Summary:

- Micron has been impacted by a dour economy, as discretionary consumer spending for PCs and smartphones has been stymied.

- In the realm of generative AI and the much-ballyhooed ChatGPT, Micron’s late start in High Bandwidth Memory (HBM) has nearly precluded the company in this potential high-growth sector.

- China has sanctioned Micron’s chips due to cybersecurity issues, resulting in a multi-billion dollar loss of revenues for the company.

Geetarism

Micron Technology (NASDAQ:MU) will report its fiscal third quarter financial results after the market close on June 28, 2023, with the memory chip maker expected to realize a loss of $1.71 per share as compared with a per-share profit of $2.59 during the same period last year. The consensus revenue forecast for 3Q is $3.67 billion, down from $8.64 billion a year earlier.

In the previous quarter, Micron missed the analysts’ consensus estimate of a $0.75 per-share loss with a reported loss of $1.91 per share, while also falling short of the $3.74 revenue forecast with sales of $3.69 billion.

Micron has gained much press lately and none of it good when analyzing financial metrics and drawing comparison with competitors. This article will provide a deep dive into why I recently became negative on the company’s management after a long period of giving them the benefit of the doubt.

AI Strategy and HBM

As I pointed out in my Feb. 24, 2023, Seeking Alpha article entitled TSMC Makes The Chips, But Nvidia Gets The Glory:

“ChatGPT uses Nvidia’s A100 GPU with the Ampere GA100 core. The A100 HPC accelerator is a $12,500 tensor core GPU that features high performance, HBM2 memory (80GB of it) capable of delivering up to 2TBps memory bandwidth, enough to run very large models and datasets.”

The HBM2 memory is important to my analysis of Micron’s late to the game strategy as detailed below.

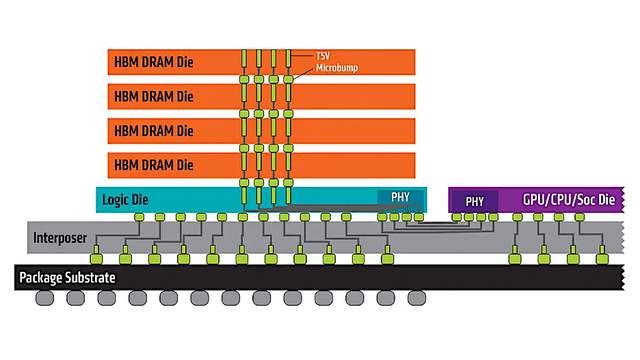

Chart 1 is an illustration of HBM2 memory. The second generation of High Bandwidth Memory, HBM2, also specifies up to eight dies per stack and doubles pin transfer rates up to 2 GT/s. Retaining 1024‑bit wide access, HBM2 is able to reach 256 GB/s memory bandwidth per package. The HBM2 spec allows up to 8 GB per package.

Up to eight DRAM dies are stacked and connected to the memory controller on a GPU or CPU through a substrate, such as a silicon interposer. Within the stack the die are vertically interconnected by through-silicon vias (“TSVs”) and microbumps.

On Jan. 19, 2016, Samsung Electronics (OTCPK:SSNLF) announced early mass production of HBM2, at up to 8 GB per stack. SK hynix (OTC:HXSCL) also announced availability of 4 GB stacks in August 2016.

AMD

Chart 1

Historically, the first HBM memory chip was produced by SK hynix in 2013, and the first devices to use HBM were the AMD Fiji GPUs in 2015. Being first, hynix remains the industry leader.

Hynix has released a first-generation HBM (“HBM”), a second-generation HBM (“HBM2”) in 2018, a third-generation HBM (“HBM2E”) in 2020, and a fourth-generation (“HBM3”) in 2022, and has secured a market share of 60%-70%.

HBM3 offers several enhancements over HBM2E, particularly the doubling of bandwidth from HBM2E at 3.6 Gbps up to 6.4Gbps for HBM3, or 819 GBps of bandwidth per device. Hynix has successfully supplied Nvidia’s H100 after passing stringent performance evaluations of HBM3 samples by demanding customers.

In May 2023, SK hynix also confirmed that the next-gen 1bnm node will be used to produce DDR5 and HBM3E solutions. Following the announcement, Nvidia (NVDA), the market leader in AI semiconductors, is reported to have requested a sample of the next-generation HBM3E that SK hynix is currently developing with the goal of mass production in the first half of next year.

HBMs’ average selling price – ASP – is at least three times that of DRAM. HBMs require a complex production process and highly advanced technology.

HBM market share in 2022 was led by SK hynix with a 50%, followed by Samsung with a 40% share, and Micron with a 10% share.

Micron Late to the AI Game

The Hybrid Memory Cube (“HMC”) is a high-performance computer random-access memory (“RAM”) interface for through-silicon vias (TSV)-based stacked DRAM memory competing with the incompatible rival interface HBM. Hybrid Memory Cube was co-developed by Samsung Electronics and Micron Technology in 2011.

While Micron was working away on this program with their consortium that included IBM, Intel Altera, Xilinx, ARM, Samsung, and SK hynix, HBM was being developed within AMD / SK Hynix and was commercialized with the announcement of AMD’s Fiji-based family of GPUs. Second generation product HBM2 first appeared in AMD’s Vega GPUs.

Micron had a lead time of several years with its HMC sine 2011. As Hynix launched the first generation of HBM and announced the production of HBM2, Samsung, gave up waiting for HMC and switched to HBM, mass producing the industry’s first 4-gigabyte DRAM package based on HBM2 interface on January 16, 2016.

In August 2018, Micron announced a move away from HMC to pursue competing high-performance memory technologies such as GDDR6 and HBM.

Hence with its late start, Micron has just a 10% share of the HBM market. NVDA is partnering with SK hynix and Samsung with partnering with Google (GOOG) (GOOGL) and most likely NVDA. While MU is partnering with NVDA, it is for GDDR6 for the GeForce RTX 40-Series GPUs and not for AIGPUs.

Micron Sanctioned by China

On May 21, 2023, The Cyberspace Administration of China (“CAC”) said Micron had failed to pass a cybersecurity review. The Chinese regulator’s decision came seven weeks after it kicked off a cybersecurity review of Micron’s products.

I’ve written numerous SA articles on U.S. sanctions against China, but this is the first time a U.S. company was sanctioned by China.

The review found that Micron’s products have relatively serious potential network security issues, which pose a major security risk to the country’s key information infrastructure supply chain and affect the country’s national security. For this reason, the Network Security Review Office has made a conclusion that the network security review should not be passed. According to the “Network Security Law” and other laws and regulations, operators of critical information infrastructure in China should stop purchasing Micron products.

Separately, Micron said it would invest roughly $604M in China over the next few years at its chip packaging facility in Xian. In 2014, Micron reached an outsourcing deal with Powertech for chip packaging and testing at the Xian plant, under which Micron owns the land and buildings while the Taiwan firm owned the equipment and provided the workers.

The outsourcing deal ended in April 2022, but both sides agreed to renew it on a quarterly basis, according to Powertech last year. Micron’s acquisition will allow Powertech to cash out from the Xian operations.

Micron said in a June 16, 2023 8-K filing, referencing the ongoing review by China’s Cybersecurity Administration over its products in the country.

“We now believe that approximately half of that China HQ customer revenue, which equates to a low-double-digit percentage of Micron’s worldwide revenue, is now at risk of being impacted.”

Micron’s initial estimate range of low-single digit to high-single digit impact. It updated that estimate to the high-single digit percent range. This new estimate represents about 50% of Micron’s revenue from customers headquartered in mainland China and Hong Kong, which it has disclosed are about 25% of total sales.

Last year Micron generated 11% of its $30.8 billion in revenue from China selling DRAM, NAND flash memory, and solid-state drives. FY2022 revenues increased to $3.31 billion from $2.46 billion in FY 2021. Micron’s biggest customers in China were Lenovo, Xiaomi, Inspur Electronics Information, ZTE, Coolpad, China Electronics Corp, and Oppo.

Why is Micron the Only Company Singled Out

While it may appear this action is in retaliation to U.S. sanctions, I contend that Micron’s lobbying and political meddling is responsible, as I detail below.

Back in early September 2022, a report surfaced that Apple (AAPL) is in talks with China’s “national champion” semiconductor maker, Yangtze Memory Technologies Co. (YMTC), to provide up to 40% of the chips needed for its iPhones. This was initially planned to be used only for iPhones sold in the Chinese market. However, Apple was considering eventually purchasing up to 40% of the NAND flash memory needed for all iPhones from YMTC.

Apple already had completed the months-long process to certify YMTC’s 128-layer 3D NAND flash memory for use in iPhones when the U.S. government unveiled the tighter export restrictions against China on Oct. 7, 2022.

Of interest is Micron’s comments in its 10-K signed on Oct. 7, 2022:

“We face the threat of increasing competition as a result of significant investment in the semiconductor industry by the Chinese government and various state-owned or affiliated entities, such as Yangtze Memory Technologies Co., Ltd. (“YMTC”) and ChangXin Memory Technologies, Inc. (“CXMT”), that is intended to advance China’s stated national policy objectives. In addition, the Chinese government may restrict us from participating in the China market or may prevent us from competing effectively with Chinese companies.”

According to an April 9 2023 article in Financial Times:

Paul Triolo, an expert on China tech at consultancy Albright Stonebridge, said Micron was seen as “supporting specific controls” that “severely restricted China’s memory leaders YMTC (Yangtze Memory Technologies Corp] and CXMT [ChangXin Memory Technologies) from obtaining semiconductor manufacturing gear to remain competitive in the memory sector.”

Micron will invest more than 4.3 billion yuan ($603.8 million) in the Mainland in the next few years and expand its chip packaging and testing factory in Xi’an, a move that CEO Sanjay Mehrotra said demonstrated the company’s “unwavering commitment to its China business and team.” It’s a gesture to appease China, something Apple has done numerous times.

Korean Exports

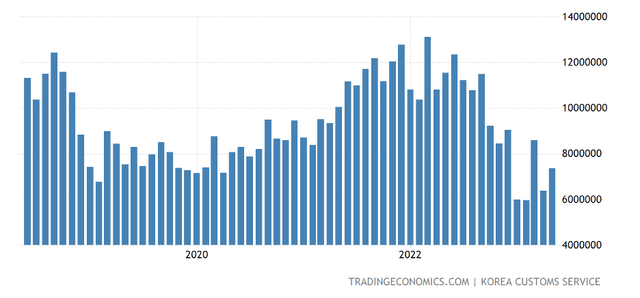

Exports of semiconductors, Korea’s largest export item, totaled US$7.37 billion in May, down 36.2% from US$11.54 billion in the same month of last year, but up from $6.38 billion in April, as shown in Chart 2.

- NAND exports in May totaled $370 million, which was down 54% YoY but up 5% MoM. ASPs increased 6% MoM in May versus a 3% increase MoM in April.

- DRAM exports in May totaled $1.19 billion, which was down 52% YoY but up 3% MoM. ASPs decreased 4% MoM in May versus a 13% MoM increase in April.

TradingEconomics

Chart 2

Forty percent of Samsung’s total flash memory chip (NAND) production capacity belongs to its plants in China. China is home to 40 to 50% of SK hynix’s DRAM semiconductor capacity and 20% of SK hynix’s NAND flash production capacity.

The U.S. began to put pressure on South Korean memory chip companies, requiring Samsung and hynix not to fill the market share of memory chips that Micron may be banned from selling in China. It’s intended to limit the development of Chinese memory chip companies in the industry and prevent further expansion of their market share.

But both Korean companies are also being negatively impacted by high inventory overhang and excess capacity, creating a dilemma.

While exports to China from Korea are down 36% YoY, it’s unknown whether Samsung and SK hynix will fill orders from production from its fabs in China. The chipmakers are caught between an ongoing tech war between the US and China, sparked by export restrictions imposed by the Biden government last year to throttle China’s advances in artificial intelligence, semiconductors and military technology.

The restrictions cut off chipmakers from new US chip equipment for use in fabs in China. However, The U.S. dangled a carrot to the companies by granting a one-year waiver to top South Korean and Taiwanese chipmakers, which was set to expire in October.

Capex and WFE Spend

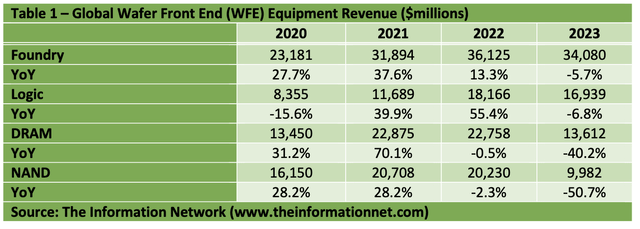

For the remainder of CY 2023, Table 1 shows my projection of WFE sales for the sector for DRAMs will drop 40.2% in 2023 while NAND WFE will drop 50.7%, according to our report entitled Global Semiconductor Equipment: Markets, Market Shares and Market Forecasts.

This means that supply of memory chips is so great that spending on new equipment to make more memory chips will plummet.

The Information Network

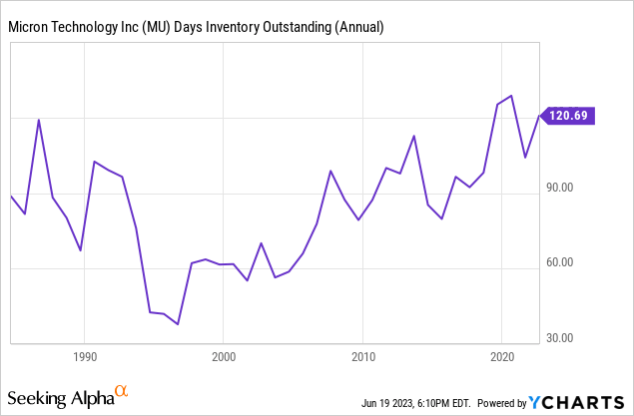

Chart 3 shows that although MU is working to reduce inventories, they’re at an all-time high, now at 120 days. Excess inventories and uncertainties over the economy are working in opposite directions, and until consumer open pocketbooks inventory won’t drop. A slowdown in China we learned recently, will extend this period.

YCharts

Chart 3

Memory Pricing

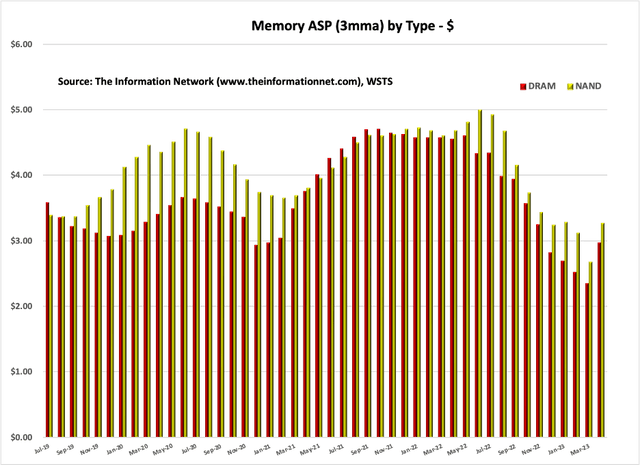

Chart 4 shows SIA reported ASPs for NAND and DRAM between July 2019 and April 2023. Total memory ASPs increased 25.5% MoM (-31.7% YoY), with NAND increasing 22.3% MoM (-30.1% YoY) and DRAM increasing 26.7% MoM (-34.7% YoY).

The Information Network

Chart 4

It’s too early to tell whether chip prices will continue to rise in the backdrop of excess inventories and uncertainties over the economy. Prices of DDR4, which have dropped more than 10% QoQ in 2Q, accounts for the majority of sales volume. As a positive, DRAM is shifting from DDR4 to DDR5, and DDR5 prices will rise next quarter based on new CPU rollouts and growing demand.

Because of AI, demand is growing for high bandwidth memory (HBM; embedded inside GPU) and 128Gb DDR6 (connected to CPU). These new chips are expensive. 1Gb DDR4 sells for $0.2, but HBM and 128Gb DDR5 are priced at the range of $1.2-$1.3 and $0.9-$1.0 (5-7 times higher), respectively.

Investor Takeaway

The two topics I discussed in this article are headwinds impacting Micron as a result of recent negative press. Importantly, both are significant.

Unfortunately, Micron has been negatively impacted by other headwinds.

Since June 2022, the semiconductor memory market is in freefall, and Micron stock is plummeting with its share price up just 23% for the past one-year period. Clearly the cause has been a drop in demand for consumer electronic items like smartphones and PCs. I’ve written extensively on this and my latest Seeking Alpha article of Nov. 14, 2022, entitled “Micron: Even The Best Technology Won’t Help Until 2024.”

Further, in my Dec. 15, 2022, Seeking Alpha article entitled “Micron: Excessive Capex Spend Responsible For Plummeting Memory Market,” I demonstrated that while the dire economy has impacted demand, an underlying root cause is the excessive capex spend by memory companies in the prior year.

Inventory oversupply at PC/smartphone customers is now intensifying in datacenters and industrial sectors of memory chips with only automotive chips secure so far.

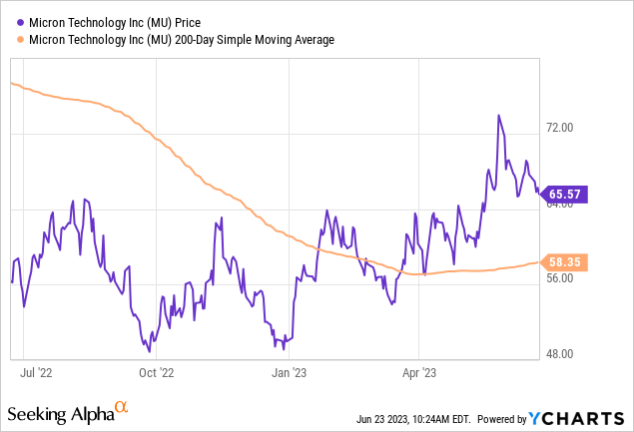

Micron’s share performance has turned positive since the beginning of 2023, as shown in Chart 5. The 1-year performance is up 23.0% and year-to-date up 34.3%.

Chart 5 also shows that MU has moved above its 200-day moving day average since the beginning of April 2023.

YCharts

Chart 5

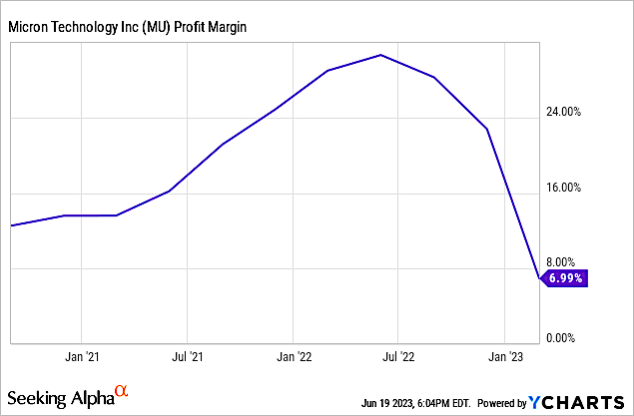

However, profit margins (7%) are lower than last year (28.9%), as shown in Chart 6.

YCharts

Chart 6

Consumer electronics products PCs and smartphones have shown minimal improvement in demand with the opening of China. Unfortunately, end-user inventory work downs have worsened for hyperscaler companies, along with continuing inventory work downs for PCs and smartphones.

Inventories at fabrication plants also appear to be rising despite production cuts across the industry. These poor fundamentals are not only weighing on the company’s second quarter results, but also create further meaningful ASP and margin degradation in fiscal Q3.

While the memory industry has showed an uptick in metrics in the past month (Korea exports, ASPs), a recovery in the industry is still stymied by high inventory and on a macro level, high inflation and interest rates.

These near-term headwinds, while showing improvements, are too early to point to a recovery. While Micron’s share price has increased year-to-date, dropping profit margins and high days inventory also need to be resolved internally at the company.

Micron’s consensus revenue forecast for 3Q is $3.67 billion, down from $8.64 billion a year earlier, corroborates my negative short-term thesis about the company.

Mid-term, the loss of business in China will not be rectified unless China reverses its stance. And if my thesis is correct, that Micron reportedly lobbied the U.S. government to block the expansion of China’s YMTC and its sales to Apple (here and here), that reversal may not happen.

Finally, its AI business is a strong long-term headwind, since the generative AI is driving the entire stock market. With the request by Nvidia to evaluate SK hynix’ HBM3E samples, following their joint program with H100 and HBM3 chips may prove to be unsurmountable for Micron.

I’m putting a Sell rating on MU. The last time I did it was prior to the last downturn in 2018 as I argued that excess capex spend was responsible for excess supply and inventory overhang. I have been more favorable during this downturn because macro factors were impacting all companies. Also MU promised to “judiciously control capex,” but they did not, as shown in Table 1.

However, a deep dive into MU in the current cycle shows that this company is significantly behind competitors in the AI space, which is significant. The reported political effort by MU to apparently block China memory companies has been a Karma event for the company. But politics continue, first with announcing a packaging plant in China to appease that country, and now with India. These expenses (fab in NY, plants in China and India) will hurt the company’s bottom line.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This free article presents my analysis of this semiconductor equipment sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here.