Summary:

- Apple Inc. is a great company that’s once again crossed a $3 trillion valuation, 18 months after doing so for the first time.

- The company’s multiple expansion is likely to slow, which will already drastically impact its share price.

- At the same, we expect the company will struggle to come up with new products to grow its earnings.

- Overall, we are predicting Apple stock will underperform the S&P 500 over the next decade.

Daniel de la Hoz

Apple Inc. (NASDAQ: NASDAQ:AAPL) has once again crossed a $3 trillion valuation threshold, at a higher price due to share repurchases. The company is a giant, its 2.5% share price appreciation in a single day accounts for $75 billion in market cap movement, equivalent to the entire value of giants such as The Progressive Corporation (NYSE: PGR) or Altria Group, Inc. (NYSE: MO).

However, with the law of large numbers, combined with increased risks to the core business, and its valuation, we expect Apple to underperform the S&P 500 (SP500) going forward.

Valuation

It might look like Apple has been on a roll, but it’s important to see where the company’s strength is coming from.

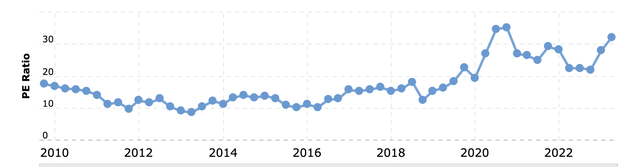

At the end of 2011, the company’s P/E was at 9.8. Today it’s at 32.19. For now, we’ll ignore which valuation you think is more valid. We’ll generously assume the current valuation is more valid. That still means that the company’s share price is 3.28x, where it would be if it didn’t have the same multiple expansion.

Another way to look at it is the company’s share price would be ~$60 / share otherwise. That’s versus $14.99. That means its share price growth over the same 12 years would be 400%. That’s 12.2% annualized returns. Not bad but much less than the 23.7% that the company has seen. So what’s the takeaway here.

The takeaway is that even if Apple can grow earnings at the same 12.2% compound rate (which as we’ll see later is unlikely), the only way it’ll get the same returns is if it keeps the same multiple expansion and grows to a triple digit P/E into the next decade. Otherwise, that 12.2% will be the sum total of the company’s returns.

Assuming the company’s P/E, on its current high-end, is fair, the company needs to match the incredibly strong earnings growth of the last decade just to eek out double-digit returns.

Services

Now let’s move onto the company’s growth engine that’s been talked about, services. It’s the company’s growth engine going from $50 billion in 2020 revenue to an estimated $100 billion this year. It’s also high-margin revenue for the company, which is important to have. The company has been working to grow this business, taking advantage of its installed device base.

However, there are some risks. The company is seeing pressure for both charging a 15-30% fee on app store subscriptions and is planning to enable side-loading apps. We expect that regulatory restriction will expand. Not only will it impact Apple’s novelty versus Android, but it’ll potentially have a big impact on the company’s service revenue.

At the same time, we expect the growth rate of the company’s installed device base to slow down. It’s recently hit 2 billion versus 3 billion globally for Android. While we do expect the % of those with a phone to expand, we don’t expect the growth rate to grow nearly as fast. Already the growth rate for services has declined to the mid-single digits.

The risks to the company’s existing service revenue along with the slowdown in growth rate means we don’t think this business will keep providing the double-digit growth.

Novelty Wearing Off

At the same time, novelty wears off. Anecdotally, we’ve noticed this locally, the excitement and buzz around purchasing the latest iPhone, Mac etc. has declined substantially. The continued decline in the middle class along with record inflation rates impacting budgets are likely to be a big part of the impact here.

We expect an increased right to repair will also have a bigger impact here. People will keep their devices for longer and longer. COVID-19 has changed trends, but even before COVID-19, replacement cycles were extending.

In our view, the single most important controversy surrounding Apple today is the iPhone replacement cycle – despite the iPhone installed base growing +9% last year, we now expect units to be down -19% in fiscal 2019, implying a material pushout in upgrade rates. Replacement cycles are elongating… a lot.

That’s a massive risk for Apple, given the current size of its installed base and the importance of turnover for HW revenue.

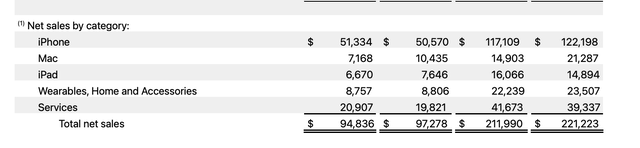

HW revenue impacts are already being seen in the current market as the company’s 1st 6 month revenue is down YoY in HW. Mac, one of the easiest products to keep for longer has declined substantially. We expect the new 15″ Macbook Air to impact this further as one of the major reasons for the 16″ Pro model (in our peer group at least) for screen size has been removed.

iPhone and Wearable sales are also down YoY. While we don’t expect the down market to continue forever, we do expect the historic strength not to continue.

How Many More Things Can People Wear

Added on to this is the lack of new products. A decade ago lets look at where Apple was. The iPhone came up in 2007 but anecdotally didn’t begin to pick-up steam until the 3/4. This can be seen in growth rates that increased dramatically before plateauing in 2015. The iPad didn’t come out until 2010 and the first Apple Watch came out in 2015.

Similarly, the first AirPods came out in 2016. These are products that are now ubiquitous. Transitions such as the switch to Apple Silicon represent substantial one-time bumps in margins. However, they also made up a major part of the company’s growth in revenue over the past decade, during the earnings growth period we discussed above.

That shows how difficult it is to grow earnings at 12% annualized as a large company, blockbuster products that achieve widespread adoption at hundreds of $ each every few years. The company’s pipeline today is now viewed as primarily consisting of the Vision Pro and a Car. The company has continuously scaled down the car.

The new Vision Pro, which will launch next year, will cost $3000. We think this product is unlikely to become a game changer, especially at its price point. However, the scale of the company is what hurts it here. The company’s current HW margin is ~37% (generously assuming no growth in operating expenses).

Current annual profits are $100 billion in net income. Even if the Vision Pro becomes 50% as big as iPhone at $3000 each, a very unlikely scenario in our view, that’s $300 billion in fresh annual revenue. Even if the margins are as high as other products, an almost doubling in the company’s net income, that’s less than 6-years of the company’s 12% earnings growth.

That shows how much the company needs to earn to continue its growth.

Small Share Buybacks Can’t Make A Company

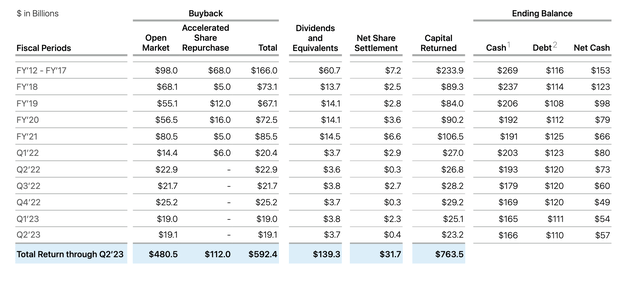

And we get to our next part. The company doesn’t have many avenues at its current level to drive shareholder returns. Buybacks have been a strong part of the company’s EPS growth, as the company started from an incredibly strong net cash position. The company is down to a net cash position of less than $60 billion from $153 billion at the end of FY’17.

The company has a modest dividend of less than 0.5%. Its repurchased a total of just under $600 billion in shares but almost $100 billion of that have come form its net cash position. Its quarterly buybacks + dividends are at roughly $25 billion which is increasing its cash position by ~$3 billion quarterly. The company’s net cash generation is ~$28 billion / quarter.

That’s $110 billion in annual cash generation or a cash flow yield of <4%. The company spends effectively all of its cash on buybacks. The company does have almost $10 billion in stock-based compensation annually it needs to make up for, which is “close enough” to that $3 billion / quarter. That means the company’s current share decline rate of ~3% annualized is its returns.

That plus a 0.5% dividend yield is an incredibly low return rate for a company that’s seeing all its cash flow go towards returns. The company’s 2021 and 2022 buyback rates are in-line with what we expect to be the company’s long-term buyback rate. Those shareholder returns simply aren’t enough to justify the company’s valuation.

Thesis Risk

The largest risk to our thesis is that Apple Inc. is a company that defies expectations. You don’t become a $3 trillion tech company by not being one. The company has convinced the average American to spend thousands of dollars every few years on its products and the benefits that they provide to their day-to-day lives.

That’s a strong force and other unknown projects in the company’s pipeline could quickly achieve widespread adoption driving increased profits even faster than expected.

Conclusion

Apple is a great company. We also know the conventional wisdom is that it is better to buy a great company at a good price than a bad company. However, valuation still comes into play and Apple, at its current size, is dealing with the law of large numbers as it needs products that would ordinarily define a company in order to keep going forward.

At the same time, even if the company manages to keep earnings lined up with an incredibly strong period, its returns won’t be nearly as high. That’s because much of Apple Inc.’s growth over the last decade has been multiple expansion. Even if you think its current valuation is more fair than its last one, it’s incredibly unlikely in our view for the company to grow to a triple digit P/E.

Overall, that makes Apple Inc. a poor investment. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.