-4 only released this year.

Technology Life Cycle for ChatGPT, Chart Built using data from (www.techtarget.com)

Therefore, there is a long way to go till the technology matures, which gives Micron time to mass produce its HBM3. This view is also aligned with Mark Murphy, Micron’s Chief Financial Officer, who mentioned that “fortunately, the volumes are still very low” during the Goldman Sachs (GS) Semiconductor conference on May 31, or only seven days after Nvidia guided 50% more sales than analysts had expected for its quarter ending in June.

Now, the next step is to show how Micron’s own guidance which it provided back in March can benefit, not only from HBM but also from less speedy chips.

How Micron FQ3 Results Are Likely To Be Impacted

Noteworthily, the algorithms which form part of Generative AI are highly data-centric signifying that they require large amounts of data in order to learn, before actually being able to generate reports. This in turn implies that the cloud servers supporting AI applications located in Microsoft’s (MSFT) Azure infrastructure need larger quantities of DRAM, and NAND in addition to just HBM.

Detailing further, compared to normal IT workloads, AI requires eight times more memory chips. This constitutes the basic reason why there could be an improvement in guidance for the Graphics and Compute/Network areas of Micron’s business which respectively house its HBM and DRAM businesses. In this connection, the main areas of the guidance provided by the company’s management during its second quarter of fiscal 2023 (FQ2-23) have been tabled below. These have then been augmented by the effect of joint demand and other related factors to show how FQ3-23’s results can be impacted.

Table built using Earnings Transcripts data from (www.seekingalpha.com)

Looking at profitability, any uptake in demand will likely decrease inventory write-downs in turn positively impacting the gross margins as shaded in green above. However, as shaded in red above, this could be offset by a decrease in revenues after China’s Cybersecurity Administration labeled Micron’s chips as a security risk. As per my calculation, mainland China constituted 10.8% ($3.3 billion out of $30.76 billion) of overall revenues in 2022, but, the full scope of the ban still needs to be known.

Furthermore, investors will note that due to AI-related demand, Micron may have to roll back on earlier Capex and Opex reduction moves aimed at cost optimization, as it will have to invest in HBM production capacity. This may in turn negatively impact the consensus EPS estimate of $-1.56 for FQ3-23.

Micron Deserves Better Valuation After Accounting For China’s Risks

Shifting to a more positive note, investing for growth should positively reverberate on the top line, namely for FY’24 which ends in August next year, especially for the Enterprise and cloud server segment which includes the DRAM and NAND memory chips. This segment constituted 20% of Micron over sales of $30.76 billion in FY’22, or $6.15 billion.

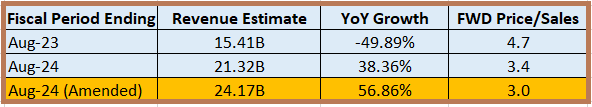

Furthermore, considering that AI applications use 8 times more memory chips than conventional ones as I touched upon earlier, Micron could potentially harvest an additional $6.15 billion if just doubles its sales figures for the Enterprise and cloud server segment. Here, I have assumed a factor of only 2 instead of 8 for moderation purposes, and in view of the competition and memory pricing pressures. Subtracting a potential $3.3 billion revenue loss from China in the worst-case scenario of a complete ban, this comes to about $2.85 billion. This should come as an addition to the $21.32 billion estimated by analysts as shown in the table below.

Revenue Estimates (www.seekingalpha.com)

The total of $24.17 billion is the new (amended) revenue estimate for FY’24 or an increase of 56.86% (instead of 38.36% initially expected) over FY’2023. Now, since more sales will decrease the Price-to-Sales ratio, this translates to a P/S of 3.0x ((3.4x (21.32/24.17) instead of the previous 3.4x. Now, amending the share price accordingly, I obtain a target of ((66.25 x 3.4)/3.0)) or $75.1 based on the current share price of $66.25.

This is slightly above Wall Street’s average price target of $72.38 and also higher than the current share price by 13.3%. Tellingly, this bullish position may contradict current economic conditions where high-interest rates have somewhat dampened business sentiment, exacerbated by the banking turmoil causing lenders to exercise more caution before disbursing funds. In this respect, some are now invoking a mild recession in case the Fed continues to hike, with the World Semiconductor Trade Statistics predicting that the industry will contract by double-digit figures in 2023.

Still, despite recession talks echoing louder since the start of this year, strong job numbers in May show that the U.S. economy remains resilient, driven to a large extent by the consumer. Thus, sentiment remains high thanks to inflation numbers trending lower, which may be a sign that the Fed tightening of monetary policy is delivering results. Focusing on semiconductors, the sizeable GPU orders enjoyed by Nvidia seem to indicate that despite economic uncertainty, corporations have prioritized AI, either for increasing sales or streamlining operations, and are ready to invest in the technology.

Thus, as a potential beneficiary of joint demand, one can simply not ignore Micron’s prospects, especially when considering that in several parts of its guidance, the company is expecting an improvement for the second part of 2023 based on inventories.

Pay Attention to Earnings and Volatility

In conclusion, this thesis has charted a path for investing in Micron, one which is based on joint demand. Well, to be precise, Nvidia currently purchases its high-bandwidth memory chips from S.K. Hynix which is based in East Asia but this could change in the future, and it could buy them from a U.S. company provided Micron is able to beef up production capacity for HBM3 late this year or early 2024.

Still, running AI workloads also implies packing servers with more DDR4, DDR5, and NAND chips as well, already produced by Micron in large quantities, which mainly accounts for my optimism on the stock. Moreover, despite some moderation applied to take into account the potential revenue loss from China, there is still upside potential.

Moreover, a lot will depend on guidance during the Micron earnings call next Wednesday, especially for details pertaining to the uptake of existing memory chips as well as an update on the production status for HBMs. Also, as an AI-related product, the production of HBM is more capital-intensive than conventional ones, which may further reduce the company’s free cash flow in the short term. This is another reason for paying close attention to managerial prepared statements and responses to analysts’ queries.

Finally, do note that due to an inflation-induced slowdown in other areas like PC, as I have highlighted in red in the above table, it is also important to be prudent. For this matter, the latest price actions show volatility which comes in the aftermath of the speech of the Chairman of the U.S. Central Bank, showing the degree to which markets have become sensitive to potential interest rate-related decisions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.